Check out the benefits of the E.SUN Kumamon Credit Card at once! | Ultimate card for traveling in Japan | First-time usage comes with Kumamon suitcase

2025 下半年的玉山熊本熊卡繼續提供日本消費最高 8.5% 回饋,還有多元的首刷禮與專屬優惠。Caven 投資成長家在本文整理了玉山熊本熊卡的完整攻略,包括最新優惠方案、首刷禮資訊、申辦教學與年費規則。無論你是準備出國旅遊,還是想在日常消費累積回饋,還能同時參考永豐 Daway 卡優惠、LINE Bank 快點卡、將來銀行開戶,讓你能運用各式金融商品賺取回饋!

目錄

玉山熊本熊卡是什麼?

玉山熊本熊卡,是玉山銀行與 JCB 組織因應日本觀光熱潮,攜手日本九州熊本縣高人氣吉祥物「熊本熊」所推出的信用卡。它主打日本地區的超高回饋,讓大家到日本旅遊時能輕鬆賺取回饋減輕荷包負擔!

2025 玉山熊本熊卡最新優惠

玉山熊本熊卡基本分為兩大類:「一般信用卡」、「日圓雙幣卡」。而同一持卡人,僅限申請一張一般信用卡(正卡及附卡,需於向右右、最愛吃擇一)及日圓雙幣卡(正卡及附卡,需於向左左、很友好版擇一)。

※注意!若是重複申請,玉山銀行將不予核發。

玉山熊本熊卡

|

一般信用卡 |

日圓雙幣卡 雙幣卡版本以日圓結帳,擁日圓匯率優勢 |

||

|

最愛吃 無電子票證 |

向右右 無電子票證 |

向左左 電子票證 |

很友好 電子票證 |

|

基本優惠 / 回饋 |

|||

|

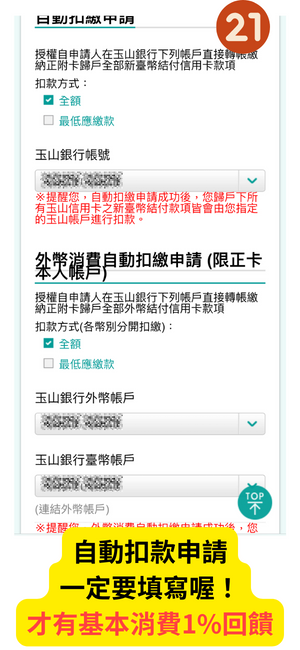

✅ 國內消費基本回饋 1% 無上限(條件:須設定帳單e化與帳戶自動扣繳) |

|||

| 點此👉「熊本熊卡優惠連結」 | |||

自 2025 年 7 月 1 日起,在日本消費雖然有 2.5% 現金回饋無上限,但他取消了 1.5% 免國外手續費的優惠,因此實際仍只有 1%「現金回饋無上限」。不過搭配 SUICA 西瓜卡,或是到指定商店消費還是有加碼 6% 回饋(需要登錄活動)!

1. 玉山熊本熊日圓雙幣卡-日本消費最高 8.5% 回饋

至 2025 年 12 月 31 日,使用玉山熊本熊信用卡在日本地區消費享以下回饋:

- 日本地區消費享 2.5% 基本回饋(日圓雙幣卡需收取 1.5% 國外交易手續費)

- 指定日本商店消費加碼 6% 回饋(每期回饋上限 NT$ 500,需登錄活動)

指定日本商店店消費加碼6%

|

回饋類別 |

指定通路 |

|

熊好遊 |

● 日本航空 |

|

熊好玩 |

● 東京迪士尼樂園 |

|

熊好買 |

● BicCamera |

| 熊好用 | ● 日本三大交通卡(SUICA、PASMO、ICOCA)儲值 |

| 熊好吃 | ● DOUTOR Coffee ● Fulgen ● 松屋 ● SUKIYA ● 勝烈亭 ● 敘敘苑 ● 牛角 ● shake shack ● 壽司郎 ● 藏壽司 |

- 指定日本商店加碼 6% 現金回饋,歸戶每期回饋上限 500 元

- 於當期帳單直接折抵

2. 玉山熊本熊加碼優惠

至 2025 年 12 月 31 日,使用玉山熊本熊卡綁定玉山 Wallet 電子支付於日本 PayPay 消費享 5% 優惠:

- 含日本 PayPay 消費 3.5%,且免收 1.5% 國外交易服務費

- 3.5% 每歸戶每季回饋上限 NT$ 100

以上優惠僅供參考,若有異請以玉山銀行官網公告資訊為準

2025 玉山熊本熊卡最新首刷禮

1. 玉山熊本熊卡新戶首刷禮

至 2025 年 12 月 31 日,首次申辦玉山熊本熊卡,於核卡後 30 天內,新增國內一般消費滿 NT$ 3,999,贈【熊本熊 26 吋胖胖箱】1 個。

※新戶:核卡日前 6 個月內未持有玉山銀行任一張流通正卡卡片,其餘則視為舊戶

※限未曾持有玉山熊本熊卡者參加

2. 玉山熊本熊卡滿額禮

至 2025 年 9 月 30 日,於活動期間內,新增國內一般消費滿 NT$ 3 萬,贈【熊本熊官方授權冰霸杯】1 個。

以上優惠資訊僅供參考,如有變動請以玉山銀行官網公告資訊為準。

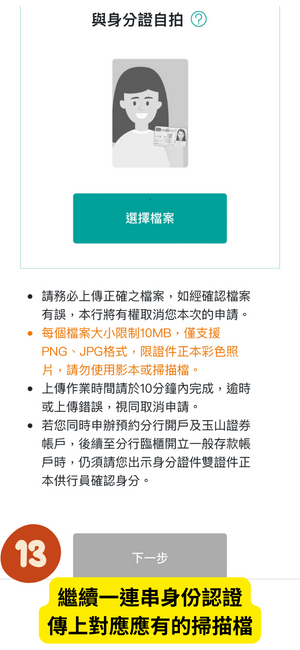

玉山熊本熊日圓雙幣卡申辦教學

若你只要辦理一般信用卡,程序非常簡單,連結進入後,按步驟填入資料,並於最後提交財力證明即可.(👉點此進入即可開始申請)

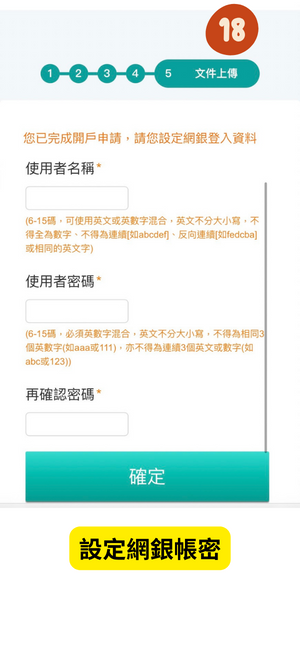

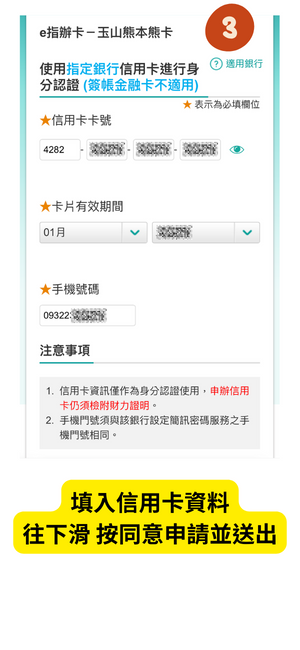

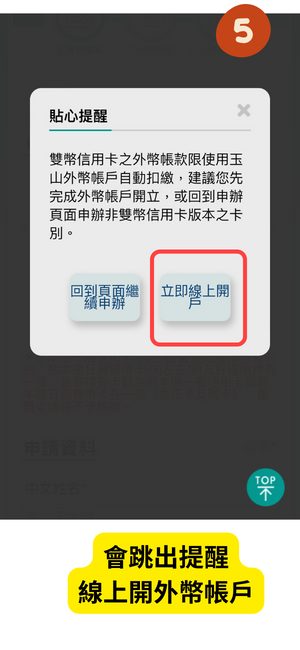

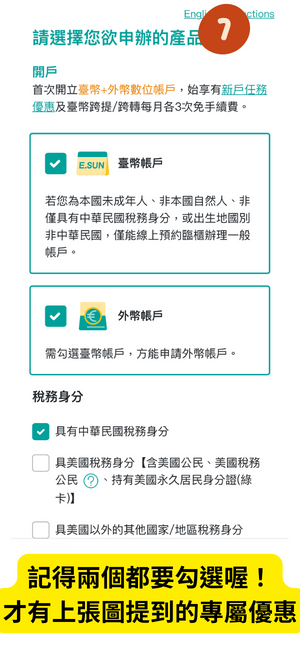

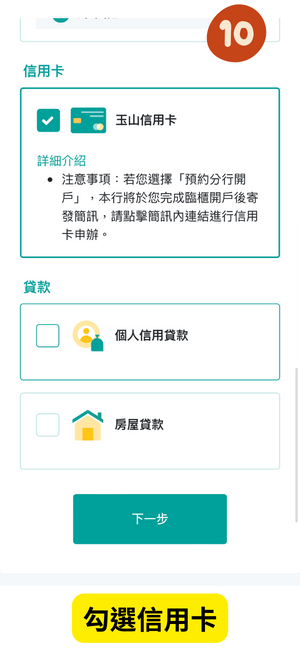

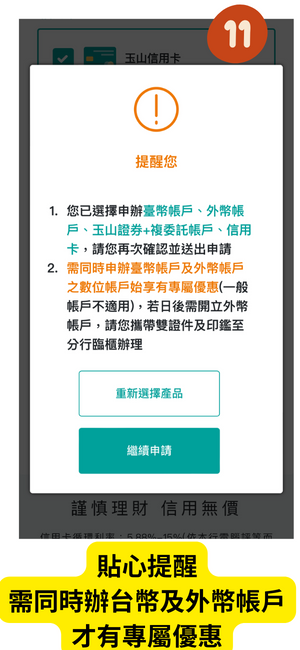

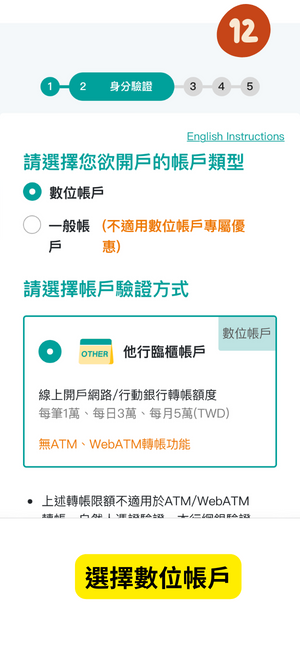

若你是要辦理玉山熊本熊-日圓雙幣卡,因熊本熊雙幣卡的外幣帳款限用玉山外幣帳戶自動扣款,所以這邊直接來教你開立外幣帳戶並申請玉山熊本熊-雙幣卡!(先從這裡點連結進入後依下方教學完成開戶+申請雙幣卡)

玉山熊本熊卡-日圓雙幣卡攻略

1. 在玉山銀行開立「台幣及外幣帳戶」:

想要申辦這種雙幣卡,必須先在銀行開立台幣和外幣帳戶,並申請讓這些外幣帳戶能自動從台幣帳戶轉帳扣繳(支付)所需的外幣。

2. 自動買匯繳款功能:

這項功能允許你設定當外幣帳戶餘額不足以支付外幣應付帳款時,系統會自動從你的台幣帳戶按當日匯率轉換相應的新台幣為外幣,並存入你的外幣帳戶來完成支付。3. 網路銀行購買外幣和自動扣款:

當你使用這張信用卡在國外消費後,信用卡帳單的繳款可以直接從你的外幣帳戶自動扣款,這樣可以節省匯率轉換的成本和時間。

玉山熊本熊卡權益&年費資訊

申辦玉山熊本熊卡之前,大家也請務必詳閱下方的相關權益與年費資訊。玉山熊本熊權益 / 年費說明表

| 權益細節 | 說明 |

|

申辦條件 |

1. 正卡:年滿18歲皆可申請,並提供相關財力證明,日圓雙幣卡須開立玉山臺、外幣帳戶。 |

|

年費 |

正卡:3,000元,附卡:免年費。 首年免年費,使用帳單e化期間享免年費優惠;每年有消費,年年免年費。 |

|

旅遊保險 |

刷卡支付當次國際機票或出國旅遊團費 80% 以上。 1.旅遊平安險:NT$ 2,000 萬 2.旅遊不便險:班機延誤 NT$ 1 萬、行李延誤 NT$ 1 萬、行李遺失 NT$ 3 萬。 |

| 刷卡禮 | 活動期間:2025/07/01~2025/12/31 新戶首次申辦玉山熊本熊卡正卡,於核卡後30天內新增國內一般消費,累積滿 NT$ 3,999(含)以上,即贈【熊本熊 26 吋胖胖箱】1個! |

| 海外消費手續費 |

熊本熊一般卡:收取1.5% 熊本熊雙幣卡:收取1.5% |

玉山熊本熊卡常見問題

Q1. 玉山熊本熊雙幣卡有什麼差別?

日圓雙幣卡需同時持有台幣帳戶與外幣帳戶。此外,當你使用雙幣卡在國外消費時(含商店收單行為外國銀行)扣款也會直接以外幣(日圓)進行結算。最重要的是,自 2025 年 7 月 1 日起,使用雙幣卡消費會收取 1.5% 國外交易服務費。

Q2. 玉山熊本熊卡年費怎麼減免?

申辦首年免年費。次年起前一年度需使用電子帳單、玉山銀行自動扣繳信用卡款,或任意消費一筆即可免年費。

.jpg)

.png)