- Home page

- Broker Recommendations

- How to get a 3.14% interest rate and $2.75 million protection with Interactive Brokers?

How to get a 3.14% interest rate and $2.75 million protection with Interactive Brokers?

Interactive Brokers (IB) offers a competitive interest rate of up to 4.83% on cash deposits, which can surpass the rates offered by many other brokerages. Here’s how you can earn this interest rate and benefit from their deposit protection which can be up to 2.75 million.

目錄

- How much are the "Interactive Brokers interest rates"?

- How does Interactive Brokers (IB) calculate the interest rates of your cash account?

- Are Interactive Brokers IB deposits protected? Up to $2.75 million deposit protection in Taiwan!

- How to check Interactive Brokers (IB) deposit Interest and settlement Time?

- Join the Interactive Brokers (IB) Taiwanese Community Forum

How much are the "Interactive Brokers interest rates"?

Interactive Brokers (IBKR) offers its clients the opportunity to earn market-rate interest on their cash balances. Below is a detailed tutorial on how to earn interest from your IB account and how it is calculated.

1. Conditions for earning IB deposit interest:

- Settled Cash Balances: Only settled positive cash balances in the IB account can earn interest.

- Net Asset Value: The first $10,000 of cash deposit in the IB account does not earn IB deposit interest; any excess cash earns interest according to the applicable interest rate.

2. What is the IB interest rate?

Interactive Brokers' interest rates for cash accounts are higher than many other banks or brokers. You can check the below USD interest rate comparison table (as of April 2, 2024)

| Category | Name | Interest Rate |

| Bank | Bank of America | 0.04% |

| Bank | Citi | 0.06% |

| Brokerage | E-Trade | 0.01% |

| Brokerage | Interactive Brokers | 4.83% |

| Bank | JP Morgan | 0.02% |

| Brokerage | Schwab | 0.45% |

| Bank | Wells Fargo | 1.00% |

Note: Interactive Brokers' interest rates are dynamic and may change based on market conditions.

How does Interactive Brokers (IB) calculate the interest rates of your cash account?

Interactive Broker's interest rates are calculated based on the "net asset value of the account". Interest is proportional to the account's net asset value (with $100,000 as the benchmark).

Calculate your Interactive Brokers' interest rates in four steps

Step 1: Determine your applicable interest rate: Accounts with a net asset value of $100,000 (or equivalent) or more will earn interest at the full interest rate (4.83%).

Accounts with a net asset value below $100,000 will have their interest rate adjusted proportionally based on the net asset value.

Step 2: Determine the Interest-bearing cash balance: Calculate the amount of cash that can earn interest.

In the account, cash balances up to $10,000 do not earn interest. Interest is calculated only on the amount of cash exceeding $10,000.

Step 3: Calculate Annual Account Interest: Annual interest is calculated based on the determined interest rate and your cash balance.

Step 4: Calculate your monthly account interest: You can divide the annual interest by 12 to get the monthly interest.

Examples of your Interactive Brokers' interest rates calculation (assuming that the IB cash interest rate is still 4.83%)

Example 1: Account equity $150,000, cash amount $20,000

Applicable interest rate: for net assets exceeding $100,000, the applicable full interest rate is 4.83%.

Interest accruable amount: $20,000 - $10,000 = $10,000.

Annual interest: $10,000 × 4.83% = $483.

Monthly interest: $483 ÷ 12 ≈ $40.25.

Example 2: Account equity $50,000, cash amount $20,000

Applicable interest rate: the applicable interest rate is 2.415%, which is calculated on a net worth of $50,000 (4.83%*(50.000/100,000)=2.415%).

Interest accruable amount: $20,000 - $10,000 = $10,000.

Annual interest: $10,000 × 2.415% = $241.50.

Monthly interest: $241.50 ÷ 12 ≈ $20.13.

Example 3: Account equity $10,000, cash amount $10,000

Applicable interest rate: the applicable interest rate is 0.483%, which is calculated on net assets of only $10,000 (4.83%*(10.000/100,000)=0.483%).

Interest accruable amount: $10,000 - $10,000 = $0 (it has no interest accrual amount).

Annual interest: $0 × 0.483% = $0.

Monthly interest: $0 ÷ 12 = $0.

| Example | Account Equity |

Cash Amount |

Interest accruable amount |

Interest Rate |

Annual Interest |

Monthly Interest |

| Example 1 | $150,000 | $20,000 | $10,000 | 4.83% | $483 | ≈ $40.25 |

| Example 2 | $50,000 | $20,000 | $10,000 | ≈2.42% | $241,50 | ≈ $20.13 |

| Example 3 | $10,000 | $10,000 | $0 | ≈0.48% | $0 | $0 |

Are Interactive Brokers IB deposits protected? Up to $2.75 million deposit protection in Taiwan!

Interactive Brokers provides protection for your deposit.

For Taiwanese investors with a "U.S. Interactive Brokers account," cash deposits are protected up to $2.75 million by the SIPC (Securities Investor Protection Corporation). In comparison, other securities companies typically offer around $250,000 in protection.

The most important thing you need to know is: that SIPC only protects those who open an IB account in the U.S. and deposit their funds in the U.S.

The following is the information about the protection related to our IB account. You will be able to better understand the deposit protection advantages that IB Interactive Brokers has given to their users!

SIPC (Securities Investor Protection Corporation)

First of all, our funds and securities placed in Interactive Brokers are protected by the SIPC (Securities Investor Protection Corporation). Each IB account is covered up to $500,000, which includes a cash protection limit of $250,000.

(Note: For Taiwanese users, every IB account we open is a U.S. IB account and is protected by SIPC.)

The protection only applies to IB accounts in the United States. For example, if you are a "Hong Kong" friend and open a Hong Kong Interactive Brokers account, you will not have this protection.

FDIC (Federal Deposit Insurance Corporation)

If our funds (cash and securities) in our IB account exceed $500,000, how can we protect the additional amounts?

Actually, Interactive Brokers has a new program for funds exceeding $500,000 called the "Insured Bank Deposit Sweep Program."

By participating in this program, in addition to SIPC protection for up to $250,000 in cash deposits, you can also benefit from FDIC coverage, which provides an additional $2.5 million in protection for cash deposits.

In summary, it can protect your IB account funds up to a maximum of $2.75 million. Even if something happens to Interactive Brokers, you can still recover your funds.

Note: FDIC protection only applies to cash deposits and does not include stocks, bonds, mutual funds, life insurance policies, securities or other investment products.

How to participate in the "Insured Bank Deposit Plan"?

When your account funds exceed 500,000 US dollars, IB will send a letter inviting you to participate, and your backend settings will also pop up this option for you to check to participate in the "Insured Bank Deposit Sweep Program"

How to check Interactive Brokers (IB) deposit Interest and settlement Time?

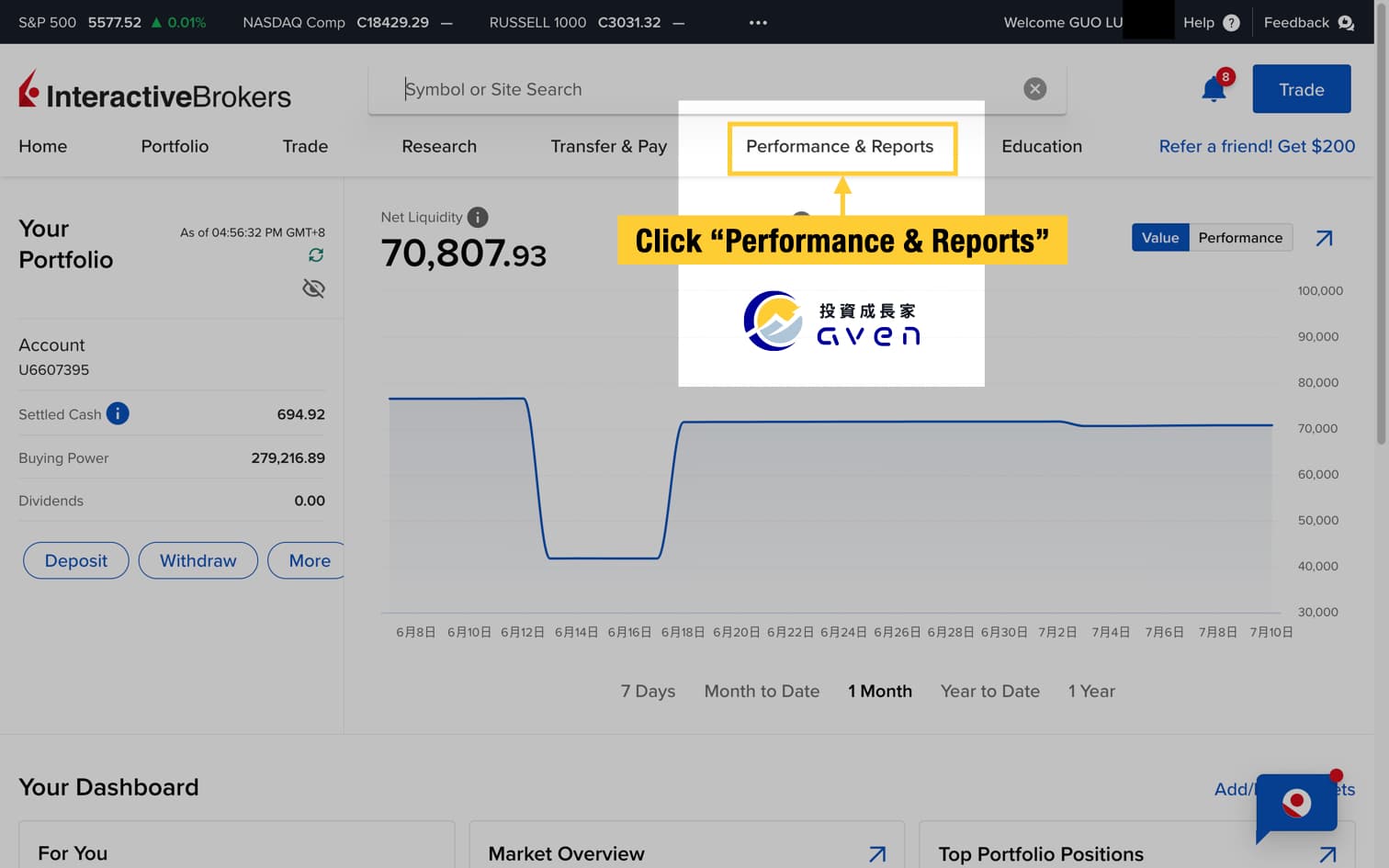

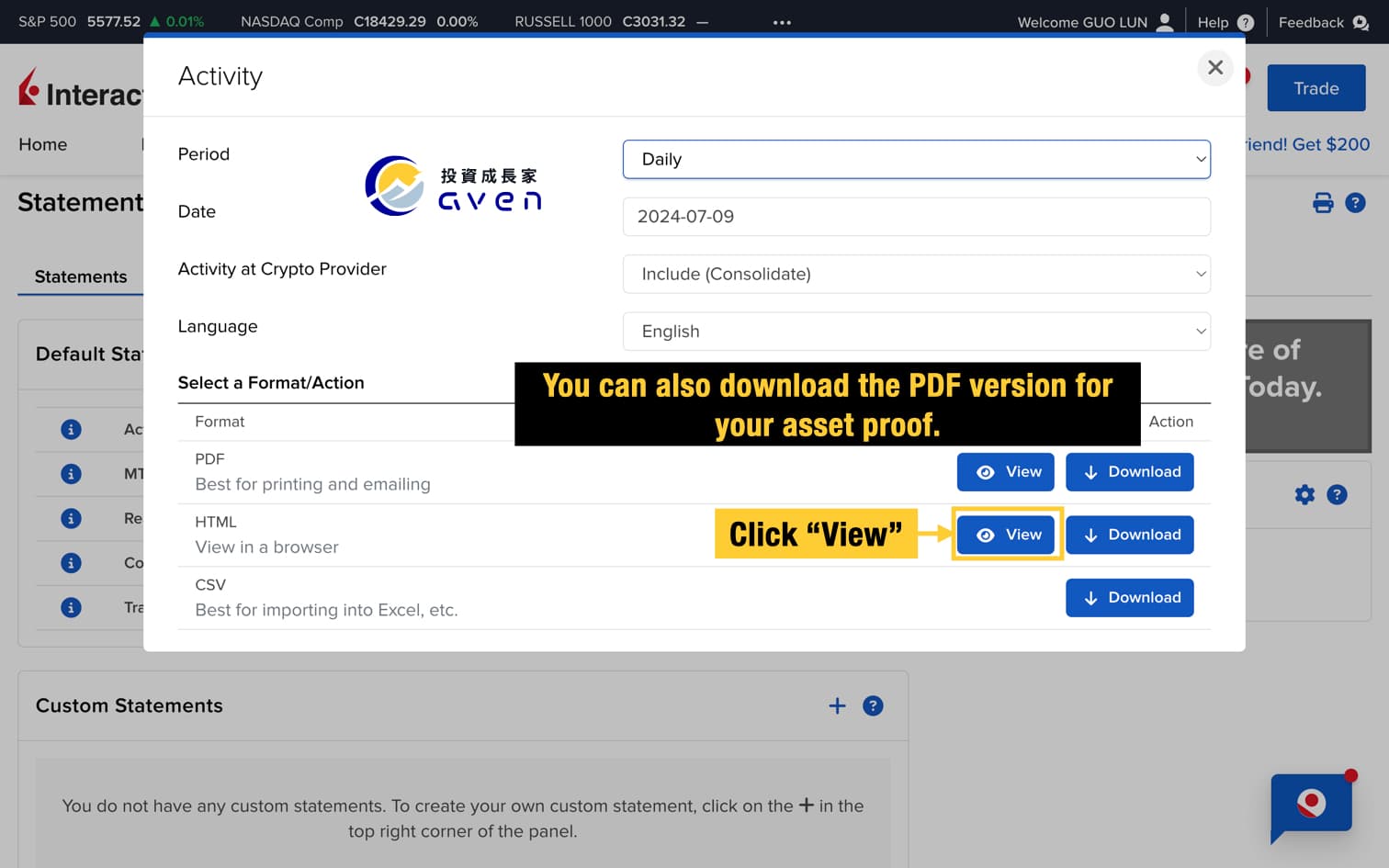

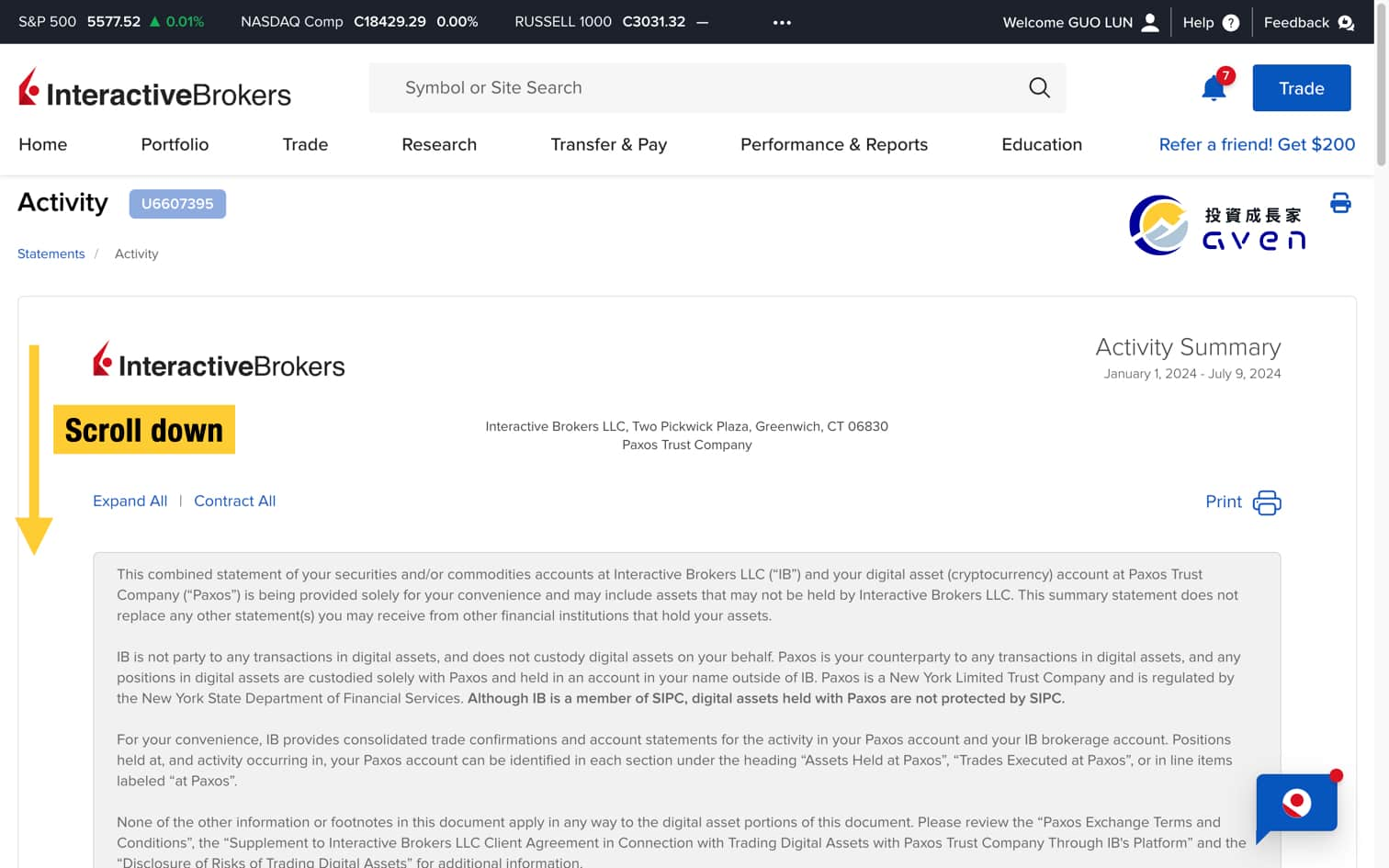

- Log in to IB official website

- Click "Performance and Reports"

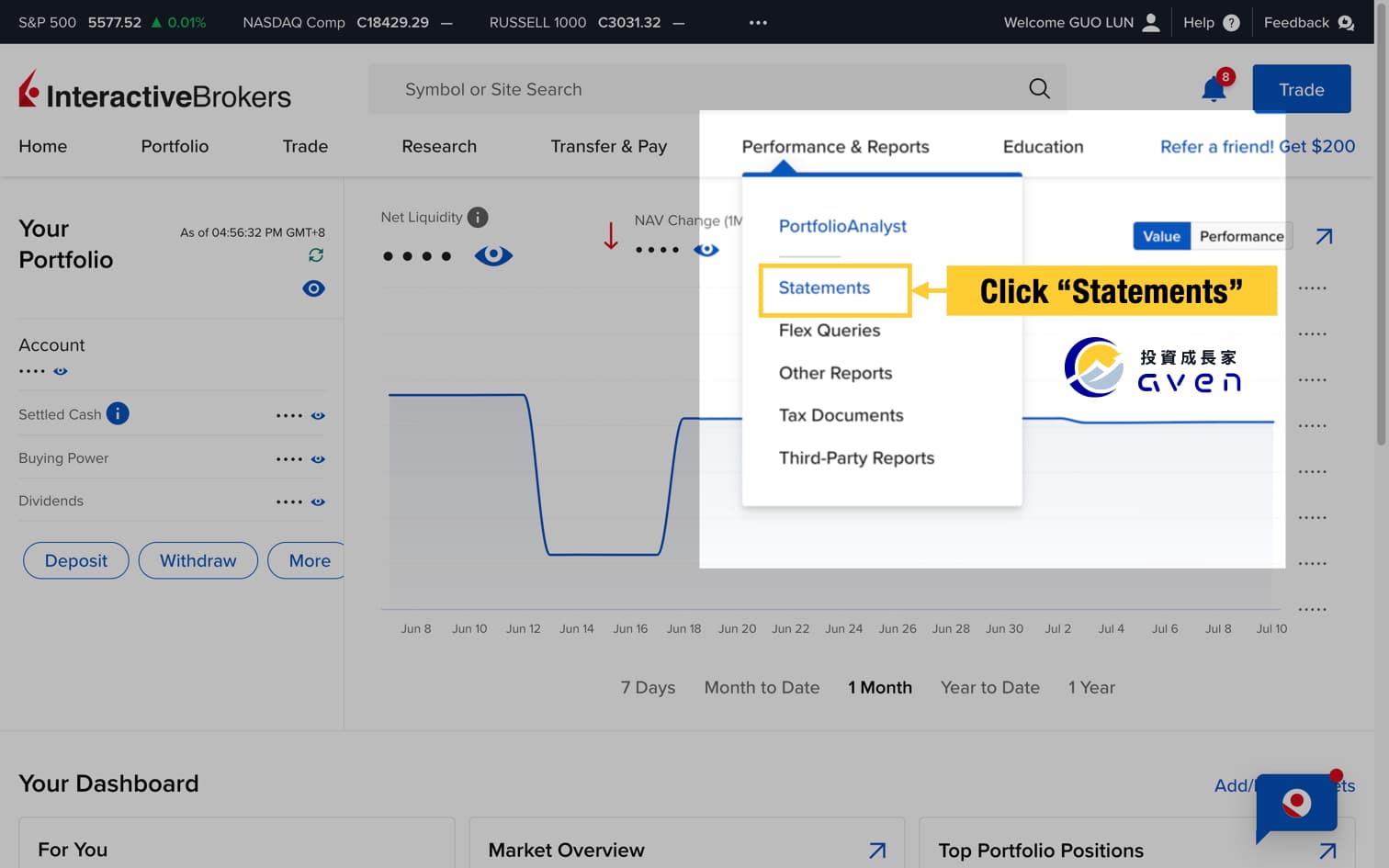

- Click "Report"

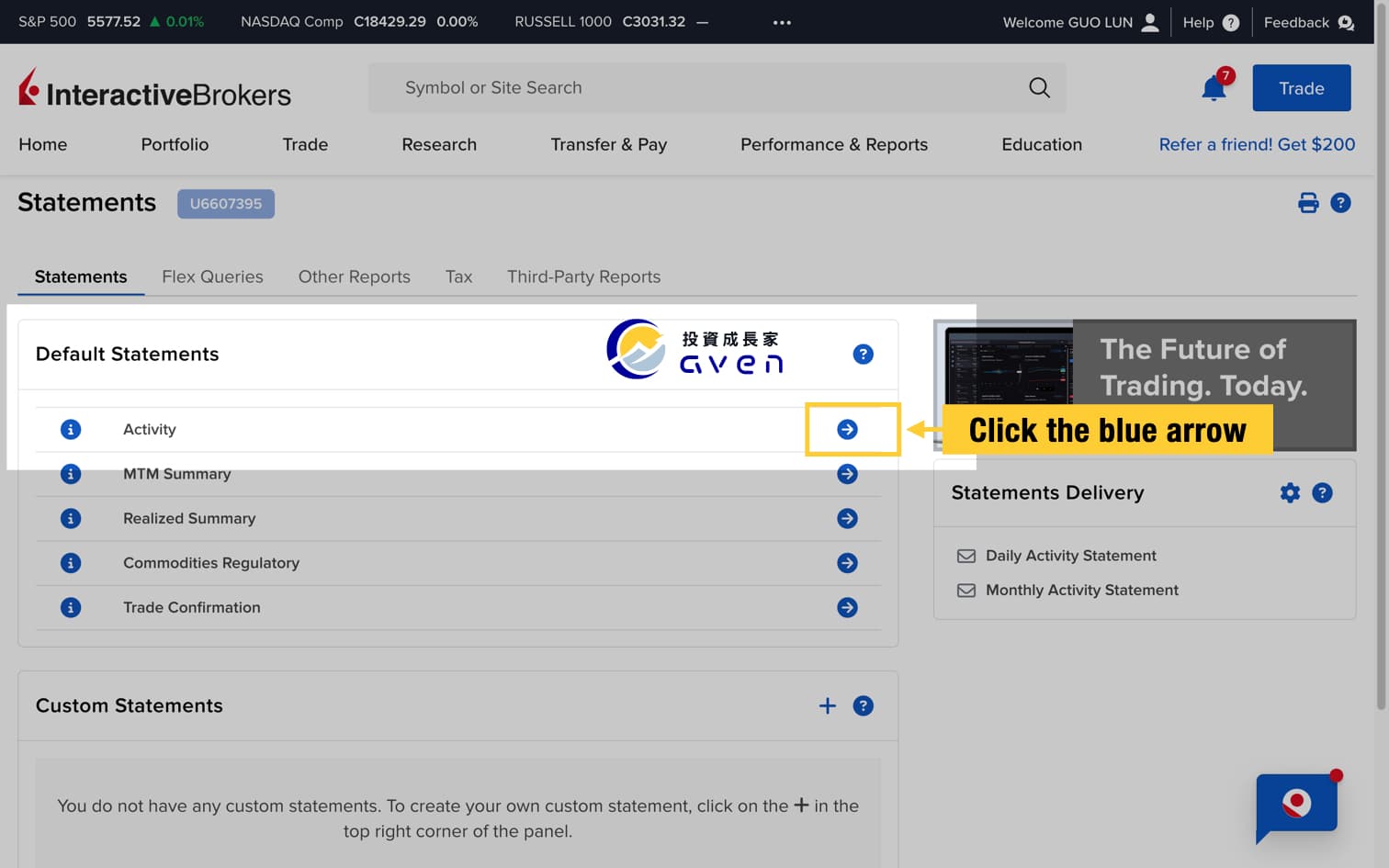

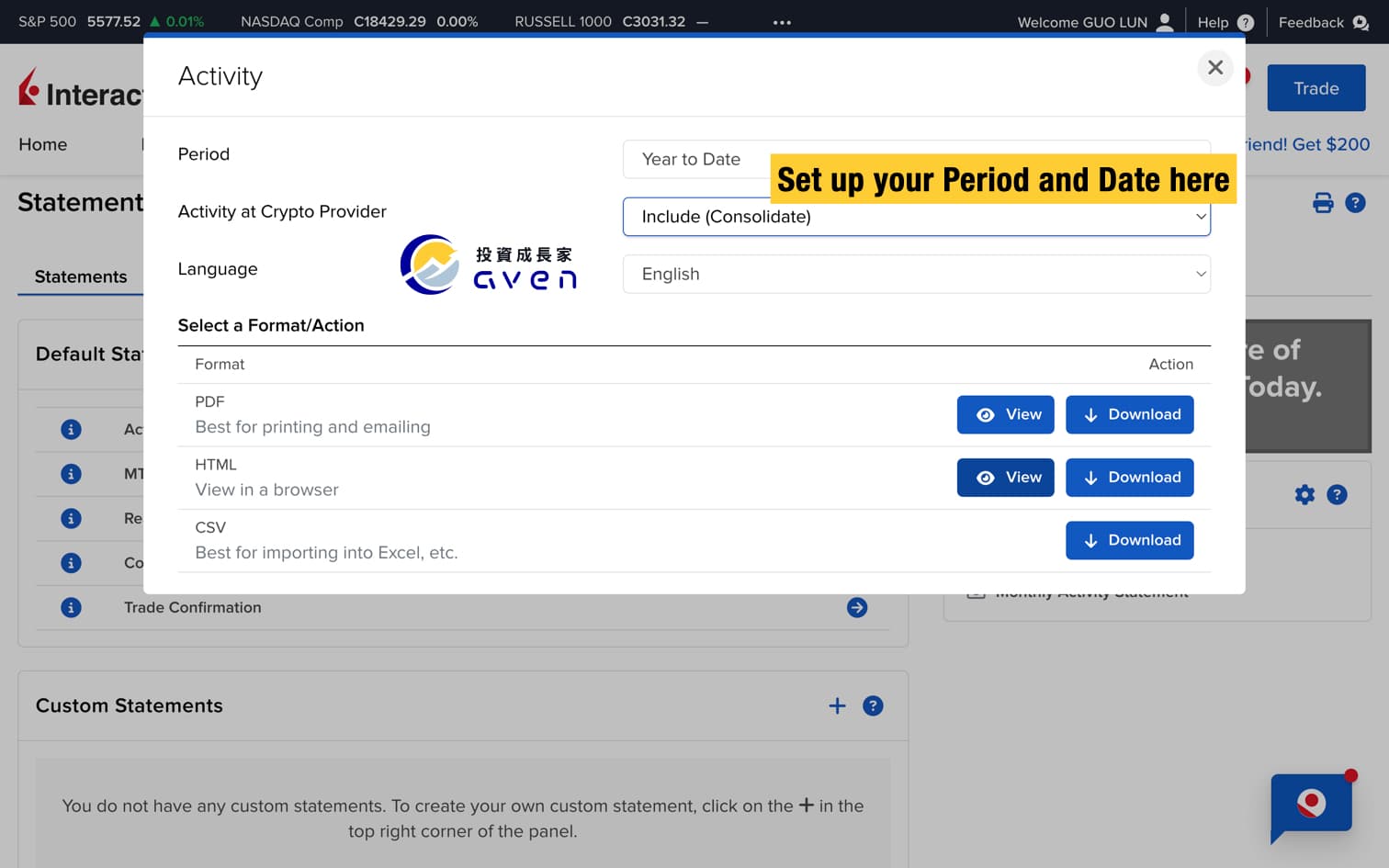

- Set "Date Range"

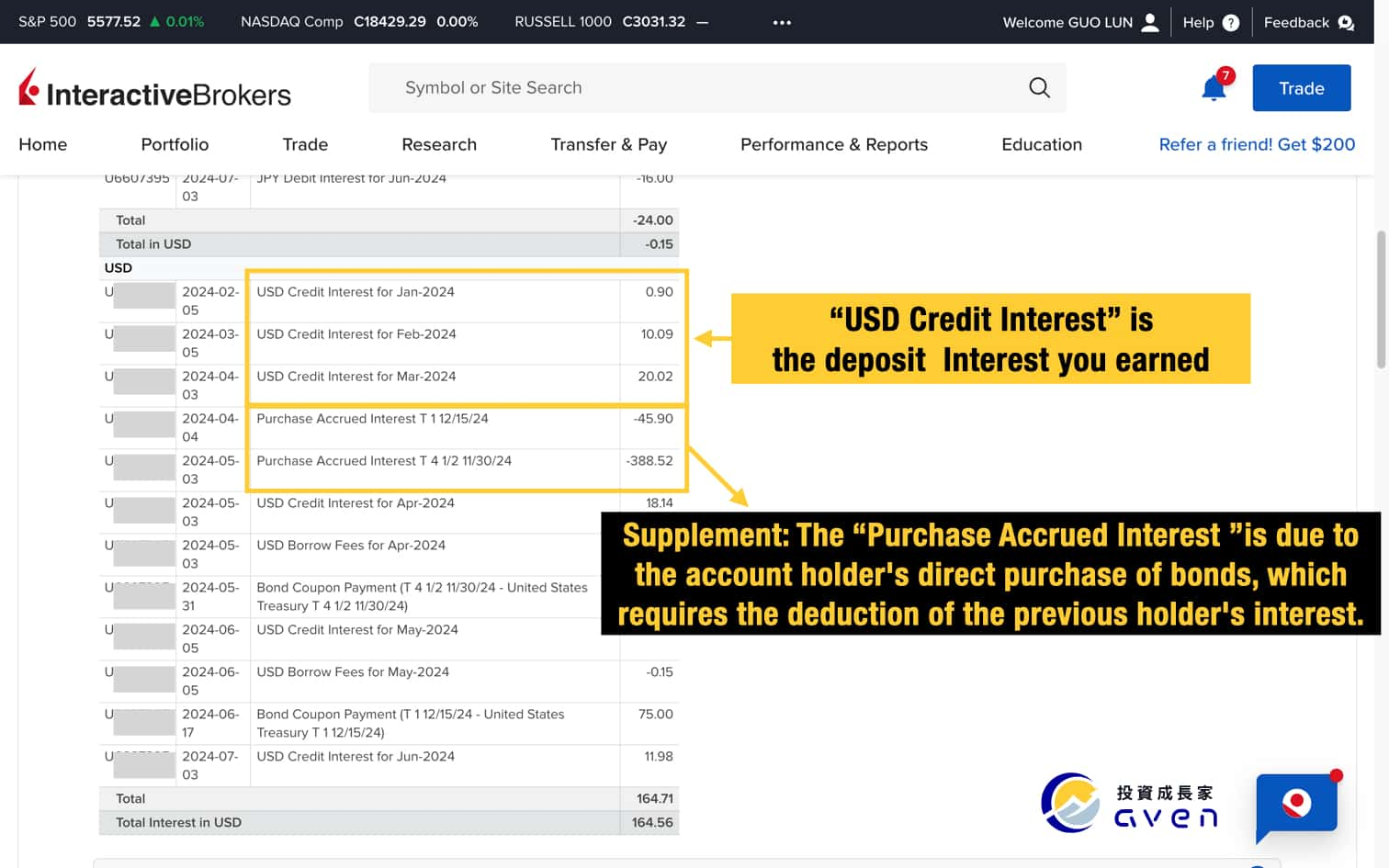

- Query the item "Interest"

- "Lender interest" is the interest earned on deposits

Interactive Brokers' interest accrues daily. The monthly interest rate, based on a tiered blended rate, is announced on the third working day of the following month.

If you want to check how much interest you get from IB account, you can follow my step-by-step tutorial.

Interest income from IB is credited to your account every month.

Join the Interactive Brokers (IB) Taiwanese Community Forum

I frequently receive many questions from investors about opening an IB account. Therefore, I have created the Interactive Brokers (IB) Taiwanese Community Forum on Facebook for both Taiwanese and Hong Kong investors.

This forum provides a space for open communication and the exchange of experiences. My team and I will also be available to answer your questions there. If you need assistance, feel free to join our community!