- Home page

- Broker Recommendations

- How do I deposit money into Interactive Brokers?

How do I deposit money into Interactive Brokers?

目錄

What is deposit/fund your Interactive Brokers account?

When you open your IBKR account, the next step is to fund your IB account! Then our action of transfering money to Interactive Brokers is also called "Interactive Brokers deposit", "IBKR deposit", and "IB deposit".

First, you need to understand "Deposit" and "Withdrawal".

- Deposit: Transfer money to your IBKR account.

- Withdraw money: Withdraw money from your IBKR account.

Interactive Brokers provides multiple flexible and convenient options for funding your account.

Later, we will give you a detailed step-by-step guide and tutorial for the top three most used IBKR account funding methods: Bank wire, Transfer from Wise Balance, and Link a New Bank Account.

For international investors, one of the deposit methods can have a fee as low as under one dollar per transaction.

For U.S. bank holders, the deposit method even has no transaction fee.

Does Interactive Brokers have a minimum deposit/fund requirement?

Speaking of the deposit fee or deposit rate, Interactive Brokers does not have a minimum deposit requirement for most of its account types, making it accessible to a wide range of investors. However, there are specific account types, such as broker accounts, which may have different requirements.

You can check the table below for more IB deposit minimum information requirements. You can also visit their website for more information.

IB deposit minimum information

|

Individual |

Advisor |

Broker |

|

Account Minimums: |

Account Minimums: |

Account Minimums: |

For Broker accounts, a USD 10,000 upfront deposit covers commissions for 8 months. If total commissions are below this, the difference is a maintenance fee. From the 9th month, a USD 2,000 monthly minimum applies; shortfalls incur fees.

What is the most low-cost way to deposit/fund into Interactive Brokers?

Interactive Brokers provides a flexible and low-cost way to fund your account. When making an Interactive Brokers deposit, you can choose from various funding methods. You can check their website for more information.

Now, I will explain the differences between the funding methods.

Deposit Methods Explained

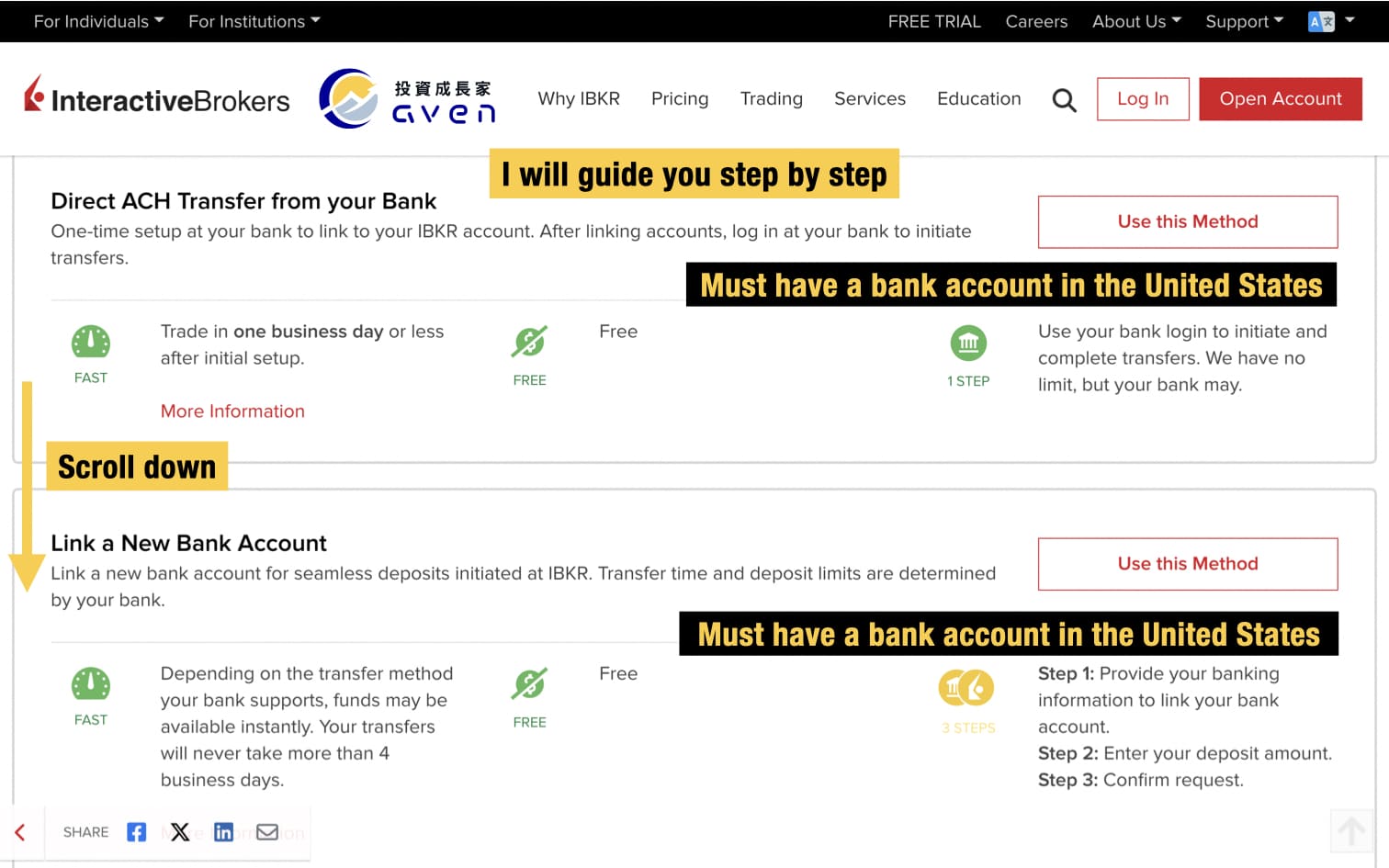

1. Direct ACH Transfer from your Bank or Link a New Bank Account

- Requirement: Must have a United States bank account.

- Details: This method is suitable for users with U.S. bank accounts, offering a convenient way to transfer funds directly to your IB account from your bank with no transaction fee.

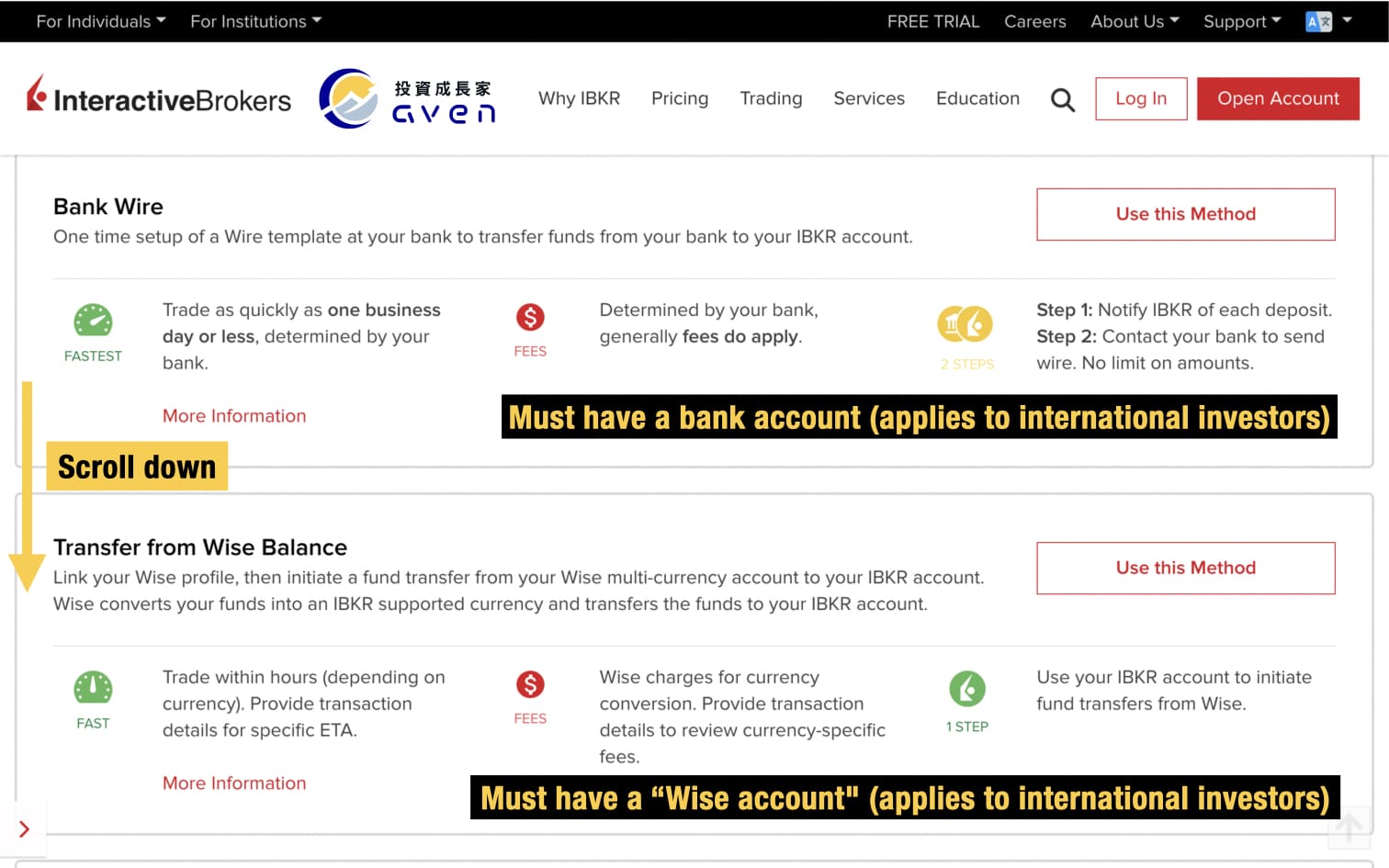

2. Bank Wire

- Availability: Available to all investors worldwide.

- Details: This option allows for international transfers, making it accessible regardless of your location.

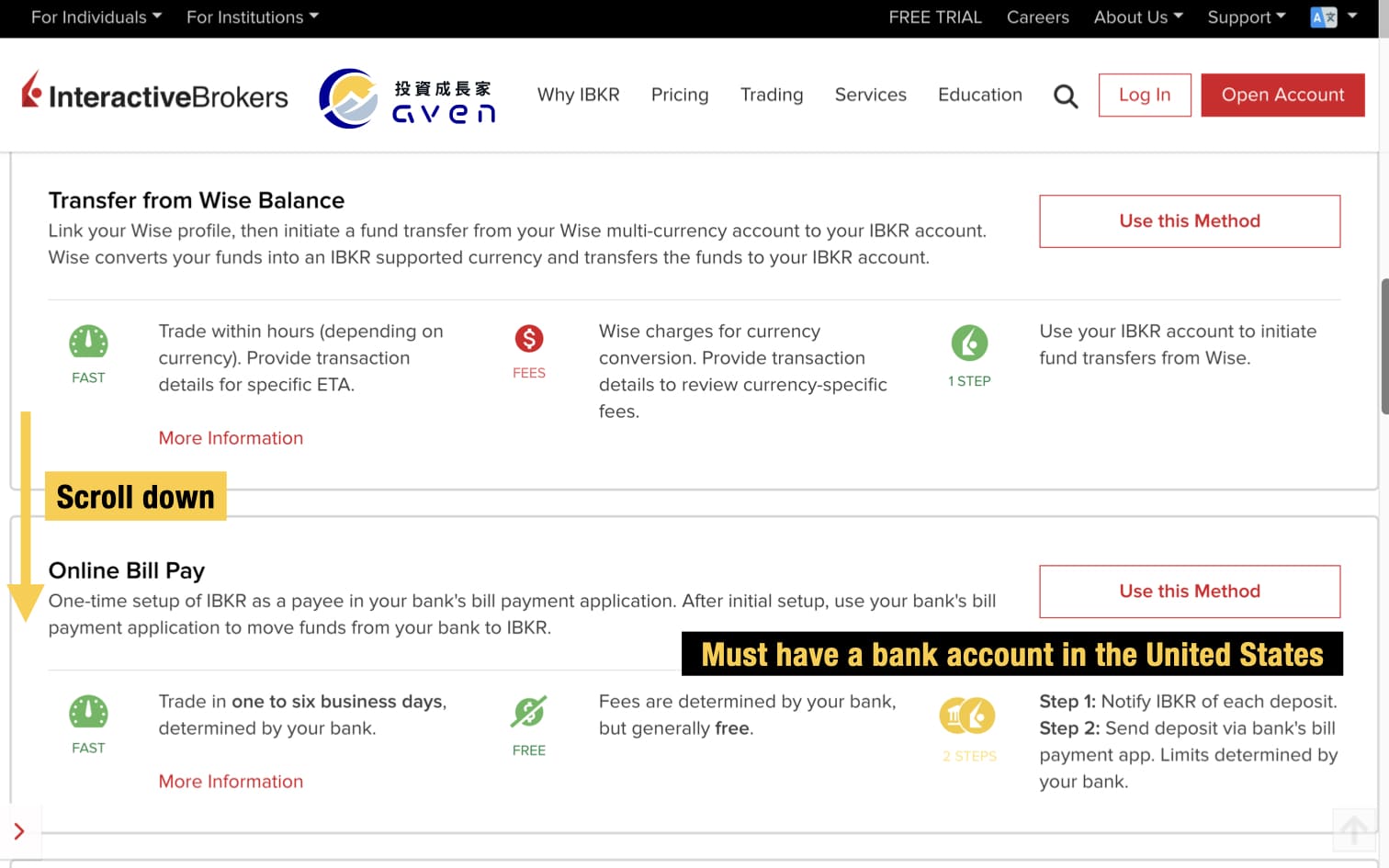

3. Transfer from Wise Balance

- Requirement: Requires a Wise account.

- Details: Ideal for international investors, this method enables fund your IB account with your Wise account balance for further management.

4. Online Bill Pay

- Requirement: Must have a United States bank account.

- Details: Allows users to pay bills directly from their bank account using the bank’s online banking platform.

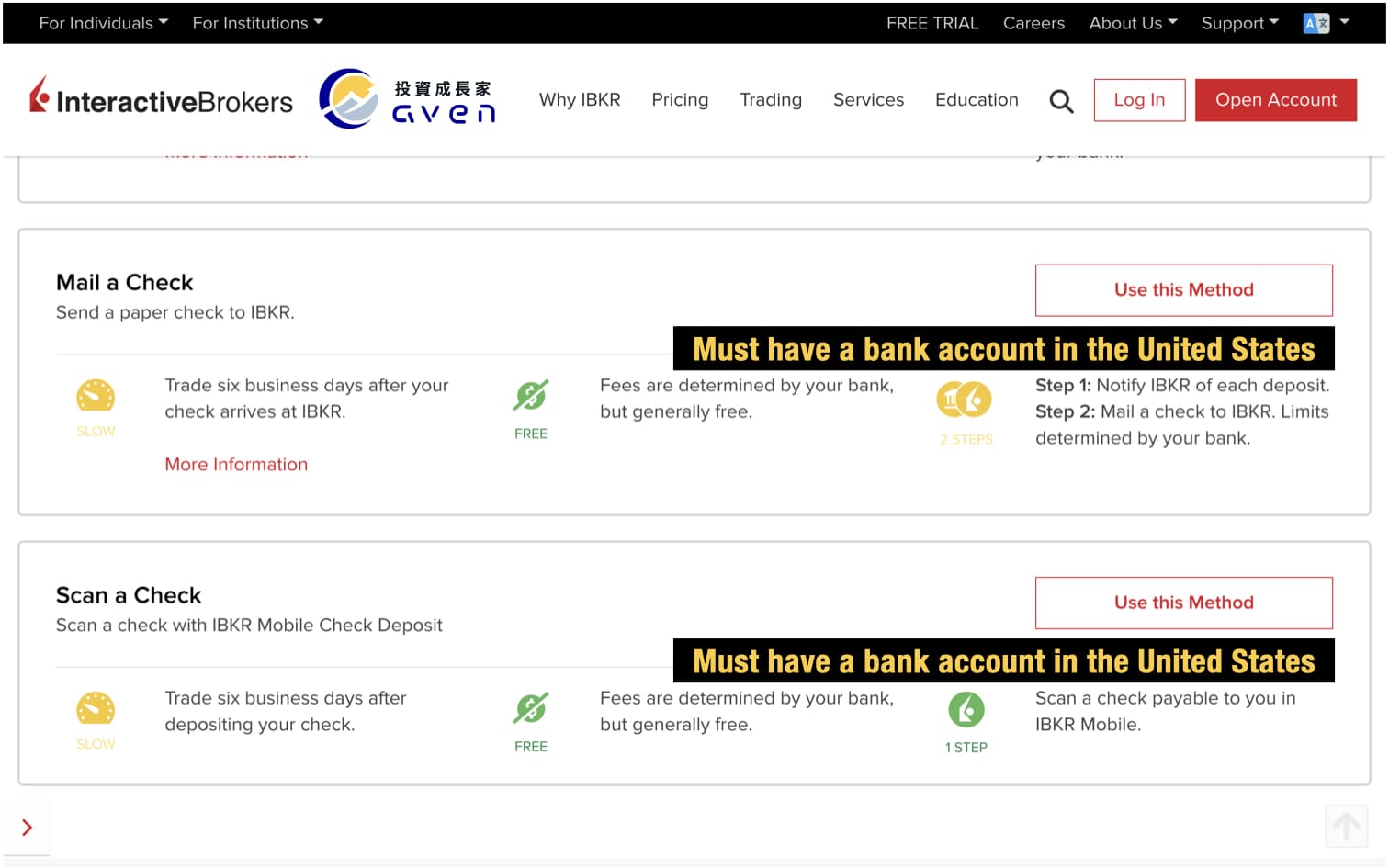

5. Traditional Check (Mail or Scan)

- Requirement: Must have a United States bank account.

- Details: You can mail your check to IB. This is a more traditional method, suitable for those who prefer physical checks.

|

Withdrawal Methods |

Requirement |

|

Direct ACH Transfer from your Bank Link a New Bank Account |

Must have a United States bank account. |

|

Bank Wire |

For international investors |

|

Transfer from Wise Balance |

For international investors (who have Wise accounts) |

|

Online Bill Pay |

Must have a United States bank account. |

|

Traditional Check (Mail or Scan) |

Must have a United States bank account. |

The most recommended funding methods are Bank Wire, Transfer from Wise Balance, and Link a New Bank Account. Bank Wire and Transfer from Wise Balance are available to investors worldwide. For U.S. account holders, Link a New Bank Account is the most convenient and fast way to fund your IB account, with no transaction fee. We will give you a step-by-step guide and tutorial on these three funding methods.

|

Deposit Method |

Transaction Fee |

Processing Time |

Applied to |

|

Bank Wire |

Depends on the bank |

A few days |

International Investors |

|

Transfer from Wise Balance |

Depends on the Wise |

Immediately |

International Investors who have a Wise account |

|

Link a New Bank Account |

0$ |

Immediately |

U.S. bank account holders |

Funding Interactive Brokers with Bank Wire Method

Step 1: Go to Interactive Brokers’ official website

Step 2: Log in to your account

Step 3: Choose your IBKR account deposit method

Step 4: Fill in the wire deposit form

Step 5: Follow the Bank Wire Instructions to fund your account

Step 6: Check your Transaction Status & History

The most common method of depositing and withdrawing funds is to use Bank Wire.

It is worth mentioning no matter which overseas brokerage it is, the logic of wire transfer is the same., so as long as you understand how to deposit funds at one brokerage, then wire transfer deposits from other brokerage firms can be solved easily.

This method can be applied by every overseas Interactive Brokers investor.

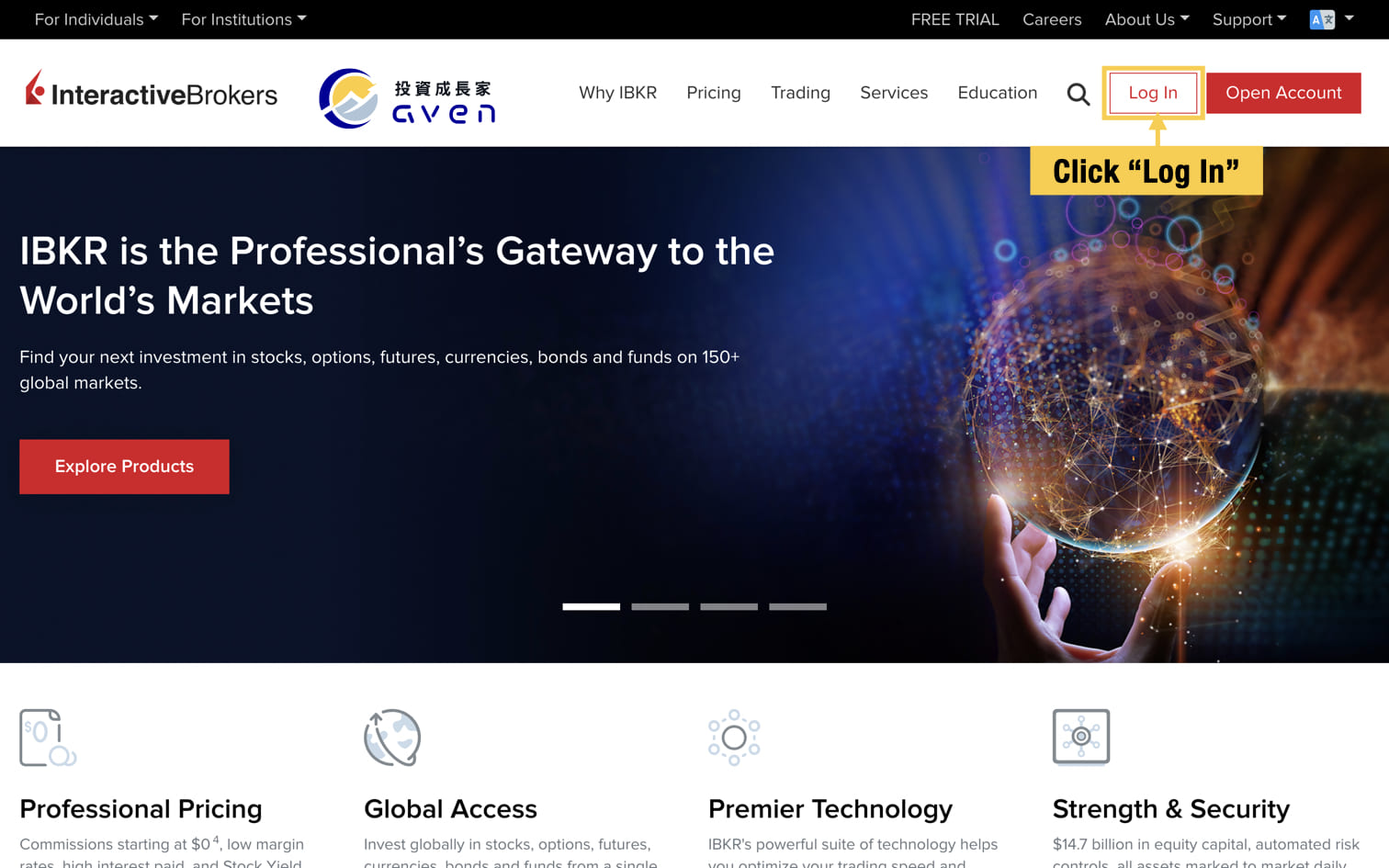

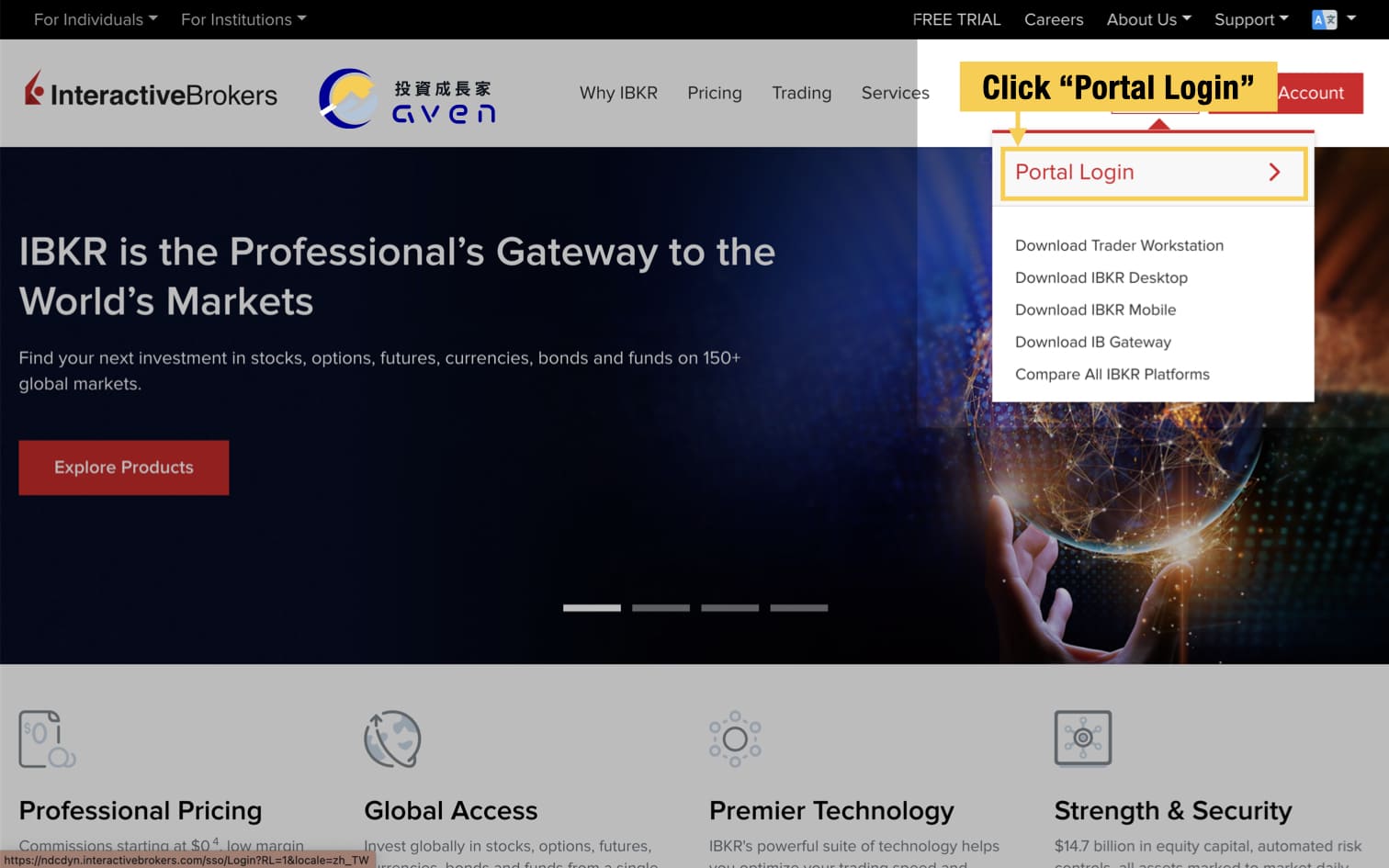

Step 1: Go to Interactive Brokers' official website

Click "Login"->Click "Portal Login:".

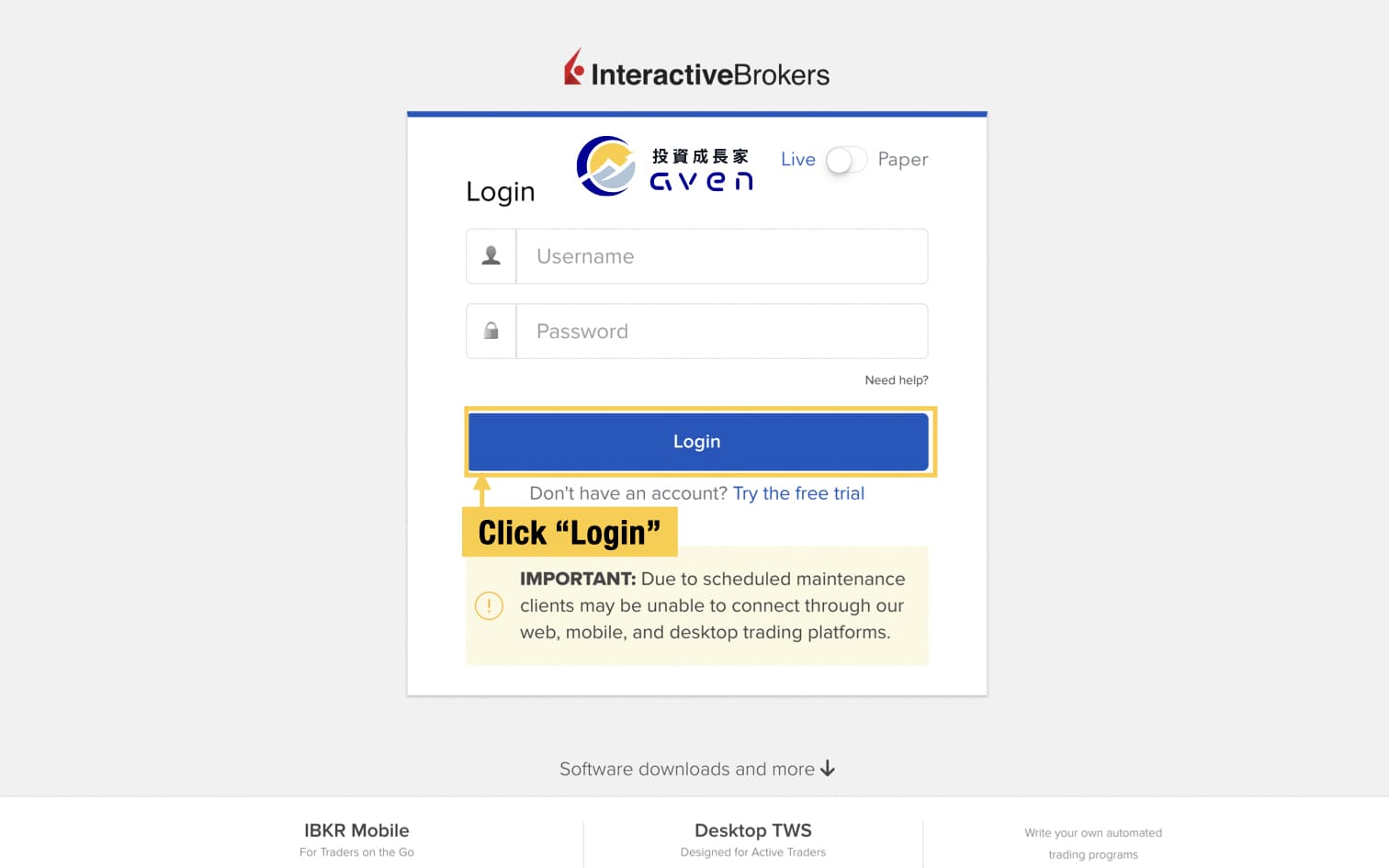

Step 2: Log in to your account

Enter your [Username] and [Password] here -> Click "Login".

When you log in, you'll need to verify through SMS or QR code scan. Just follow the instructions to complete it.

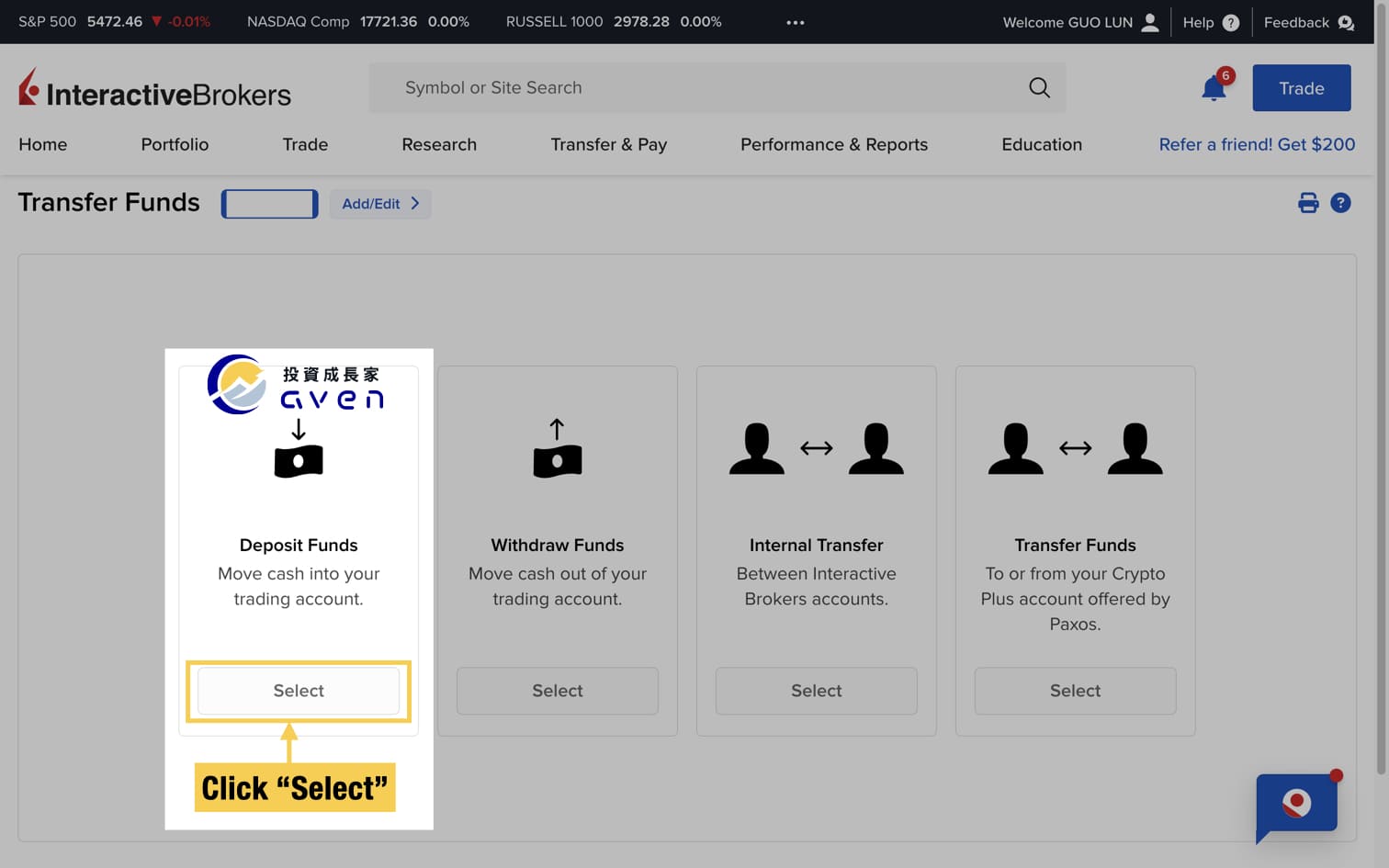

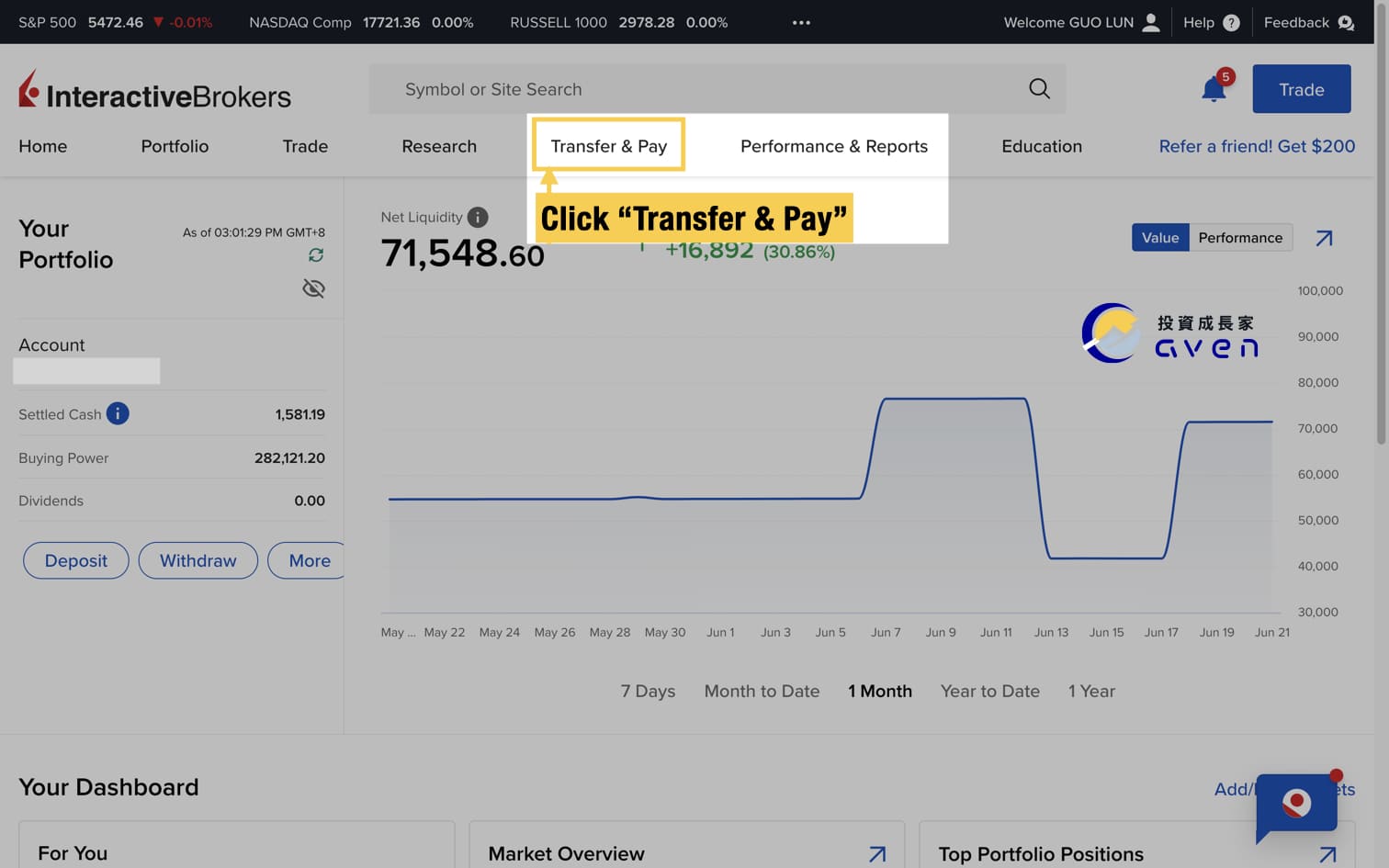

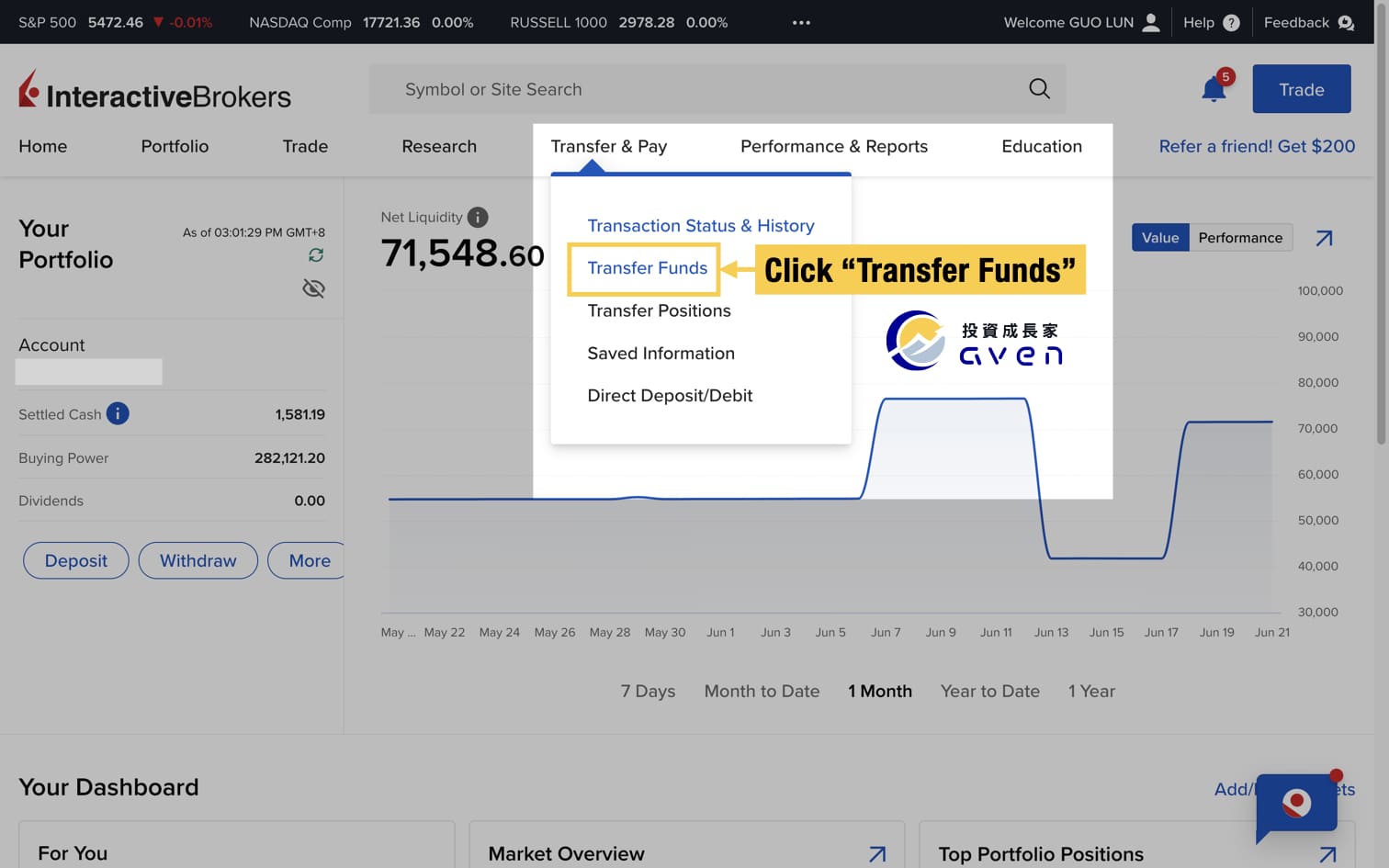

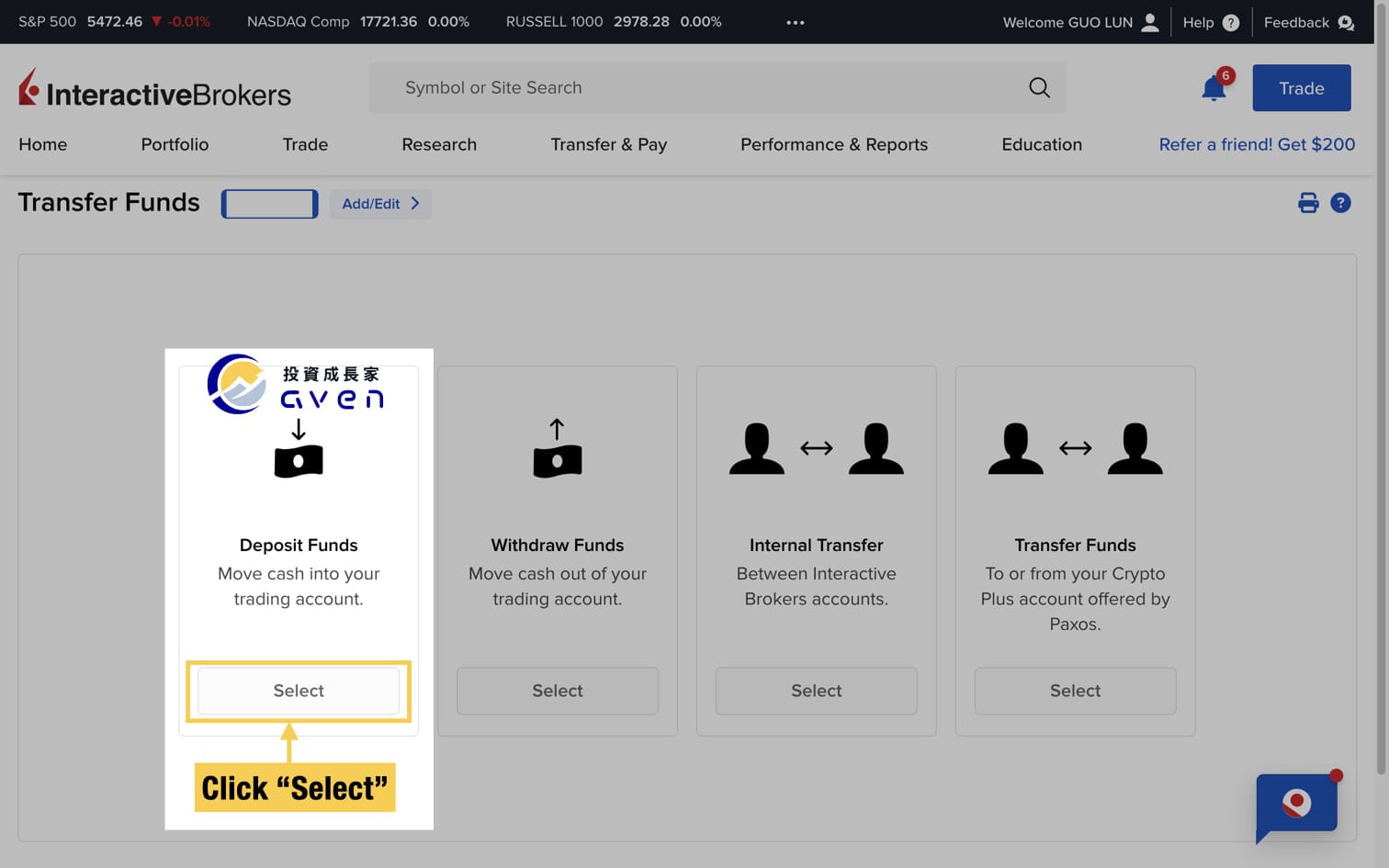

After you successfully log in, click “Transfer&Pay”-> “Transfer Funds”.

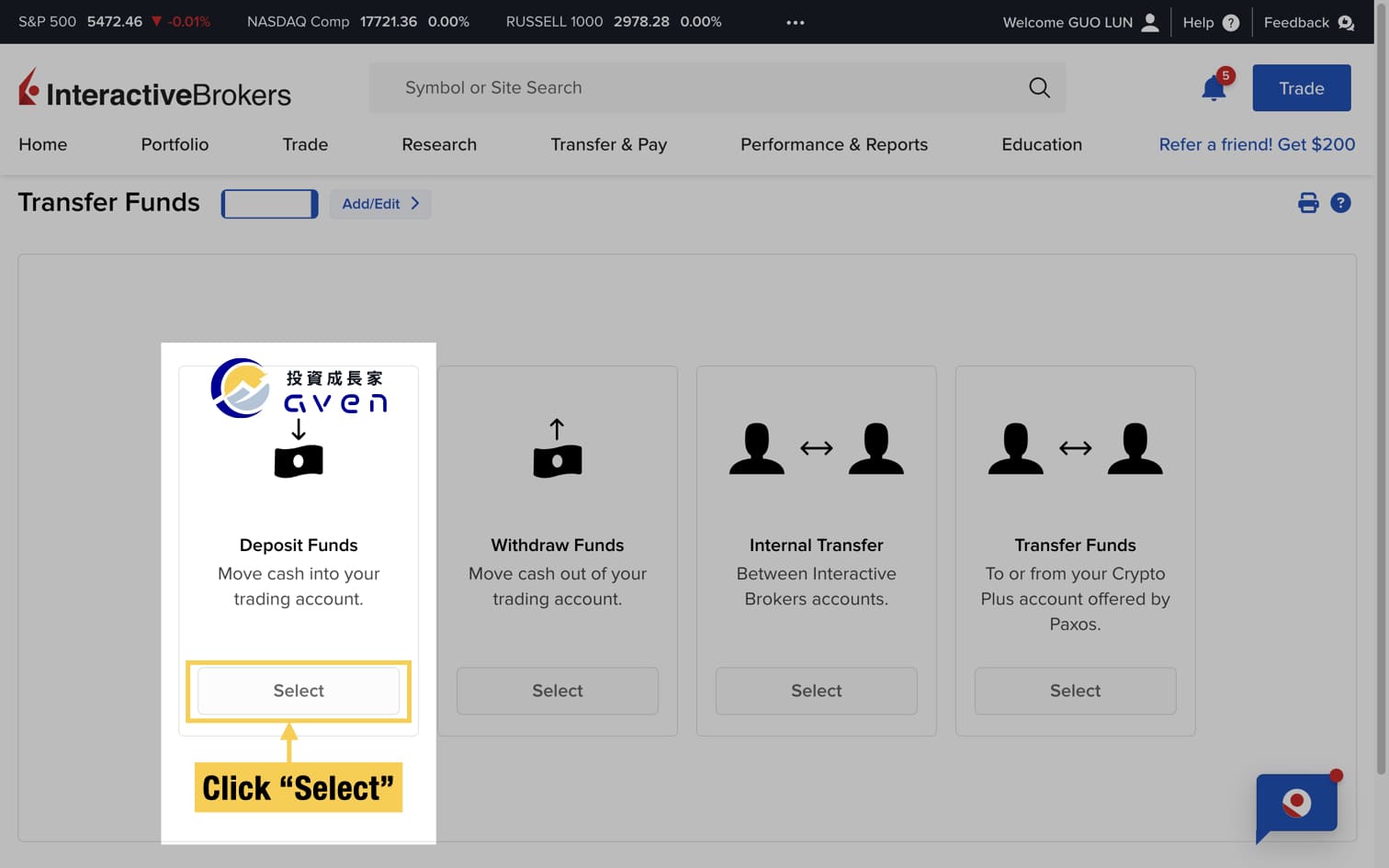

Choose "Deposit Funds" and click "Select".

Choose "Deposit Funds" and click "Select".

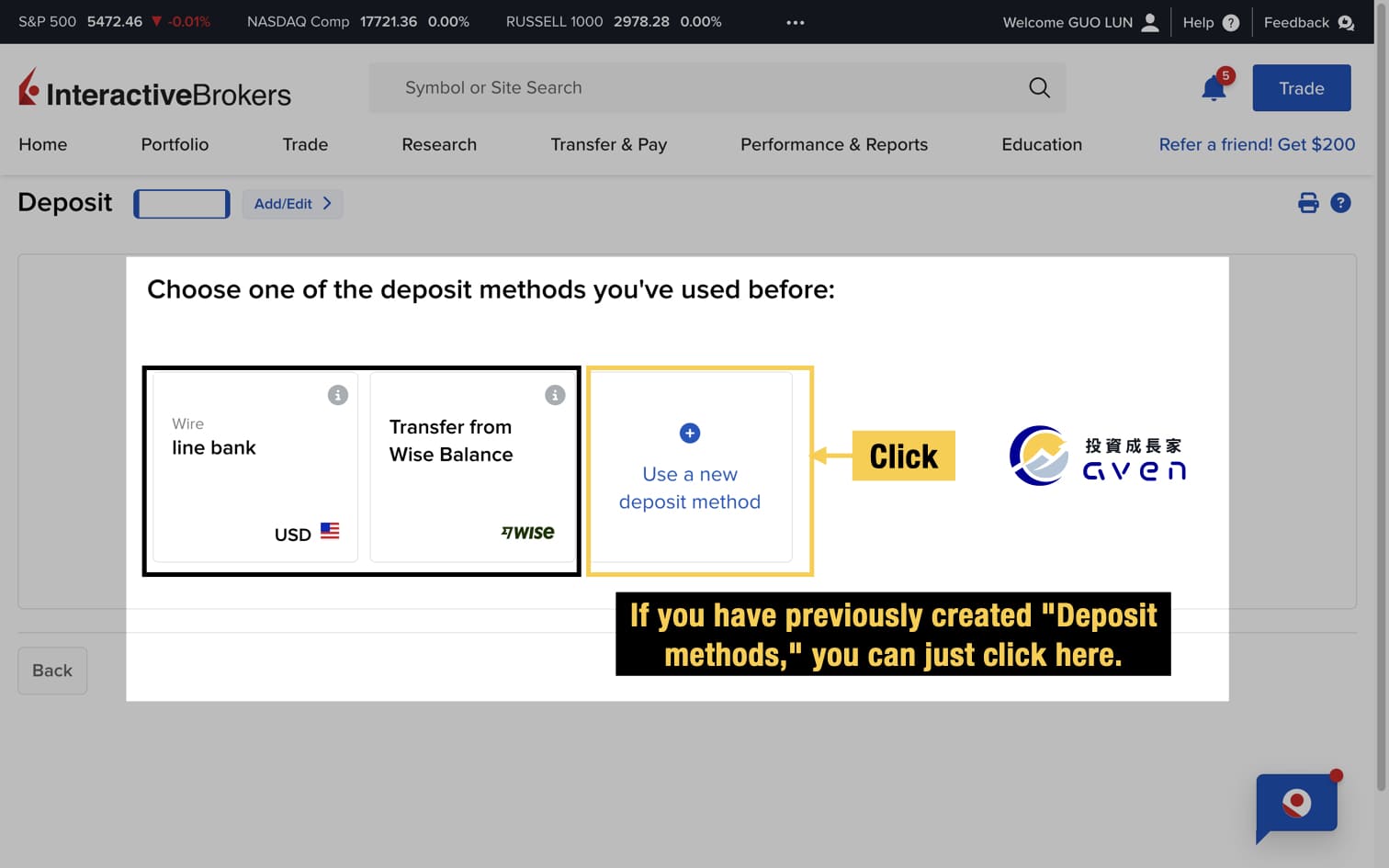

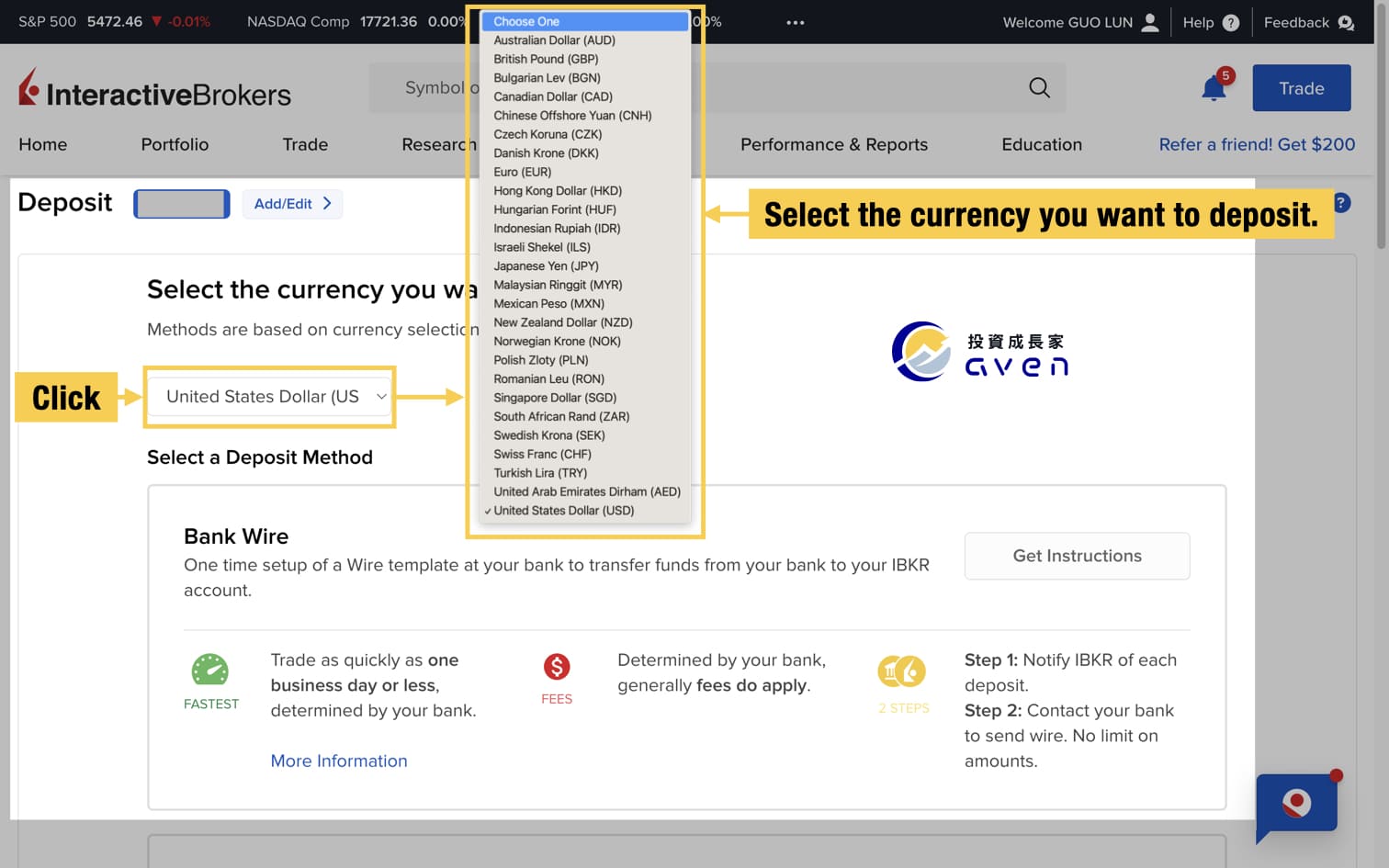

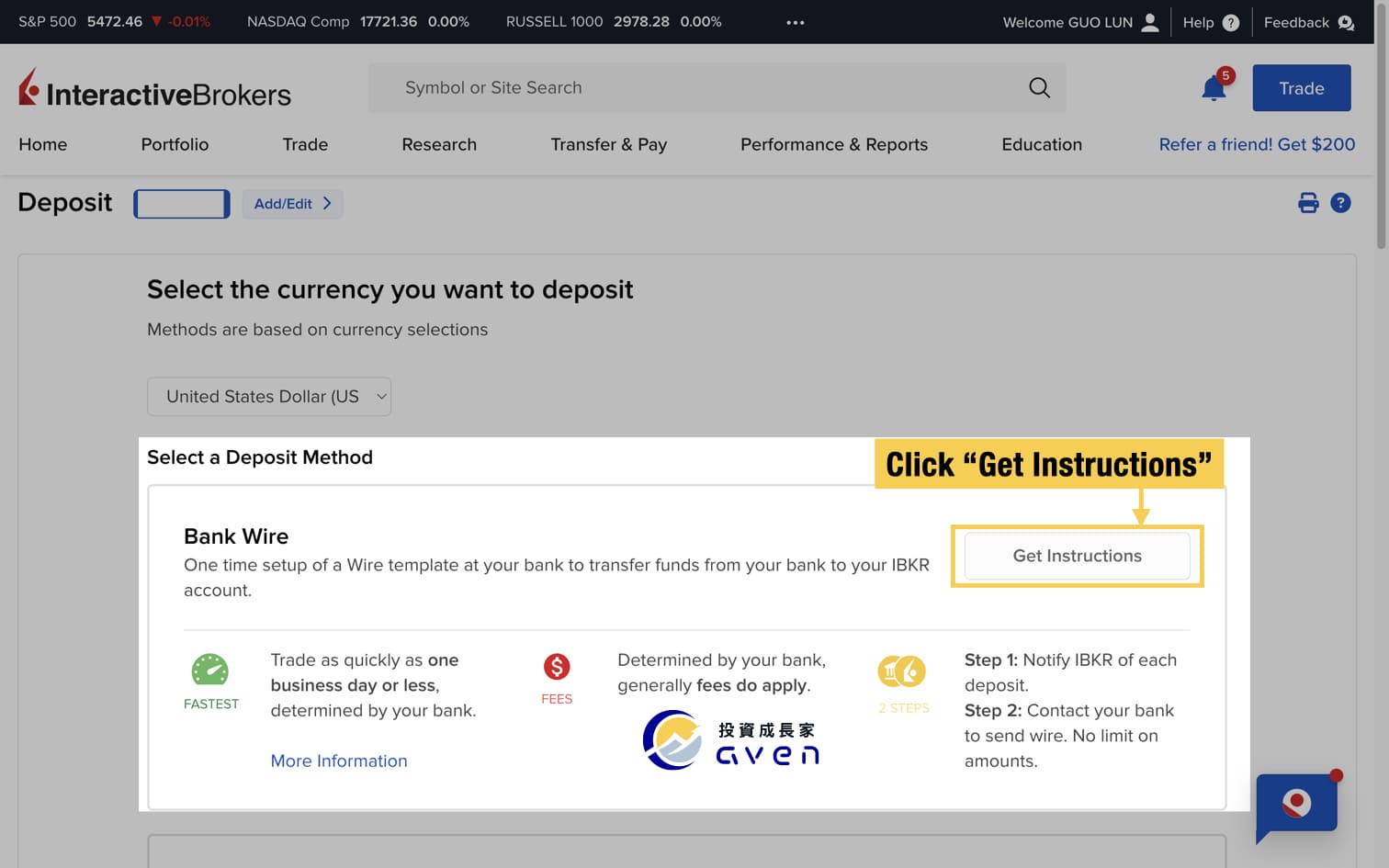

Step 3: Choose your IBKR account deposit method

There will be diverse "deposit" methods on this page. At this step, we can choose "Bank Wire". After selecting your currency as USD, click "Get Instructions". (To use Bank Wire to fund your IB account, you must have a bank account.)

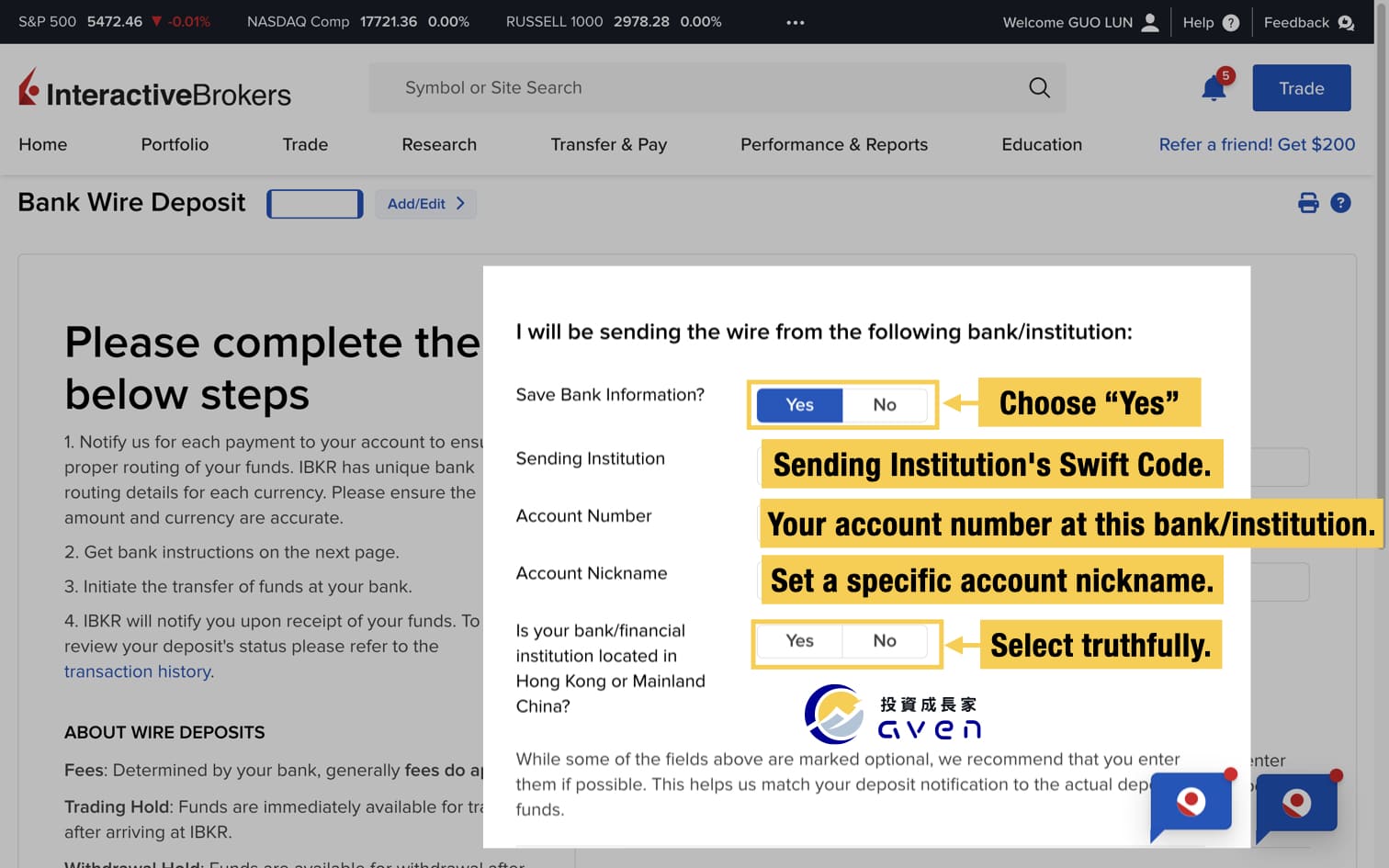

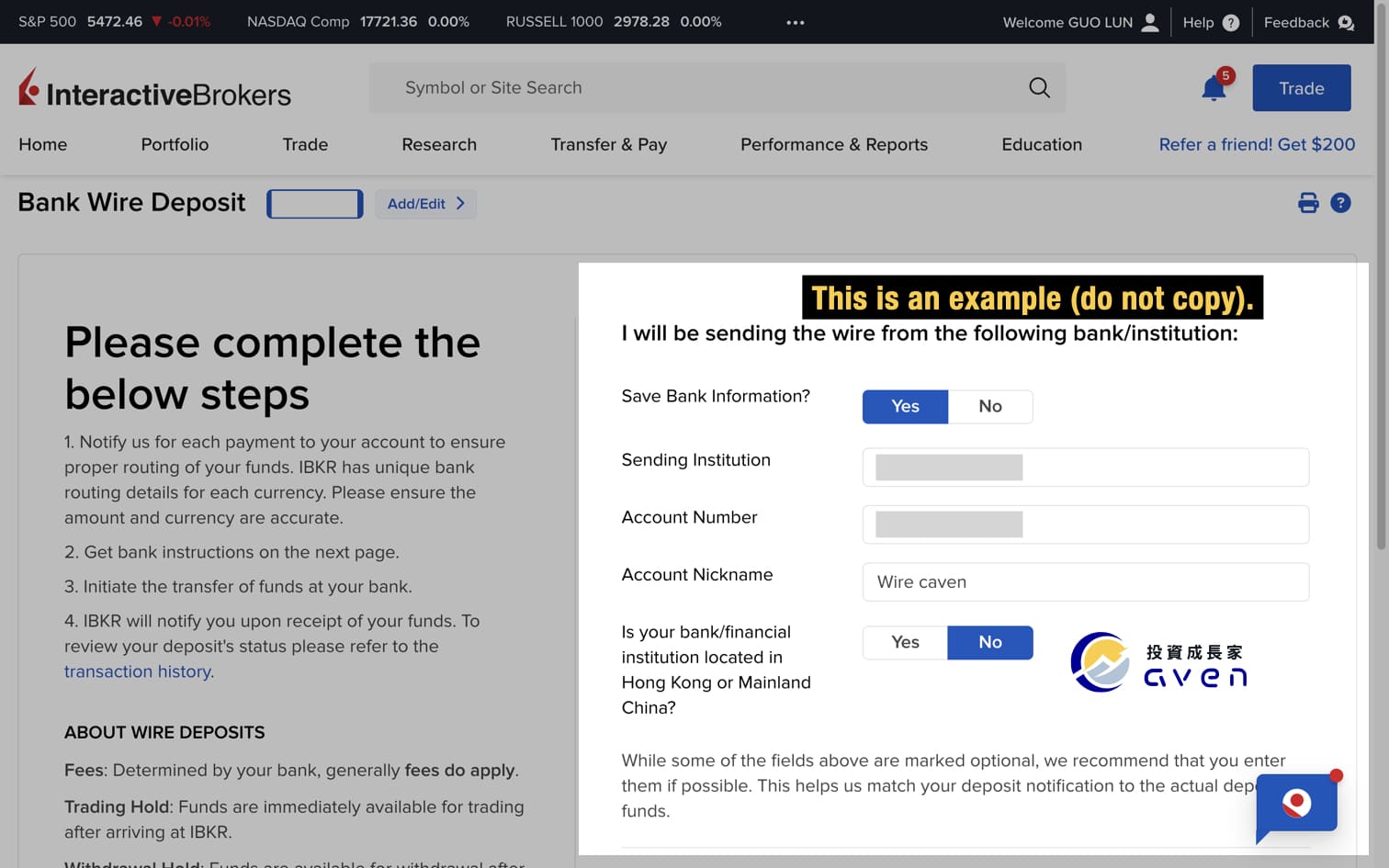

Step 4: Fill in the wire deposit form

In order to ensure the security of deposits and improve the efficiency of payment review, Interactive Brokers will require us to fill in the deposit form before depositing money., that is, informing the system that we will have a sum of money to be remitted. This notification setting only needs to be set once, and then set as a common account.

What is SWIFT Code?

SWIFT Code is a global network used to process remittances between countries.

You can think of it as your bank's ID card. In this way, as long as you correspond to the SWIFT Code when remitting money in the future, the bank can quickly know where the money is to be remitted.

If you don't know the beneficiary bank's SWIFT Code, you can find it by searching the XXX Bank SWIFT Code online.

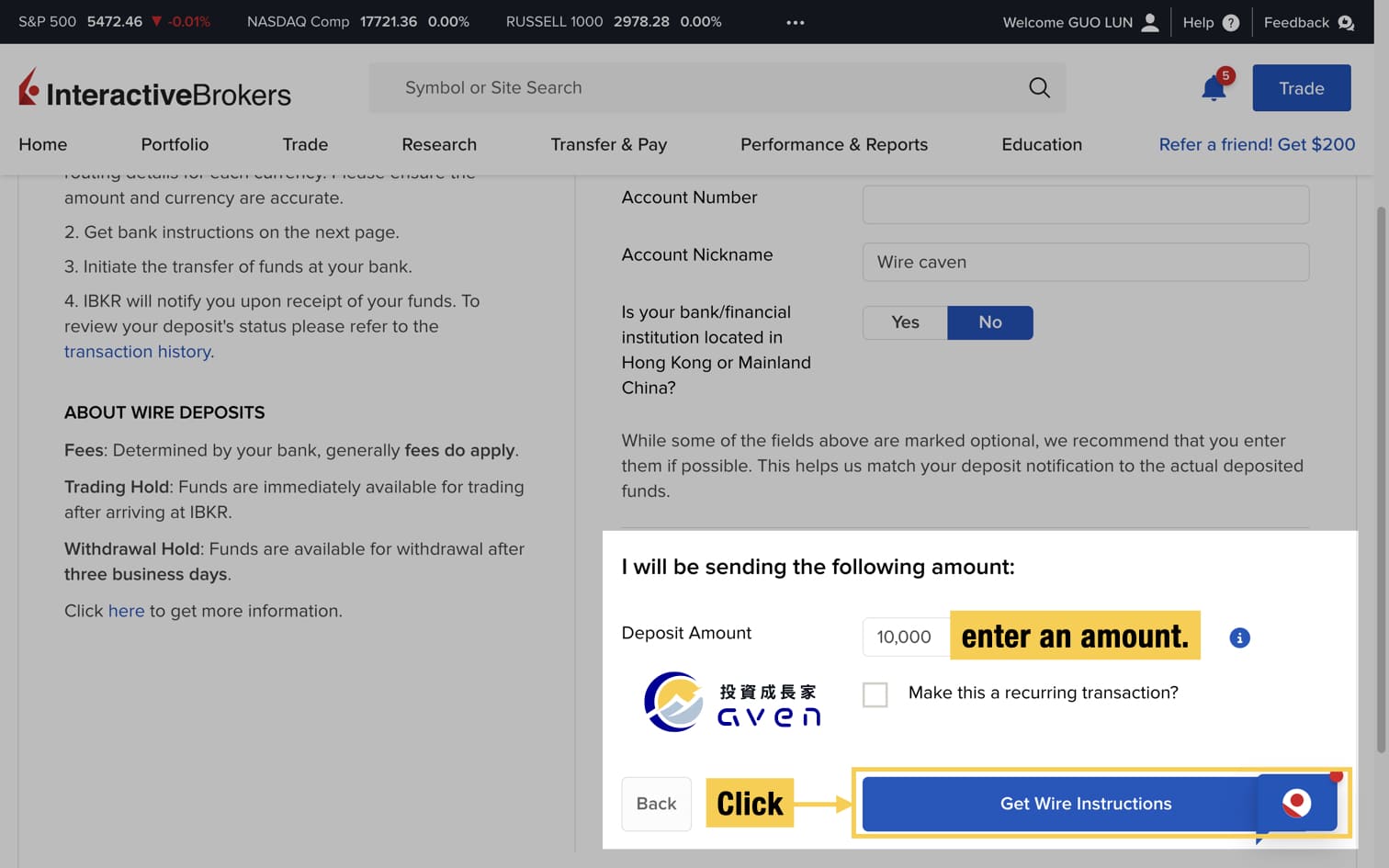

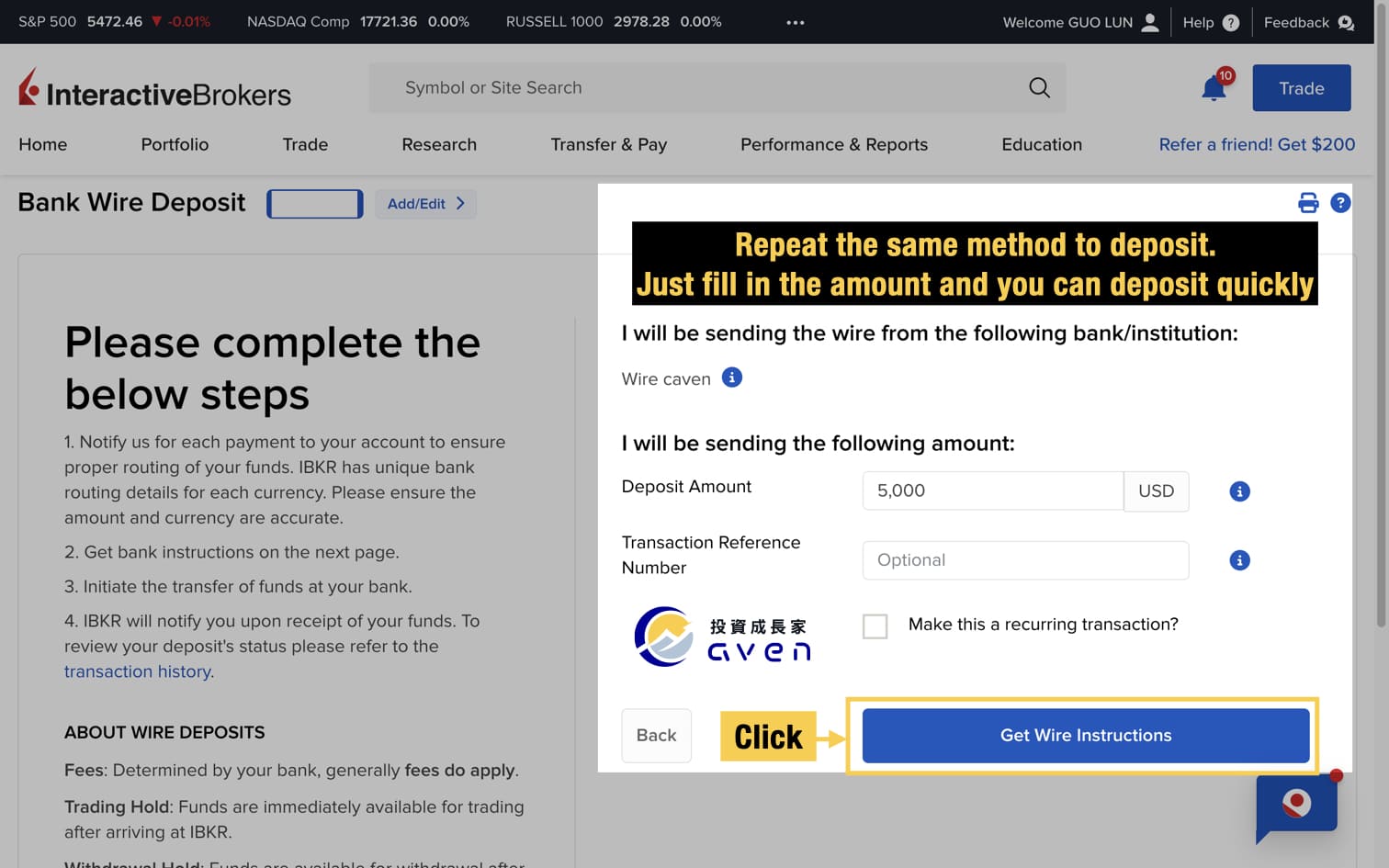

After entering your deposit amount, click “Get Wire Instructions”

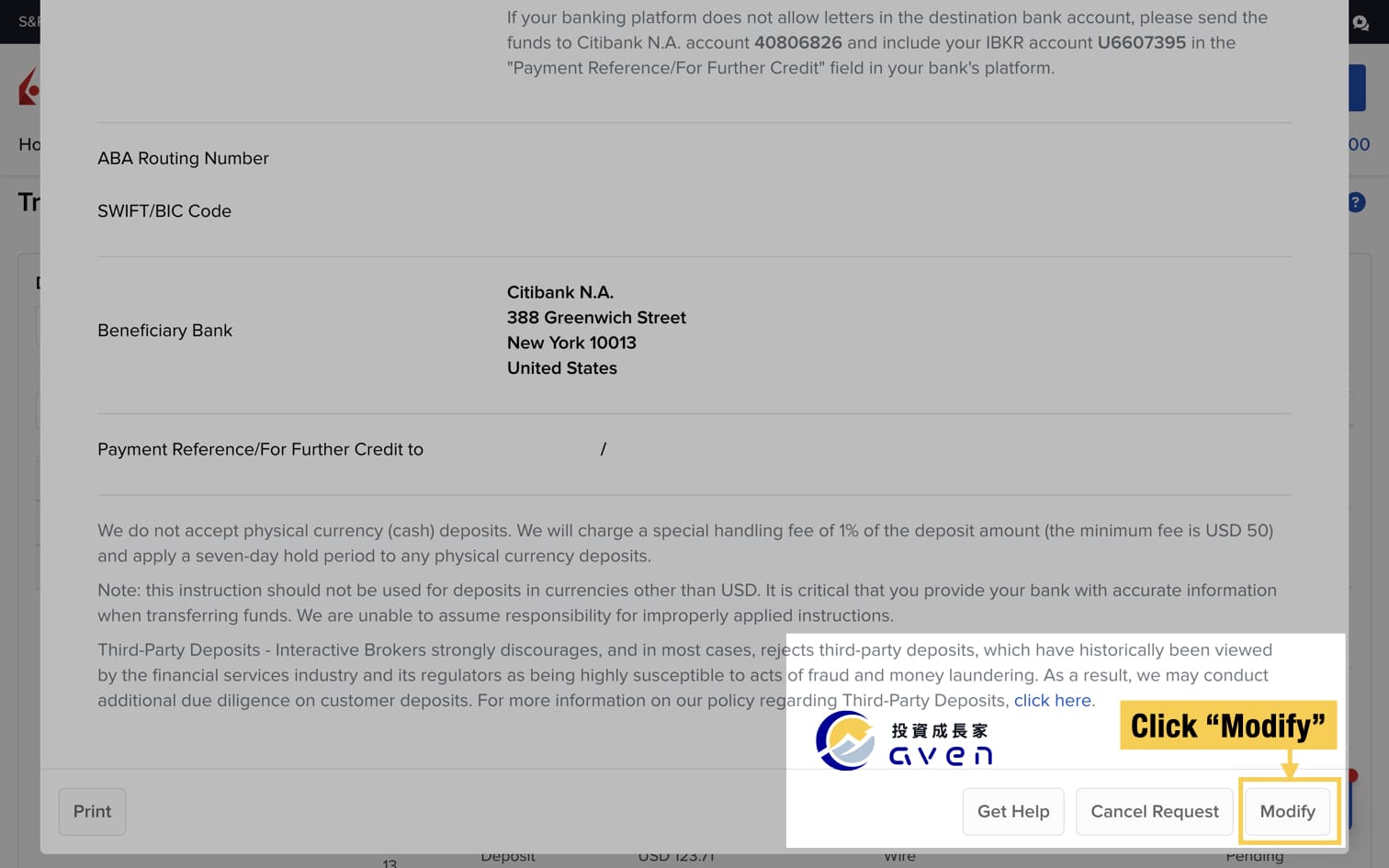

Step 5: Follow the Bank Wire Instructions to fund your account

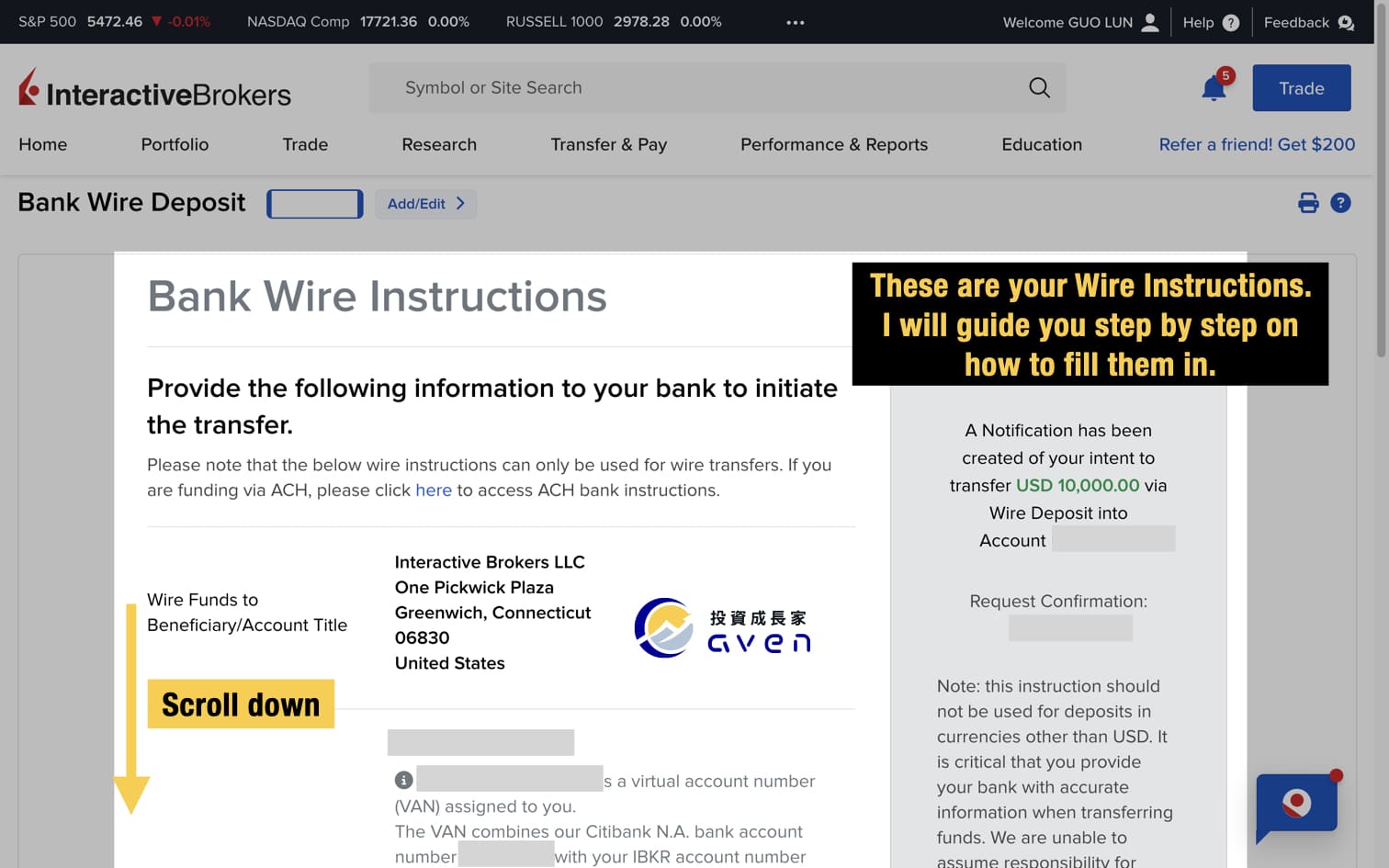

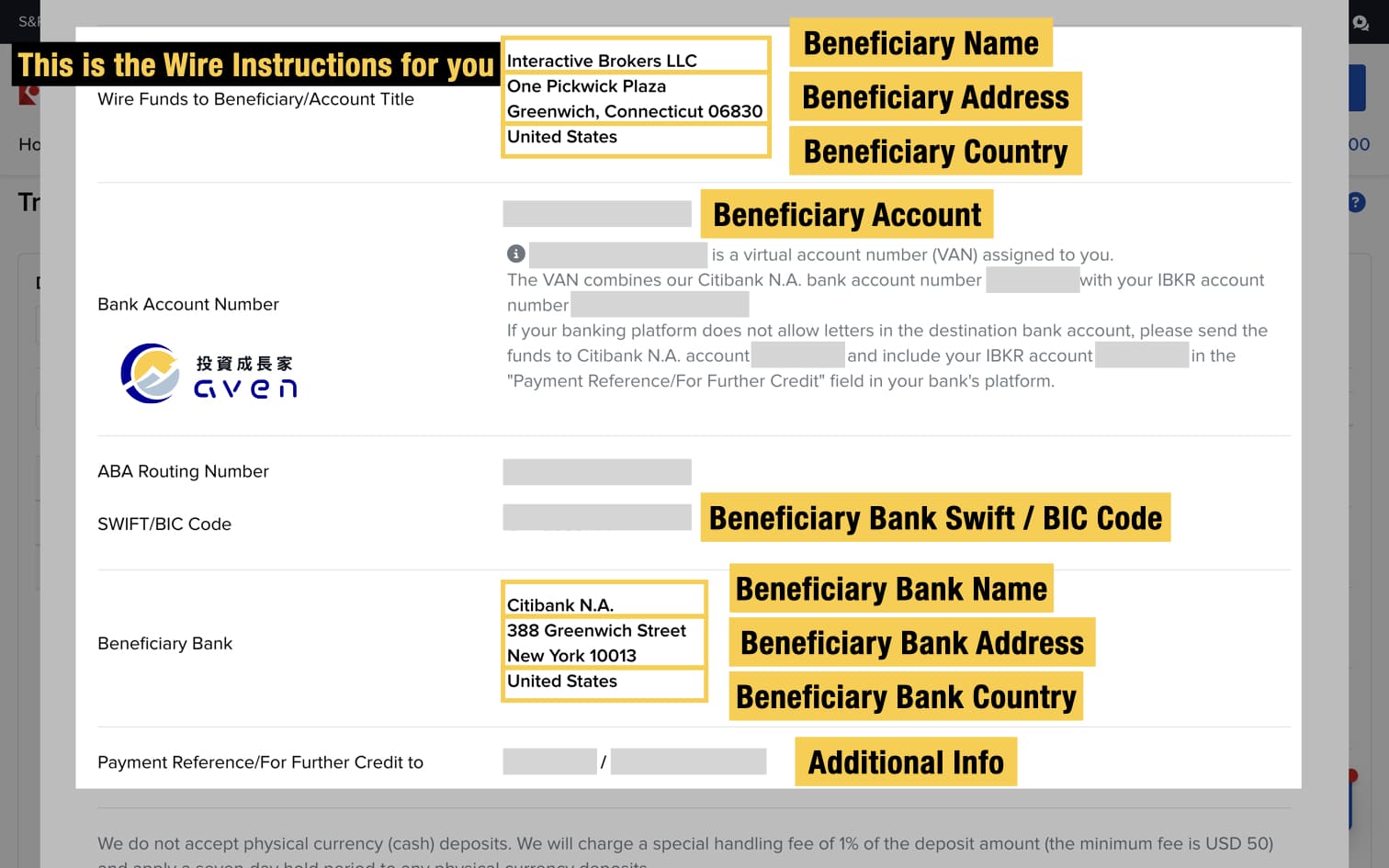

Now it will show a Bank Wire instruction for you. I will guide you step by step on how to fill them in.

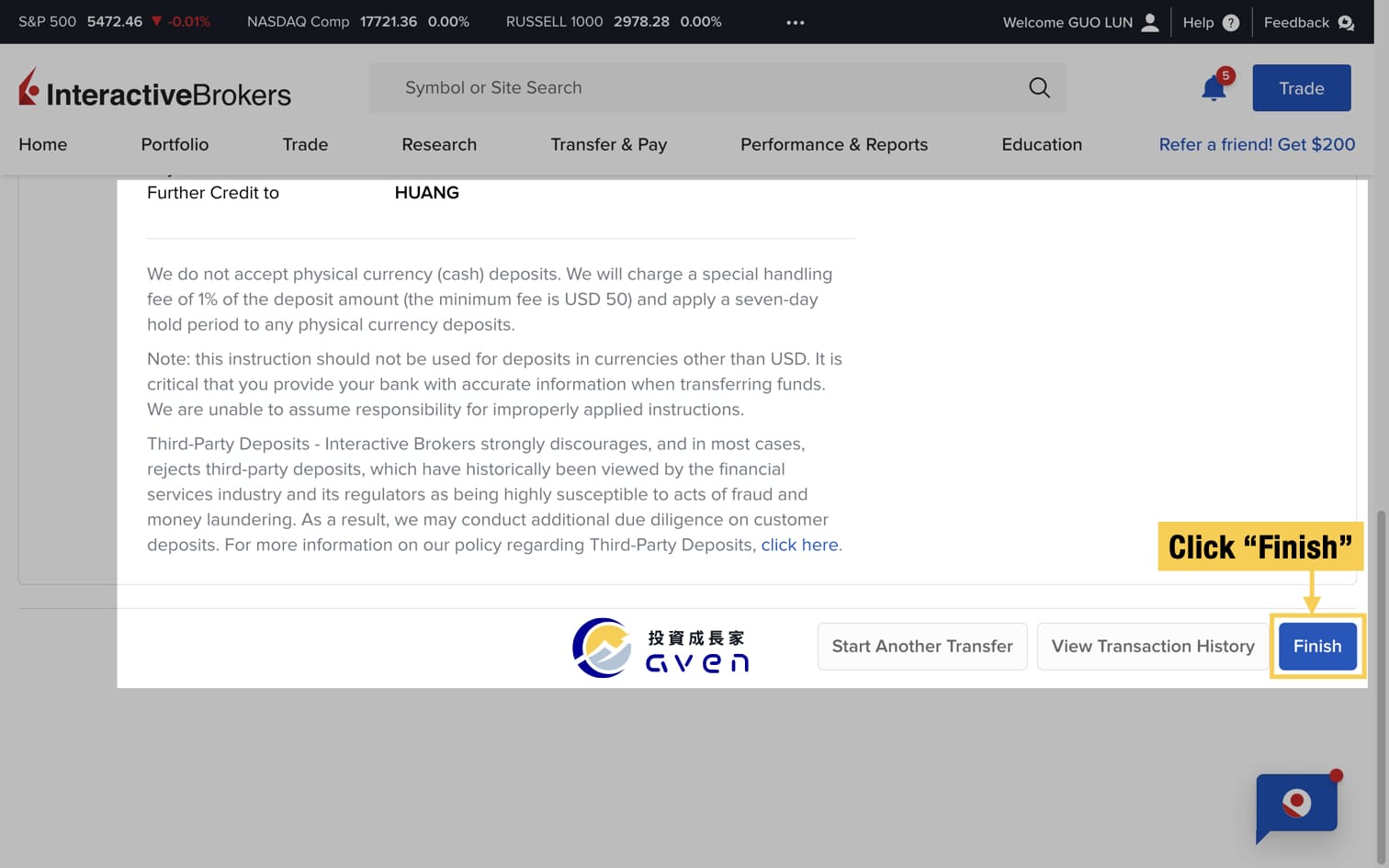

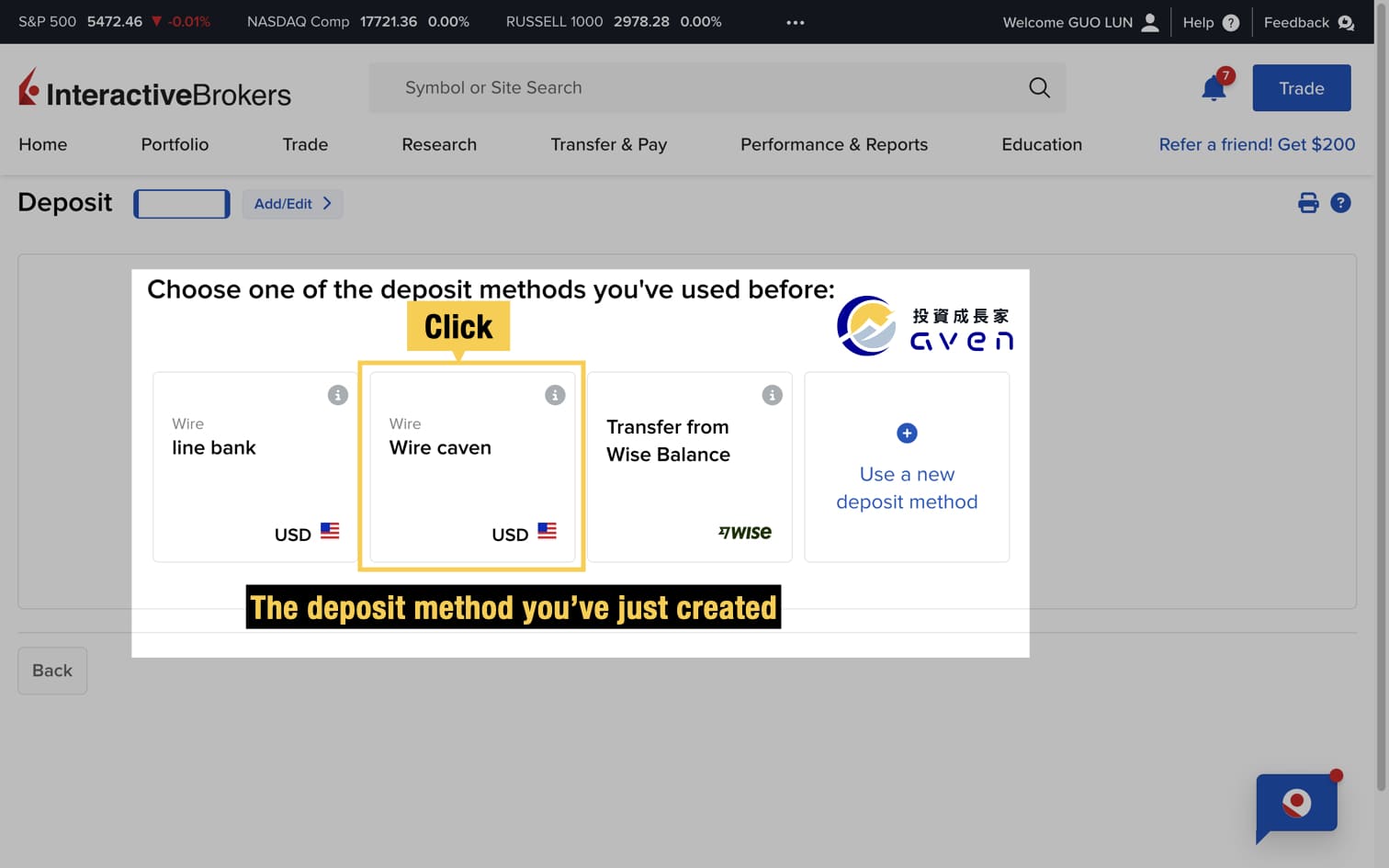

Atfer you click finish, you can go back to log in, and click “Transfer&Pay”-> “Transfer Funds”->“Deposit Funds”. Here you can see you have created a wire account option as one of your deposit methods. Just choose it!

Now you can enter your deposit amount and click "Get Wire Instructions".

It will show this page. The information on this page is particularly important. It is the information you need when you go to the bank to transfer money.

Common mistakes:

- The payee writes his/her name ( the beneficiary name is Interactive Brokers, not you! )

- For the beneficiary account, write your own IB account number ( the beneficiary account is Interactive Brokers' account in the beneficiary bank! )

- There is no account number or English name in the postscript ( the postscript is a way to authenticate you! )

- Use your parents' foreign currency account to remit money ( the remitter must be yourself, you cannot ask others to remit money, it will be returned. To prevent money laundering)

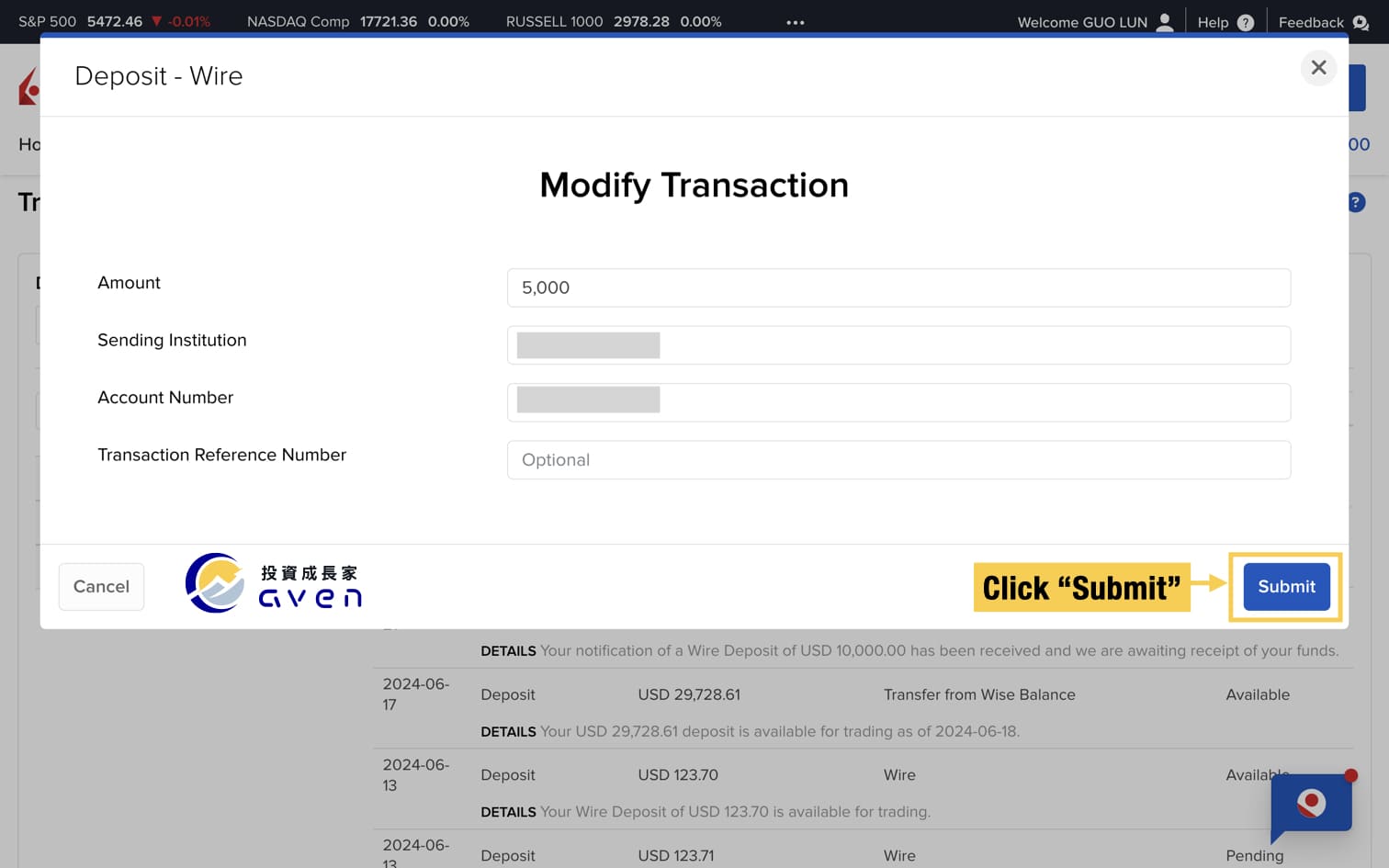

After entering your information, click "Modify" to adjust your transfer details (such as the deposit amount).

You can modify the amount of your deposit there, then click "Submit". This will complete the modification.

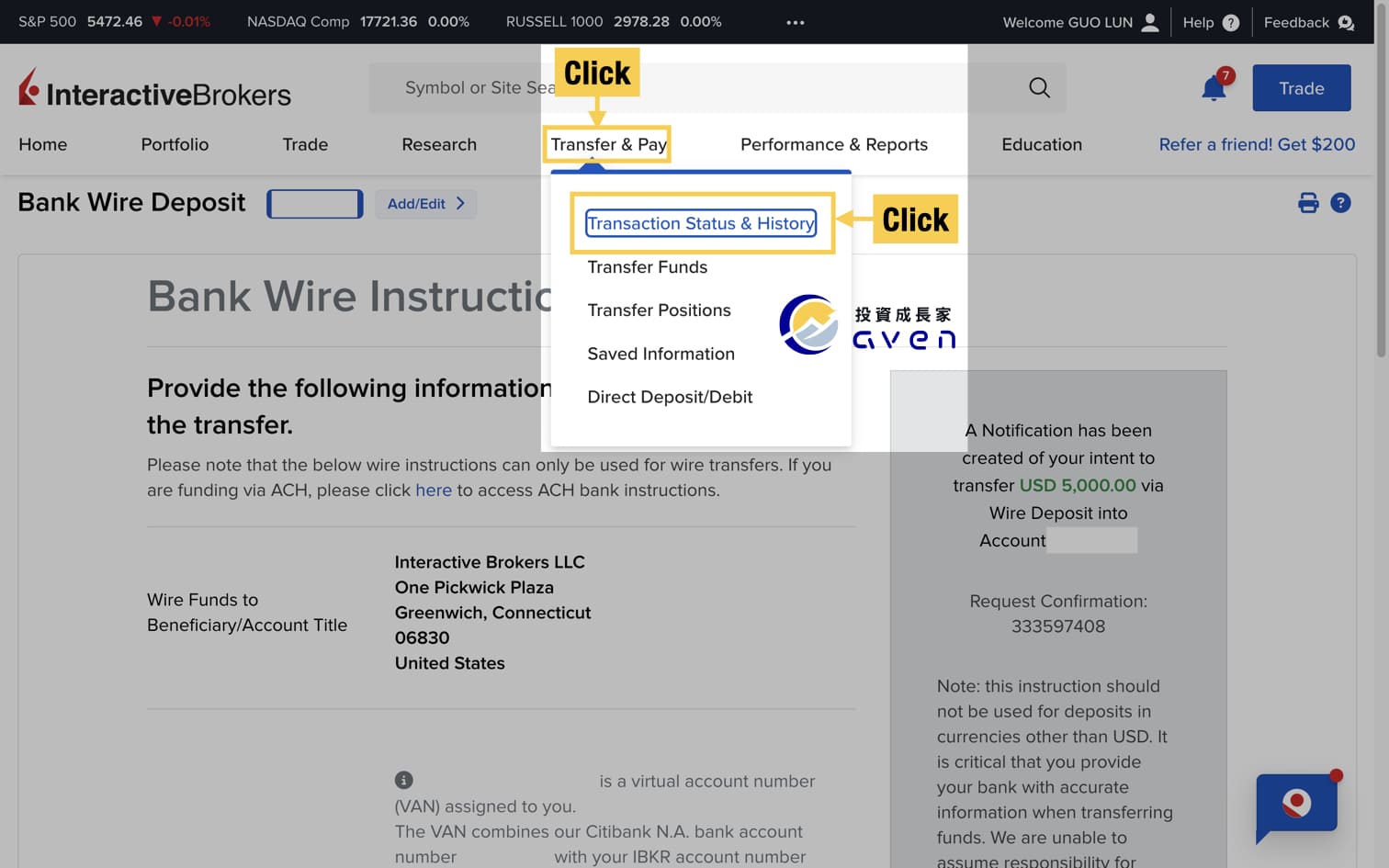

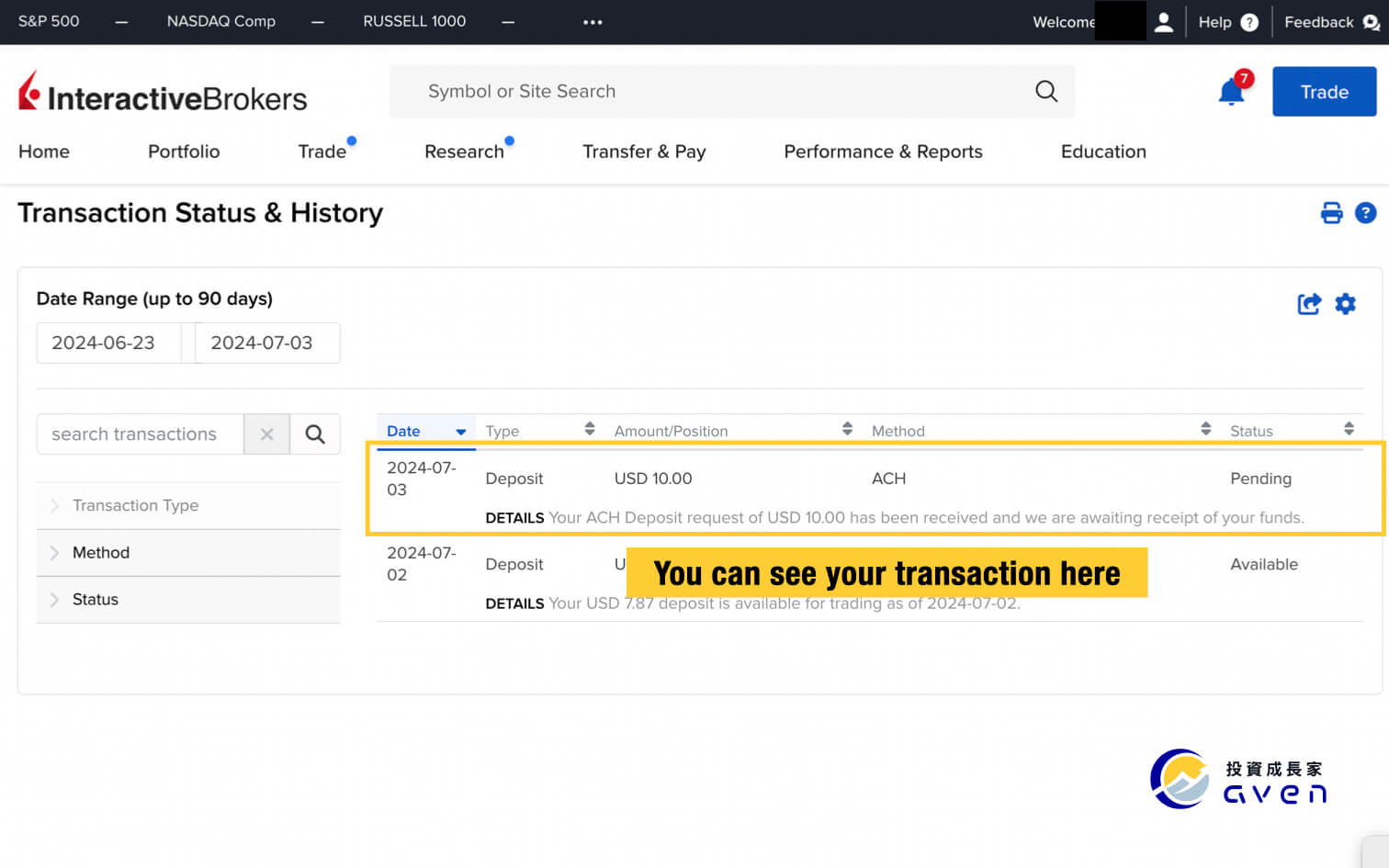

Step 6: Check your Transaction Status & History

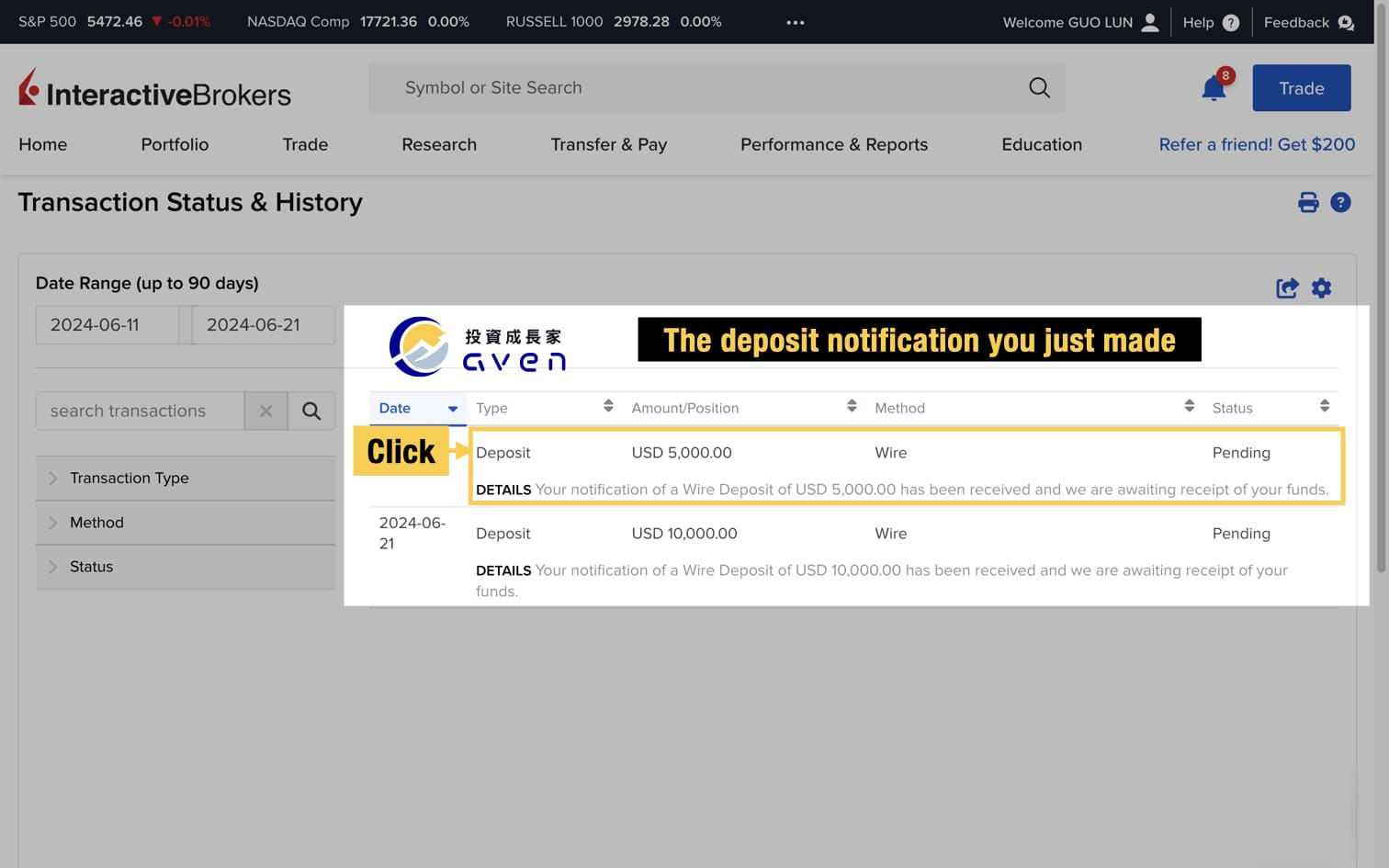

After you deposit your IB account, you can click "Transfer & Pay" -> "Transaction Status & History" to check your deposit.

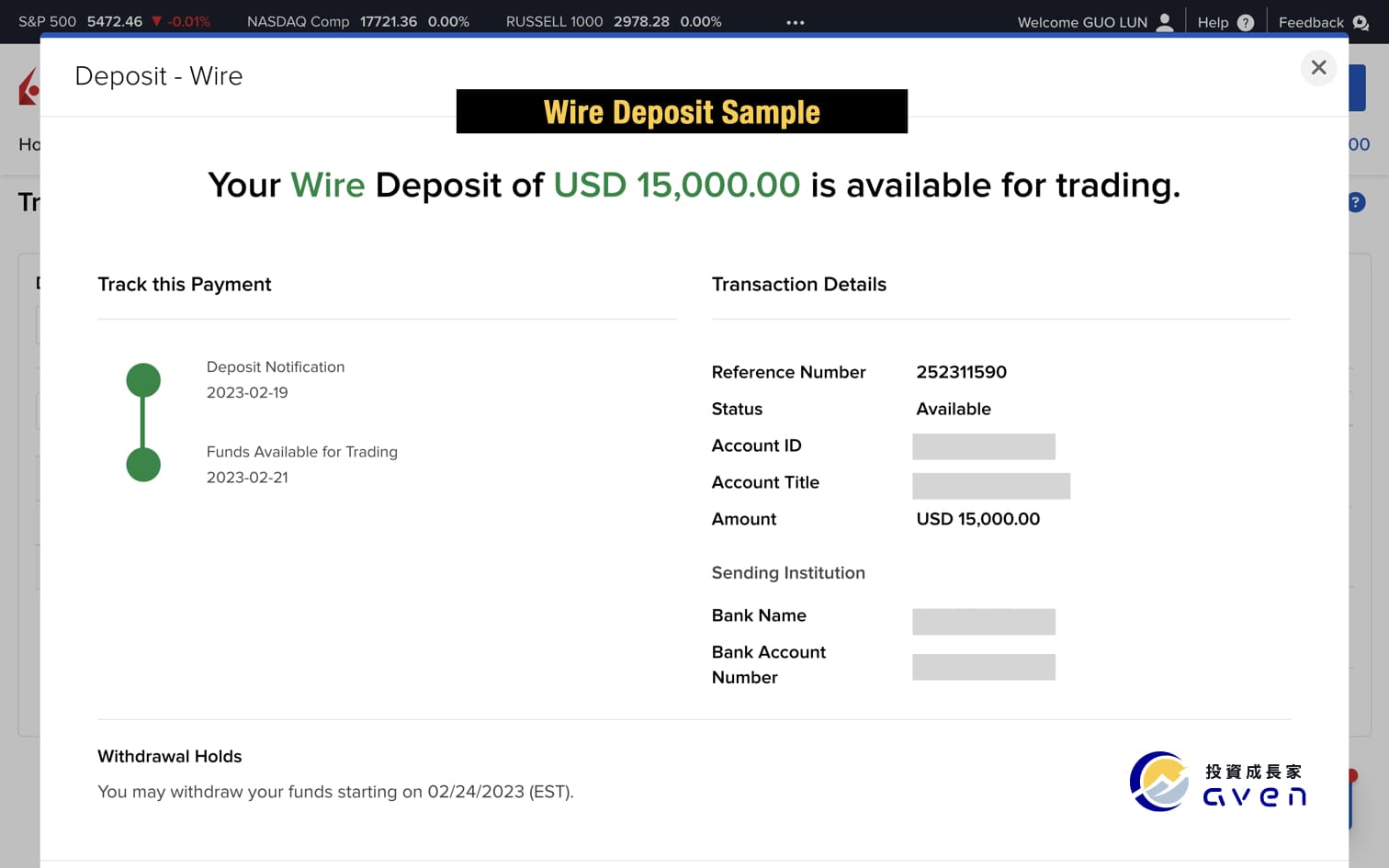

After a few days, once your transaction status has changed to "available for trading", you can now use your IB account to trade!

Funding Interactive Brokers with Transfer from Wise Balance Method

Step 1: Set up your wise account

Step 2: Fund your Wise balance

Step 3: Choose your IBKR account deposit method

Step 4: Link your IB account with your Wise account

Step 5: Fund your IB account through Wise

Step 6: Check your Transaction Status & History

Step 1: Set up your wise account

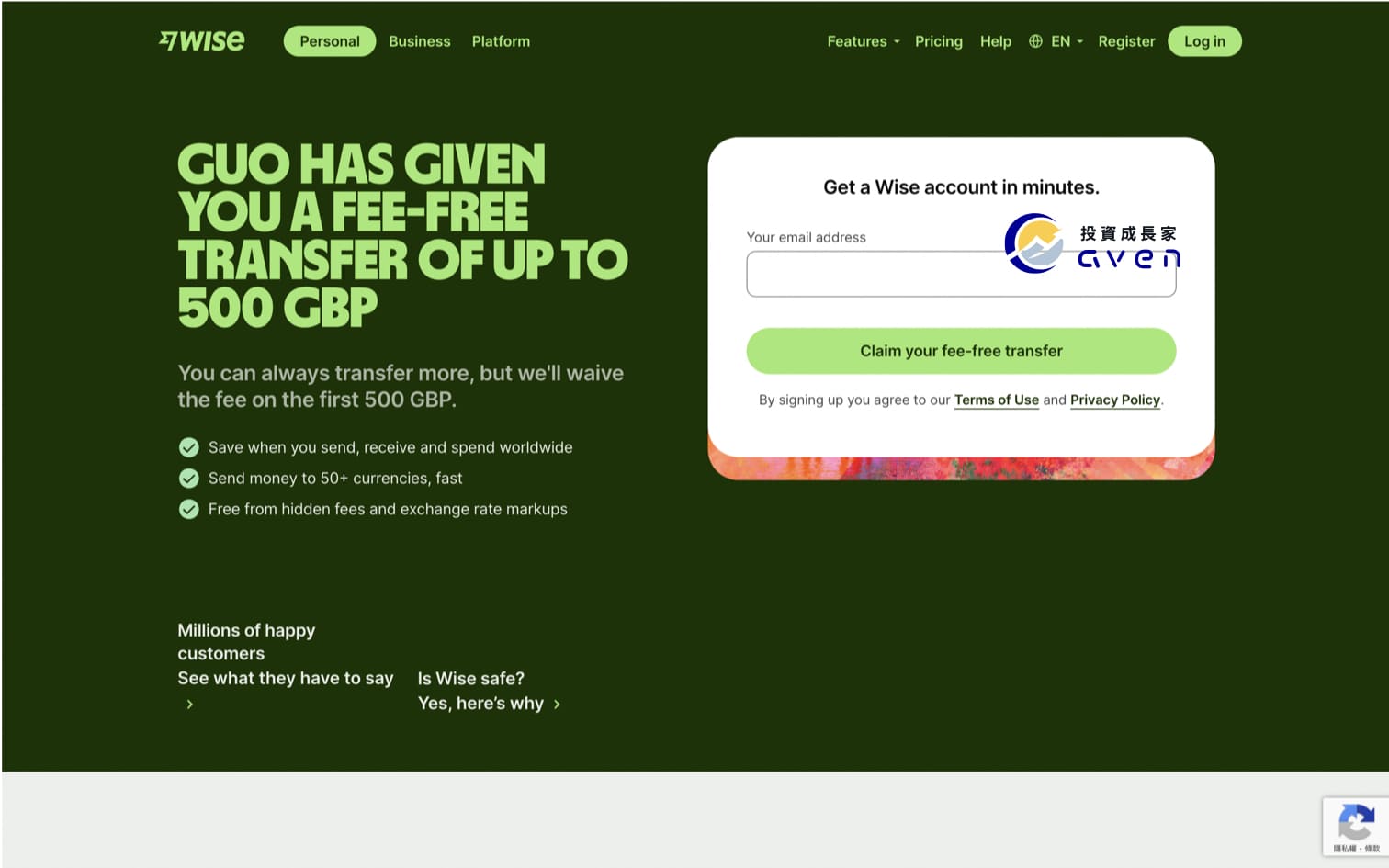

If you don't have a wise account, you can use my link to create one.

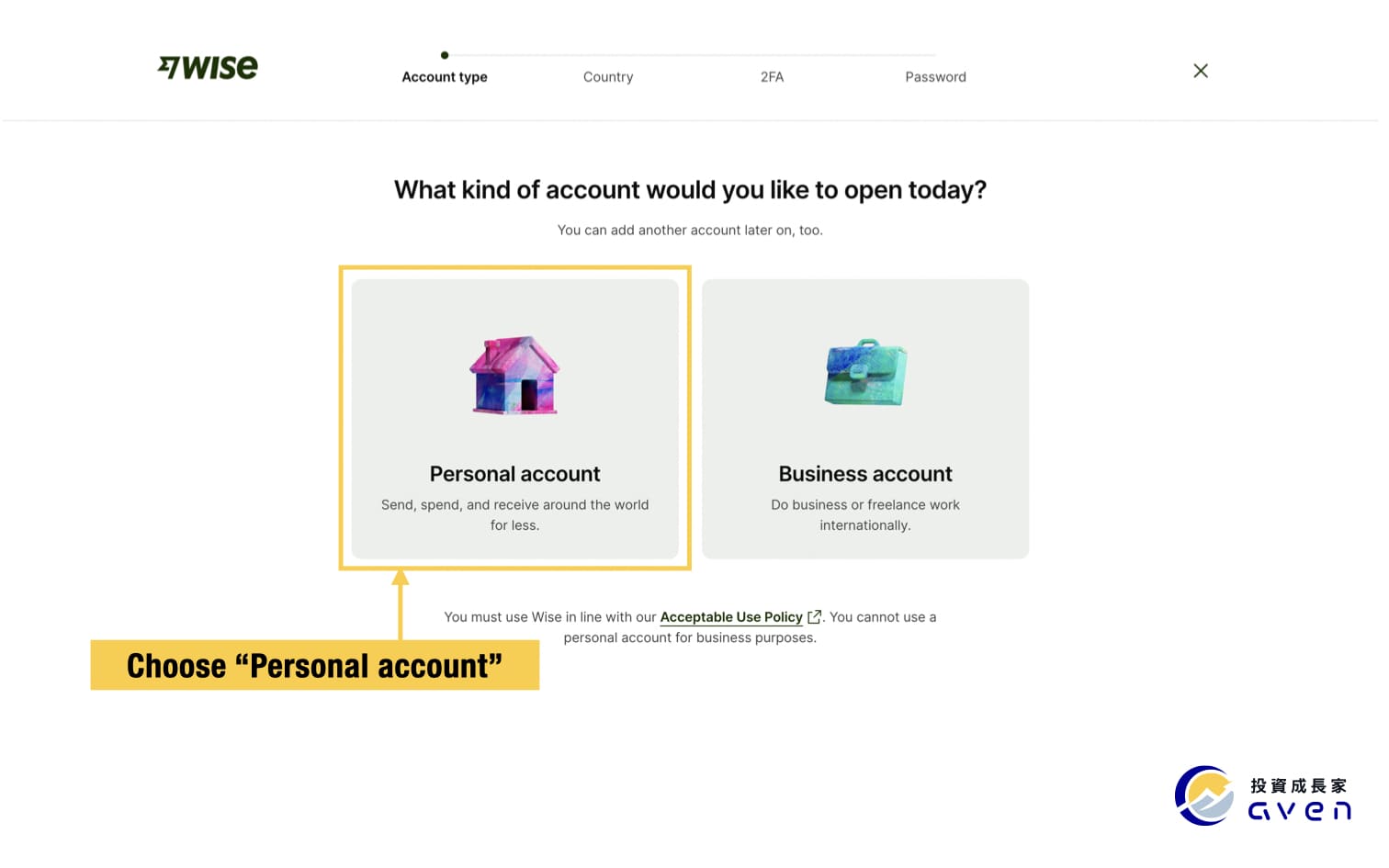

For individuals, we can choose "personal account".

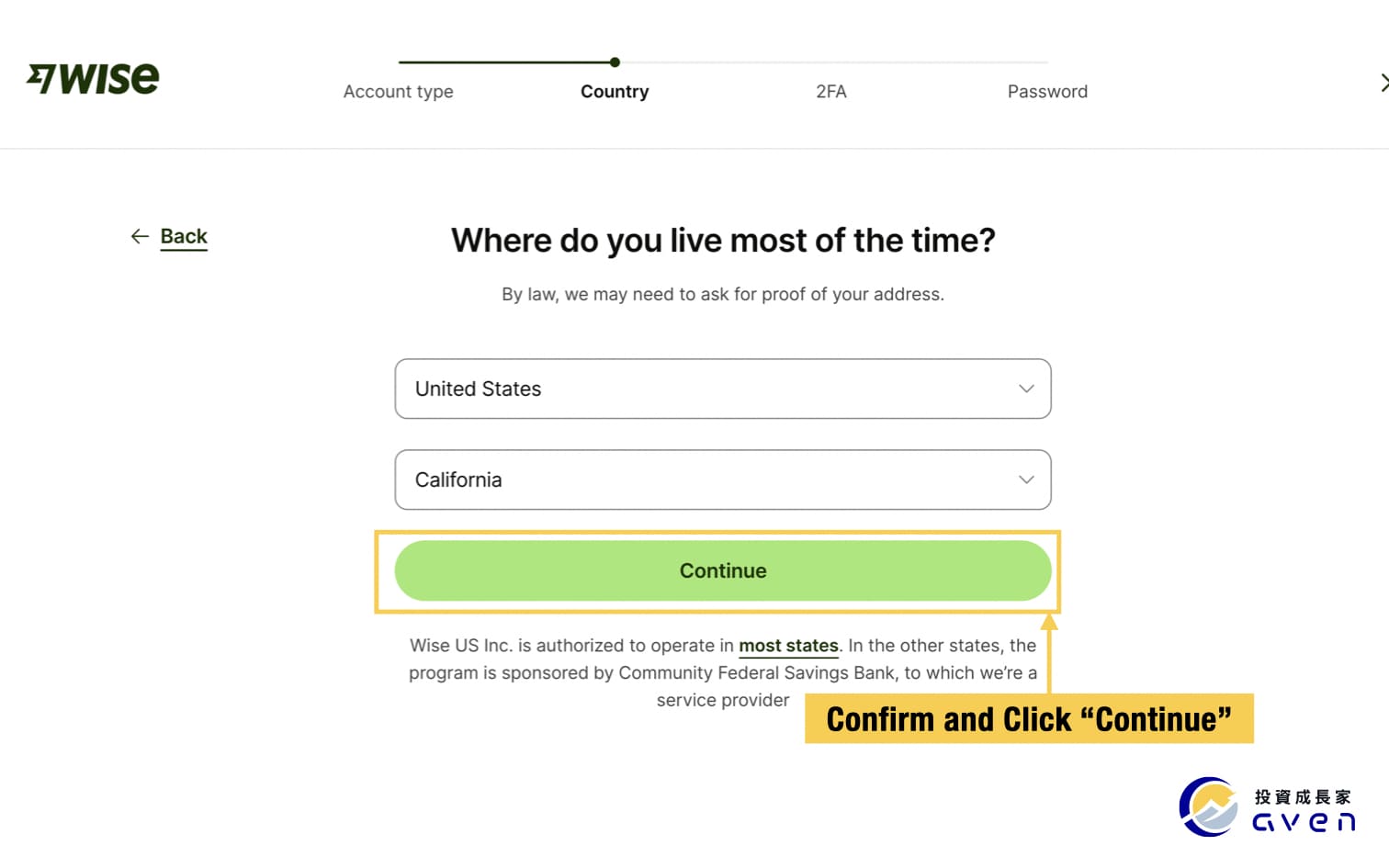

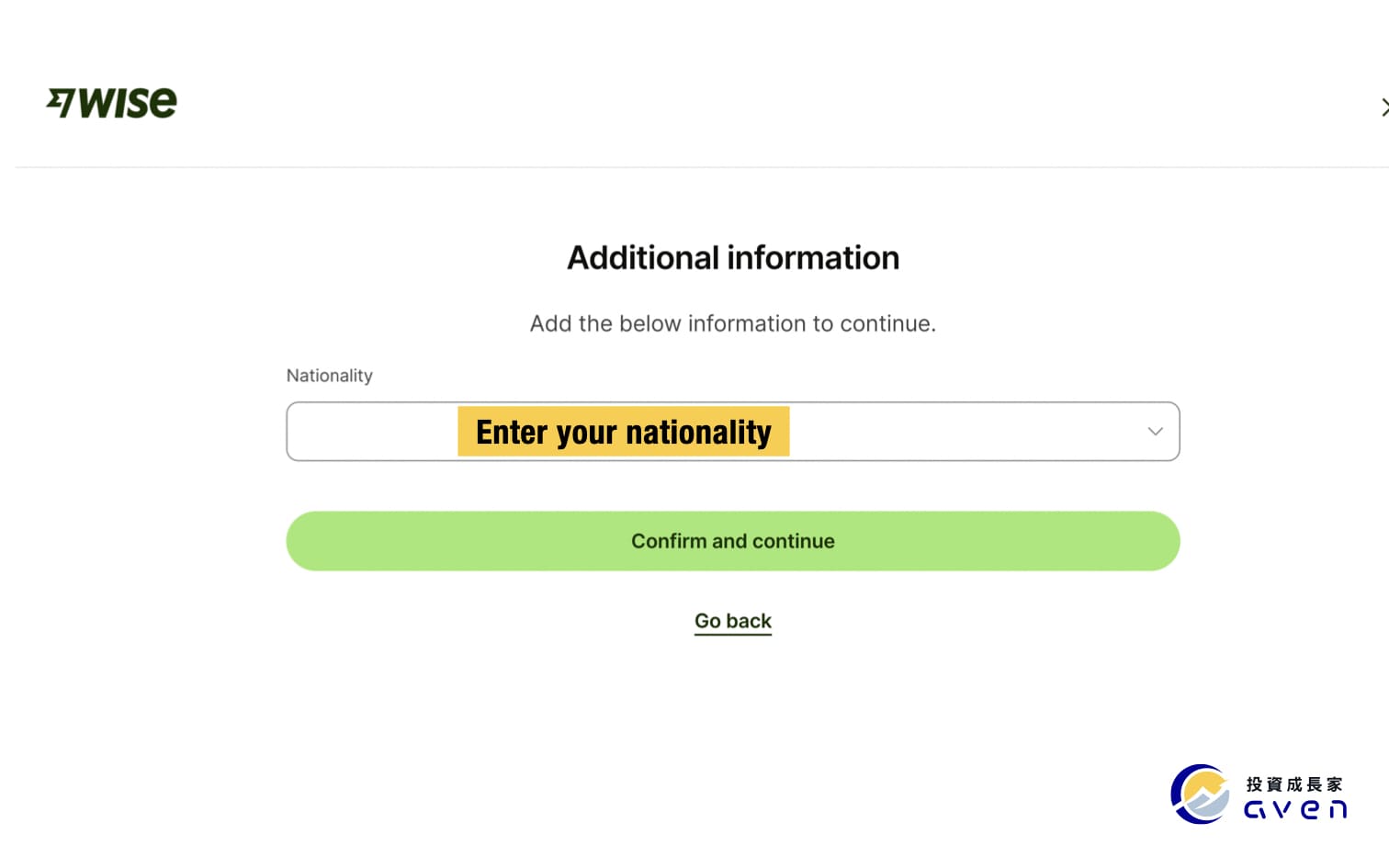

Choose your country and your living area.

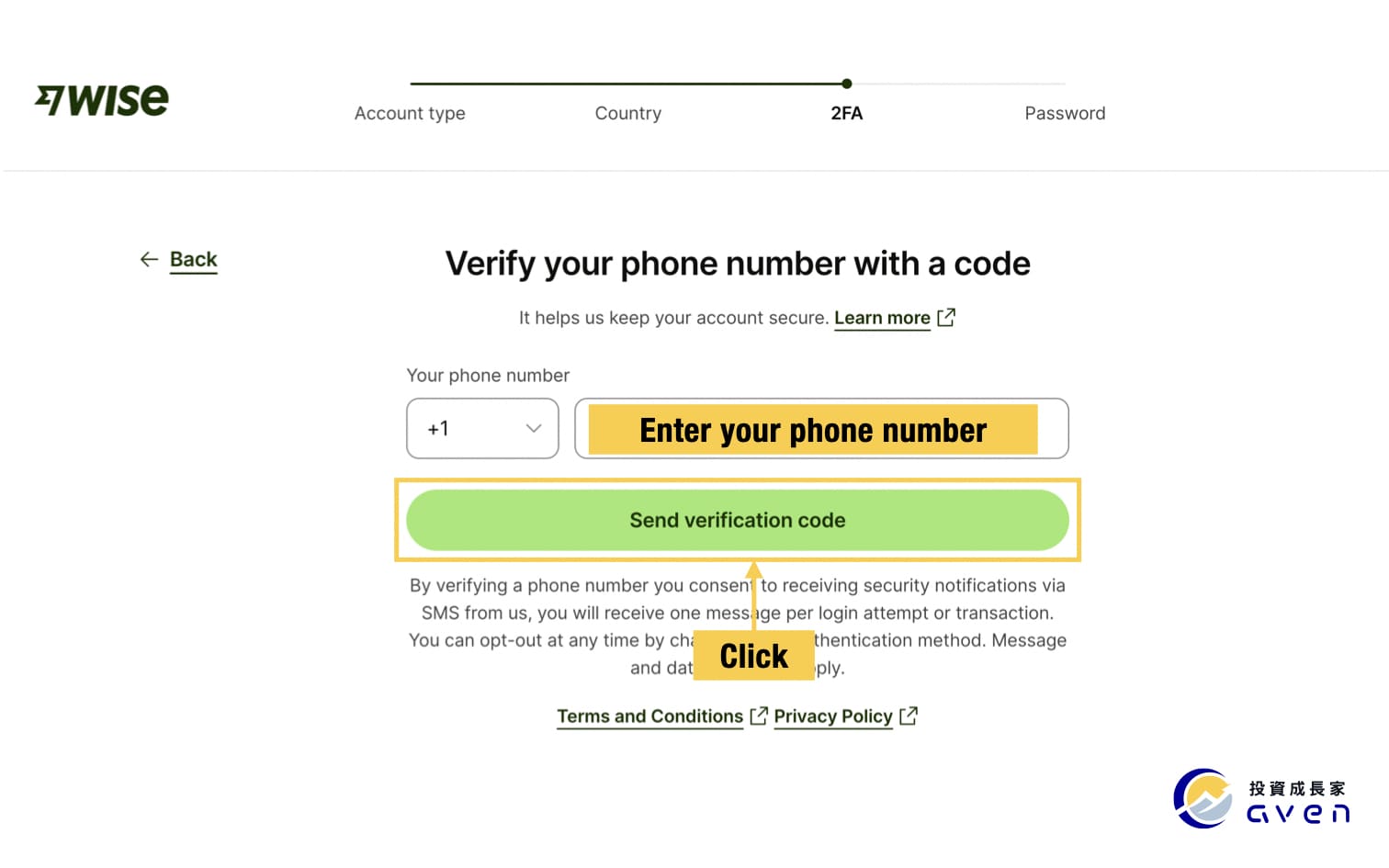

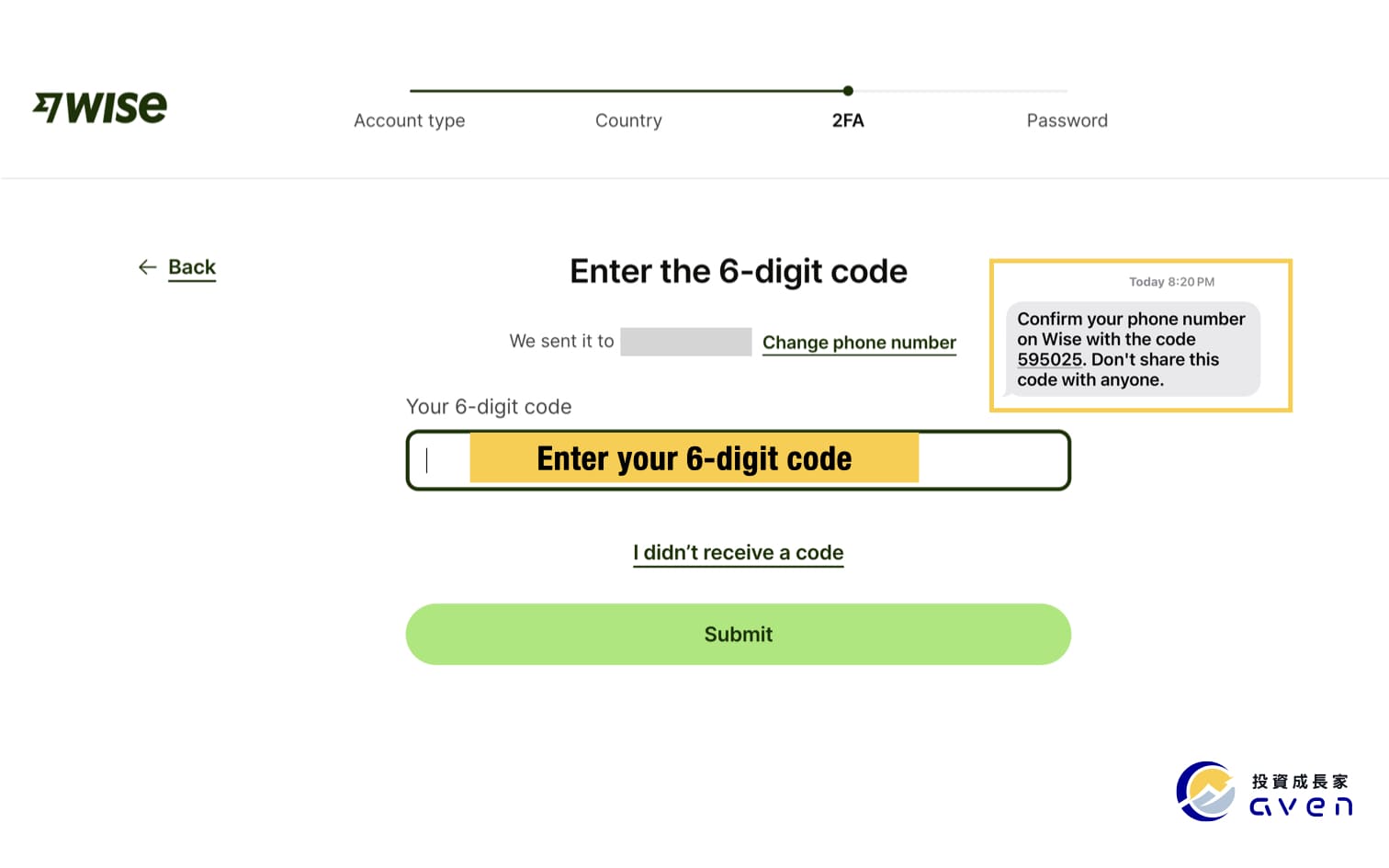

Verify your phone number.

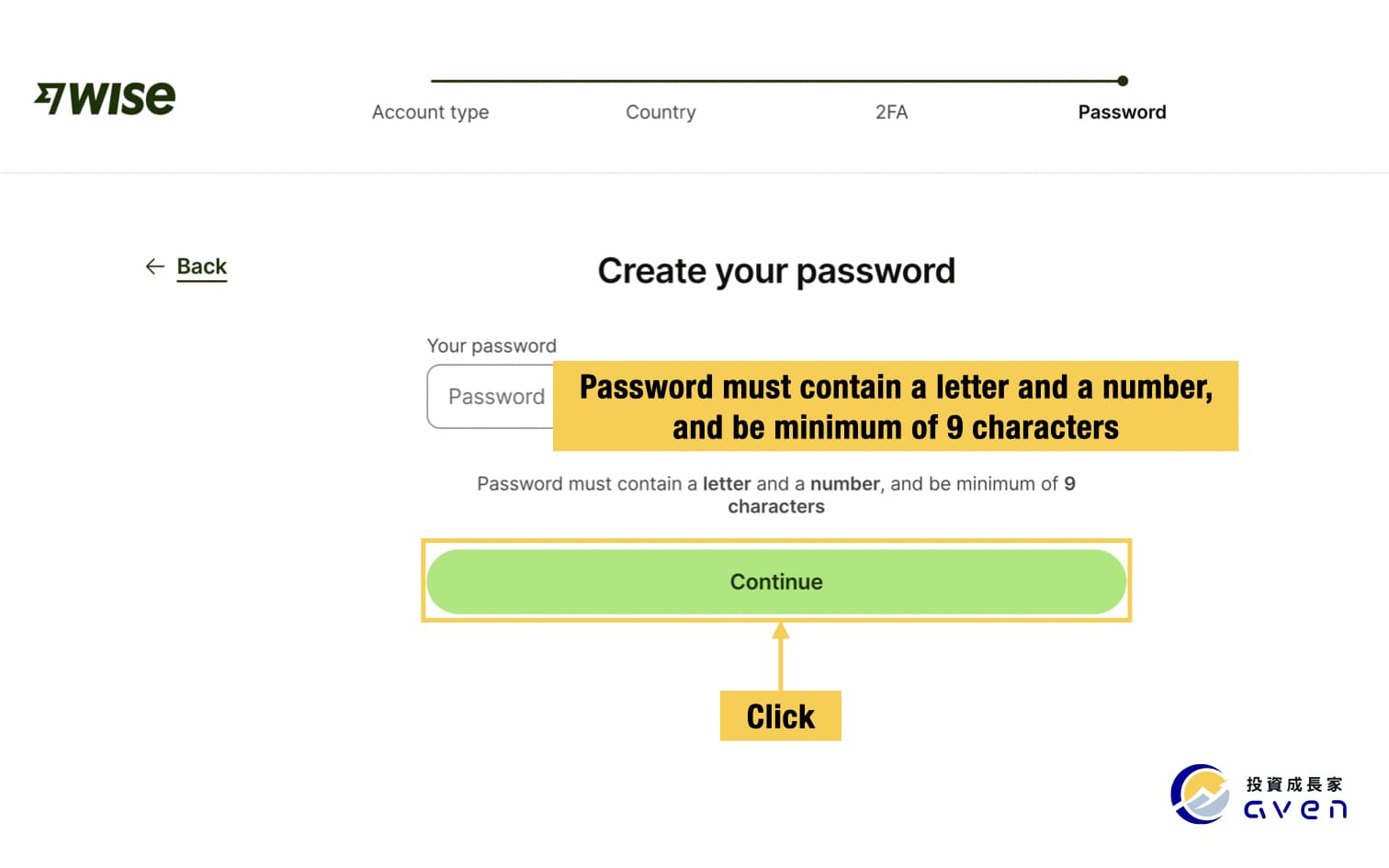

Create your Wise passwords. It needs to contain a letter and a number and be a minimum of 9 characters.

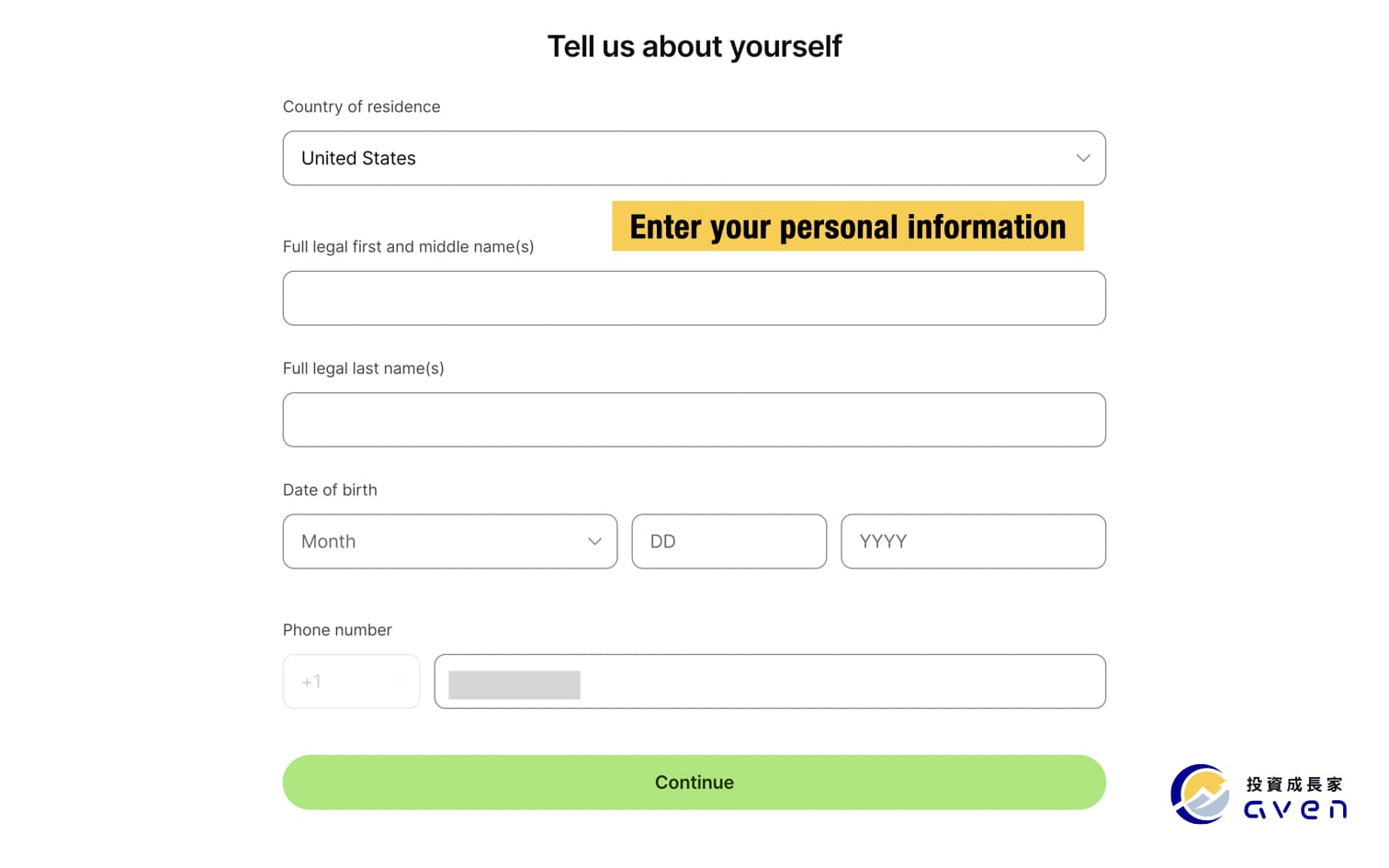

Enter your personal information, address and nationality to open your Wise account.

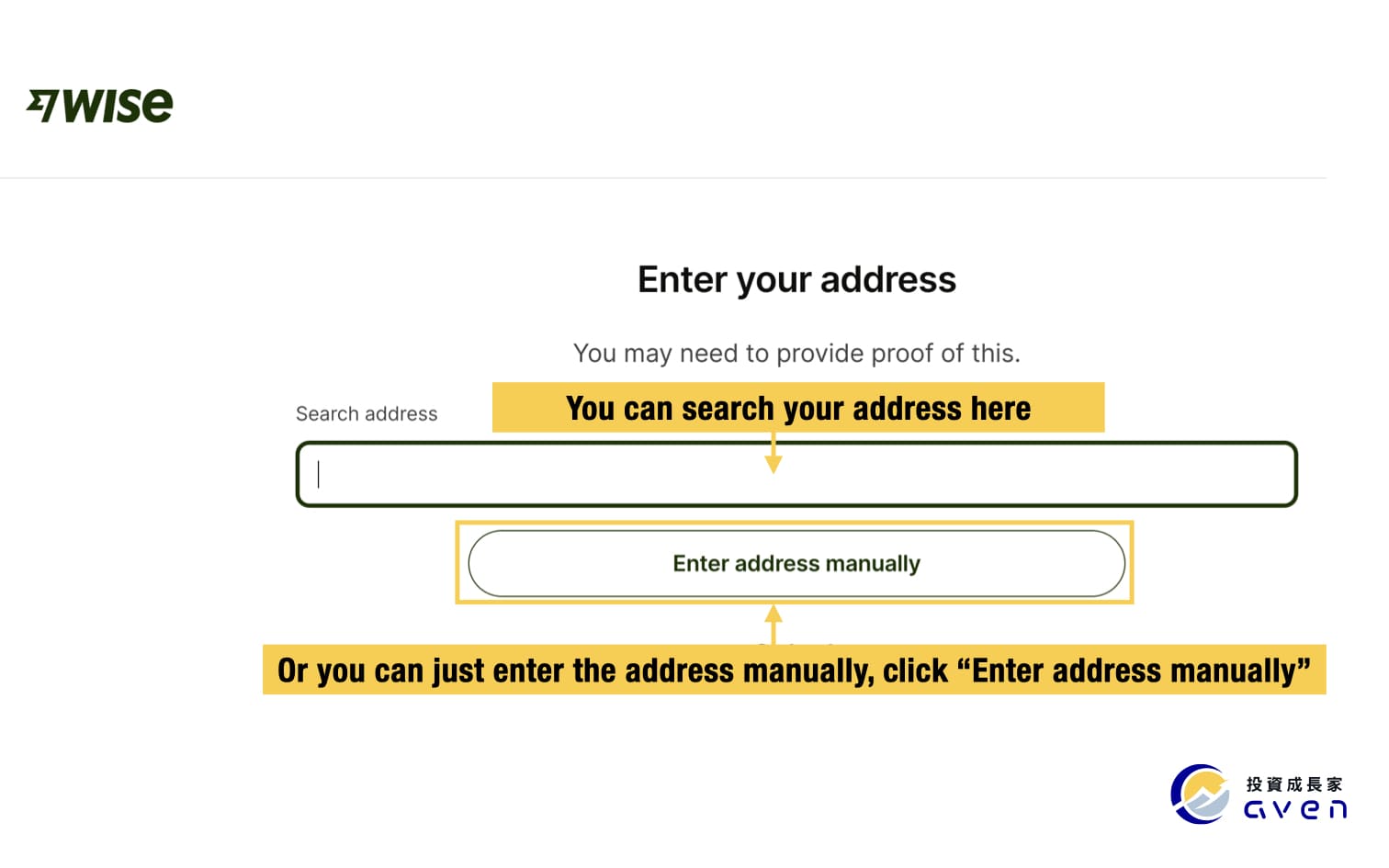

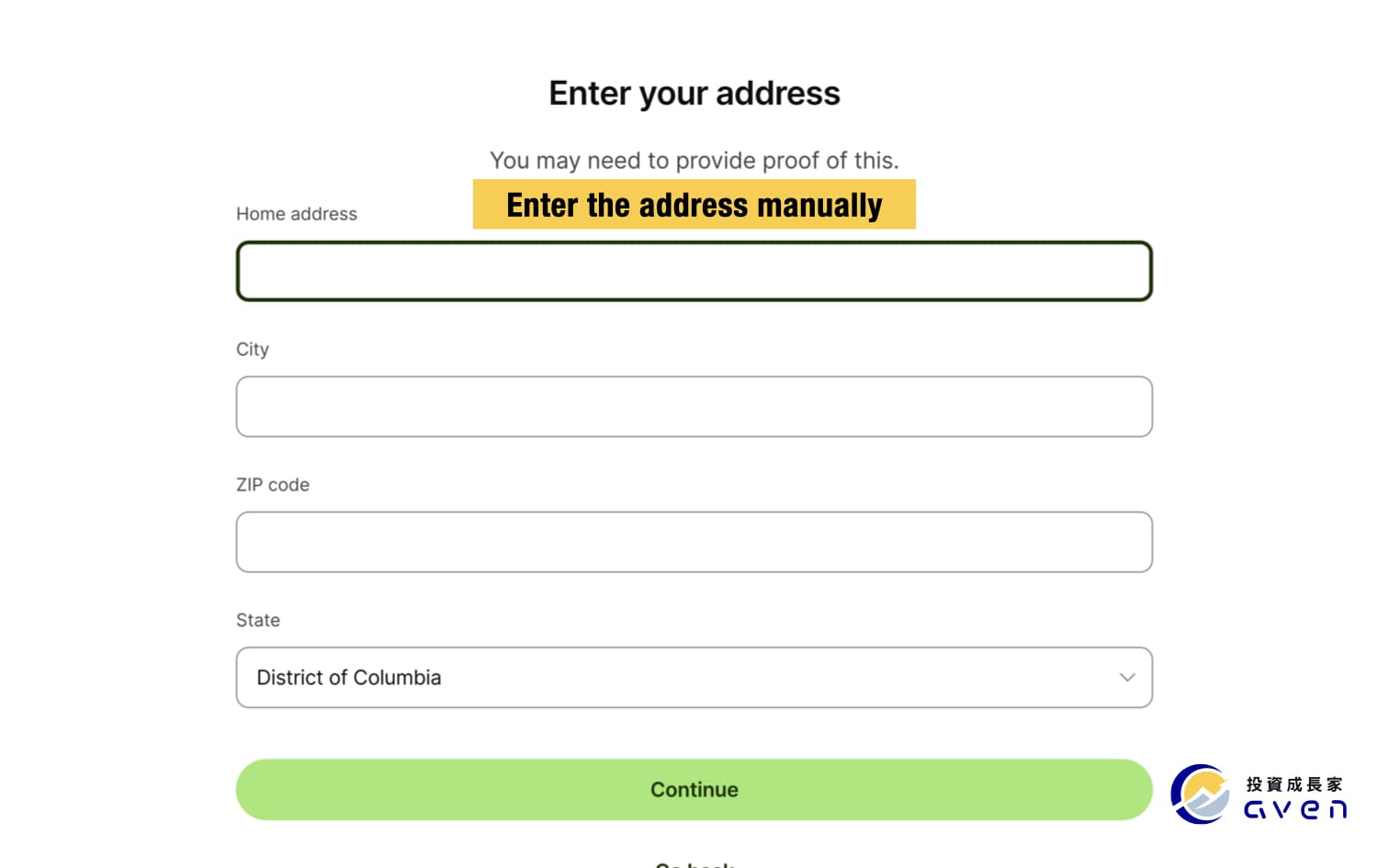

To enter your address, you can either search it or just enter it manually.

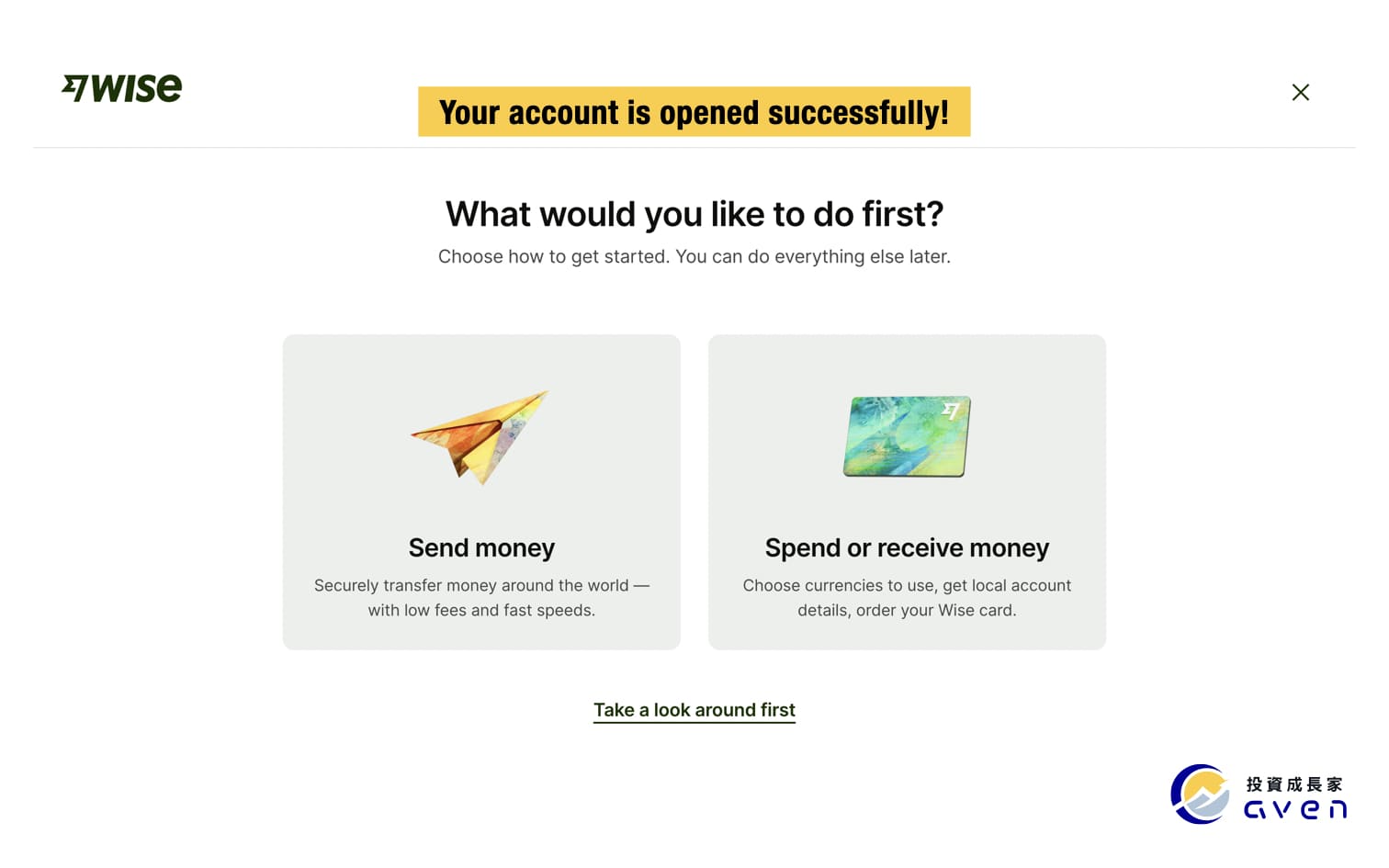

Here you can choose “Take a look around first” to view your Wise account.

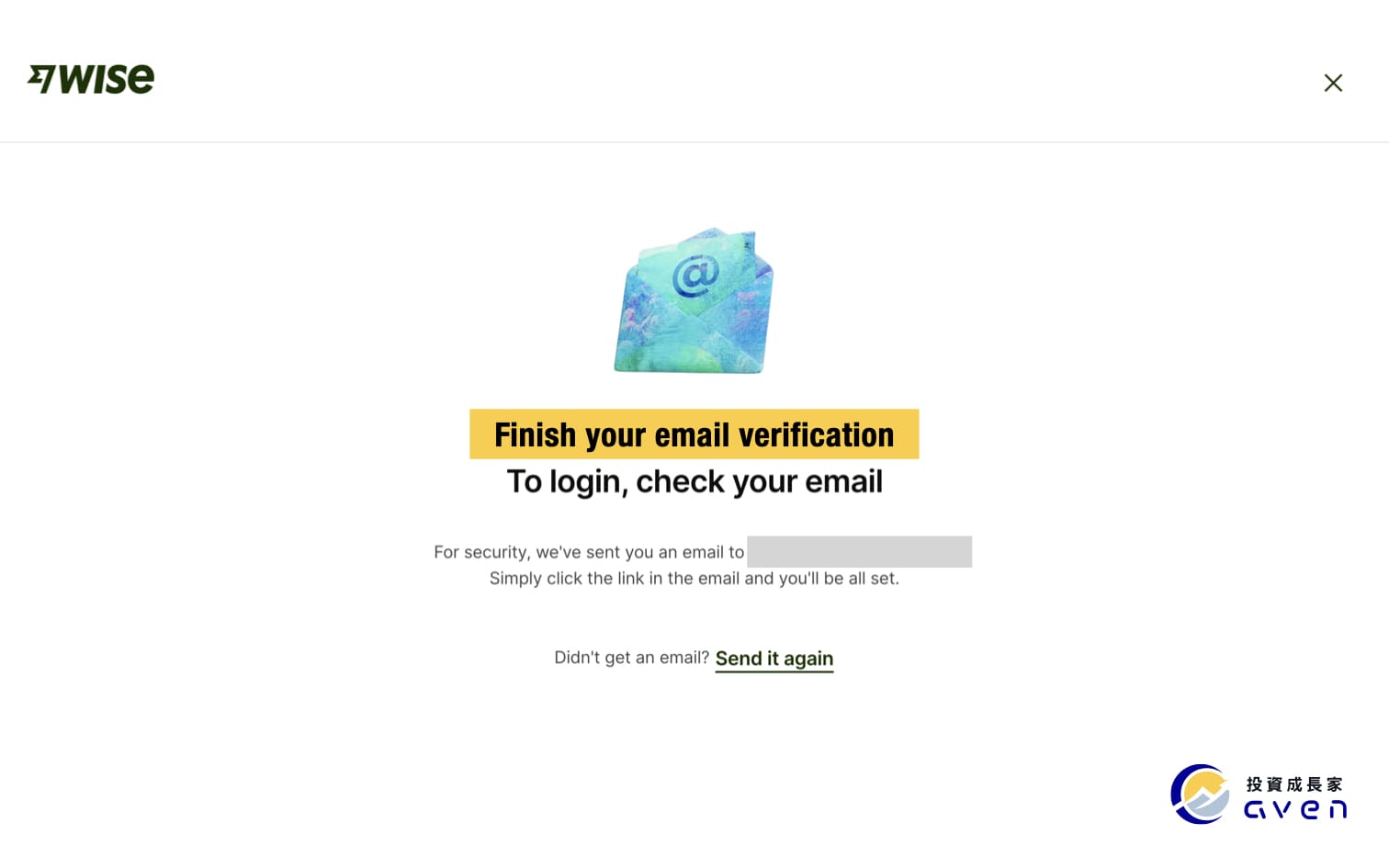

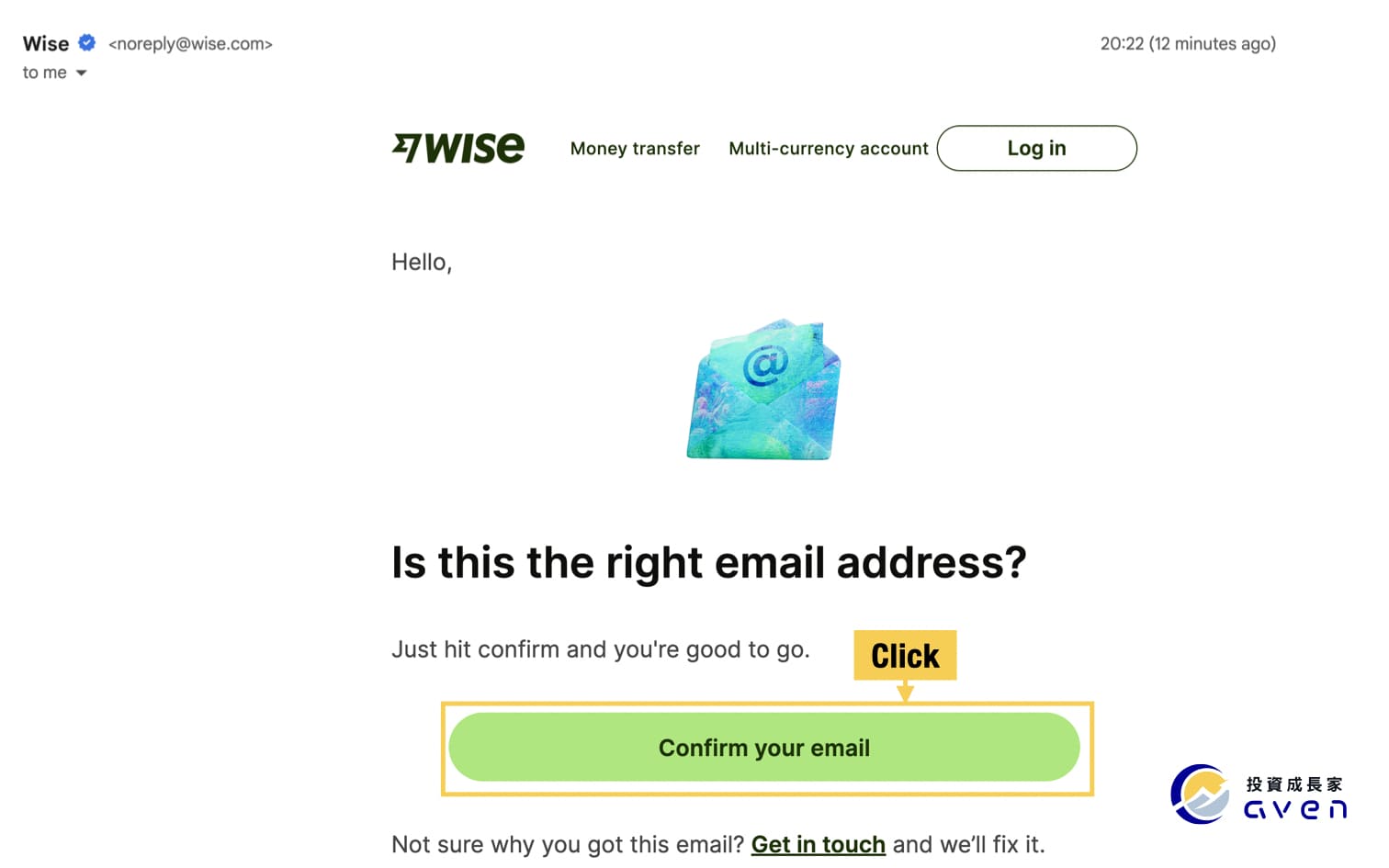

After you open the account, you need to verify your email and phone number.

After clicking the link in the email, you will see this message.

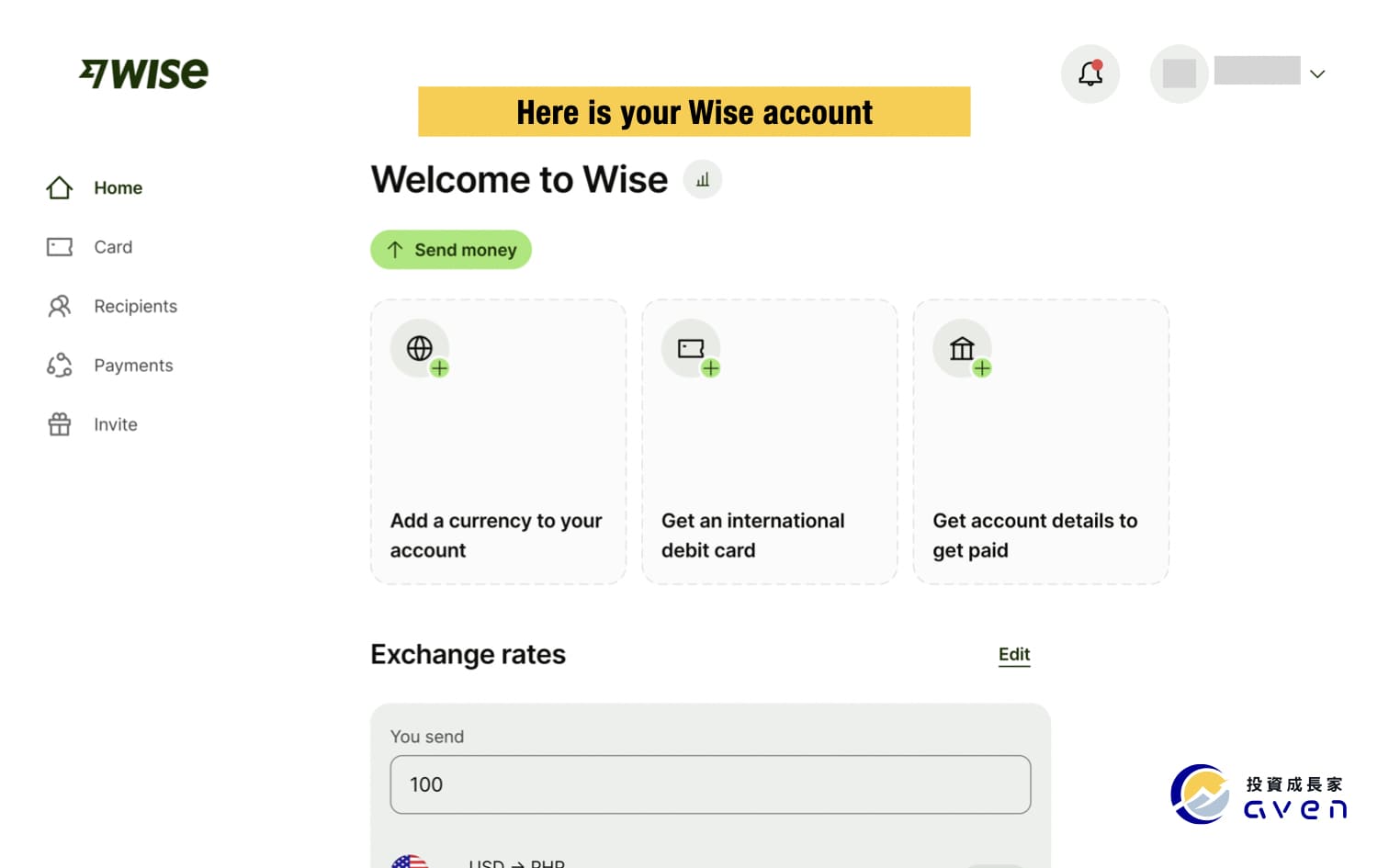

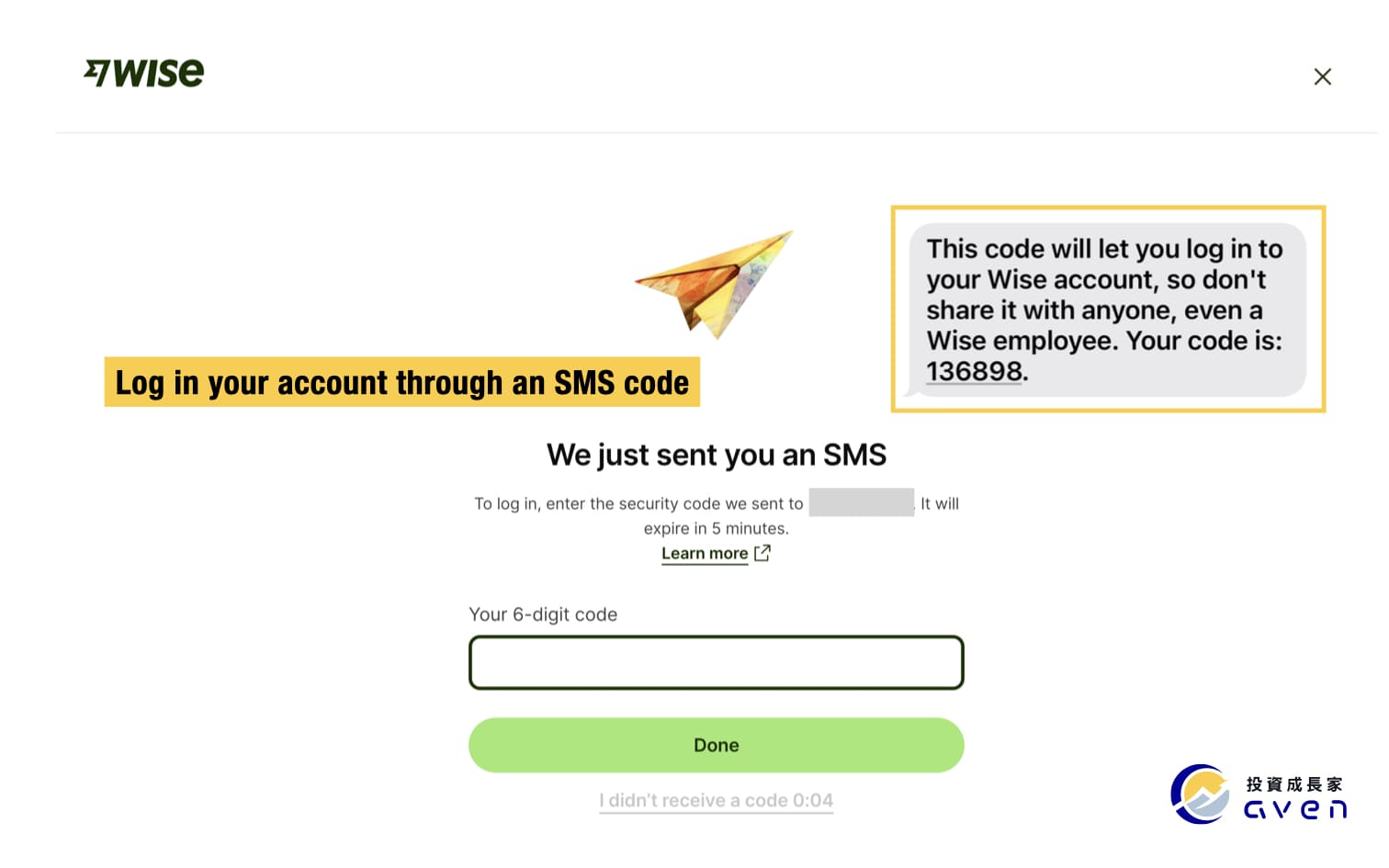

Now you can log in to your Wise account. Every time you log in, the Wise will ask for an SMS verification.

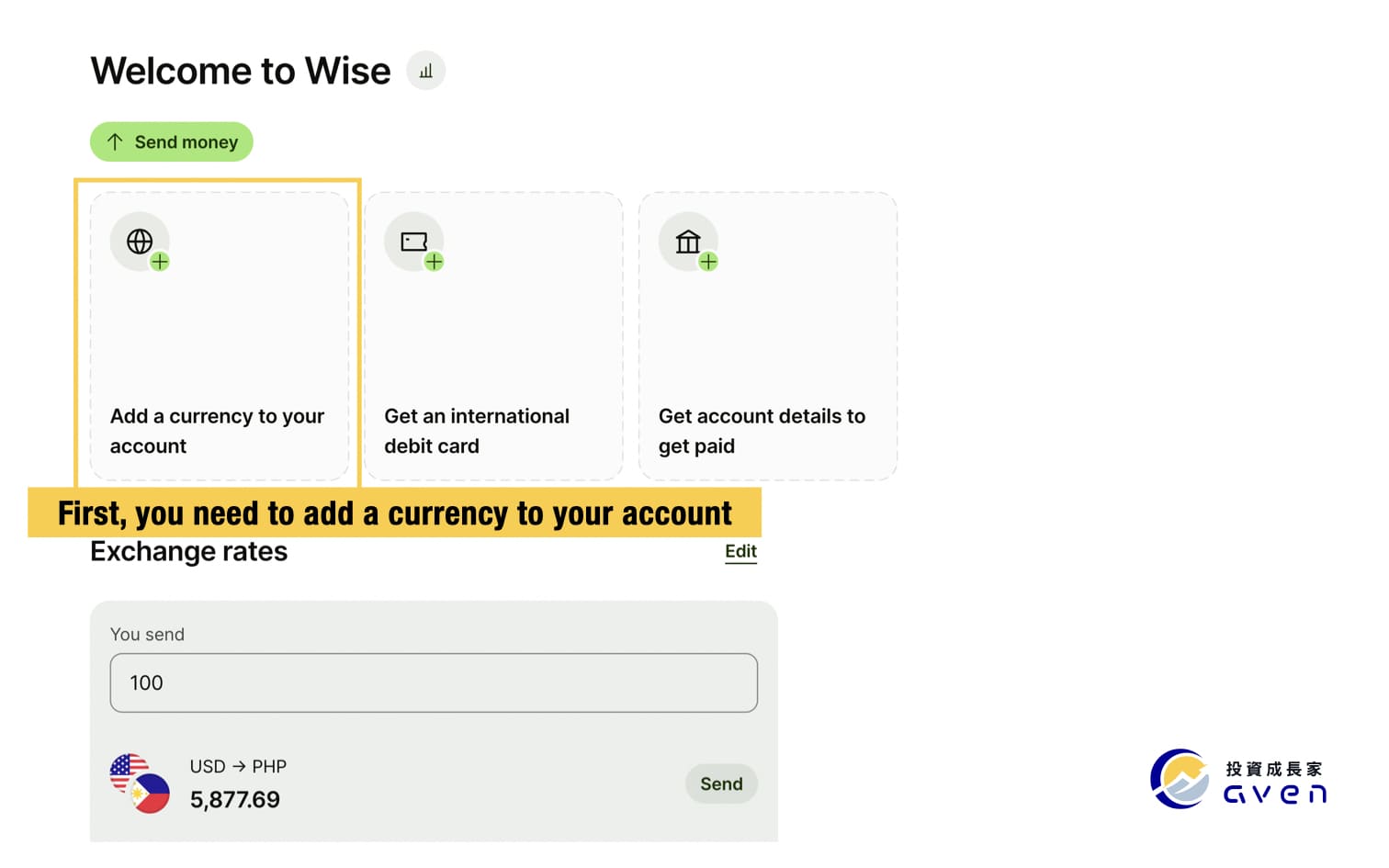

Now we've completed opening and verifying your Wise account. The next step is to add money to your Wise account before funding your IB account.

Step 2: Fund your Wise balance

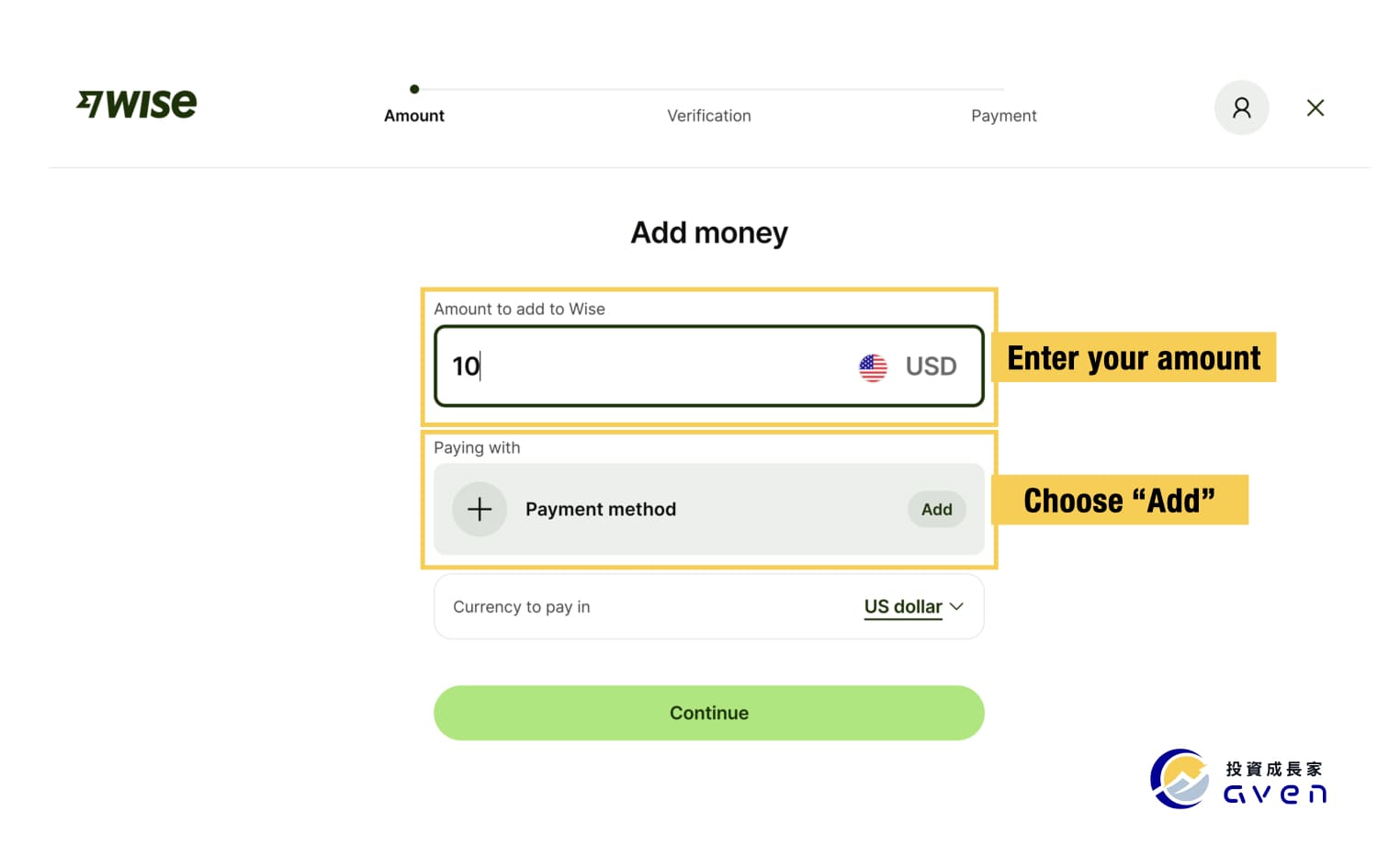

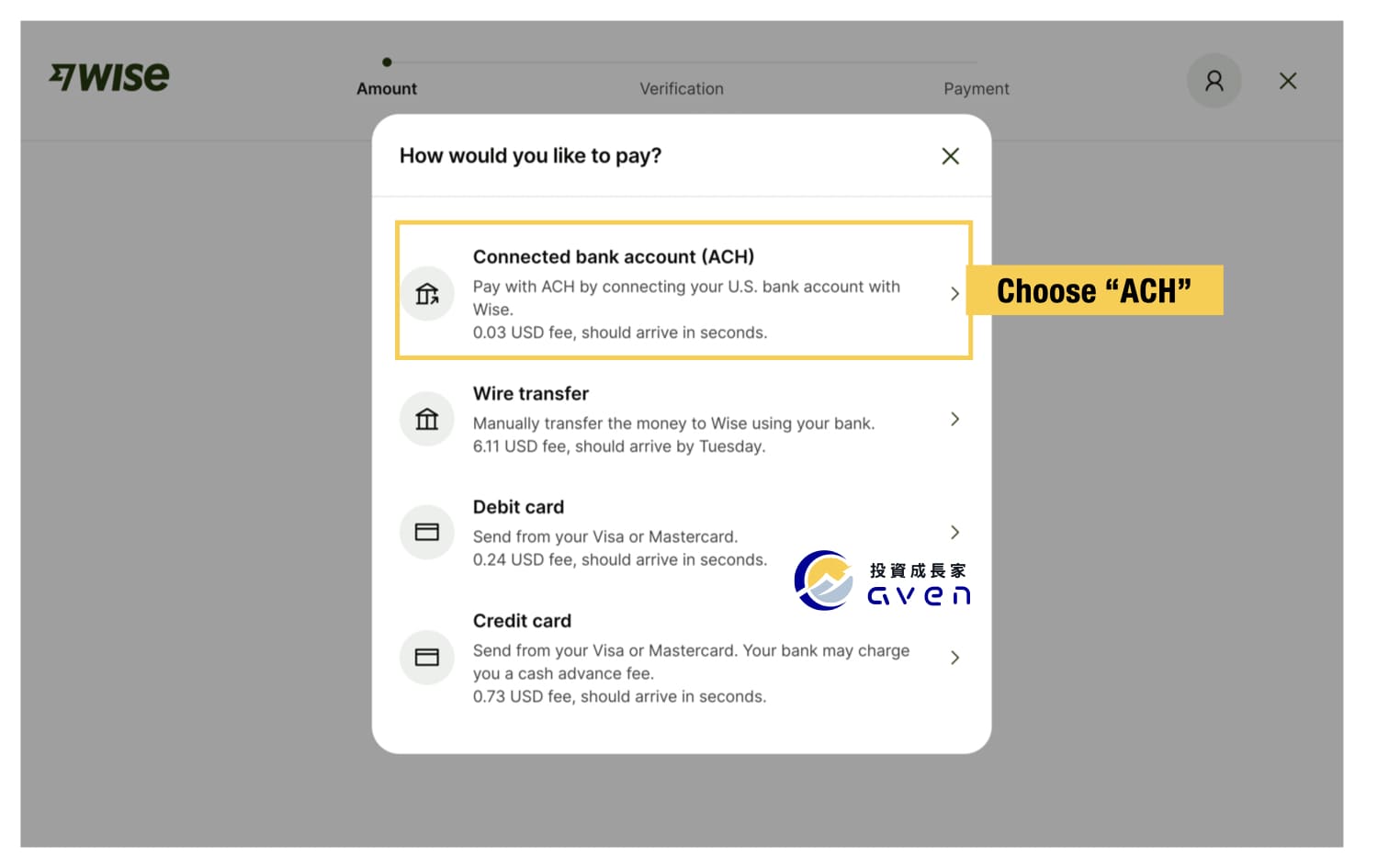

Before we fund our IB account, we need to send money to our Wise. There are plenty of methods to do it, I will choose the US bank ACH method as an example.

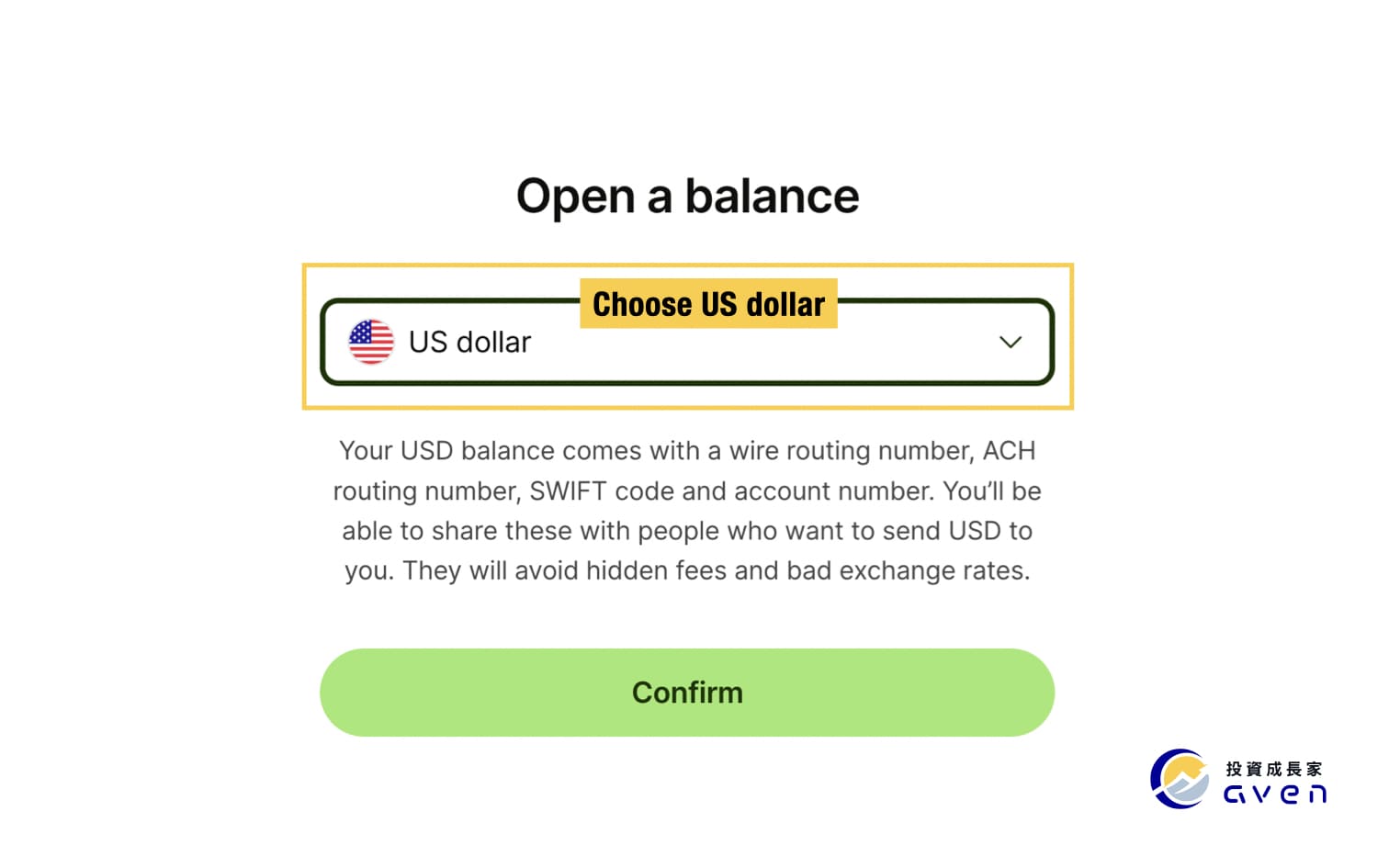

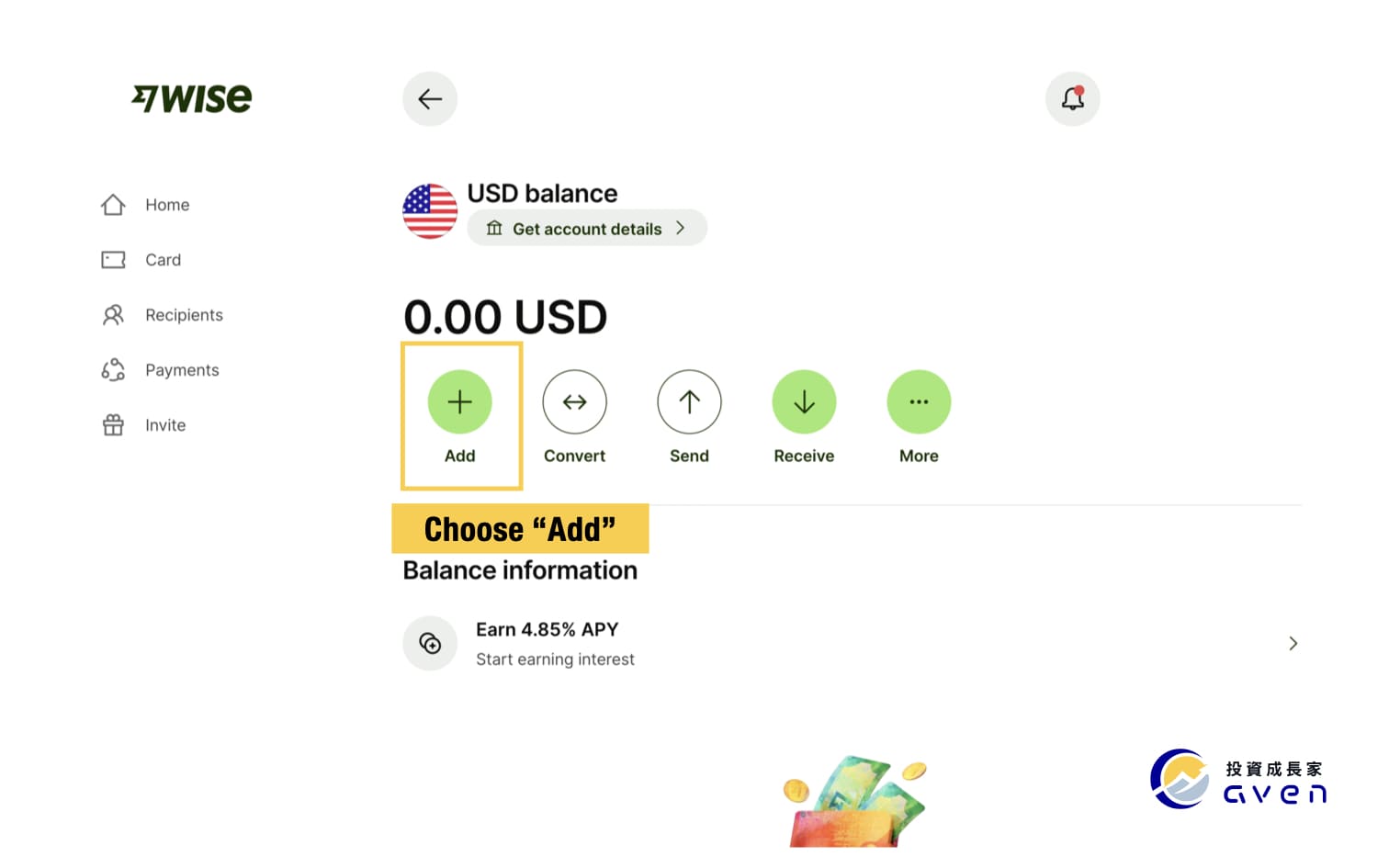

First, add currency to your account, I choose the US dollar.

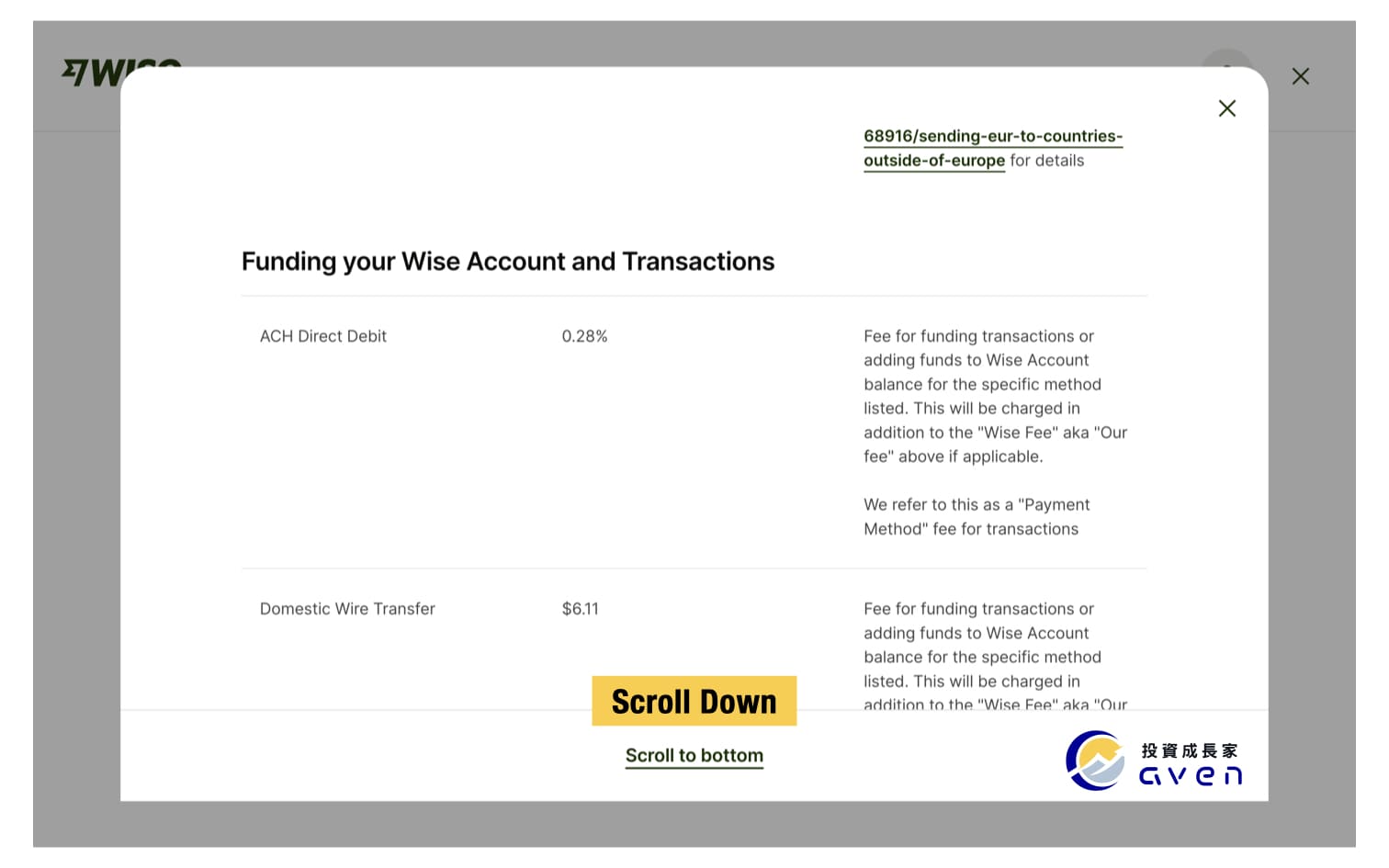

It will show the transaction fees for different ways of funding your Wise account. Just scroll down and close it.

Now you can add US dollars to your Wise account.

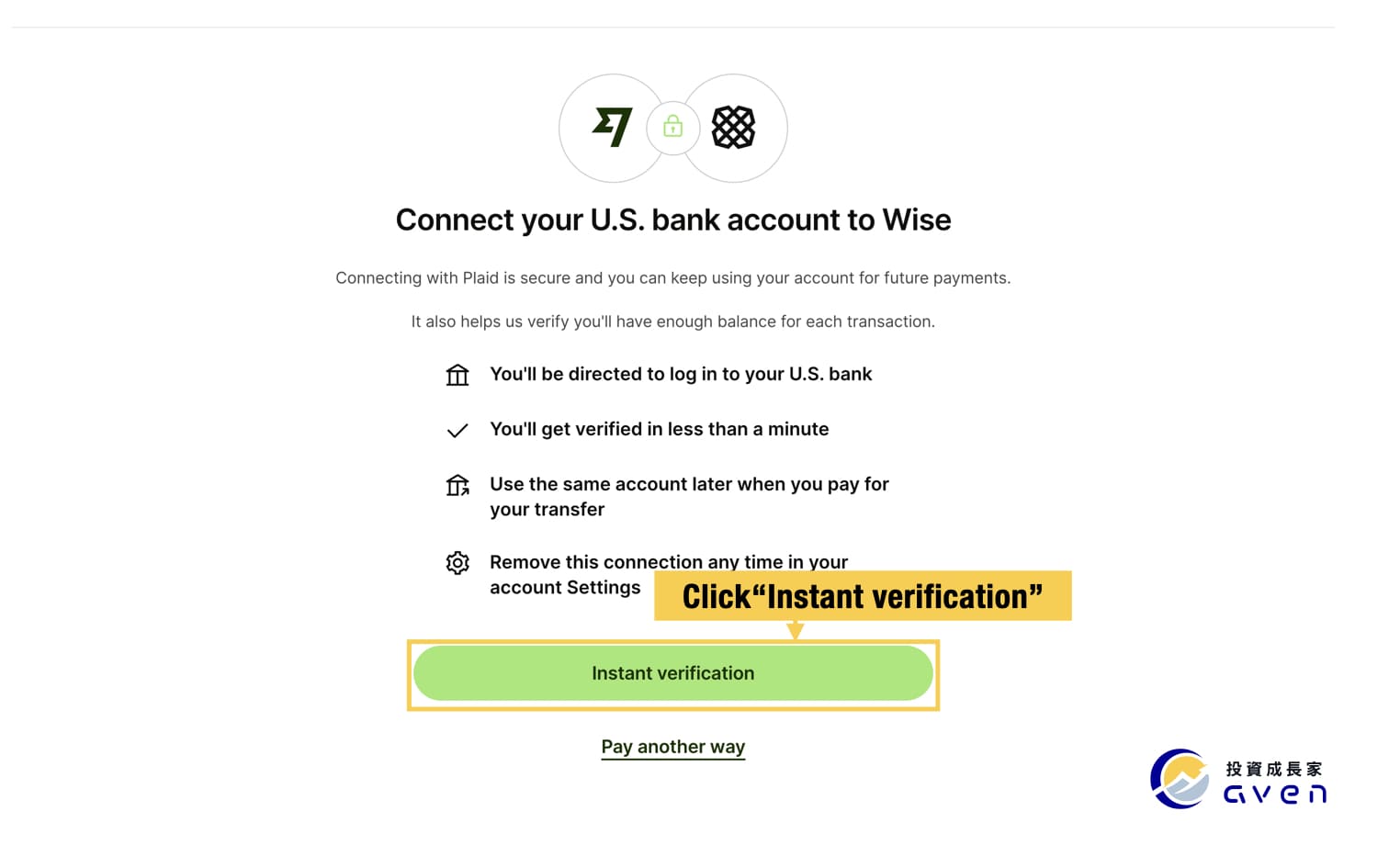

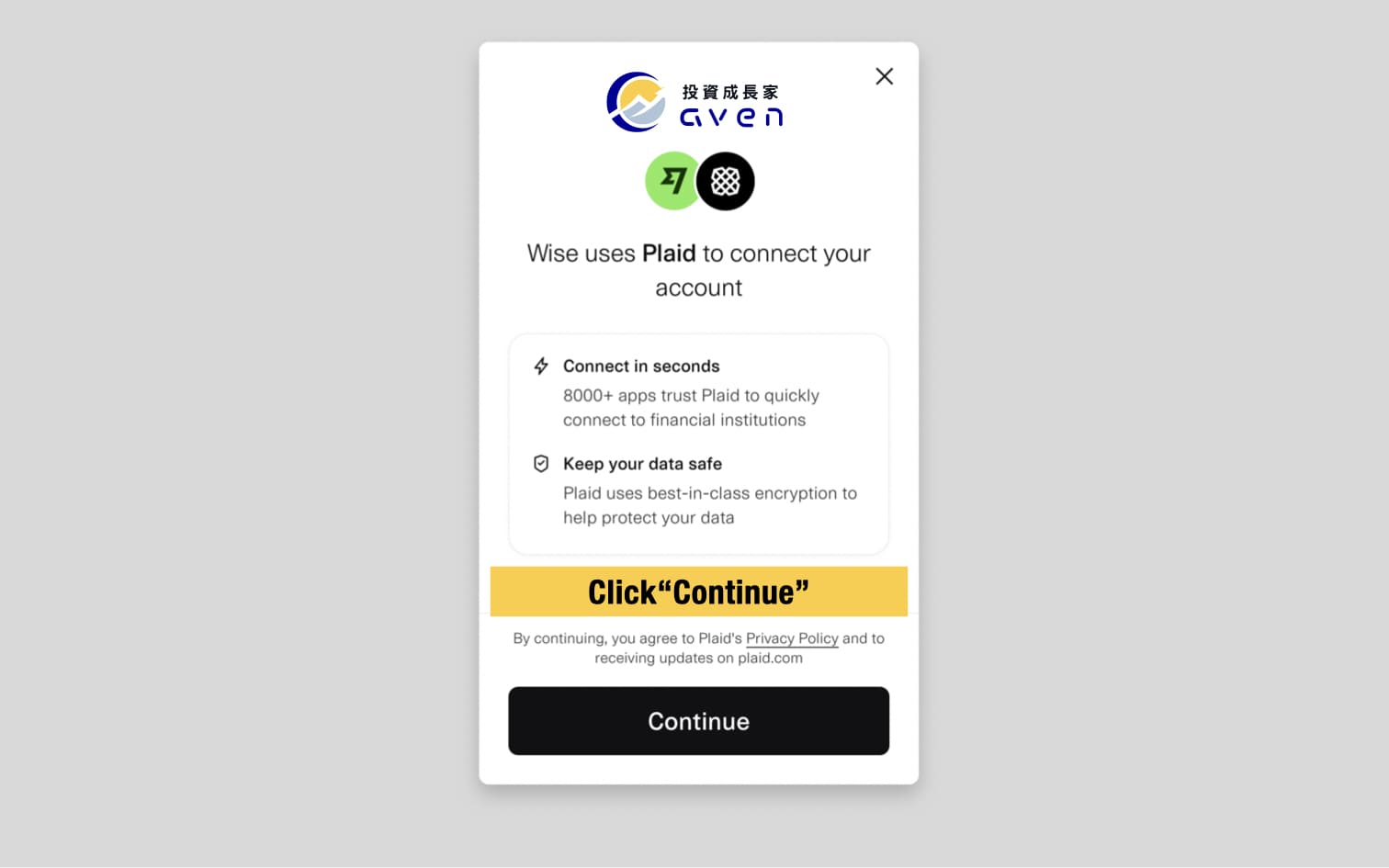

For the payment method, I use the US bank account ACH as an example. You need to link your account through Plaid.

You will see the following page. Just follow the instructions.

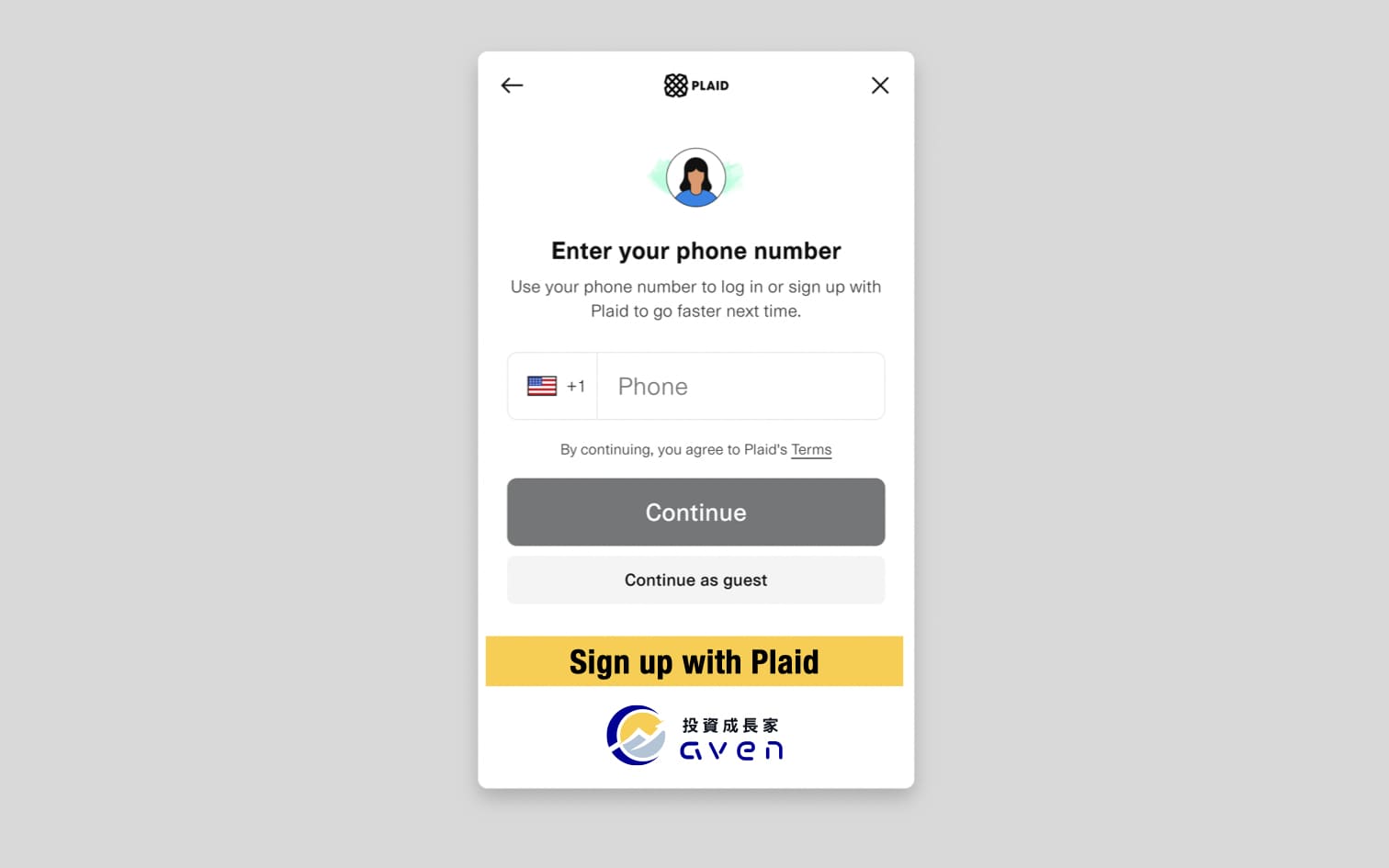

By the way, you don't need to sign up with Plaid; you can also use "continue as guest" to finalise the link between your US bank account and Wise account.

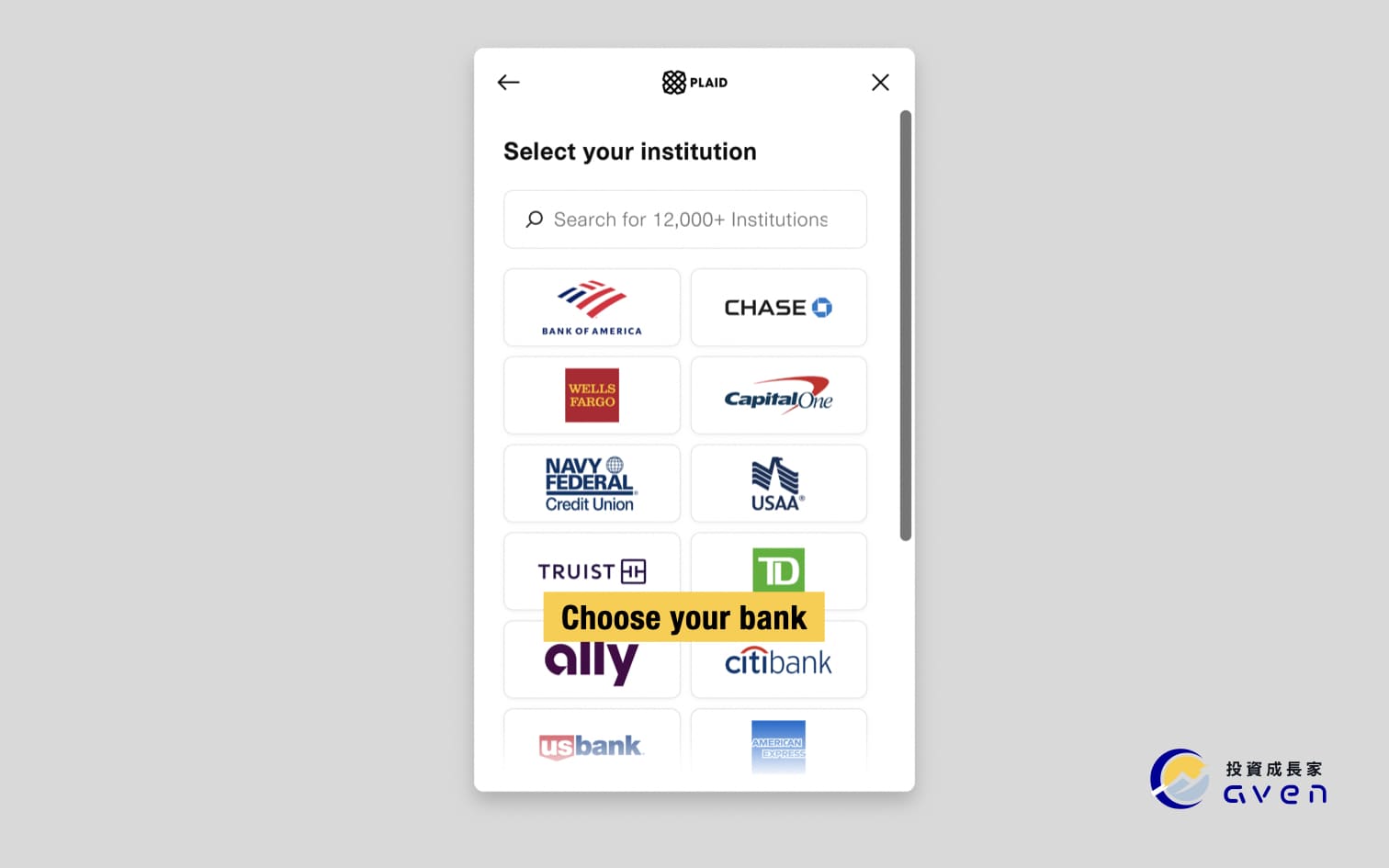

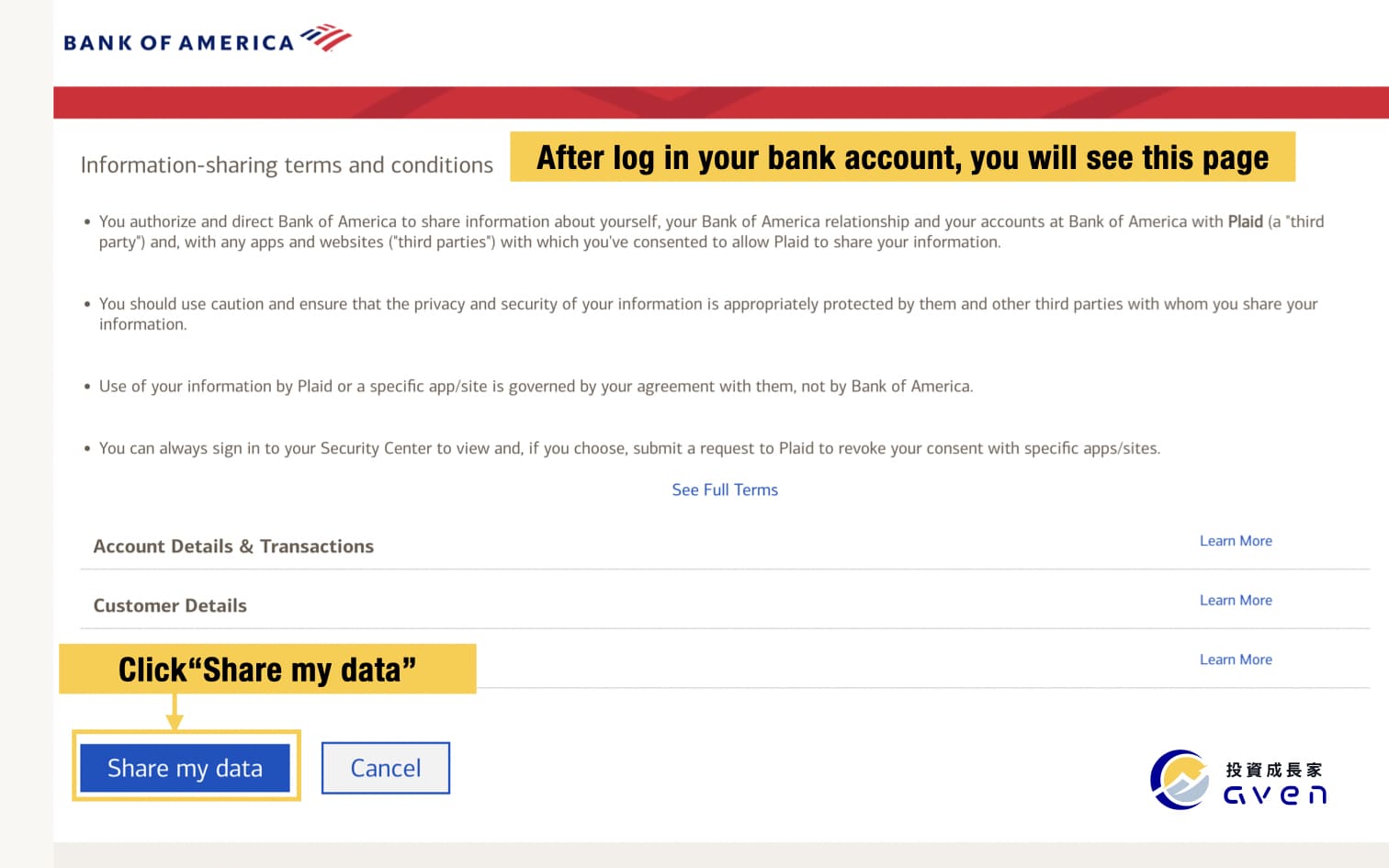

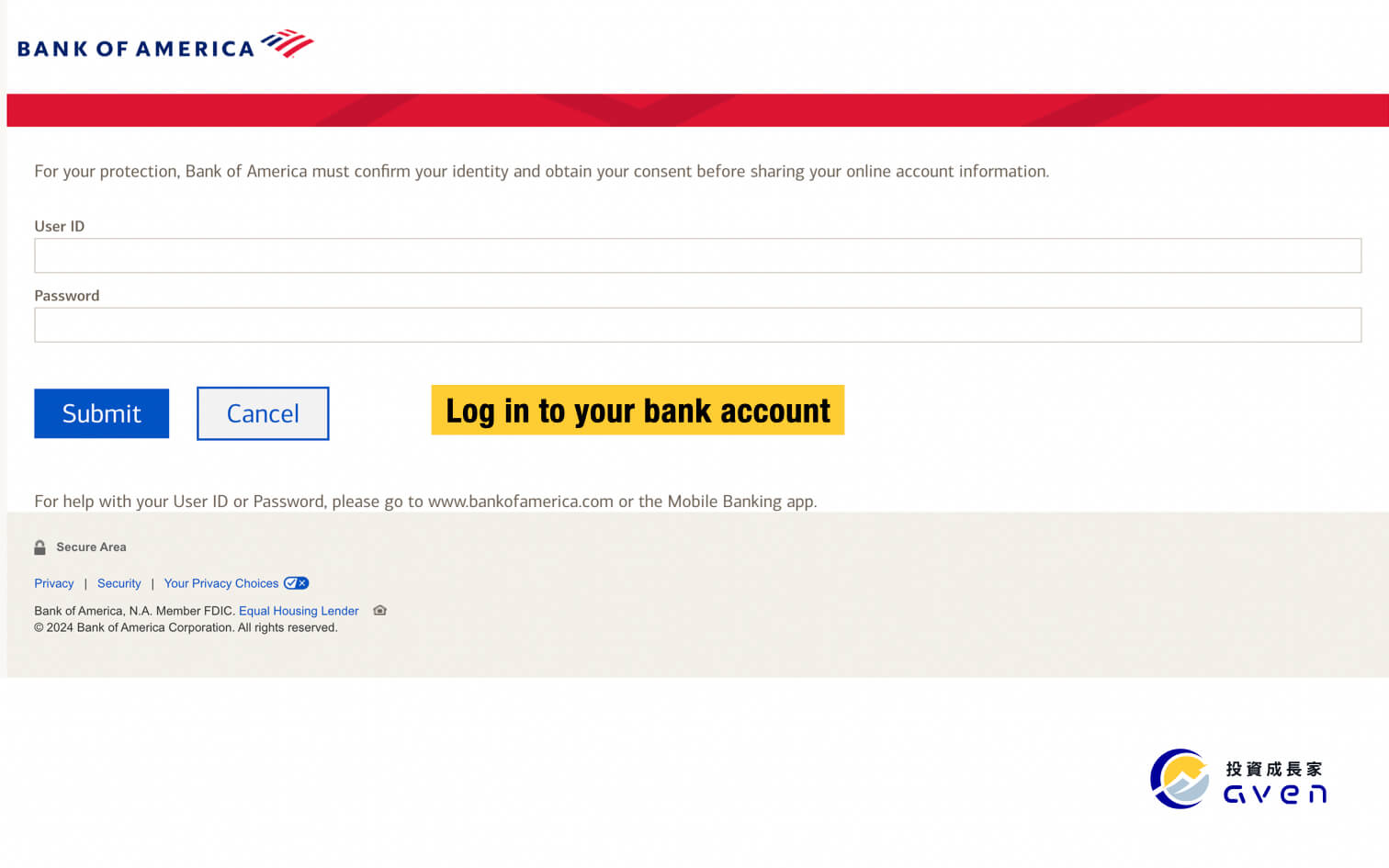

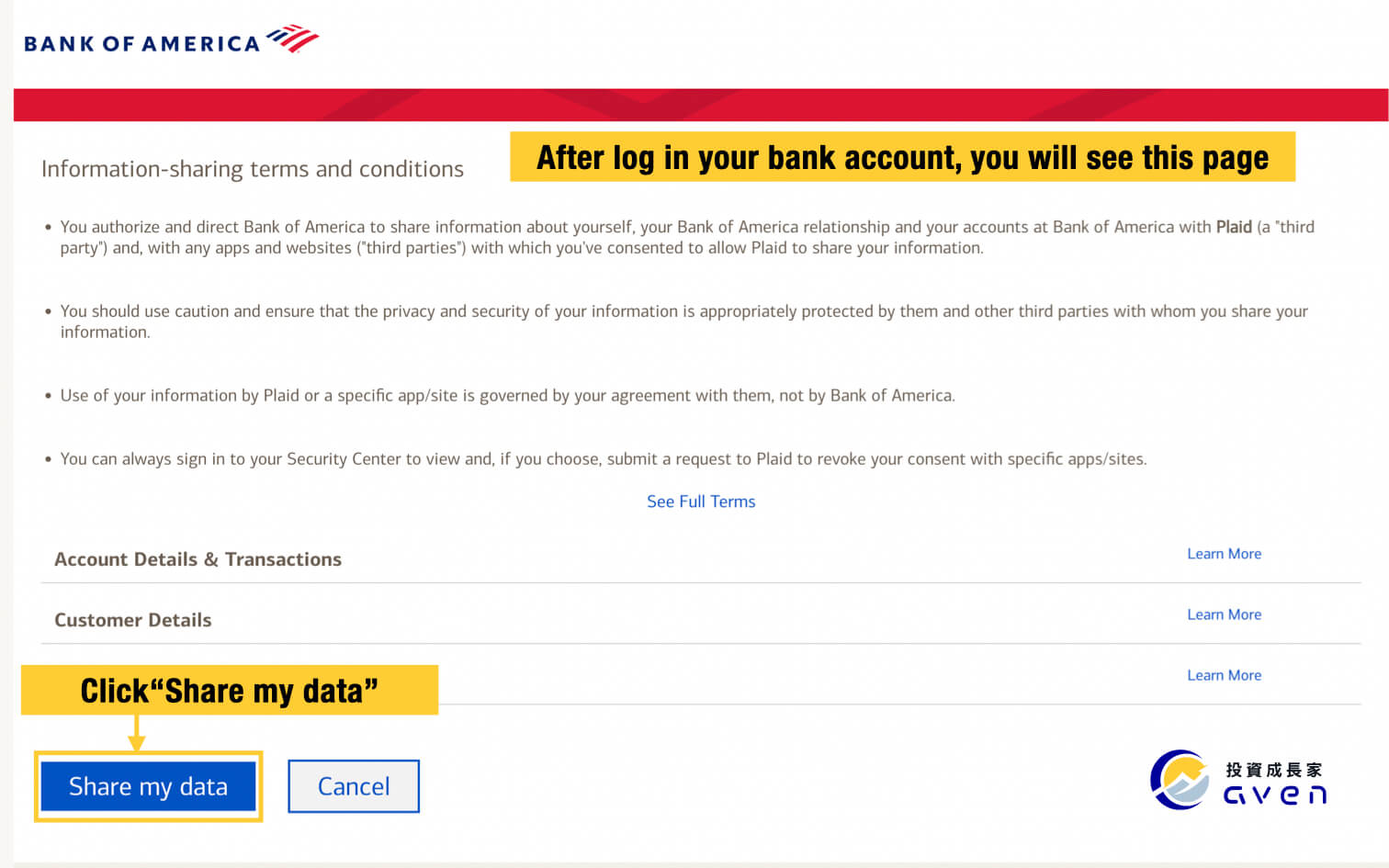

After choosing your institution (your bank), you can just log in to your US bank account and click "Share my data". I use Bank of America as an example here.

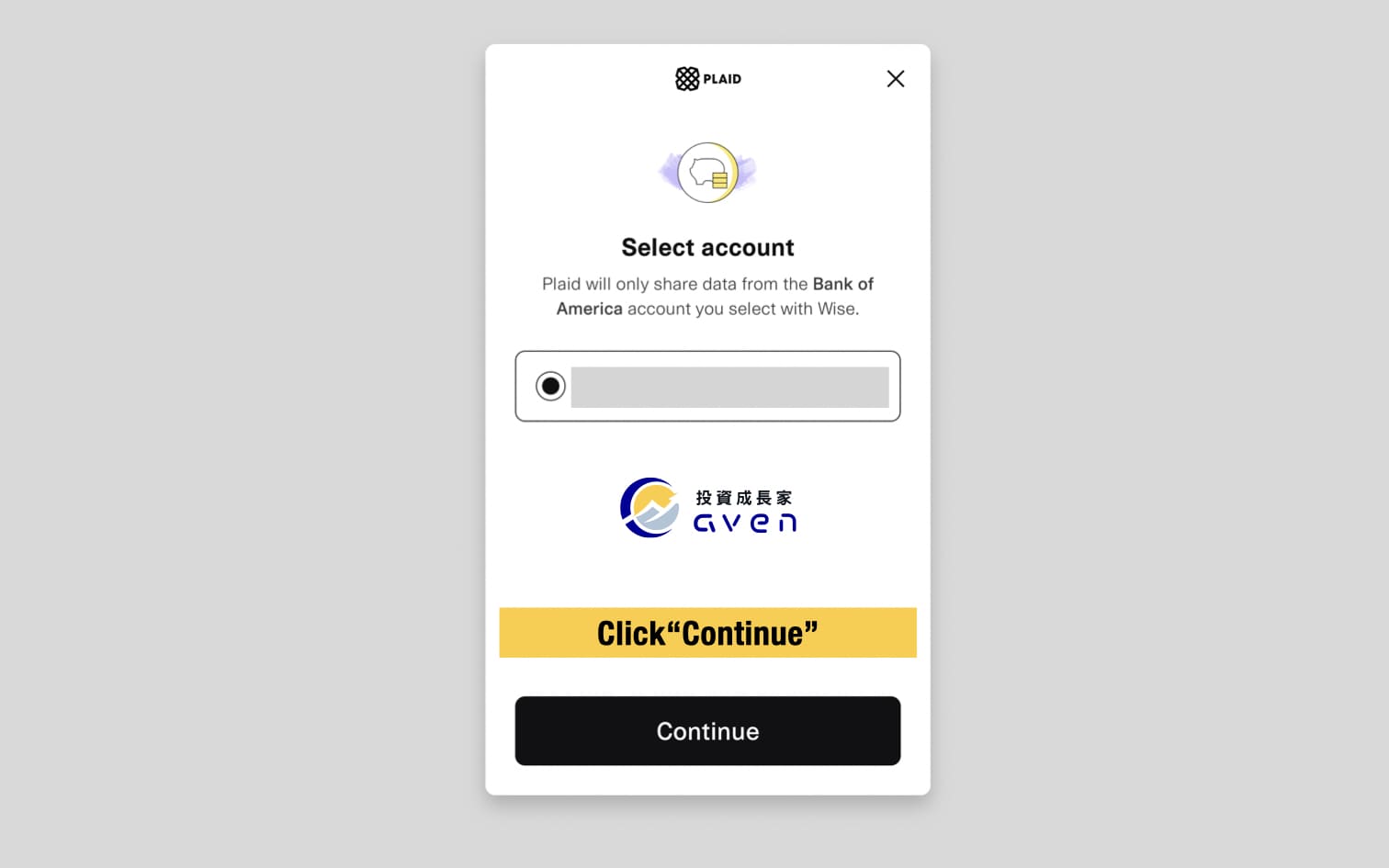

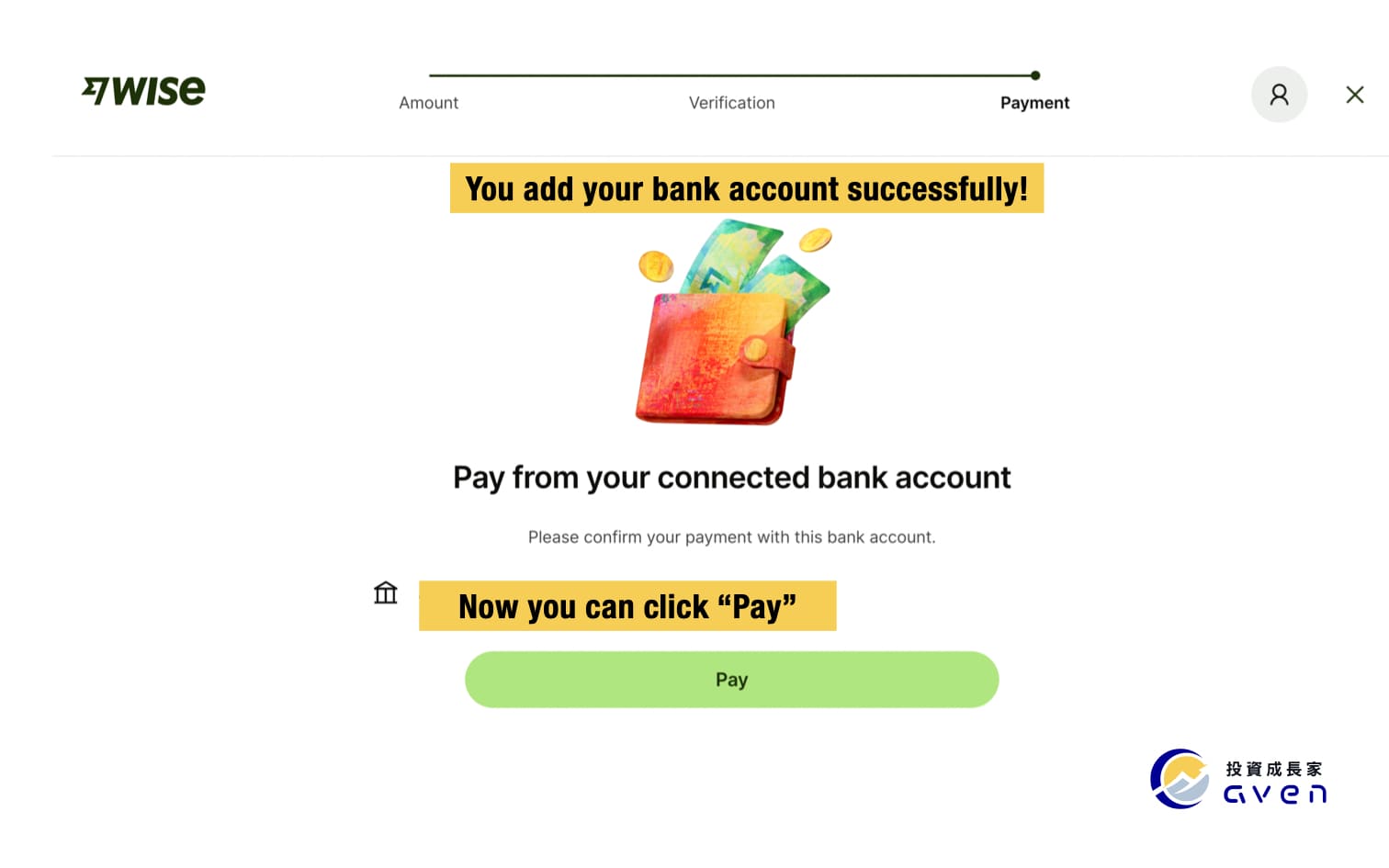

After selecting your bank account on Plaid, your account will be linked successfully! Now you can click "Pay" to fund your Wise account. And the money will be added to your balance.

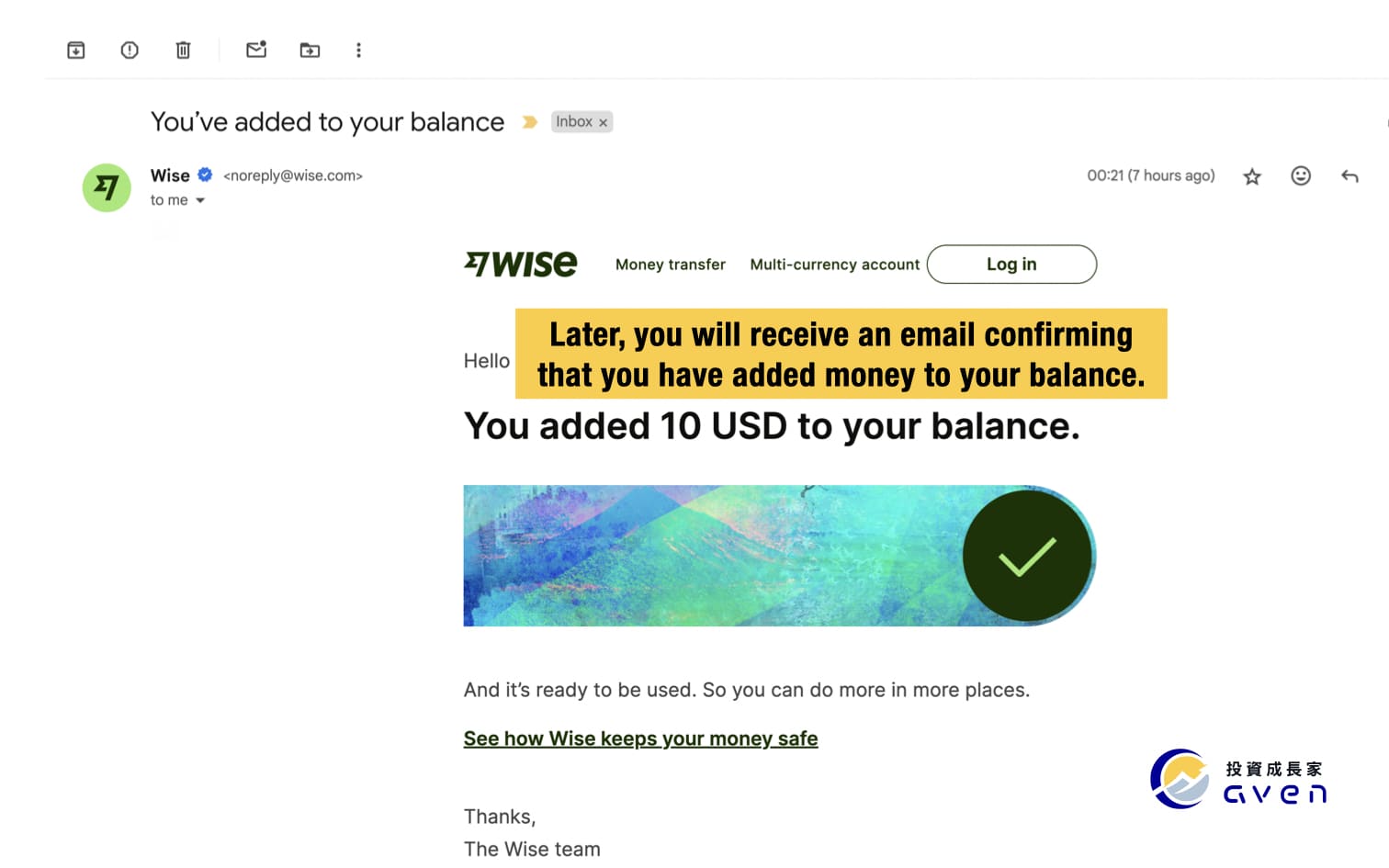

Later, you will receive an email about your transcation.

Now we've added money to your Wise account. The next step is to link your IB account with your Wise account and start funding your IB account!

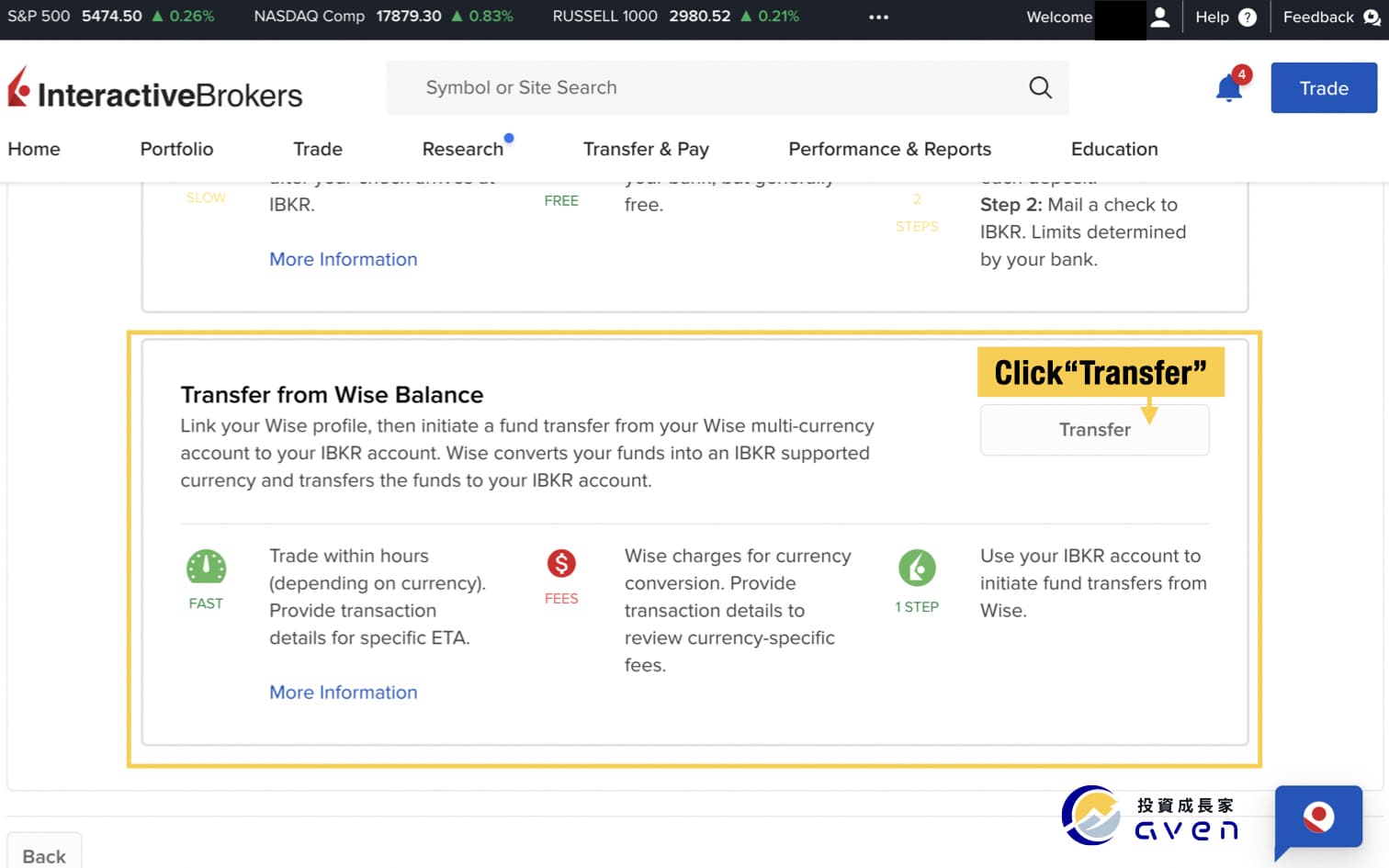

Step 3: Choose your IBKR account deposit method

Log in to your IBKR account, click "Transfer & Pay" and choose "Transfer Funds" -> "Deposit Funds".

At the step of selecting your IBKR account deposit method, choose "Transfer from Wise Balance" and click "Transfer".

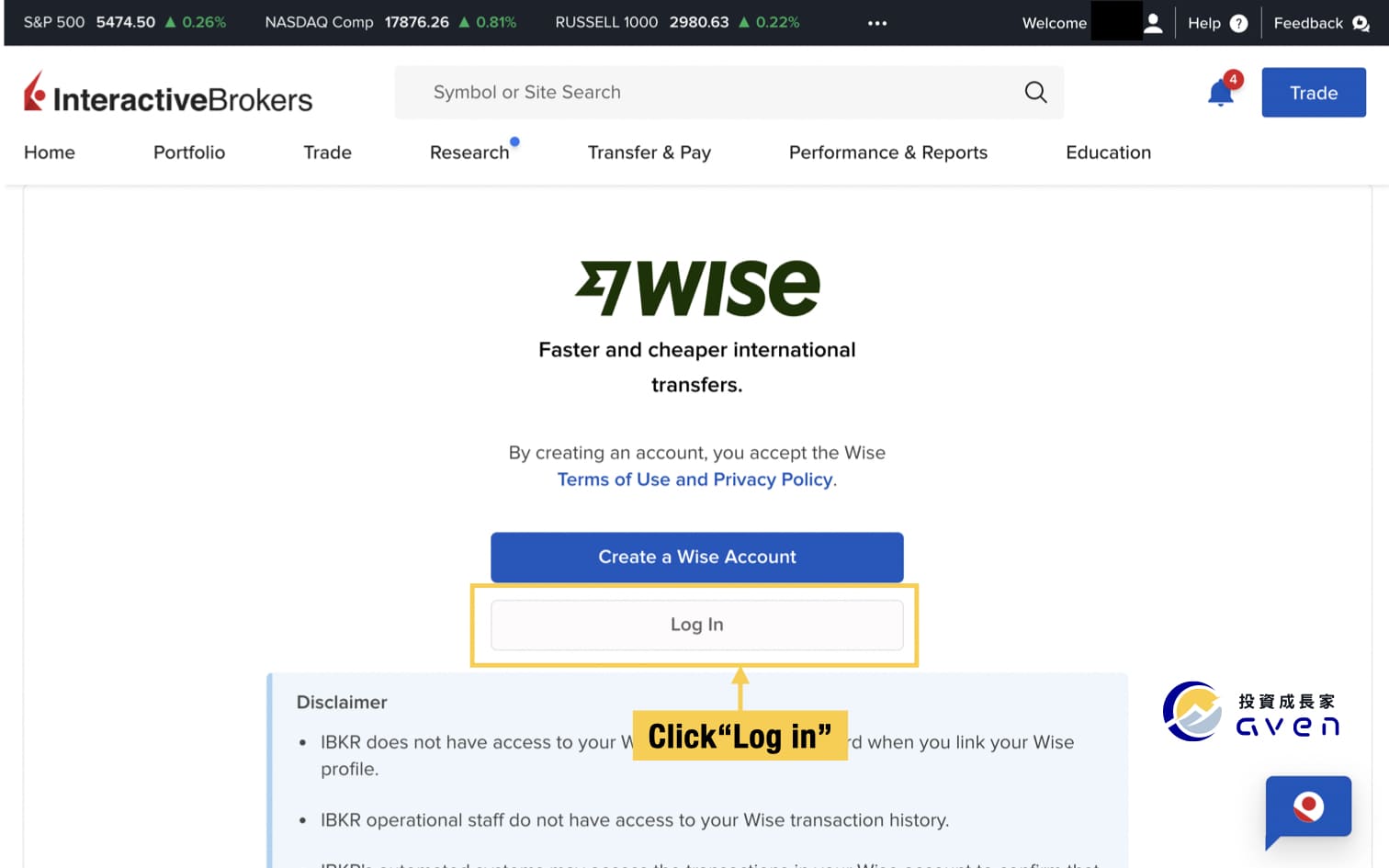

Step 4: Link your IB account with your Wise account

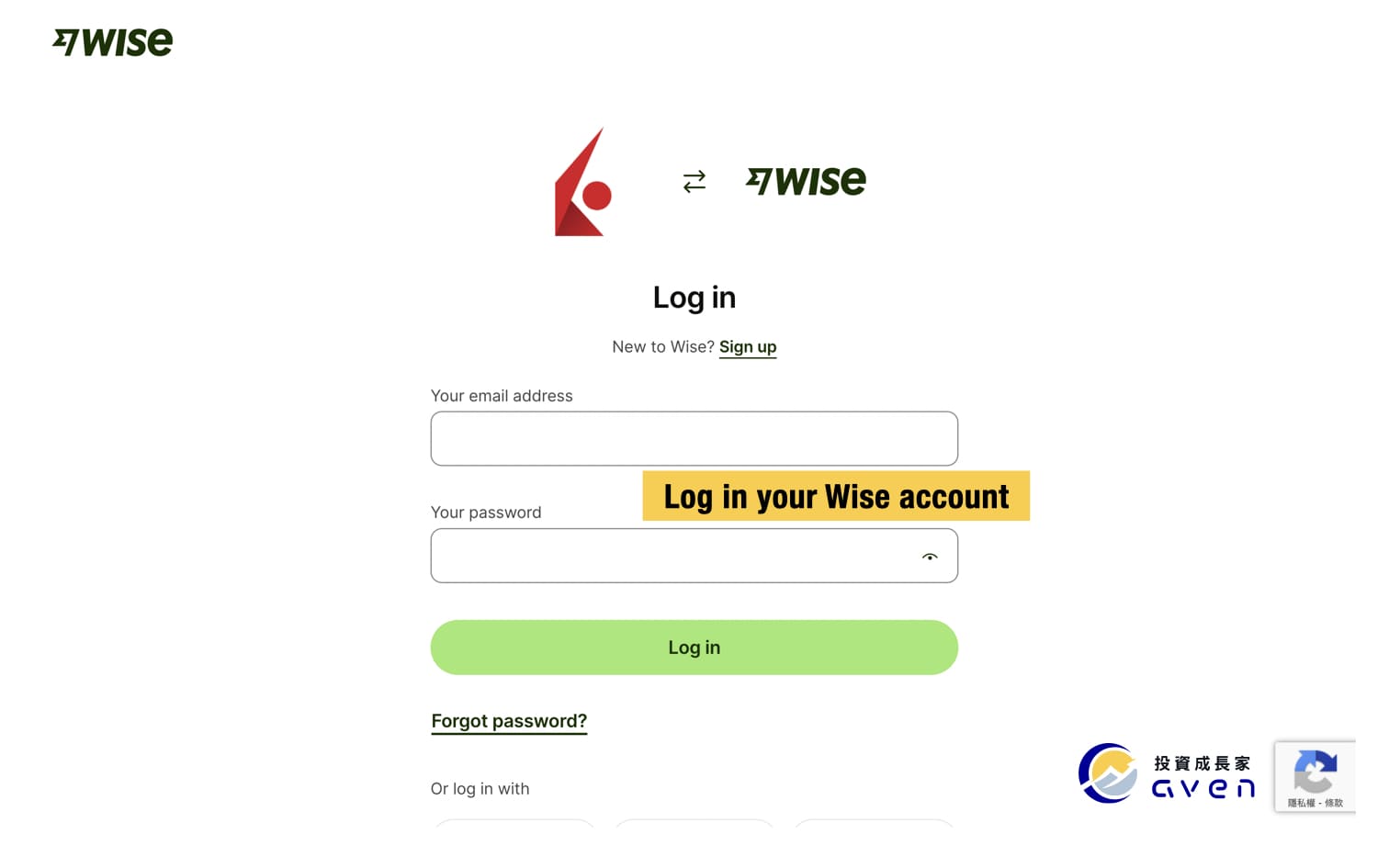

Log in to your Wise account.

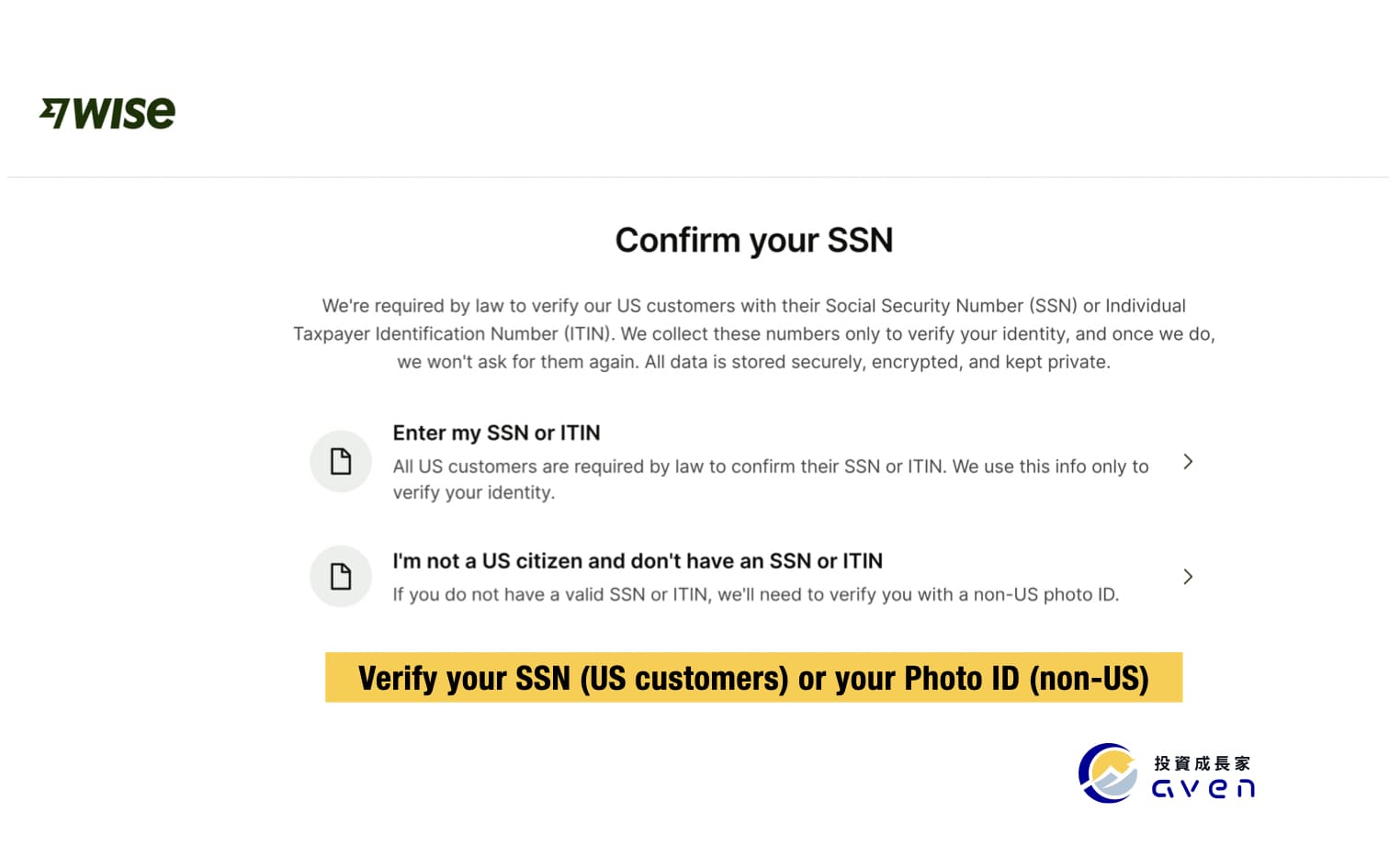

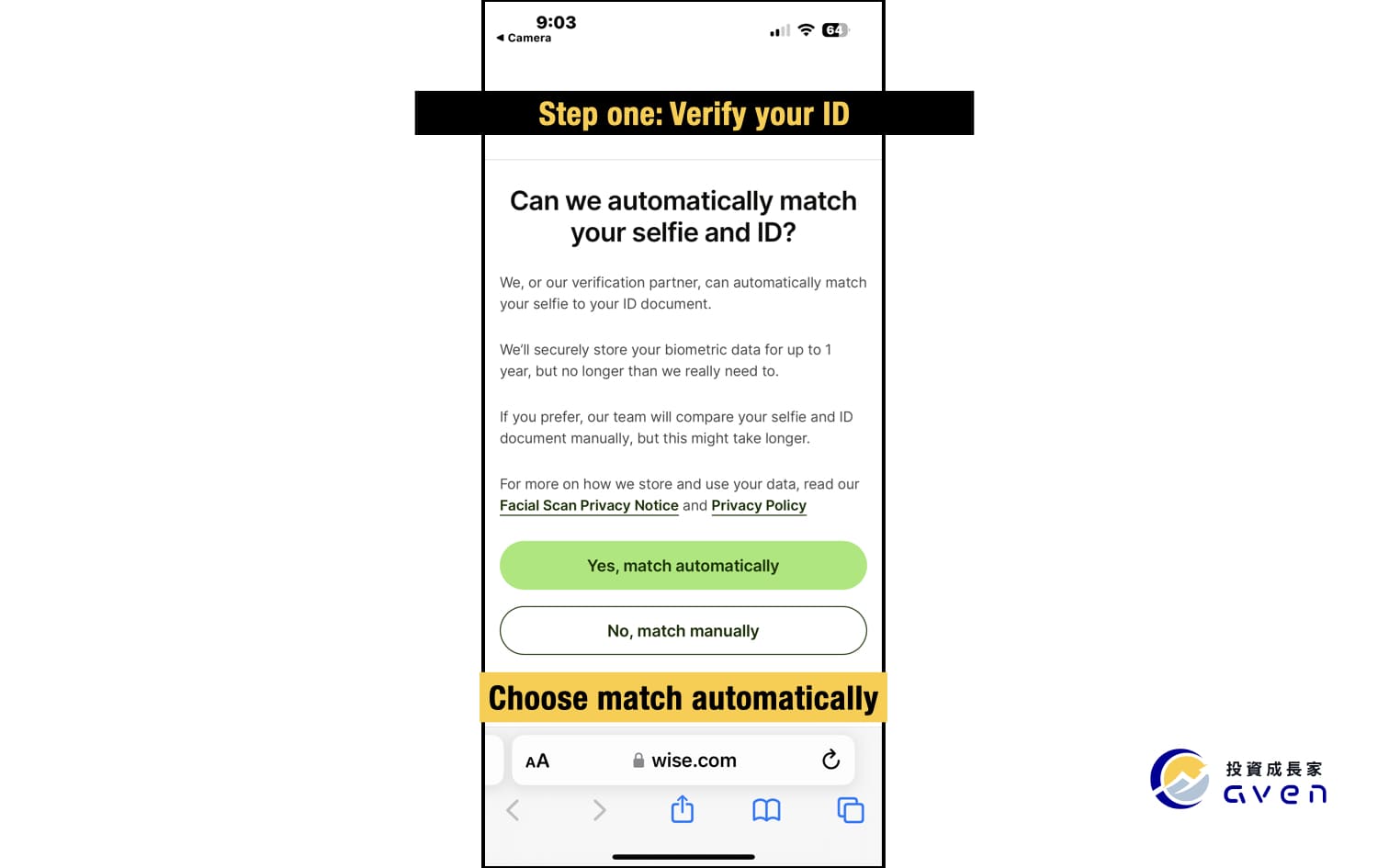

If it is your first time linking your Wise account with your IB account, you will need to confirm your identity.

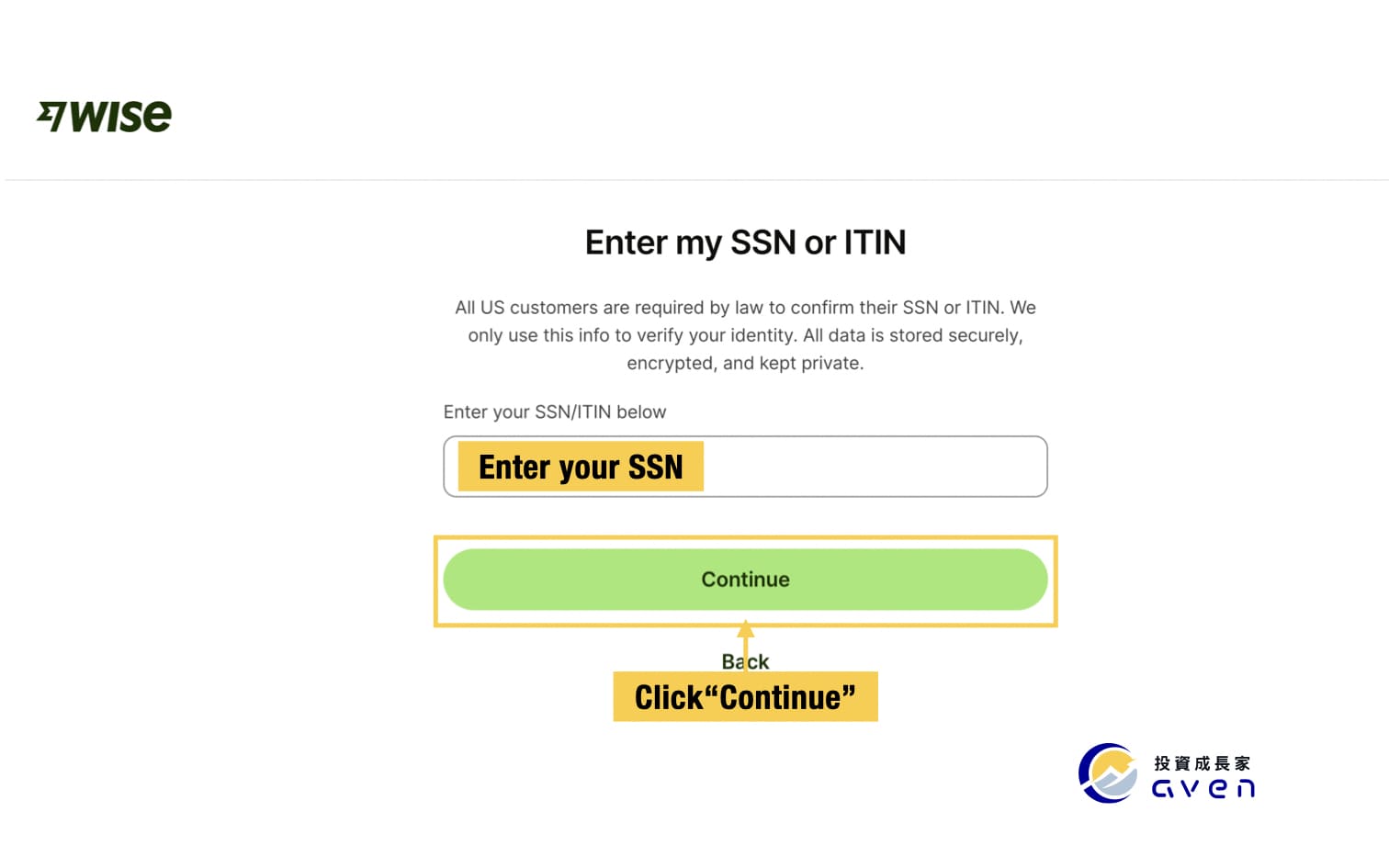

For US customers, provide your SSN or ITIN. For non-US customers, provide your non-US photo ID.

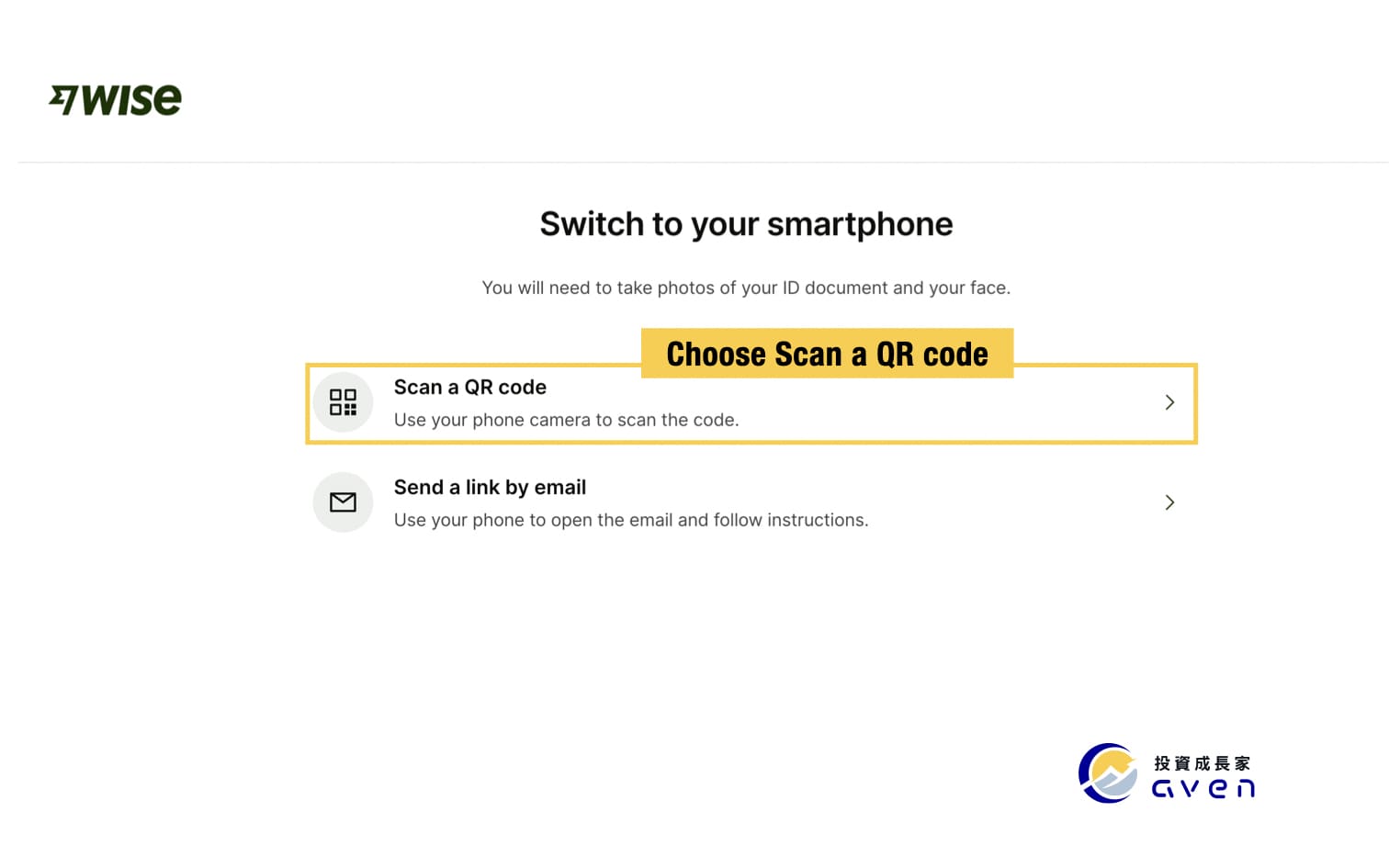

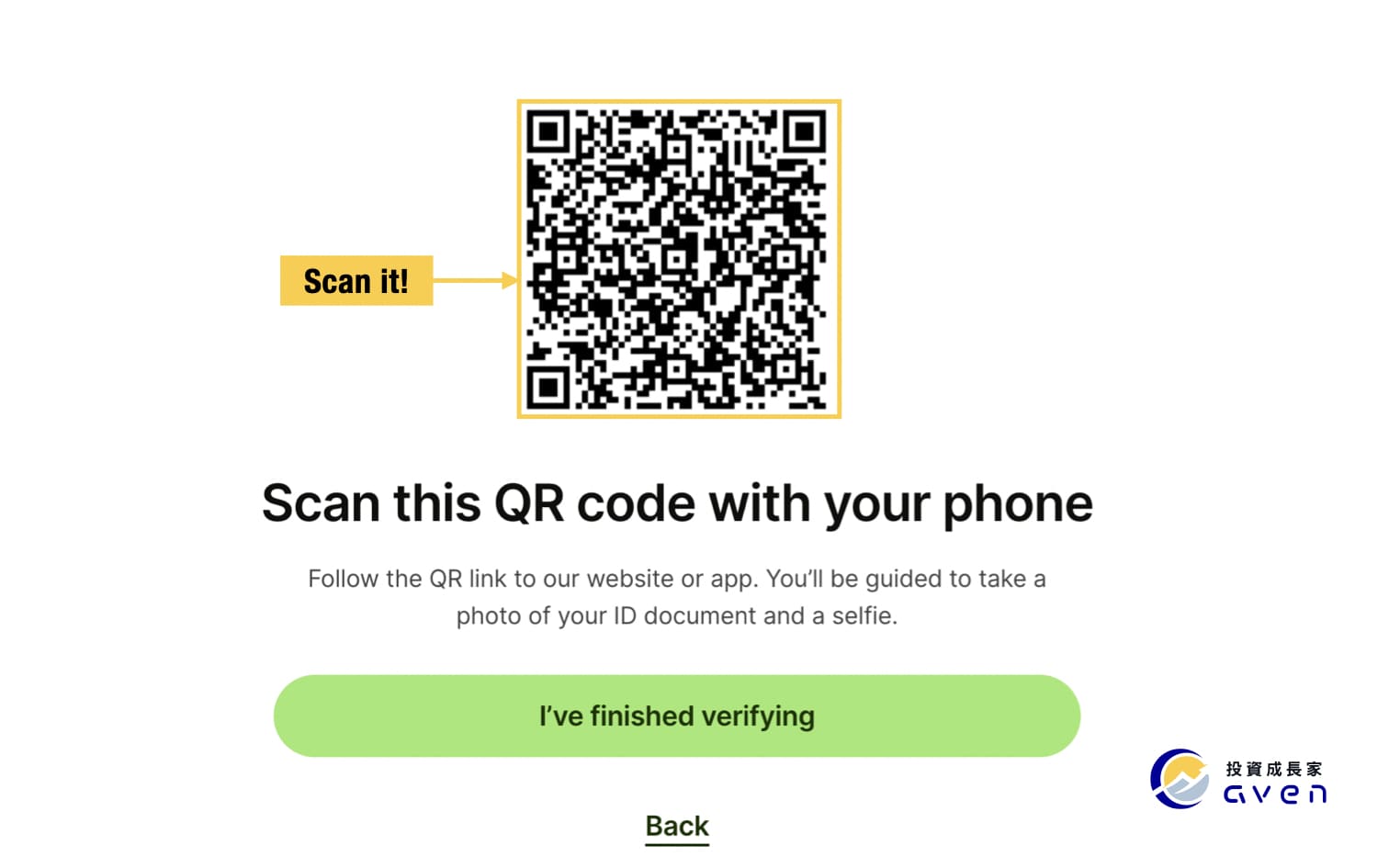

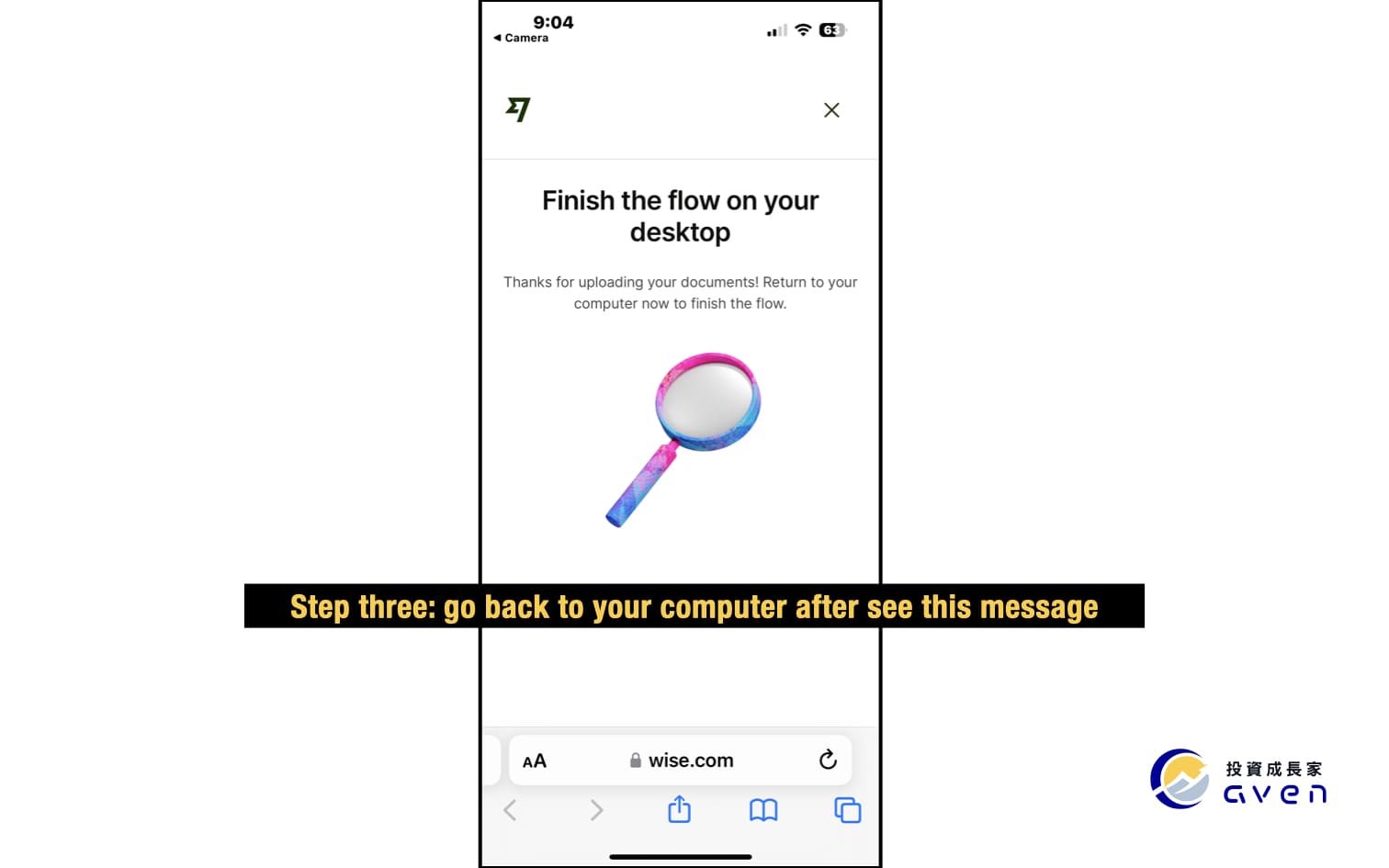

In this step, we will use a U.S. customer as an example. We choose SSN and take out our smartphone to scan the QR code.

Then, you can use your smartphone to complete your verification.

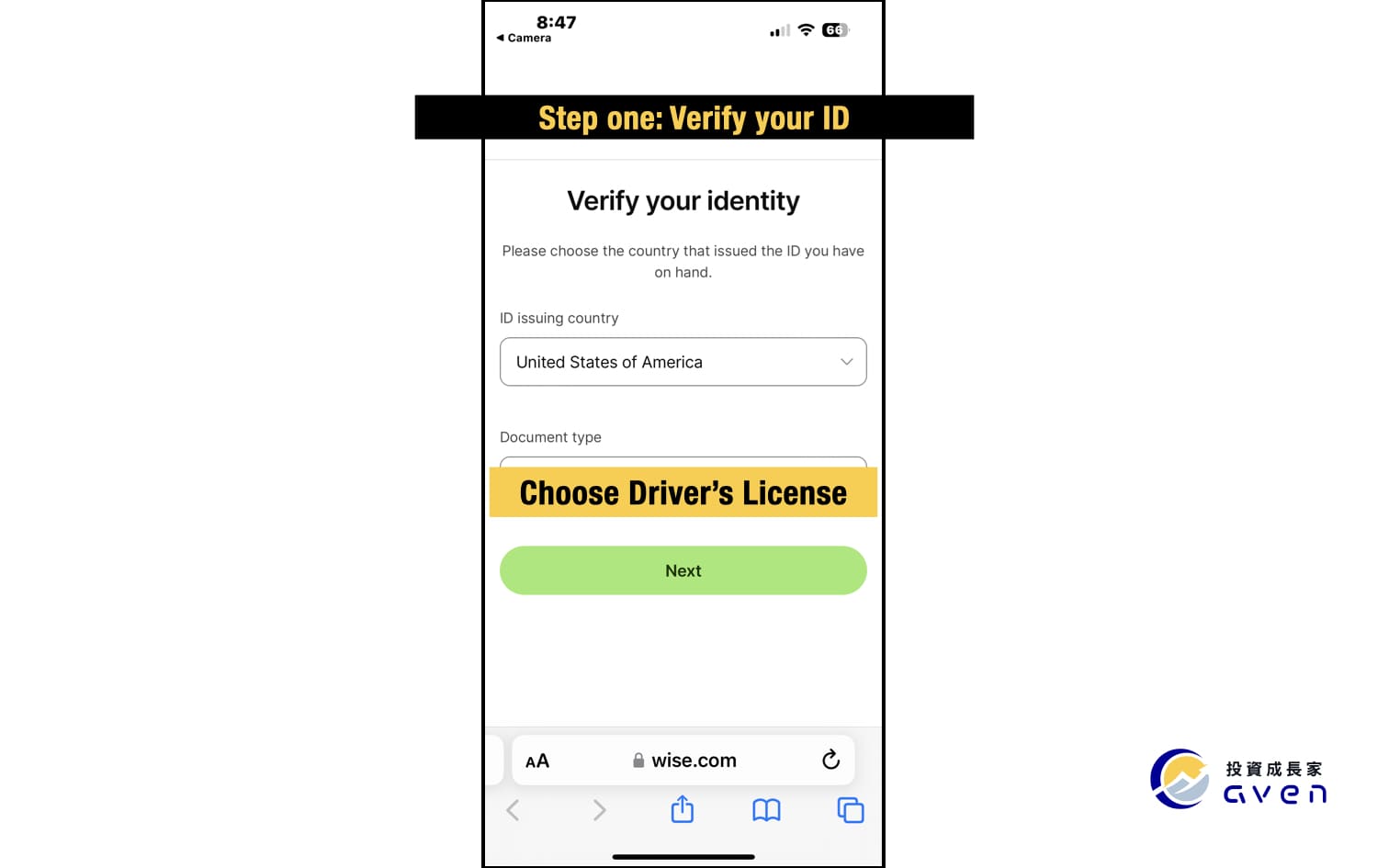

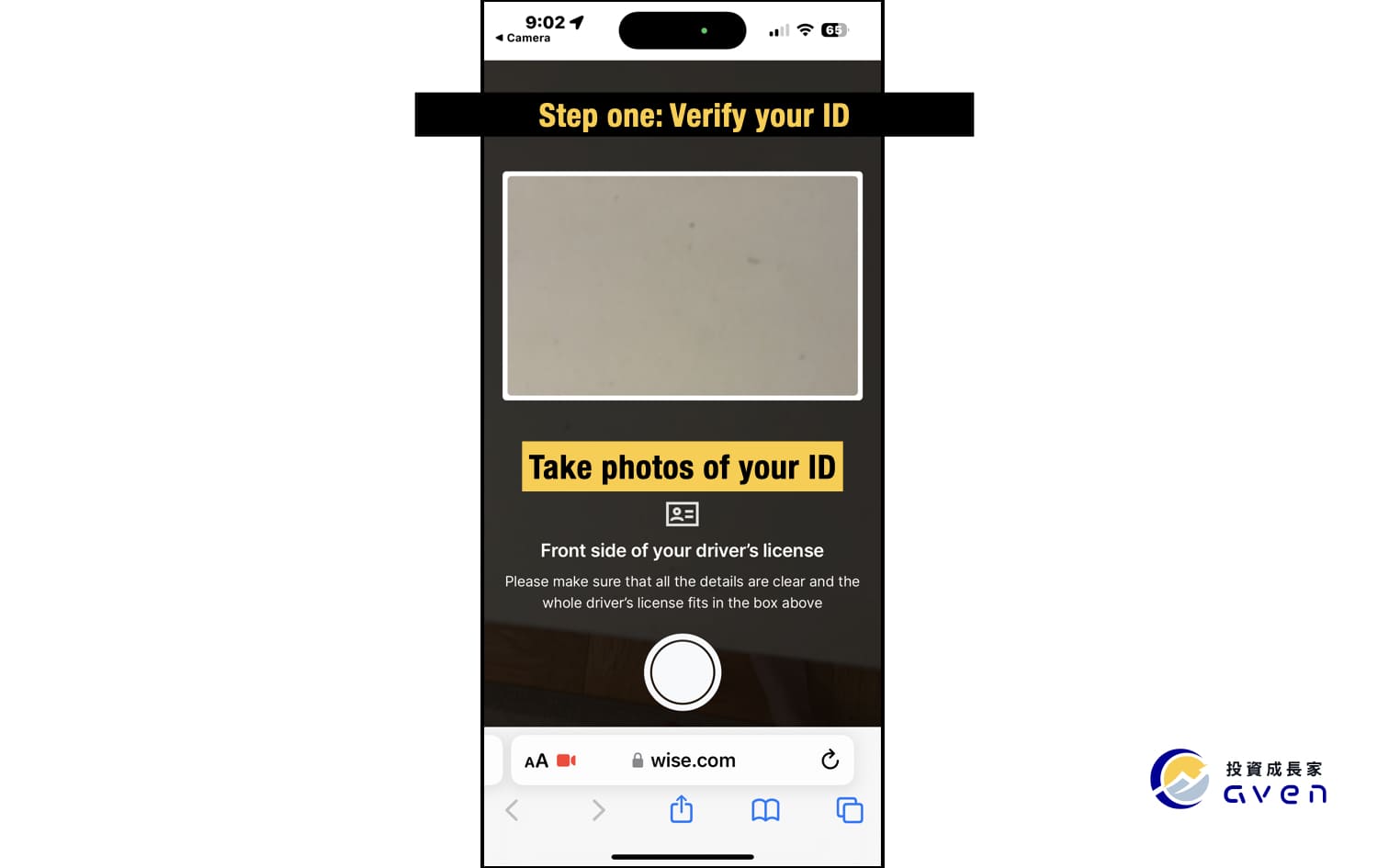

The first step is to verify your ID; you need to prepare your physical ID (I used a driver’s license as an example) and take photos of both sides.

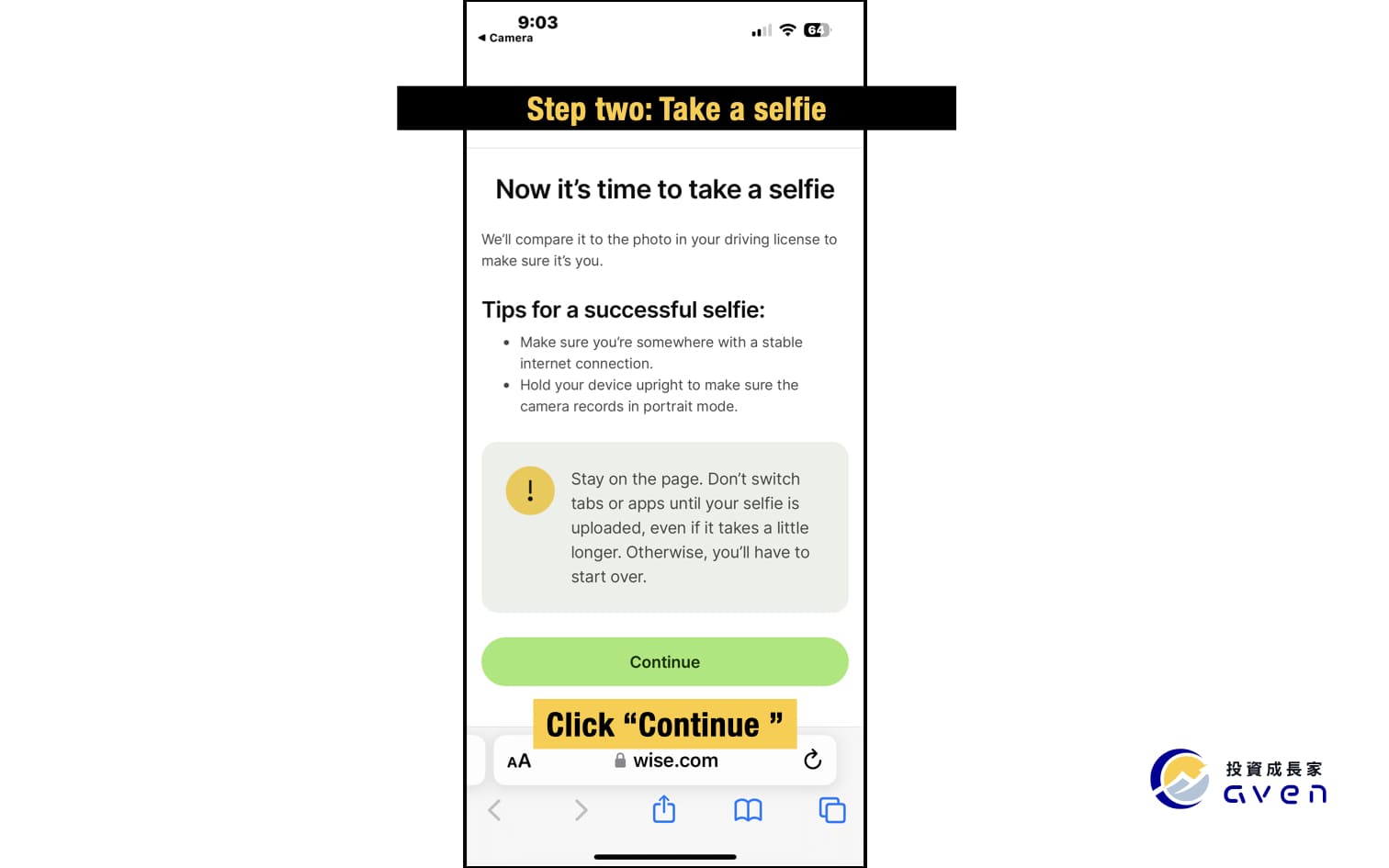

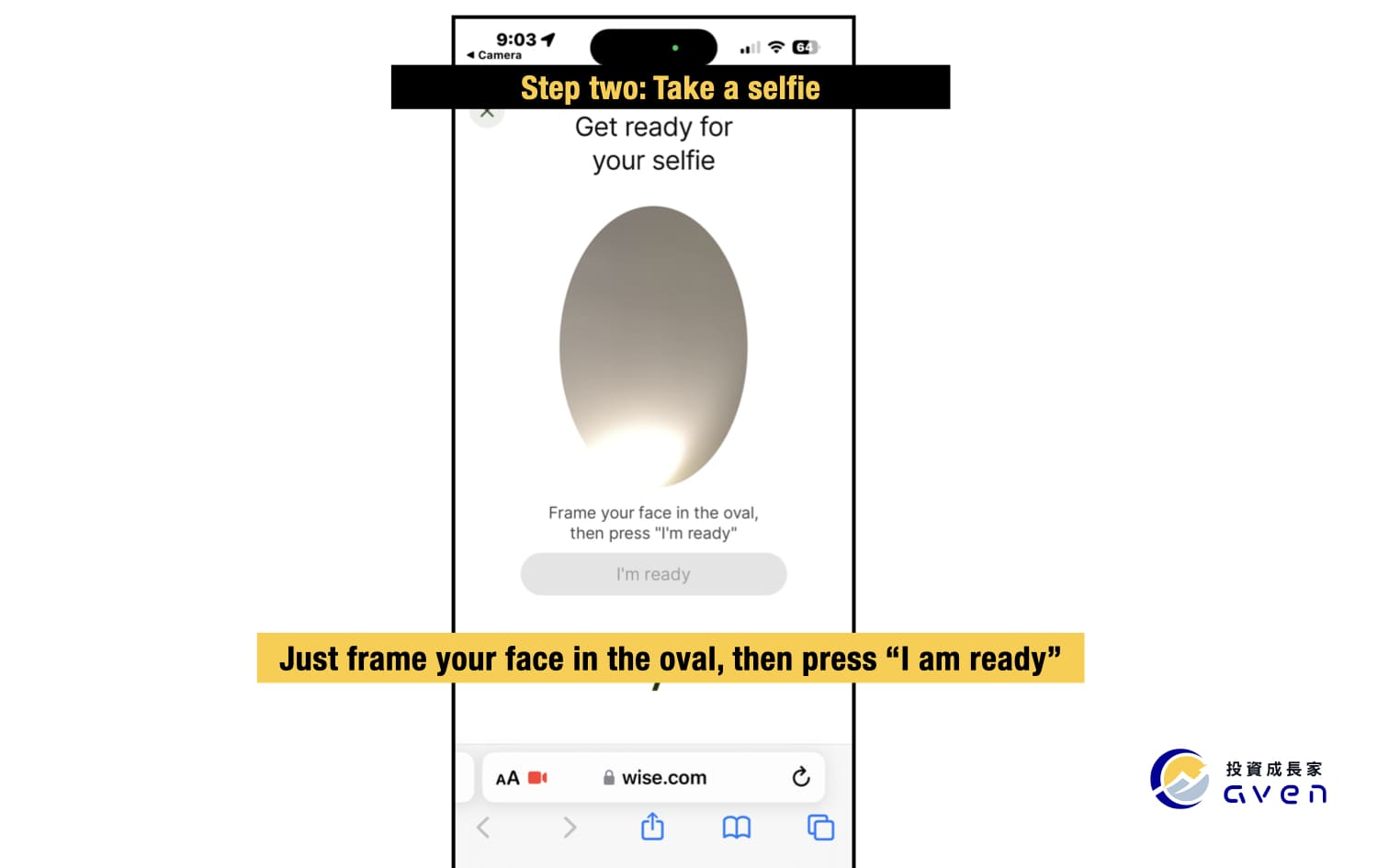

The second step is to take a selfie of yourself, just follow the instructions.

After that, you can go back to the Wise verification page on your computer.

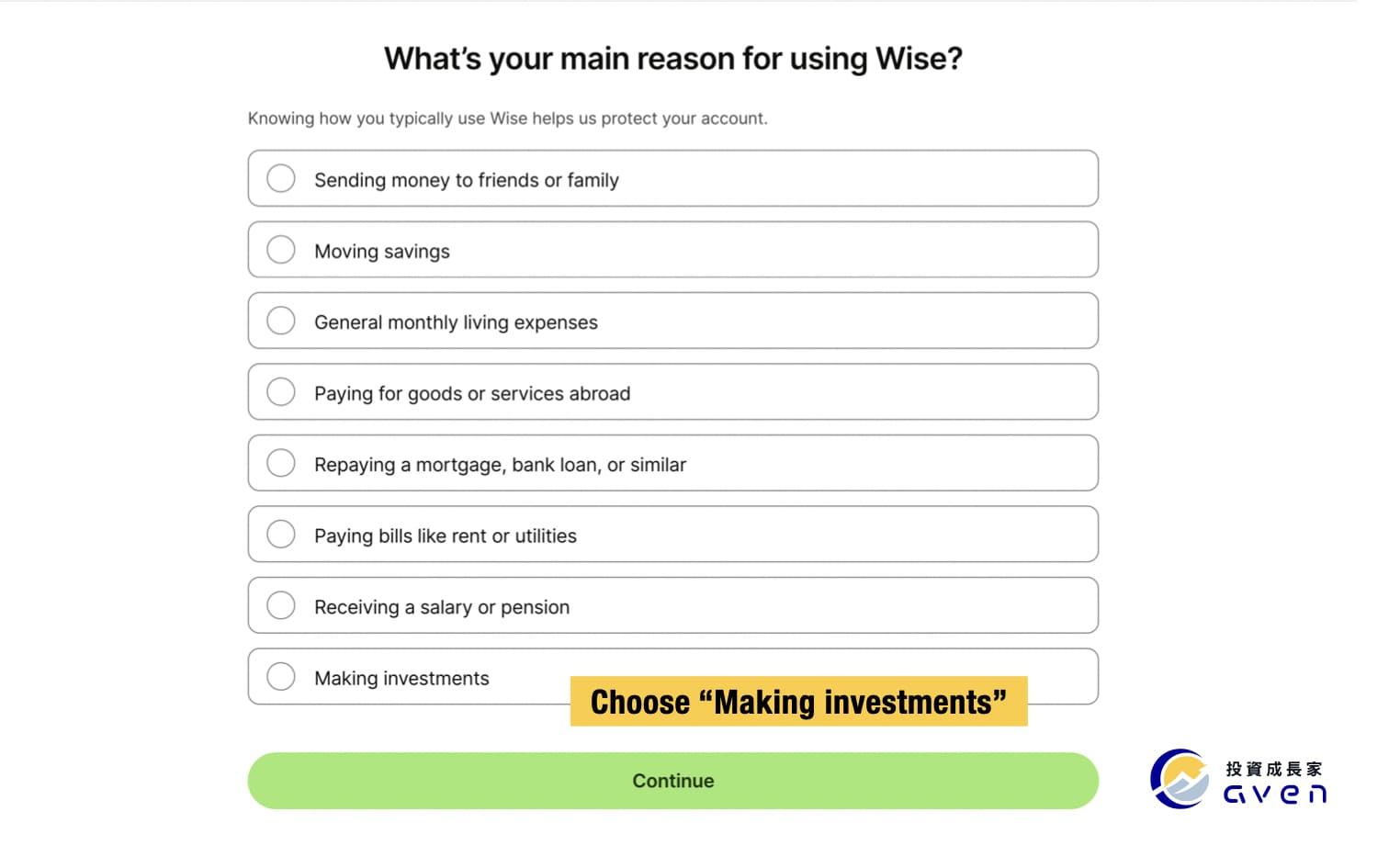

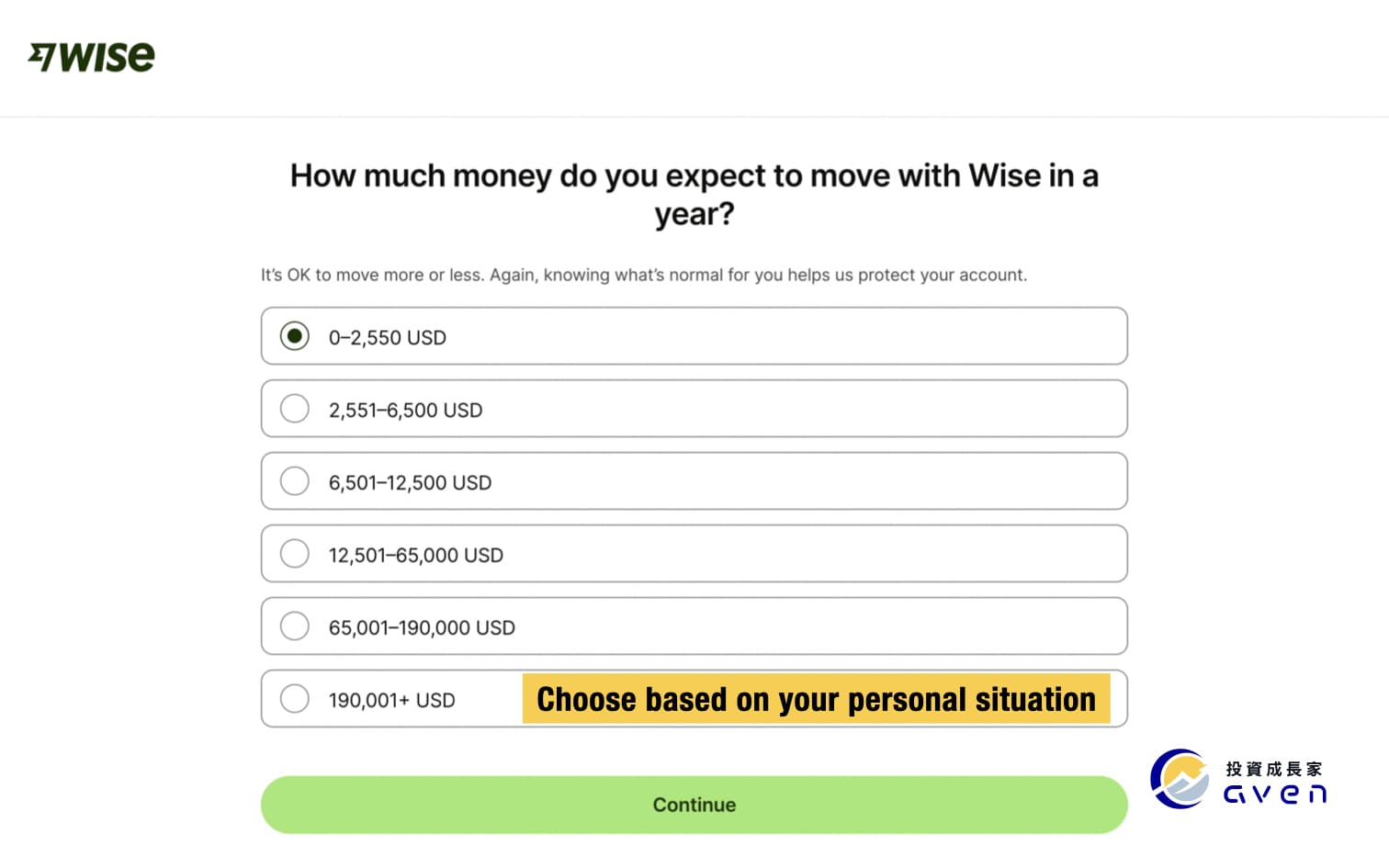

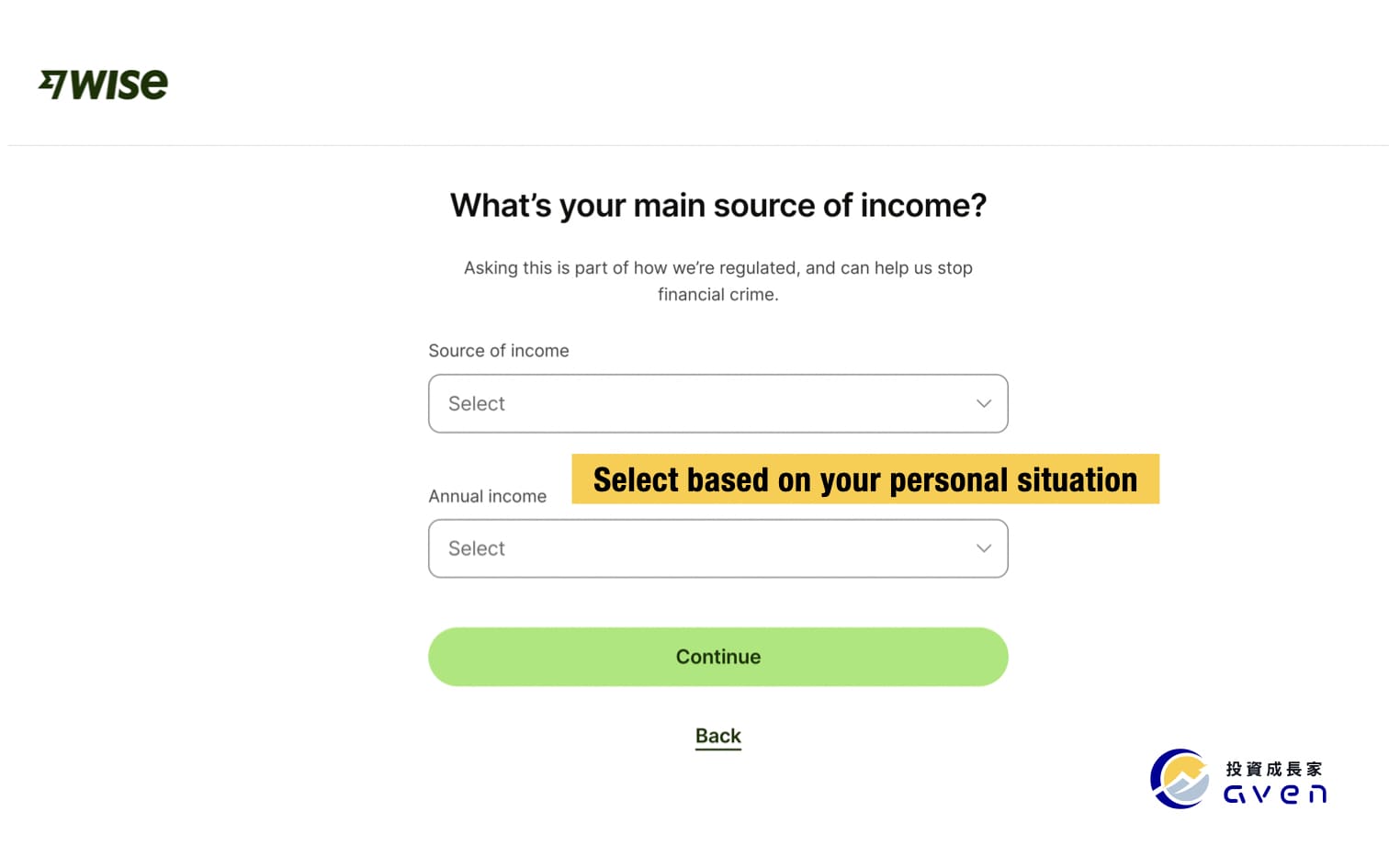

If you verify successfully, the page will turn to "What's your main reason for using Wise?". Just answer it based on your situation or you can choose "Making investments". Then just answer every question.

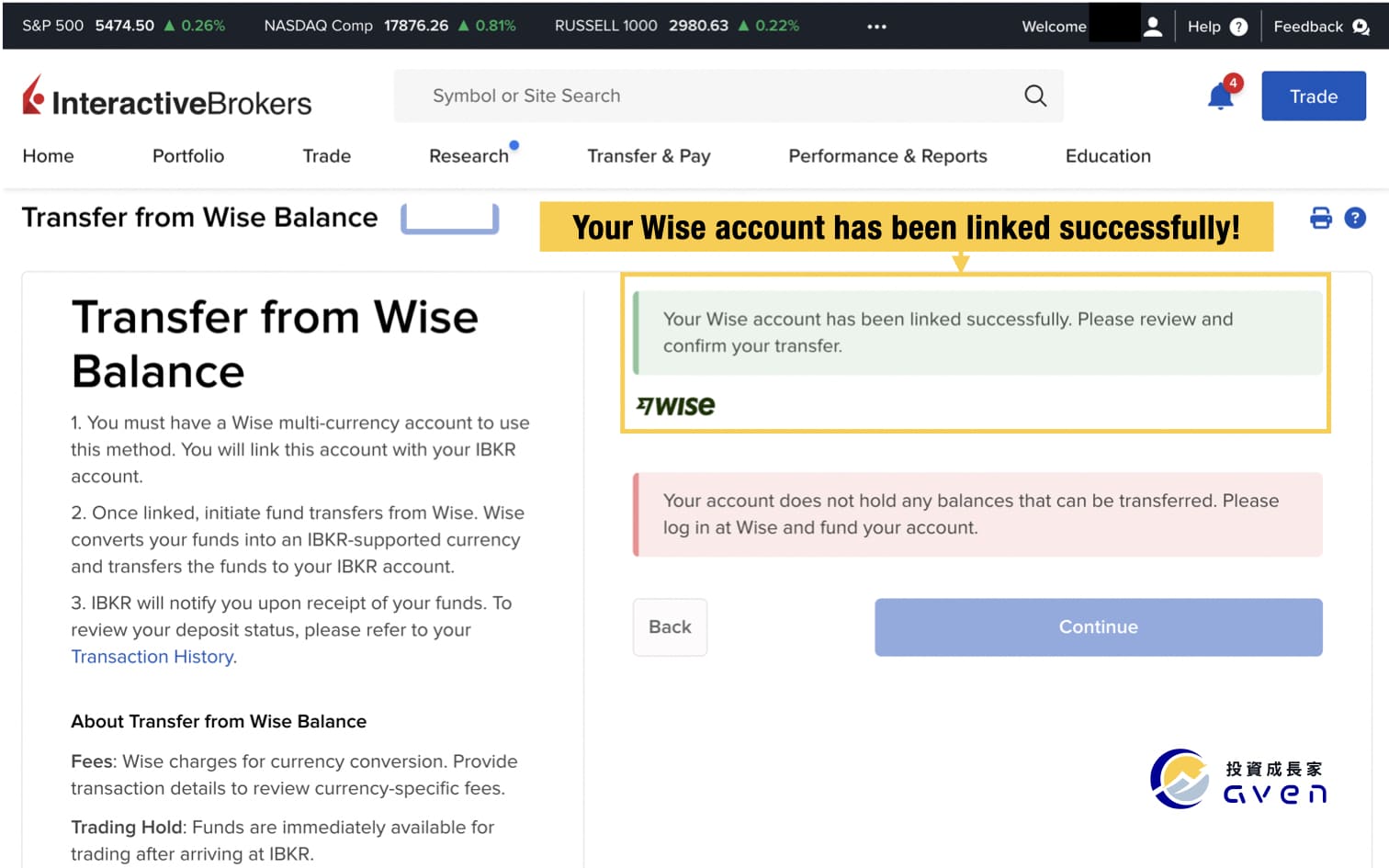

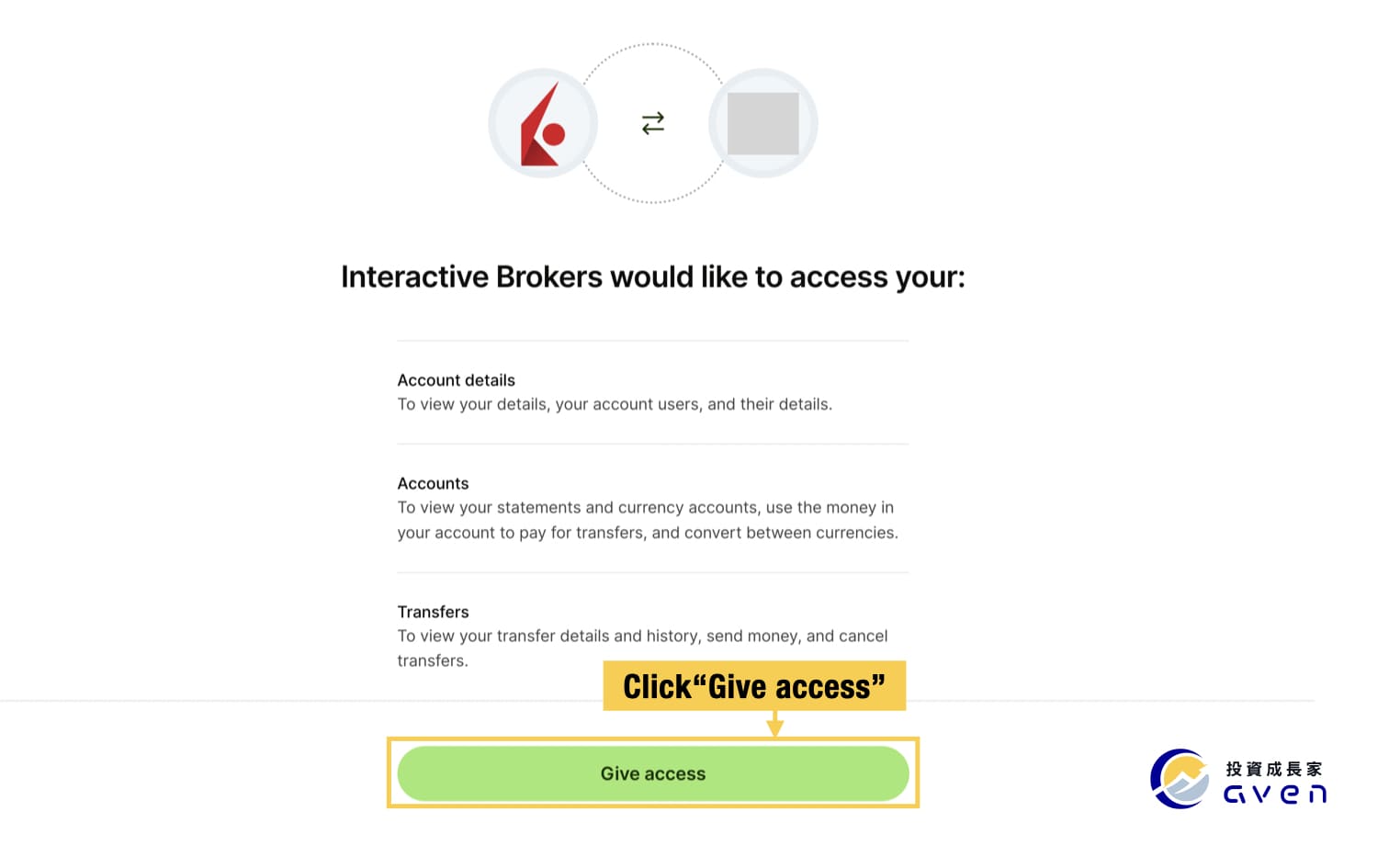

Finally, click "Give access" to link your IB account with your Wise account.

Once you see this message, it means your Wise account has been linked successfully!

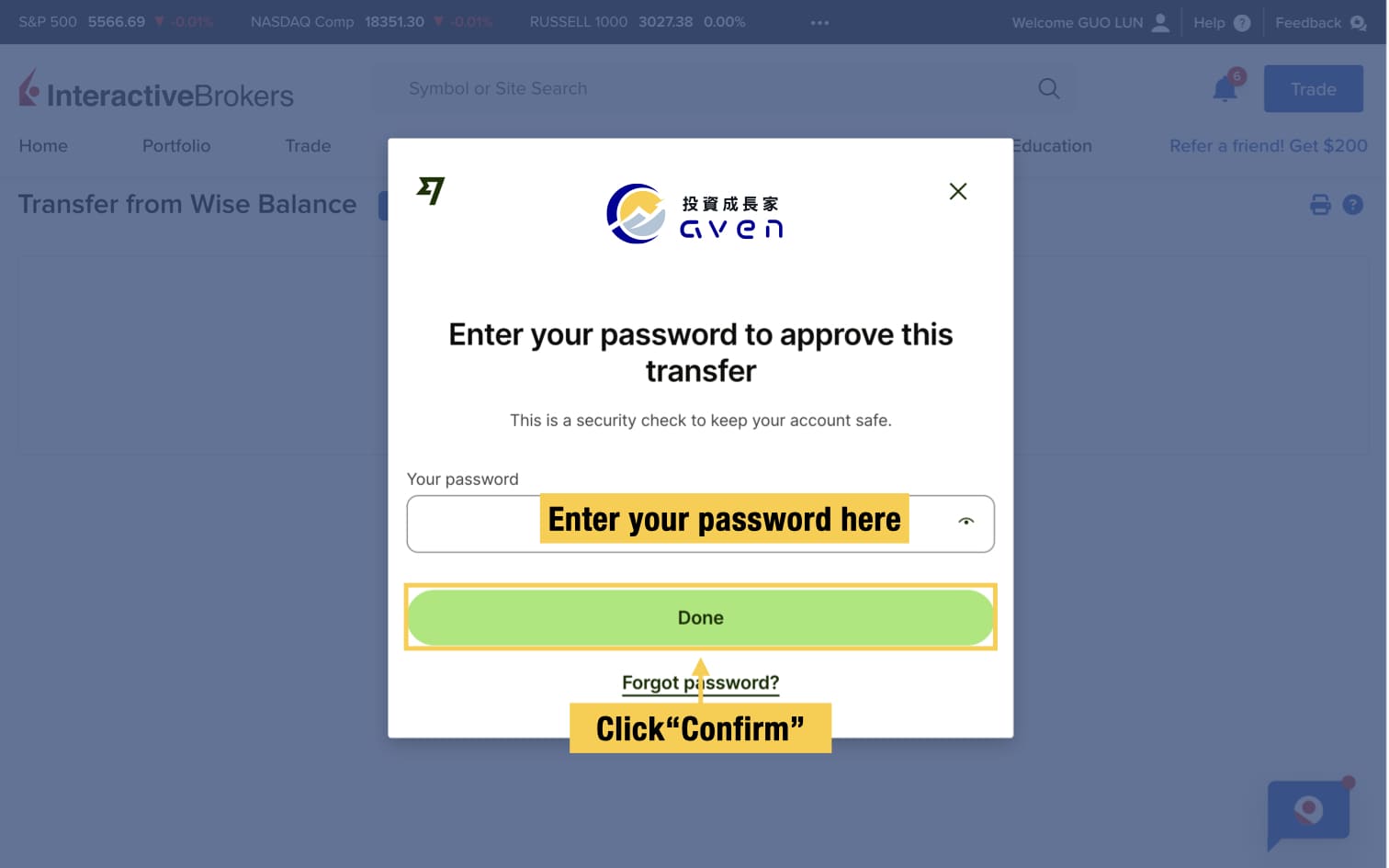

Step 5: Fund your IB account through Wise

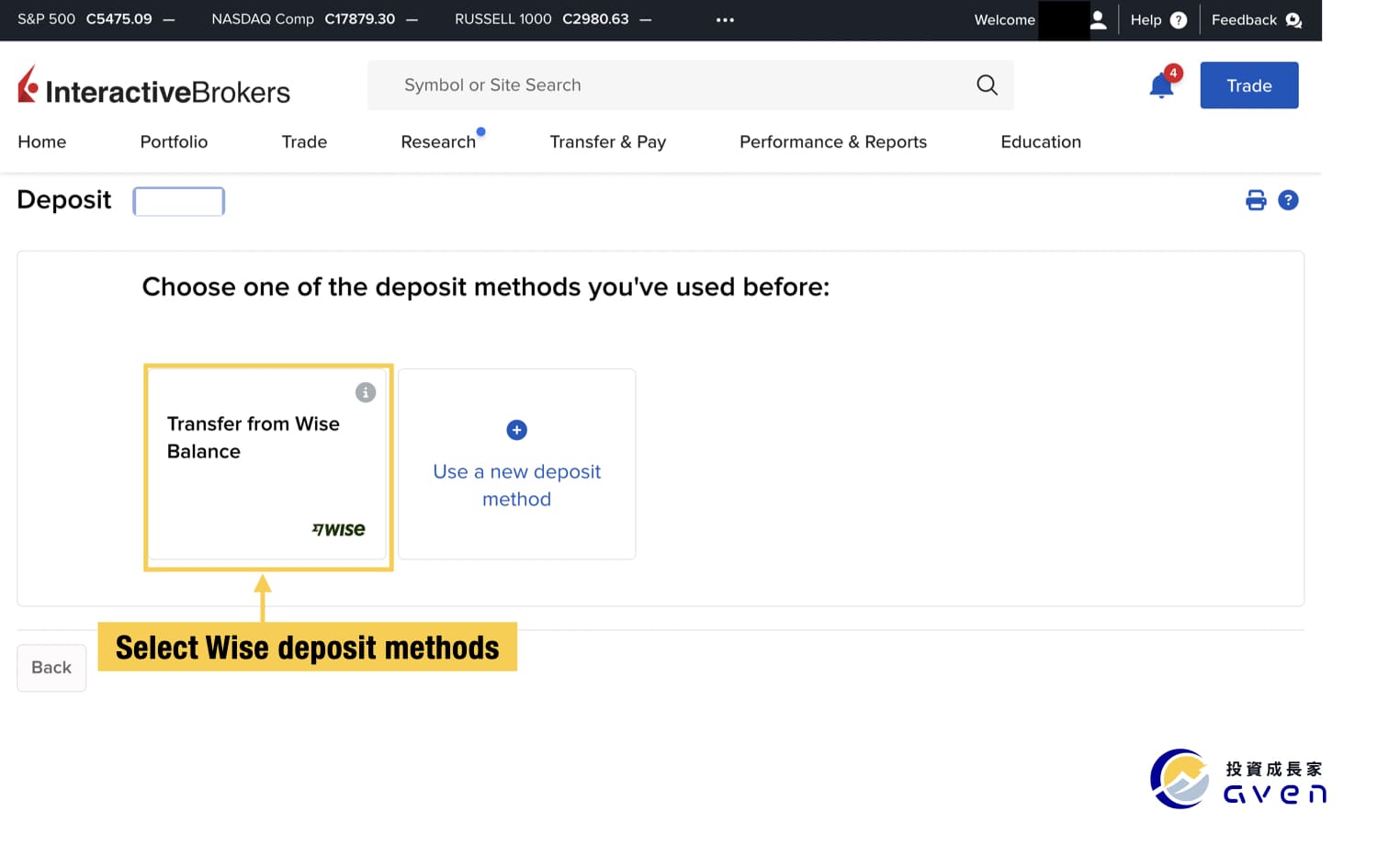

Now we can fund your IB account with your Wise balance. Log in to your IB account and click Transfer & Pay -> Deposit Funds.

If you've successfully linked you Wise account, you will see it in your deposit method. Now you can select it.

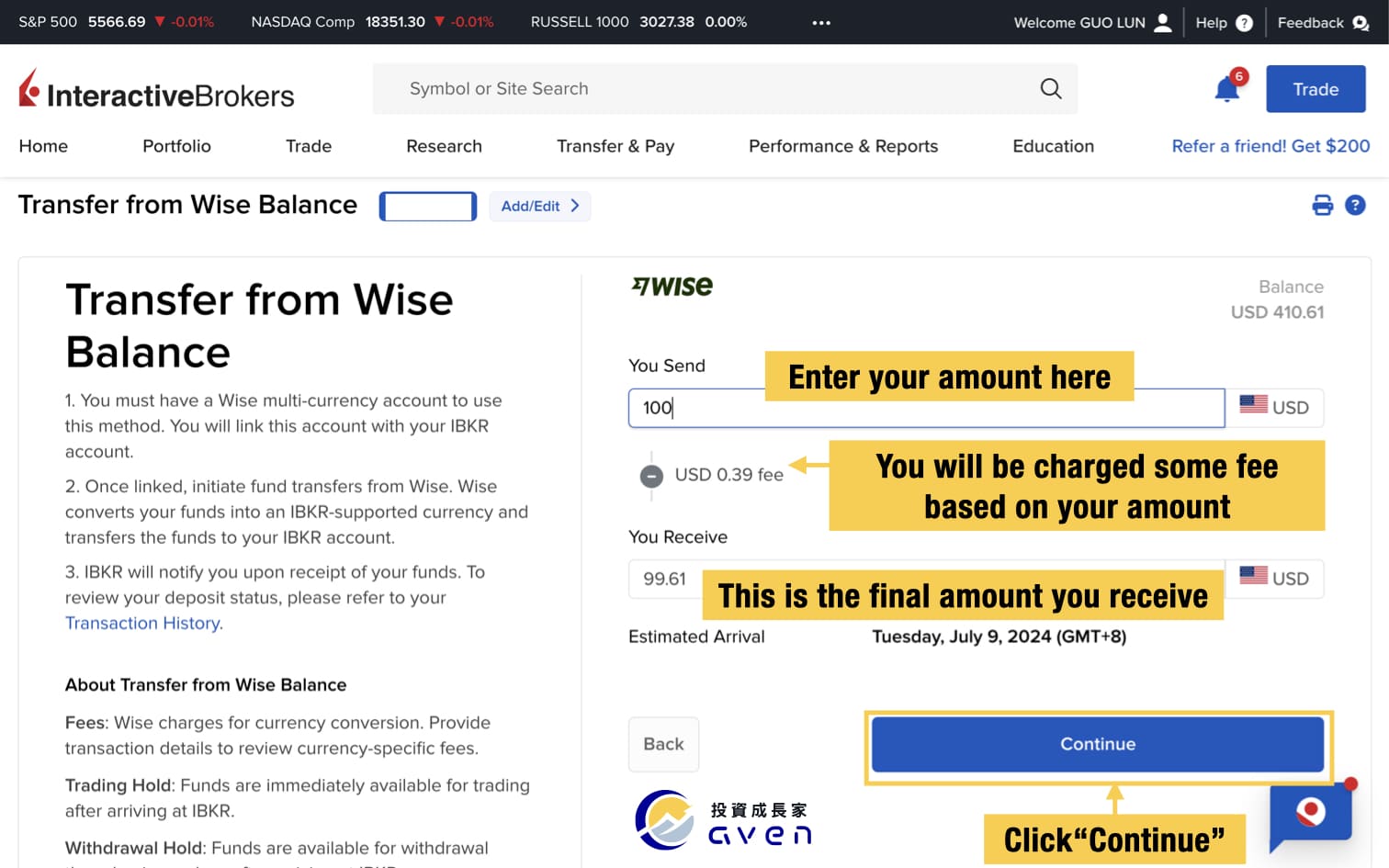

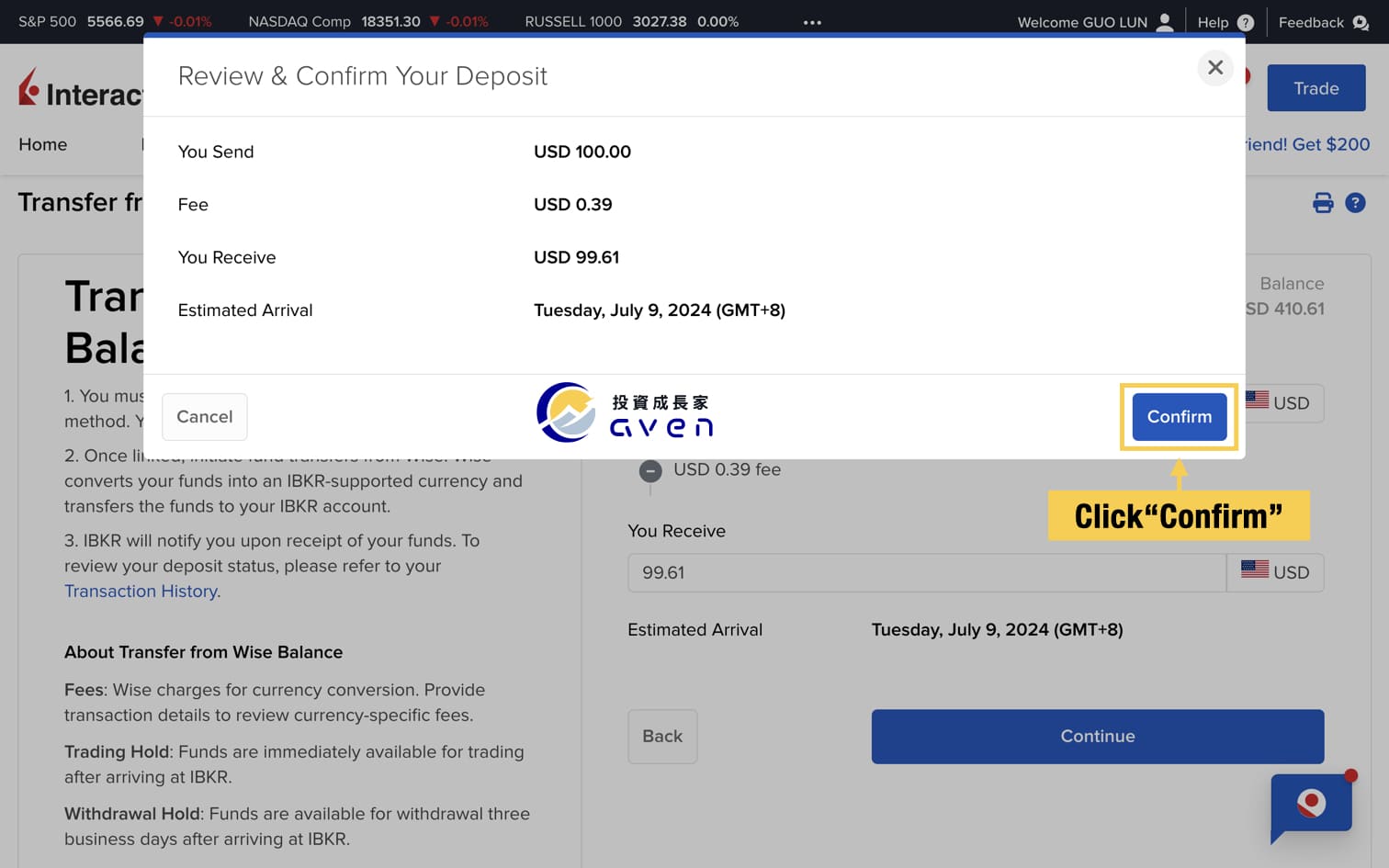

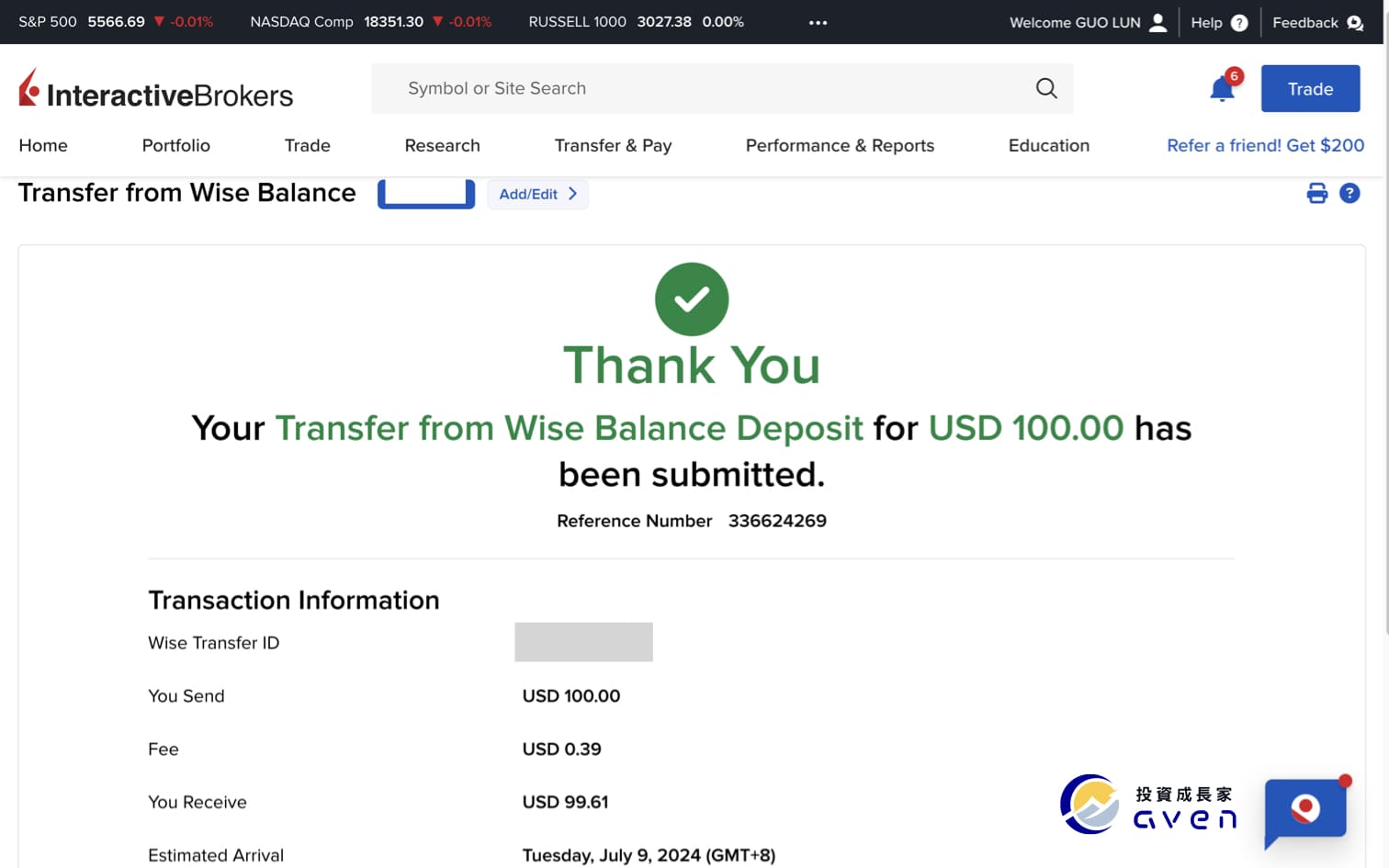

Just enter your amount, and you will be charged some fee. And it will show the last amount you will receive. The transfer fee charged by Wise varies each time depending on the account, currency, and transfer amount, so it will be different each time.

After you see this message, it means you have successfully funded your IB account through Wise.

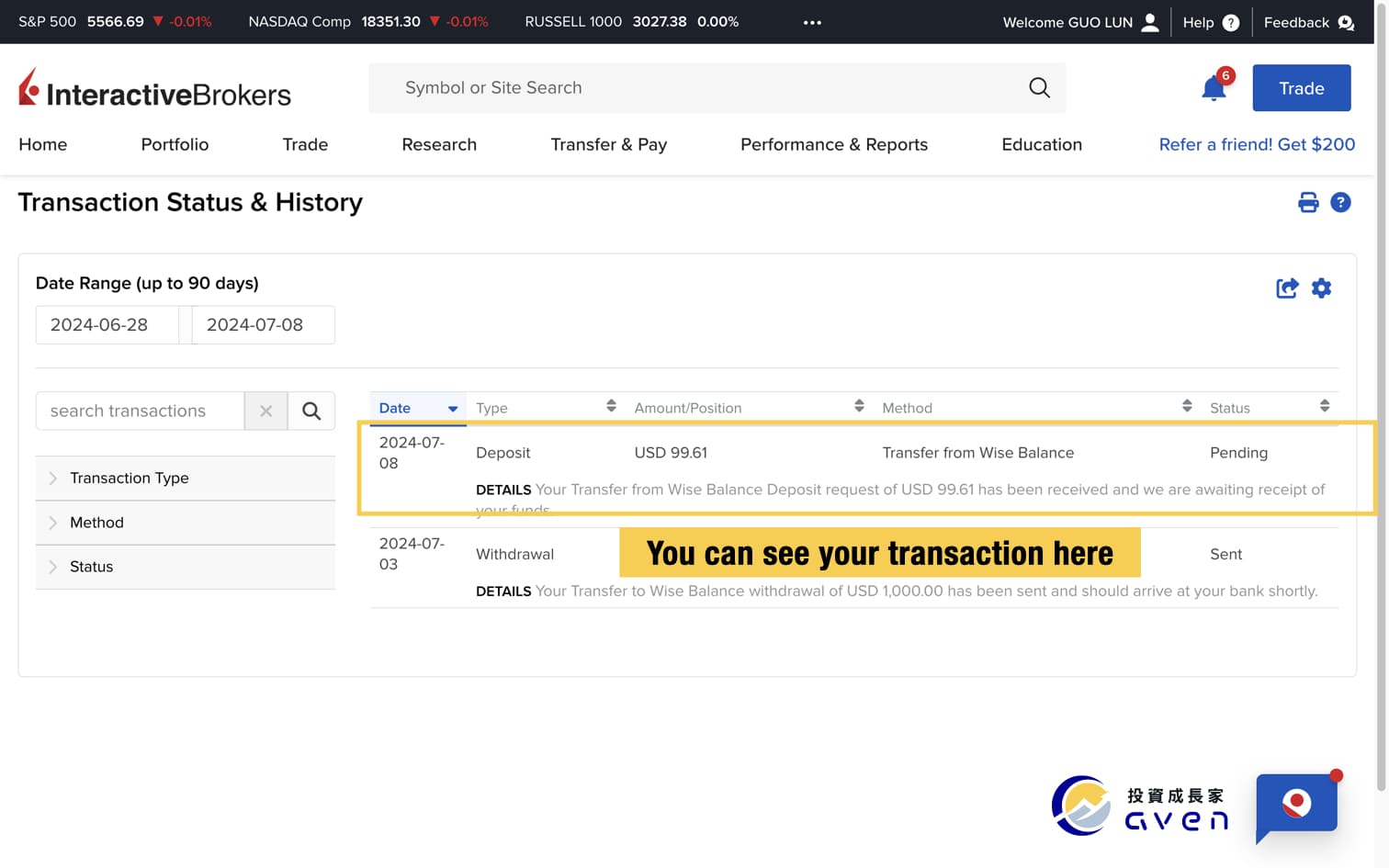

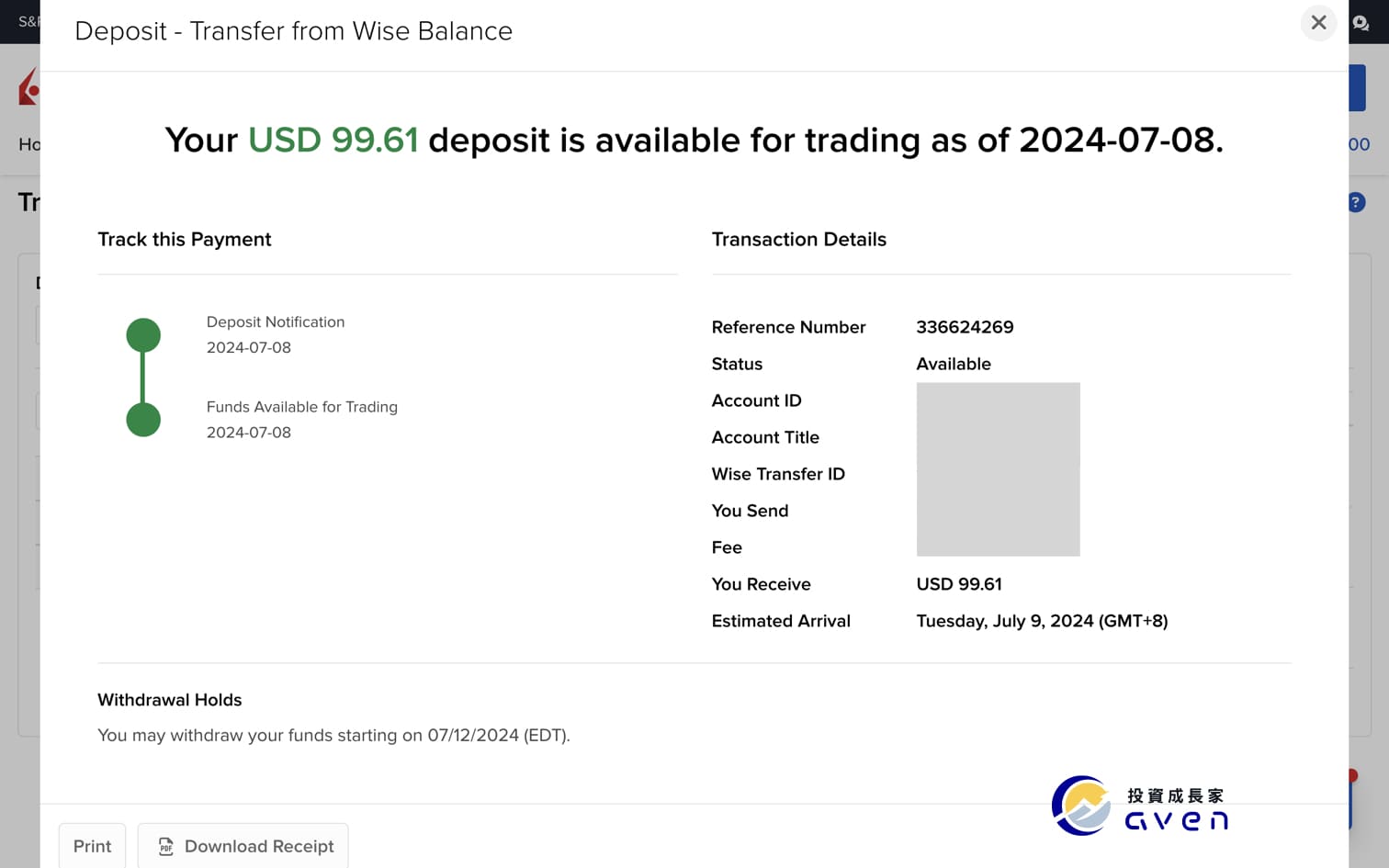

Step 6: Check your Transaction Status & History

After you deposit your IB account, you can click "Transfer & Pay" -> "Transaction Status & History" to check your deposit.

Funding Interactive Brokers with Link a New Bank Account Method (Apply to only U.S bank account owners)

Step 1: Choose your IBKR account deposit method

Step 2: Link your bank account to your IB account

Step 3: Fund your IB account through your US bank account

Step 4: Check your Transaction Status & History

Step 1: Choose your IBKR account deposit method

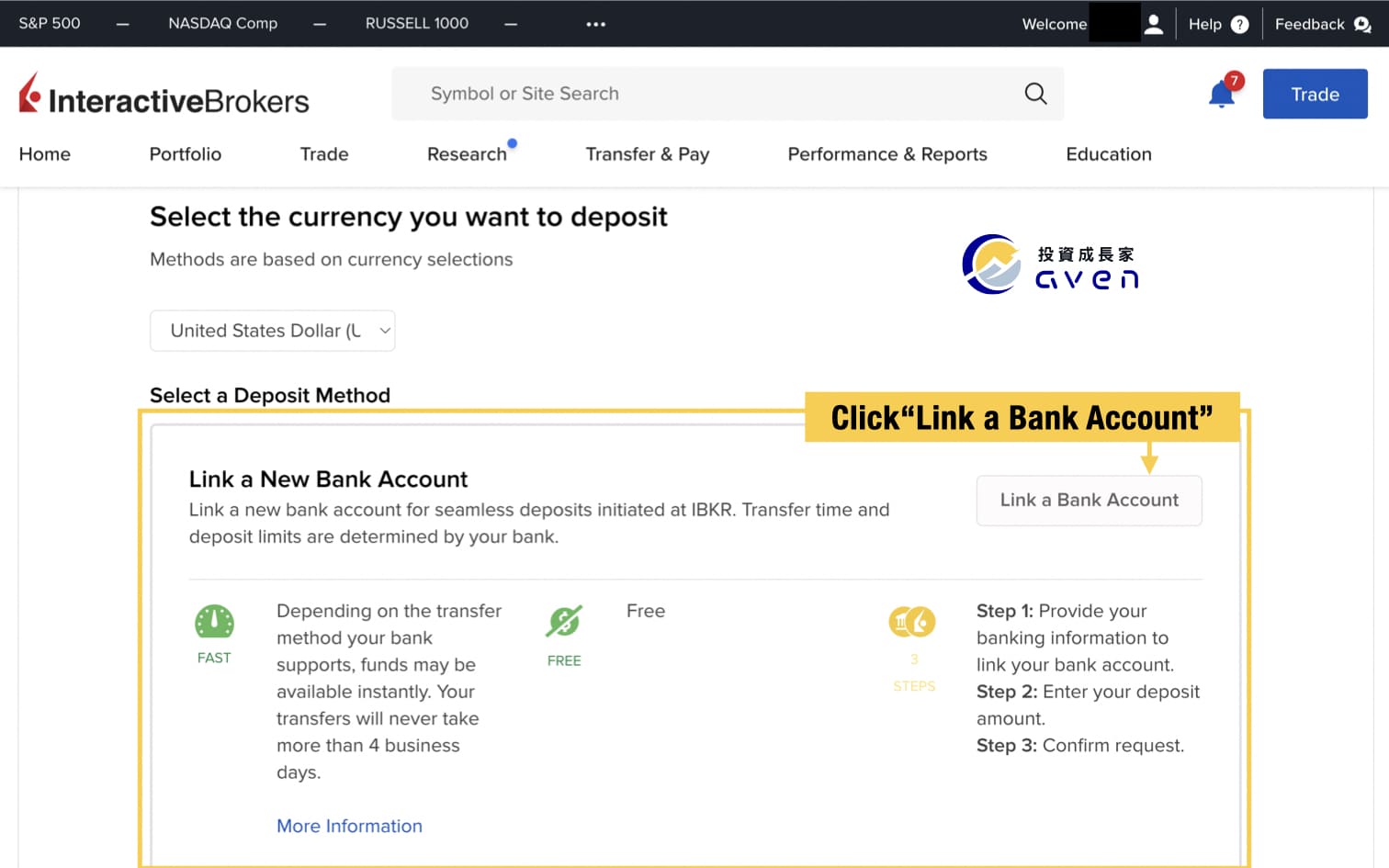

Log in to your IBKR account, click "Transfer & Pay" and choose "Transfer Funds" -> "Deposit Funds". At the step of selecting your IBKR account deposit method, choose "Link a New Bank Account" and click "Link a Bank Account".

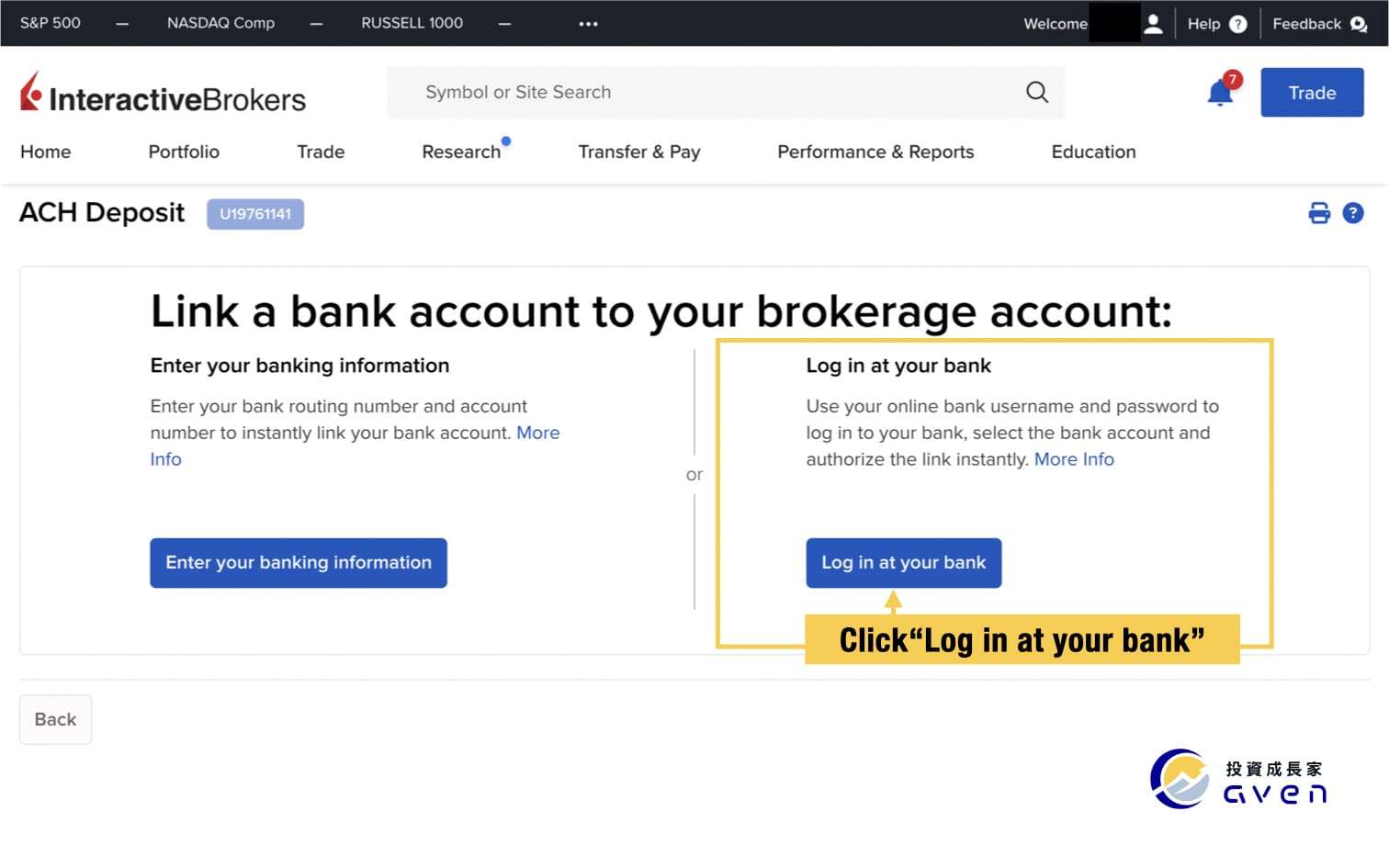

Step 2: Link your bank account to your IB account

After clicking "Link a Bank Account" It will show two options to link your brokerage account. "Log in at your bank" is the easier method, choose it.

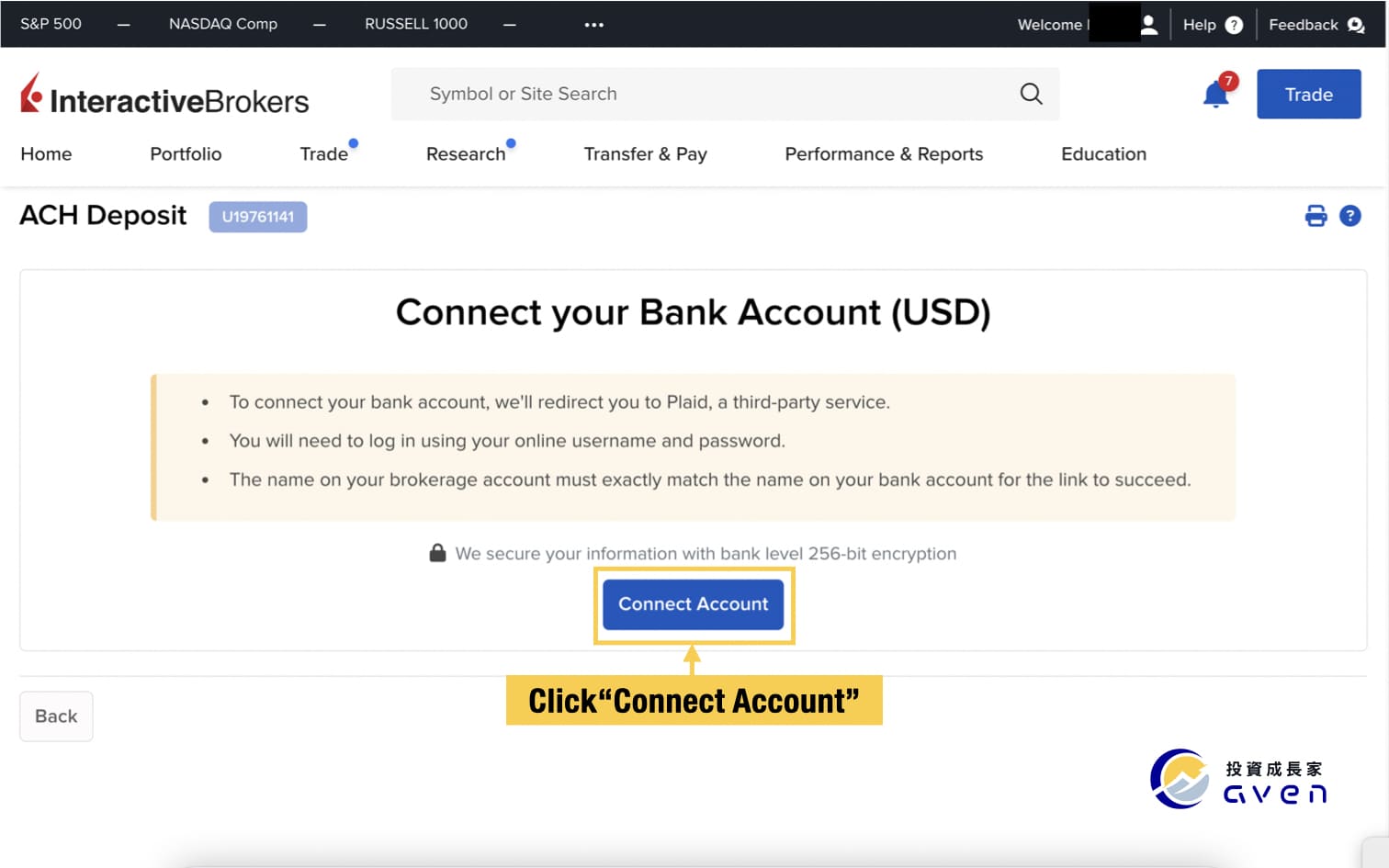

Now you can connect your US bank account.

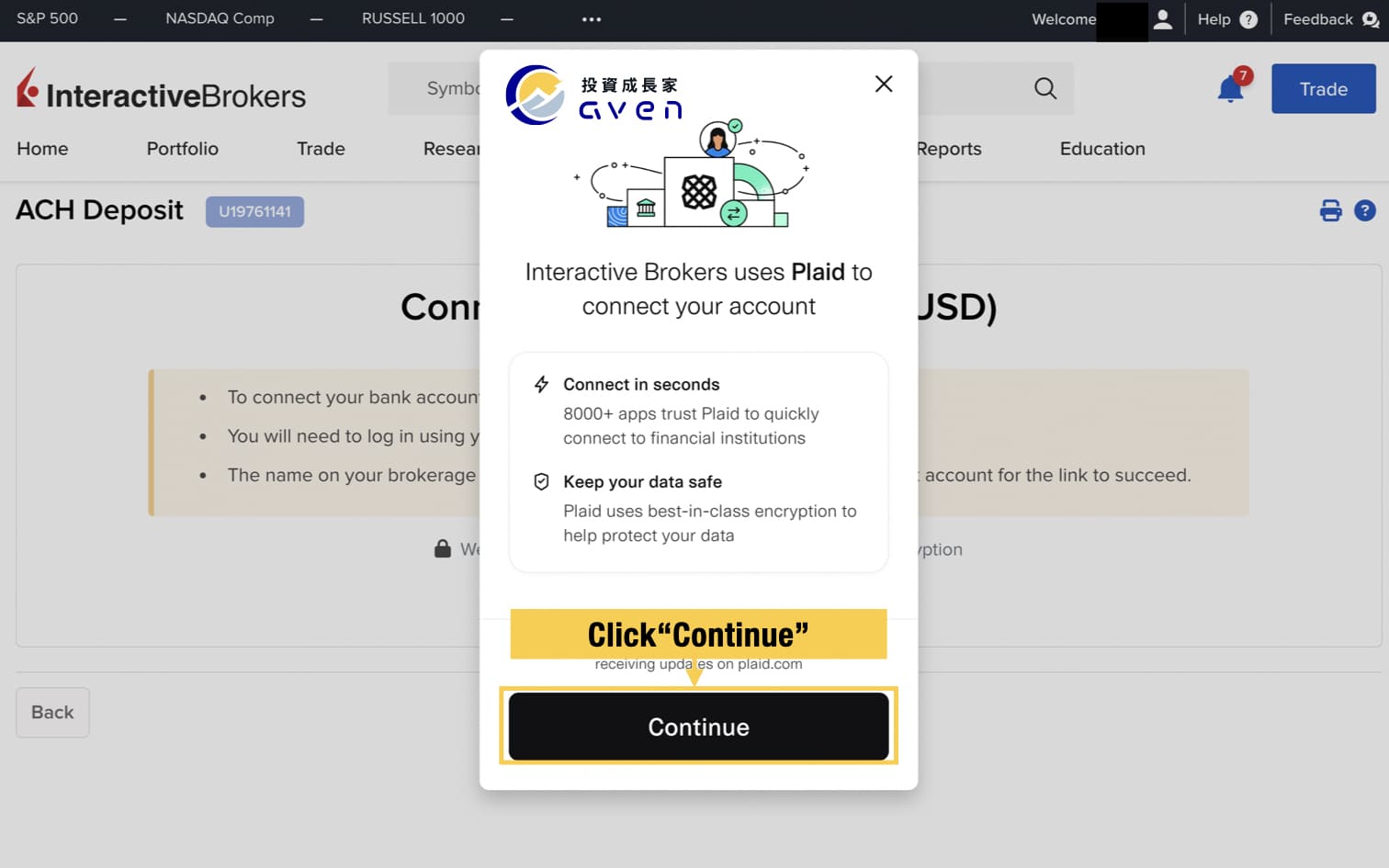

The IB will use Plaid to connect your account. Just follow the steps.

By the way, you don't need to sign up with Plaid; you can also use "continue as guest" to finalise the link between your US bank account and your IB account.

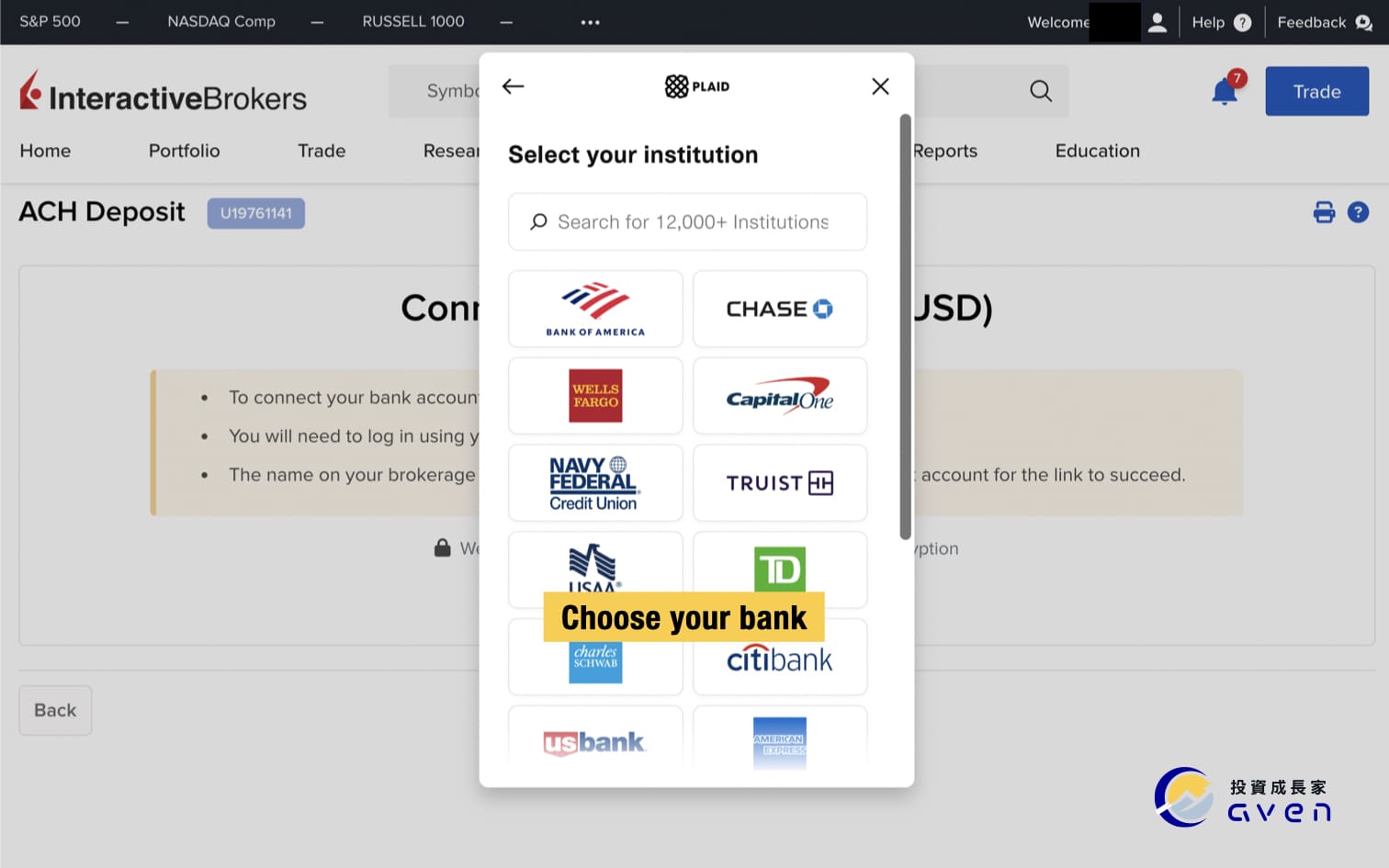

Now you can choose your bank. This tutorial will use Bank of America as the example bank for demonstrating.

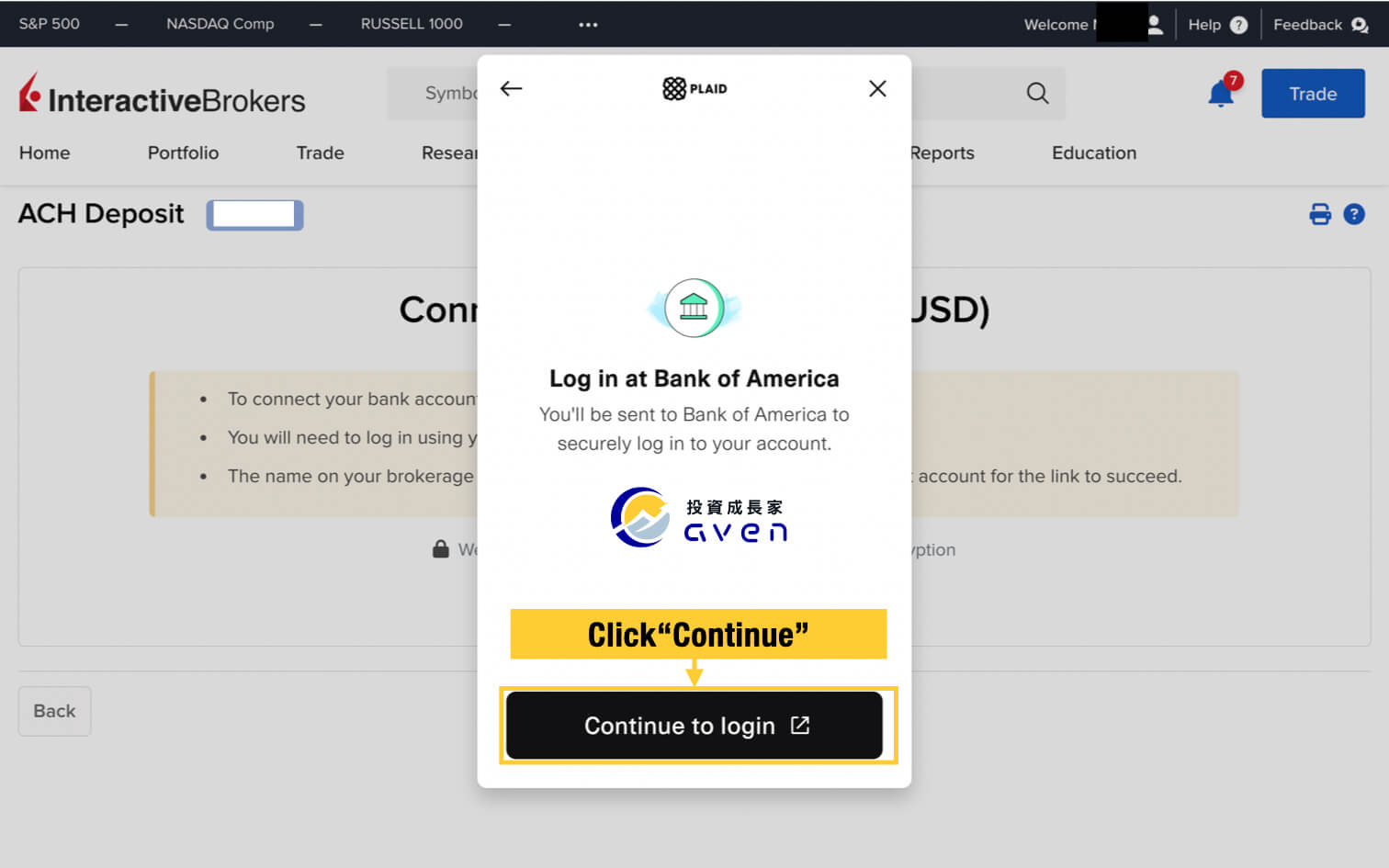

Plaid will lead you to your bank login page, just log in and click "Share my data".

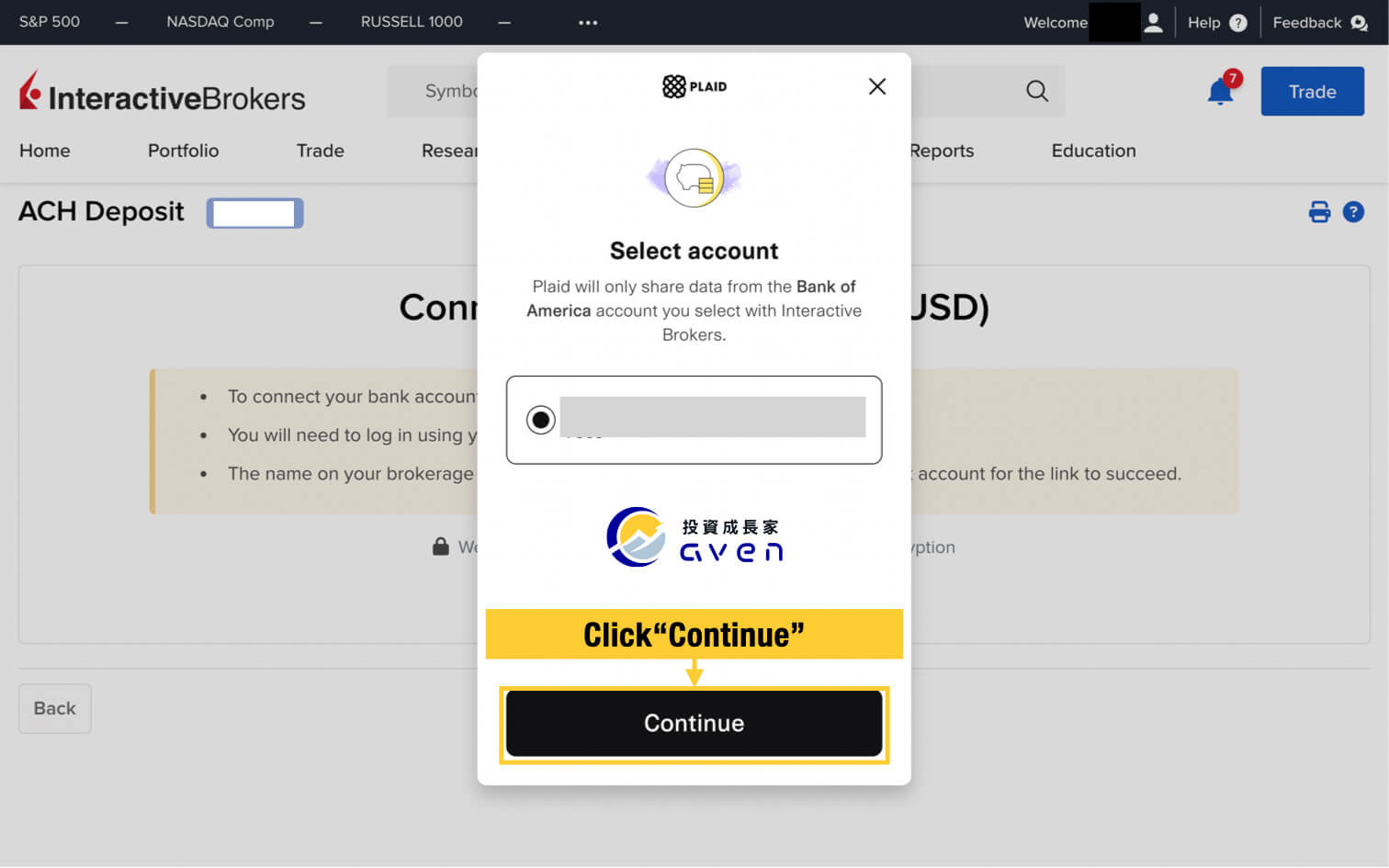

Then select your account and click "Continue" on Plaid.

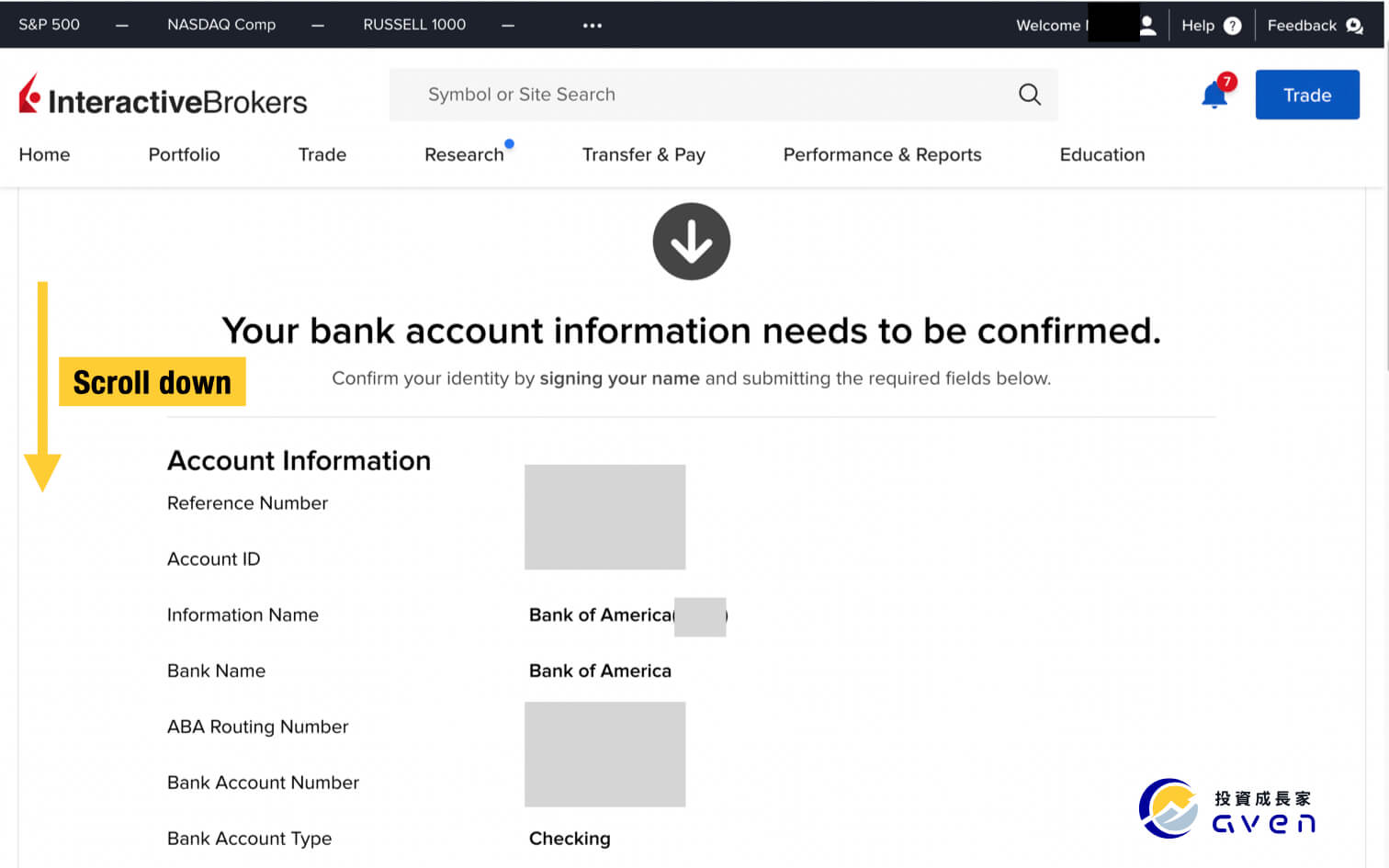

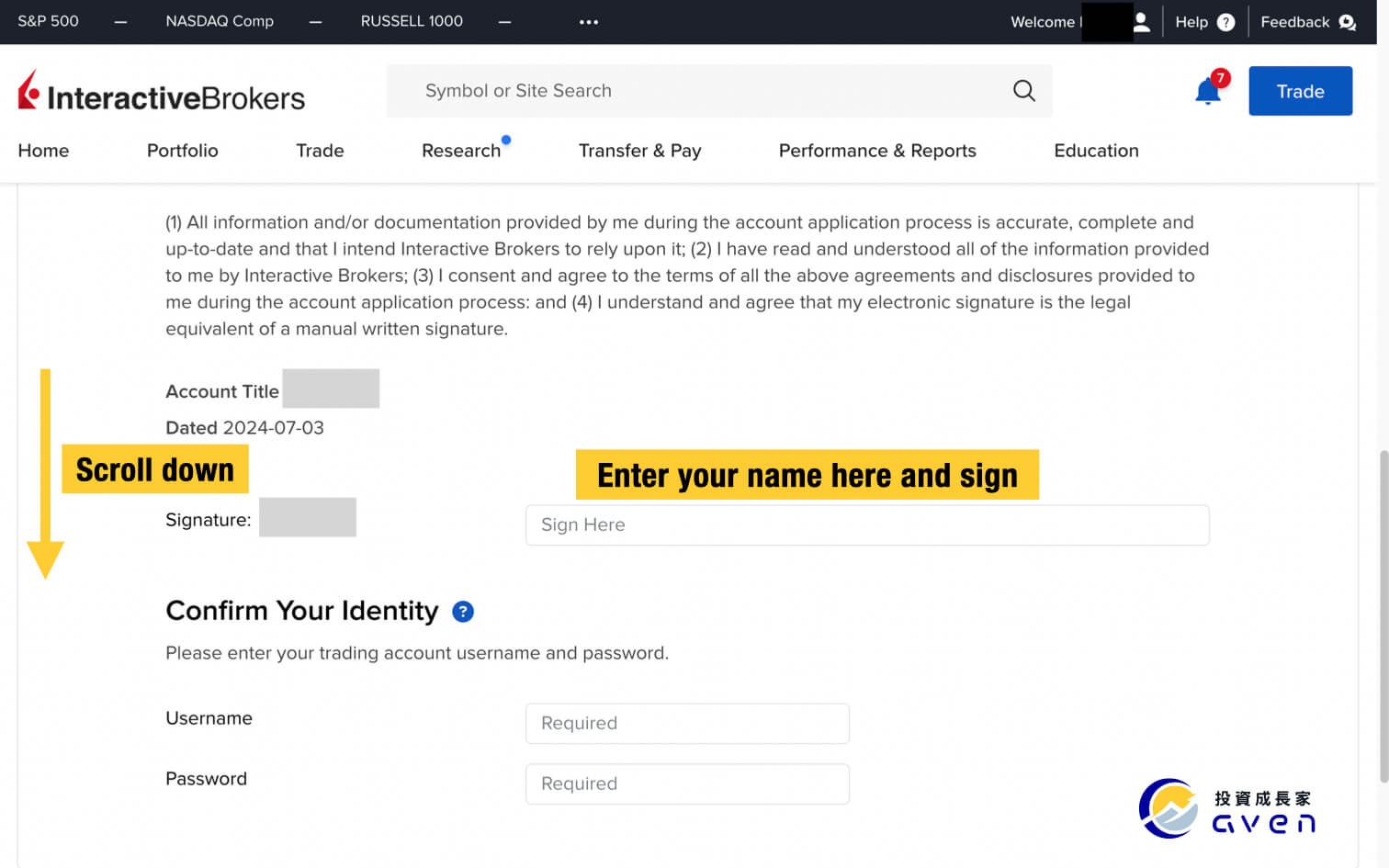

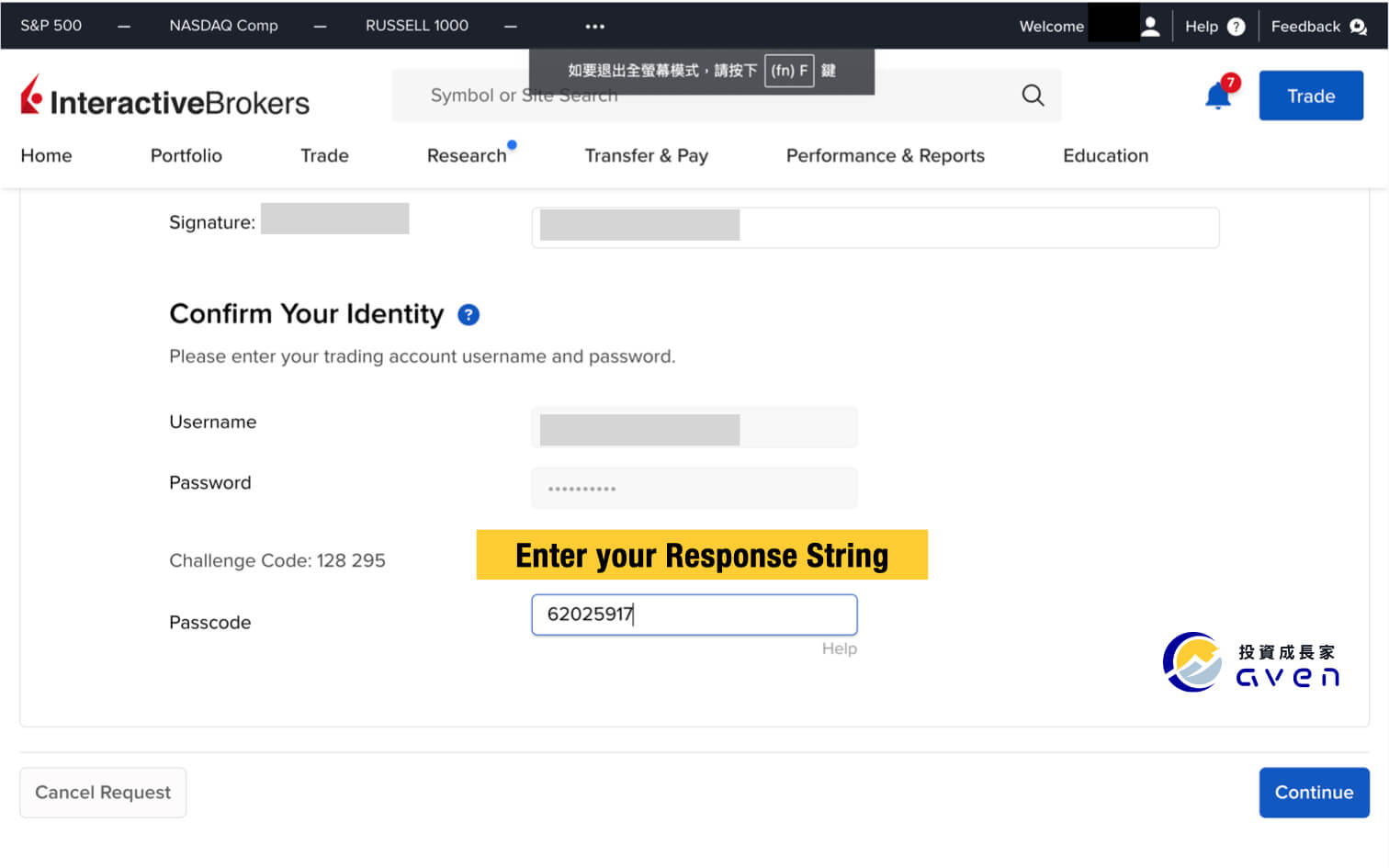

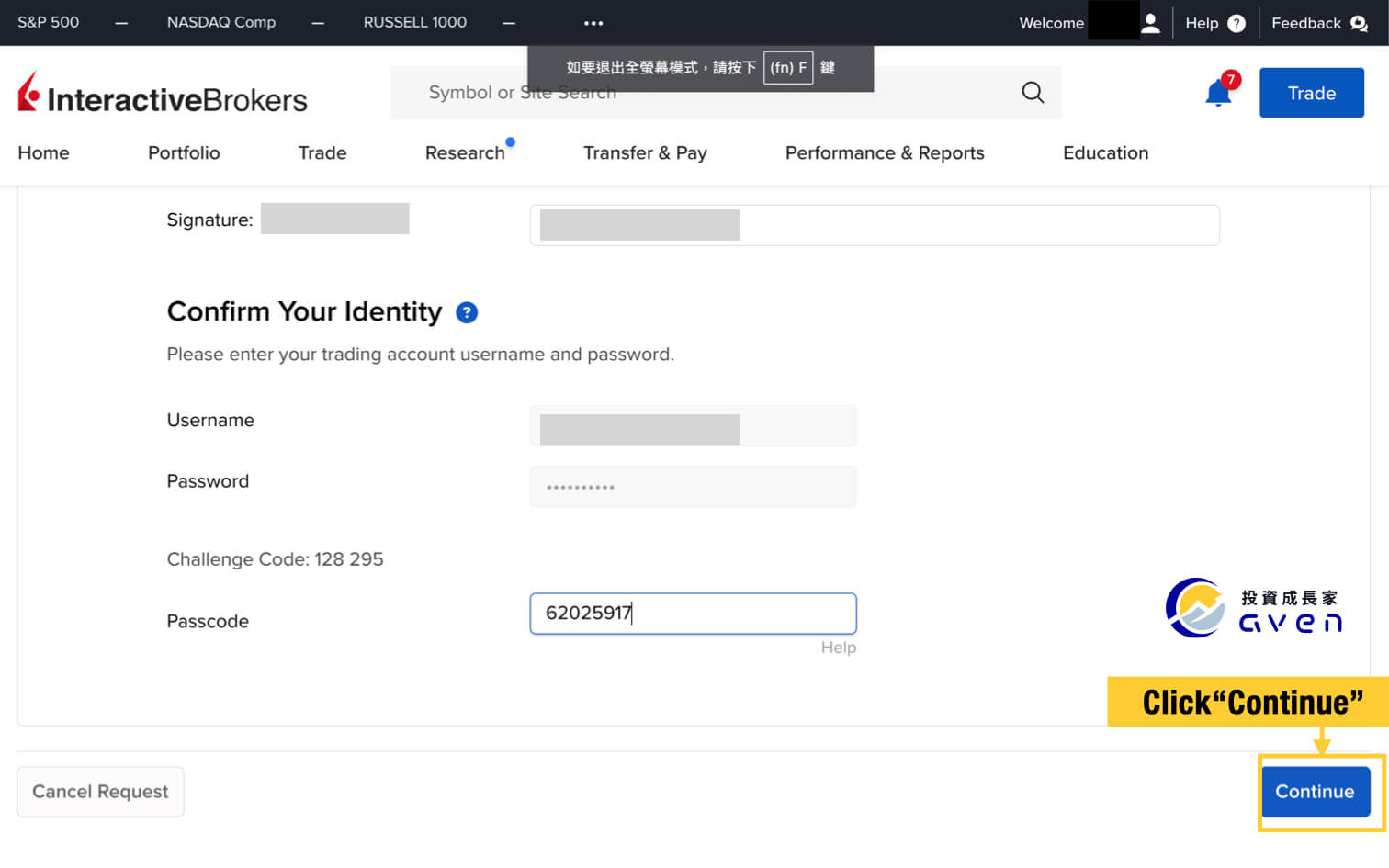

Now you need to confirm your bank information and finish the verification. You will need your smartphone at this step.

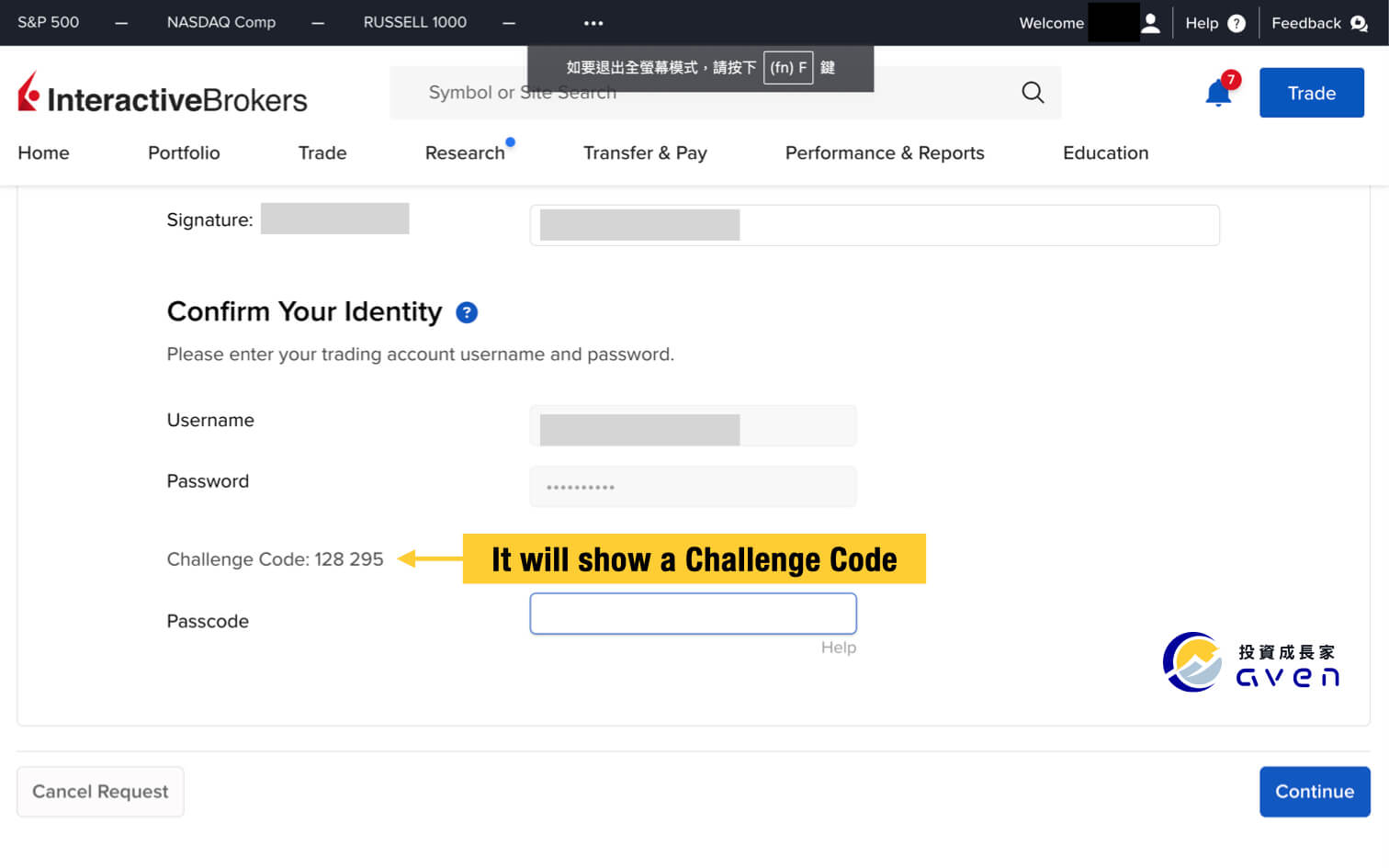

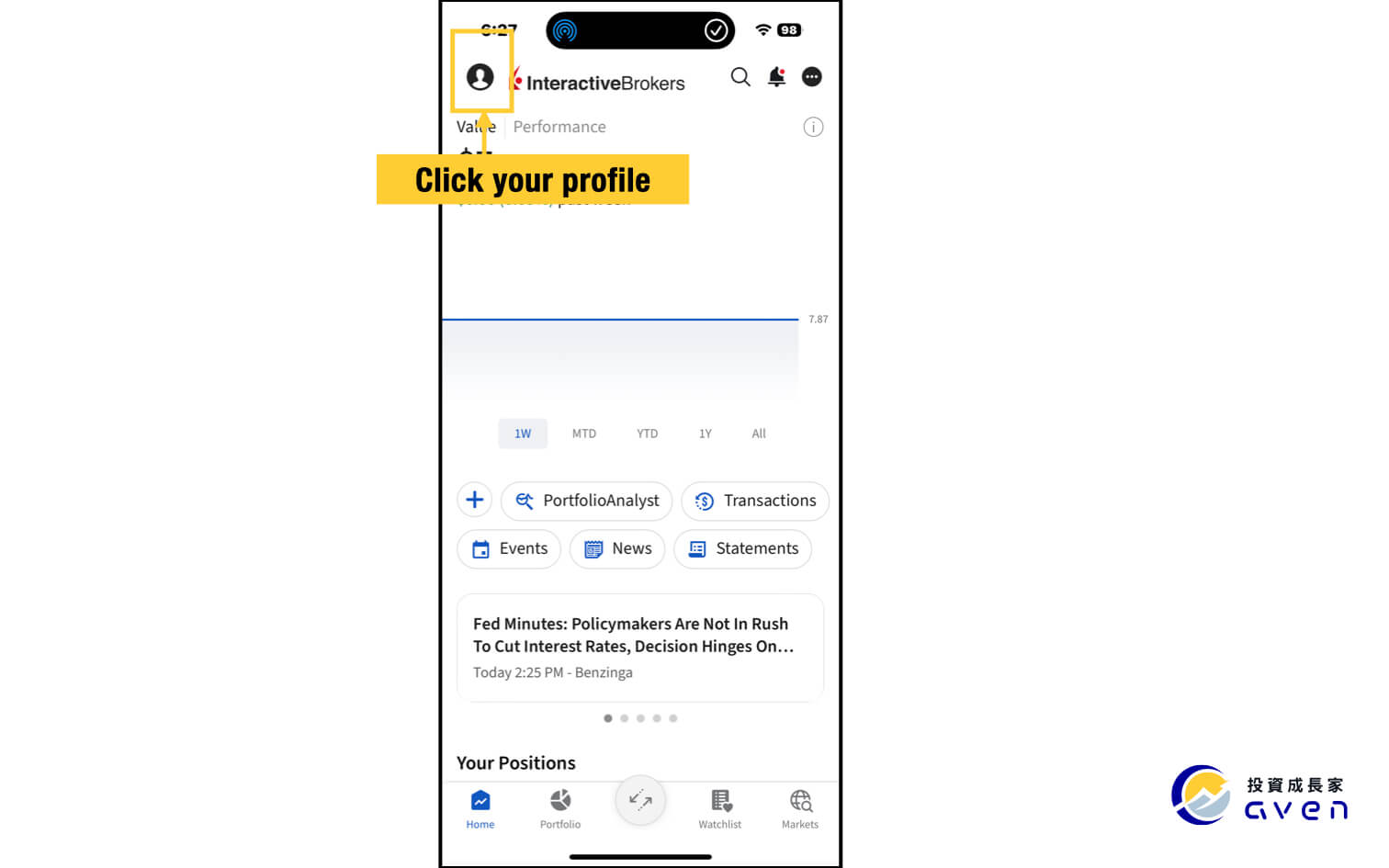

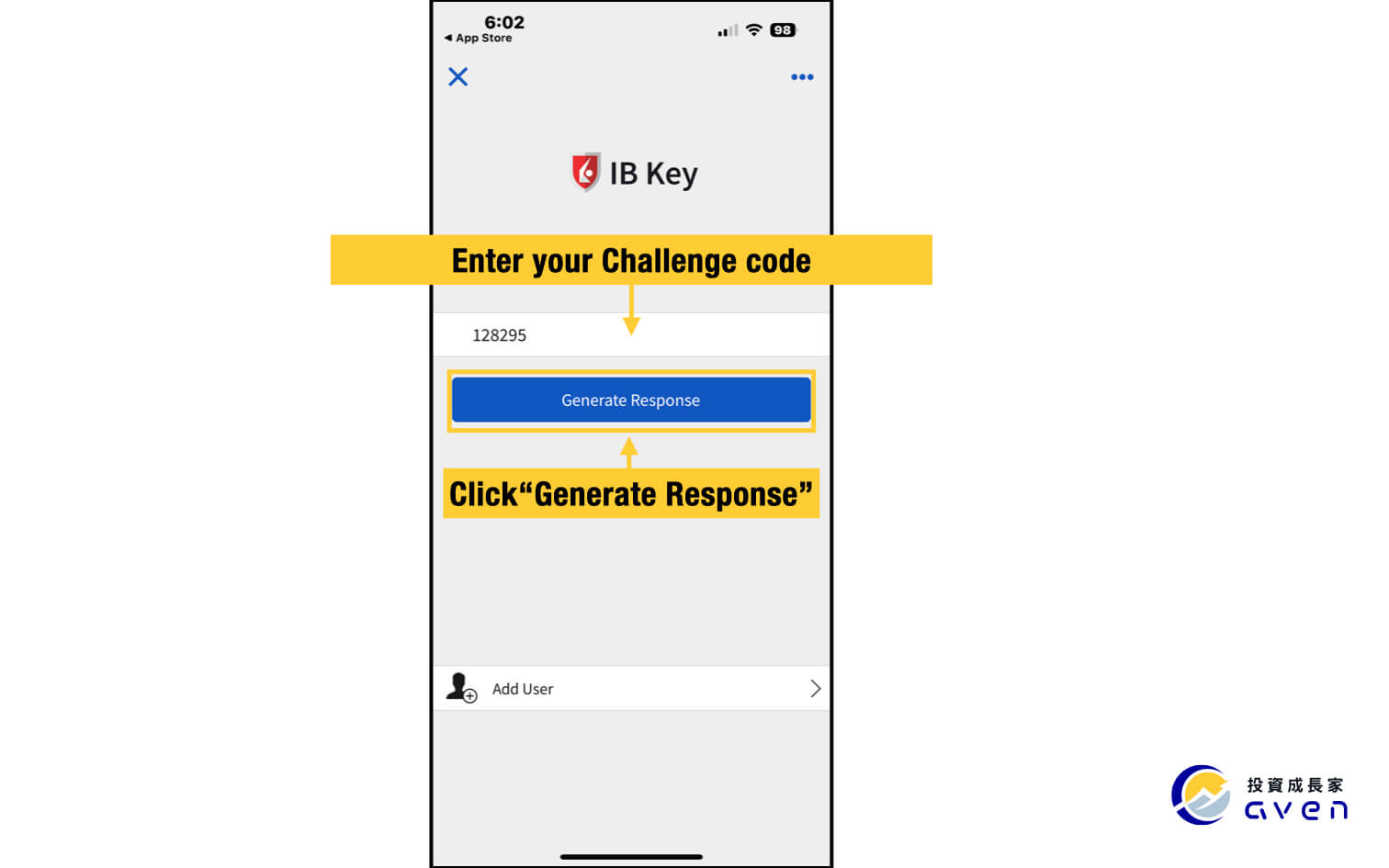

After you enter your IB Username and Password, it will show a Challenge Code. Now take out your smartphone, open your IB app, and click on your profile image.

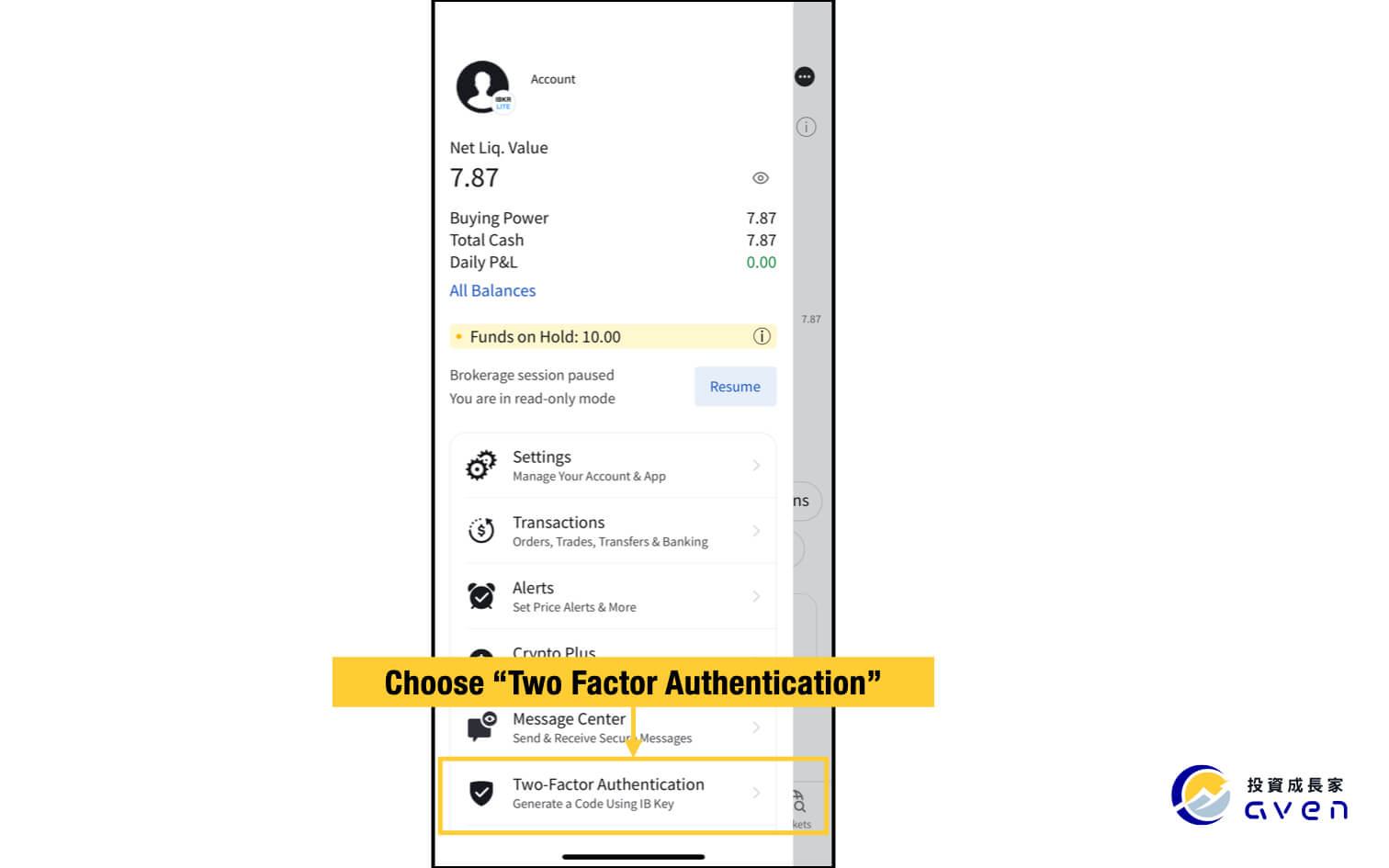

Choose "Two Factor Authentication".

Enter your Challenge Code and get your Response String code.

Go back to your website and enter your Response String code.

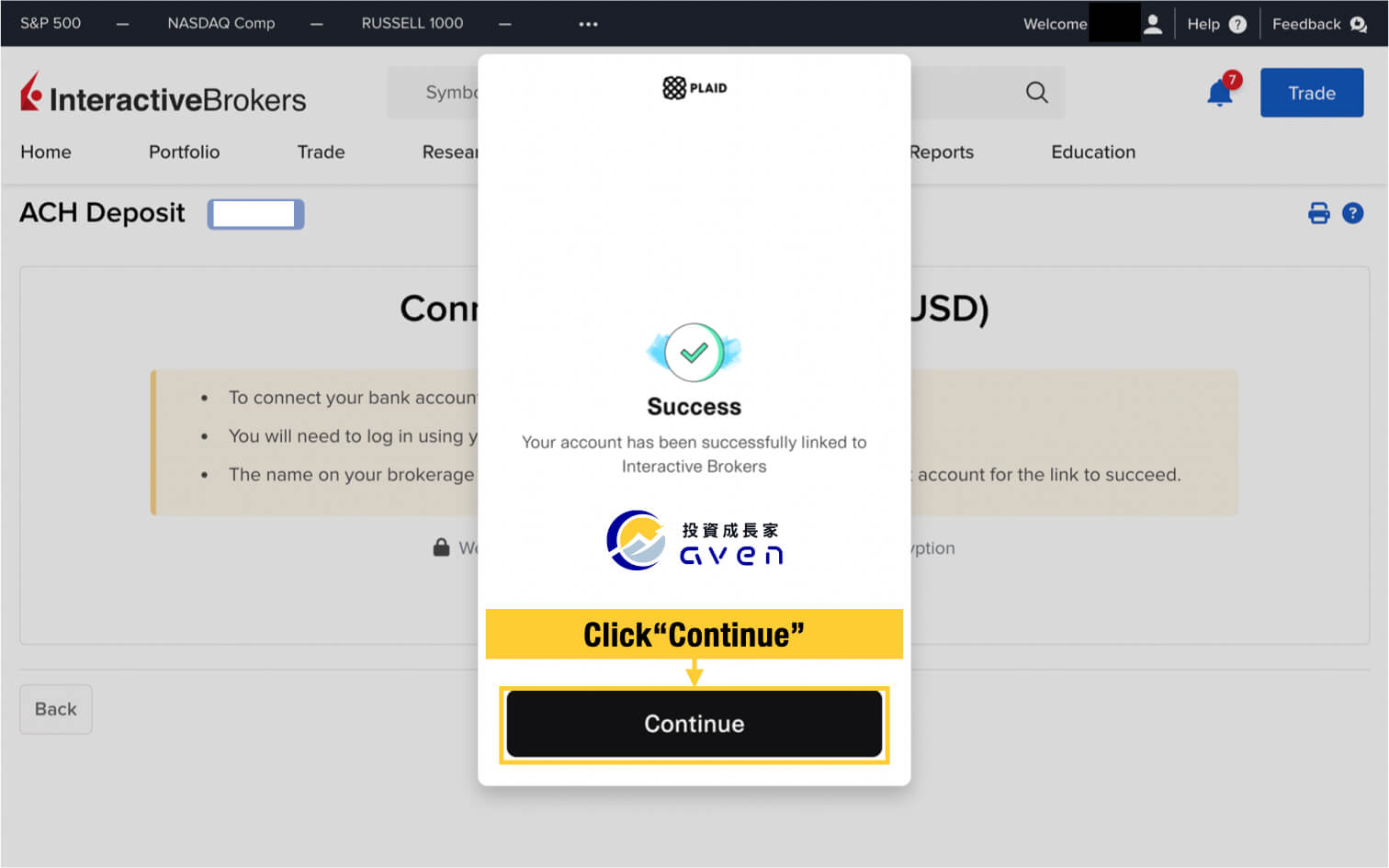

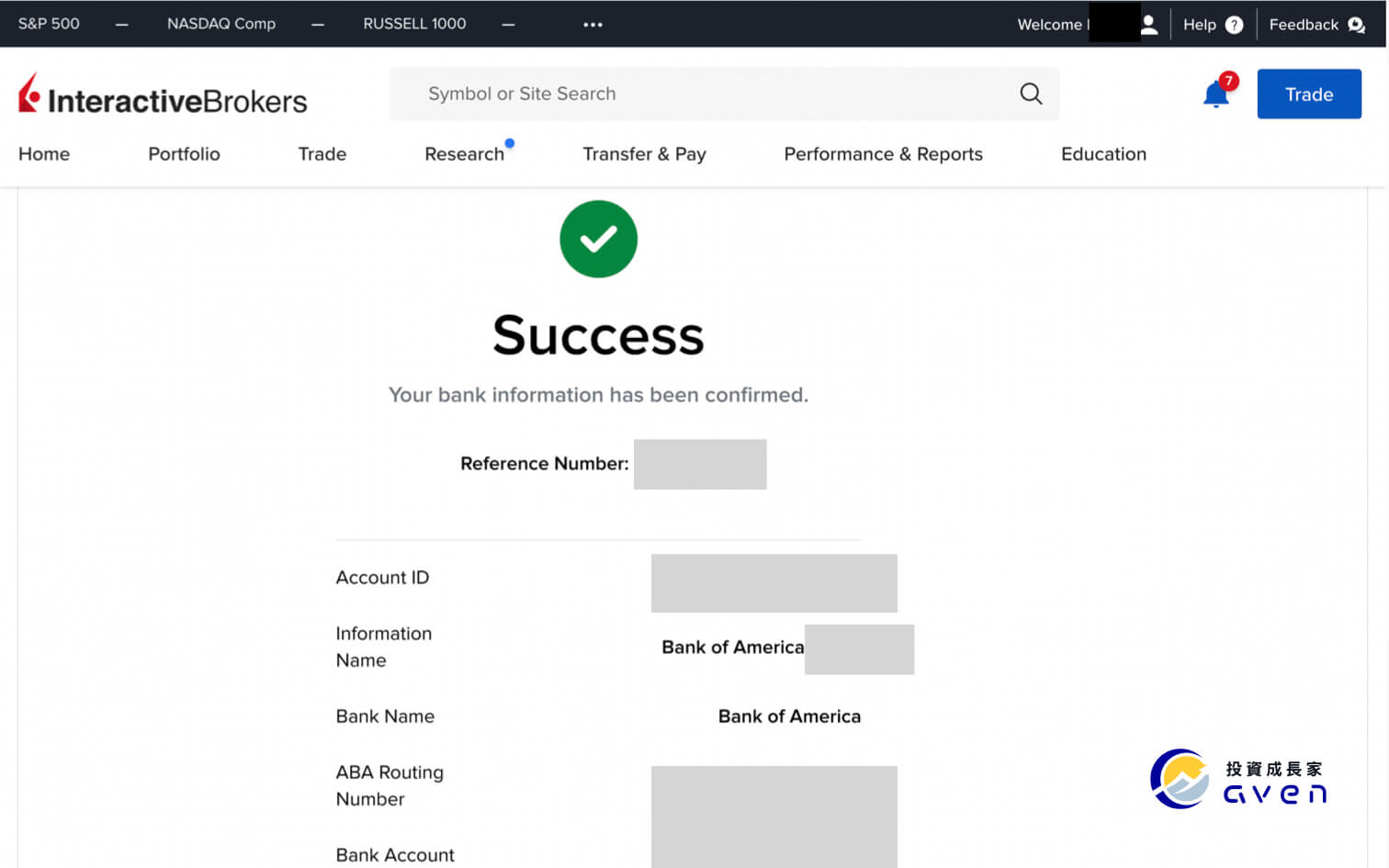

Now your account has been linked to your IB account successfully!

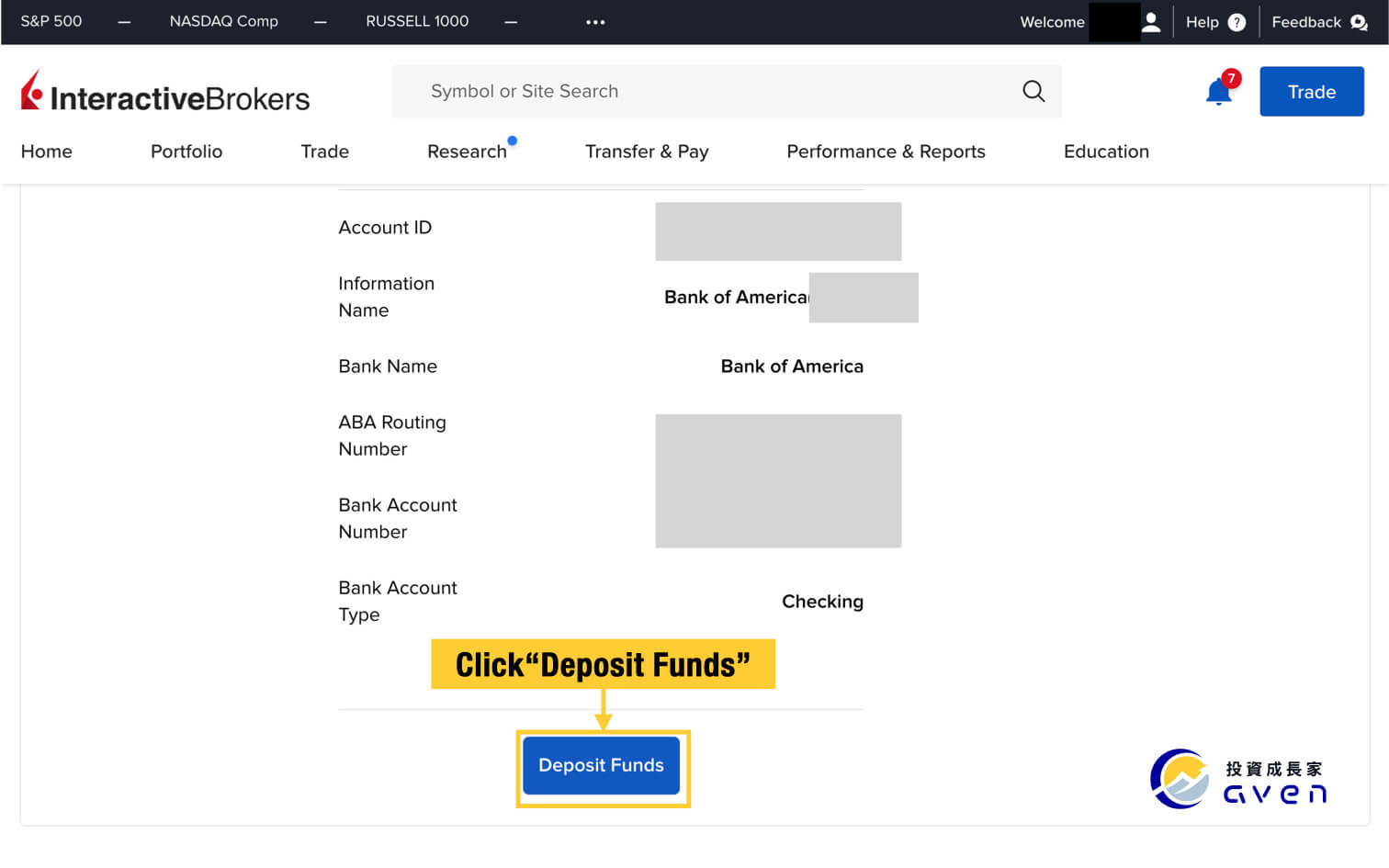

Scroll down and you can click "Deposit Funds" to start funding your IB account.

Step 3: Fund your IB account through your US bank account

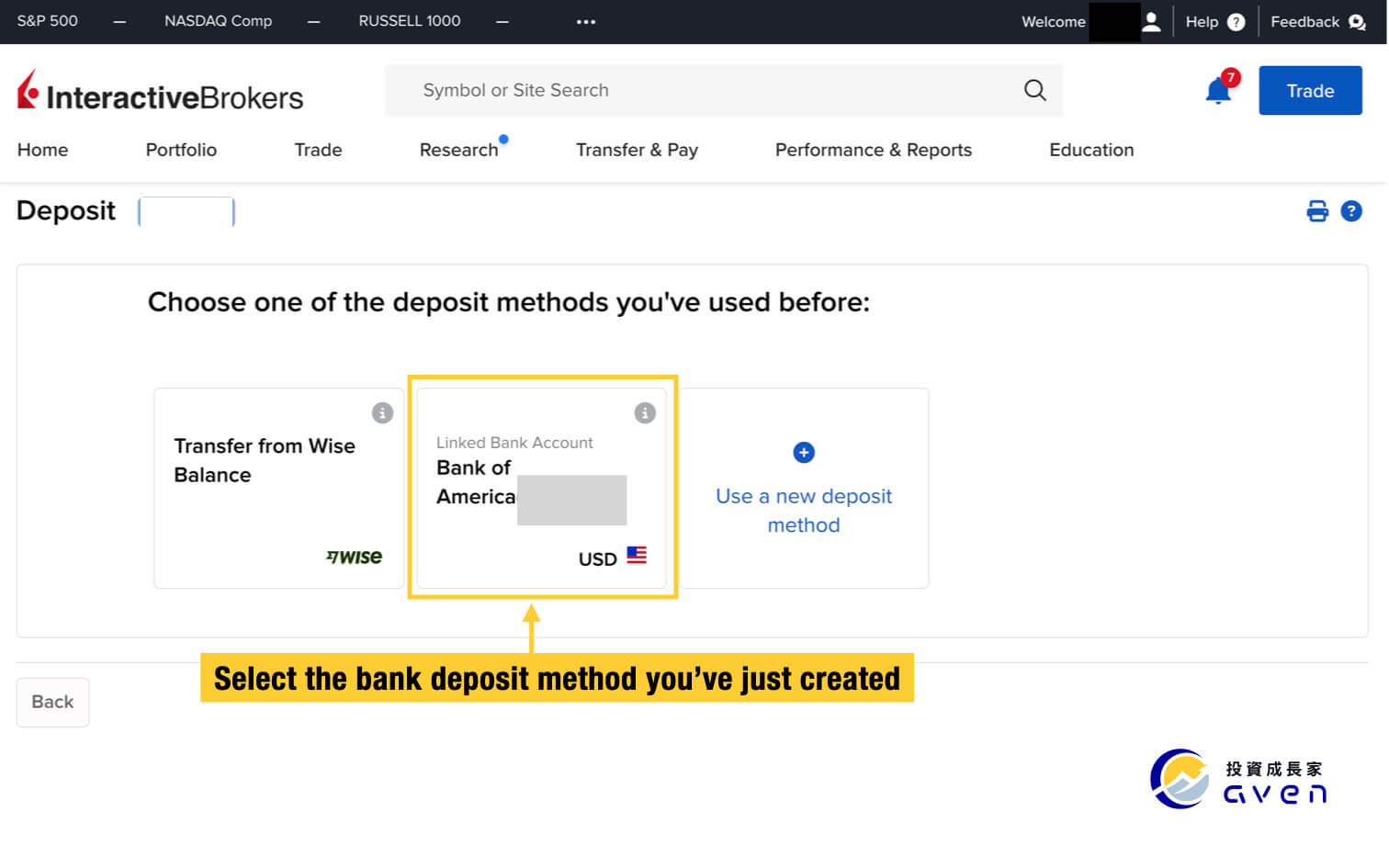

Now you can use your bank account to fund your IB account. You can also choose to log into your IB account and click Transfer & Pay -> Deposit Funds. If you've successfully connected your US bank account, you will see it in your deposit method. Now you can select it.

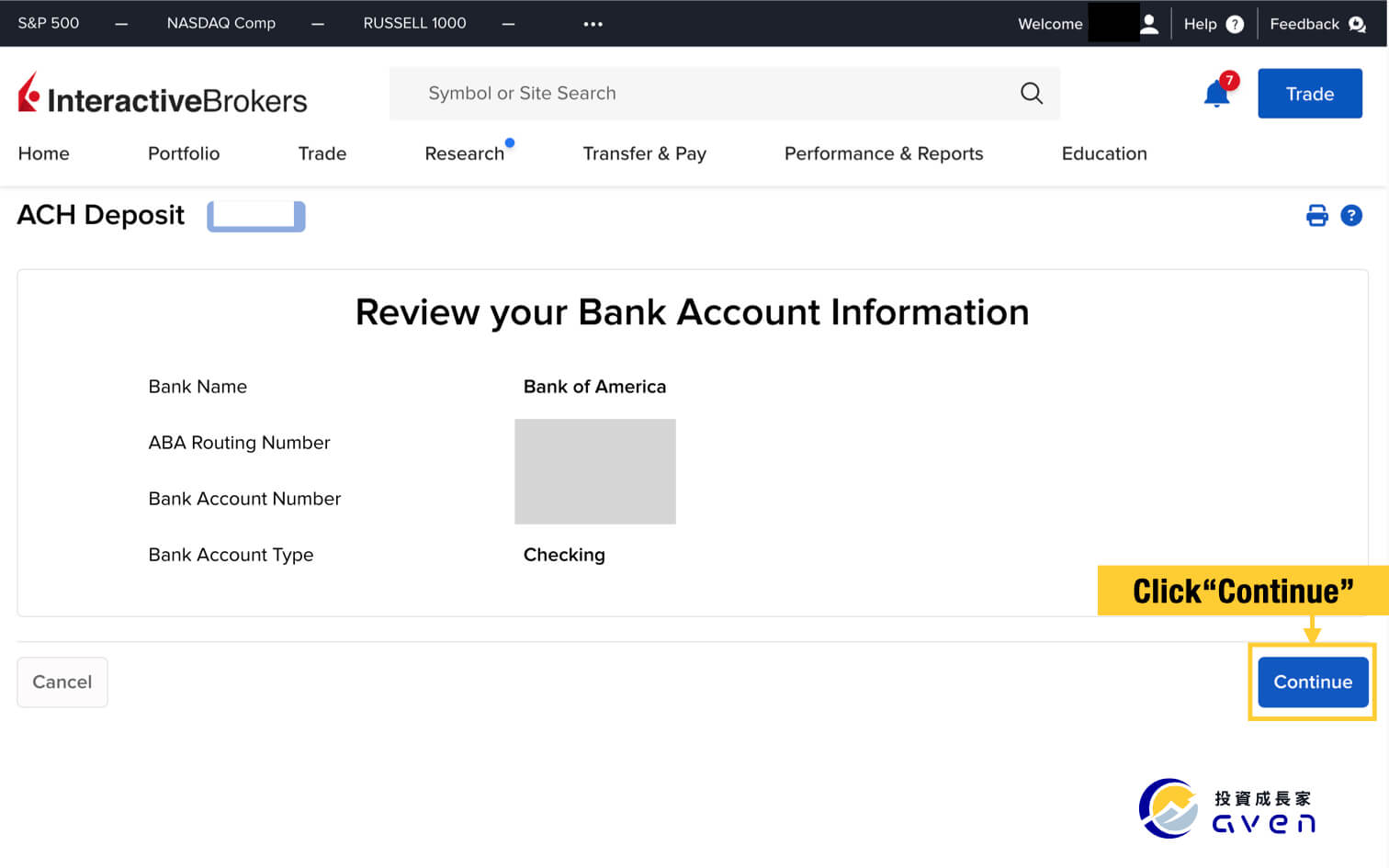

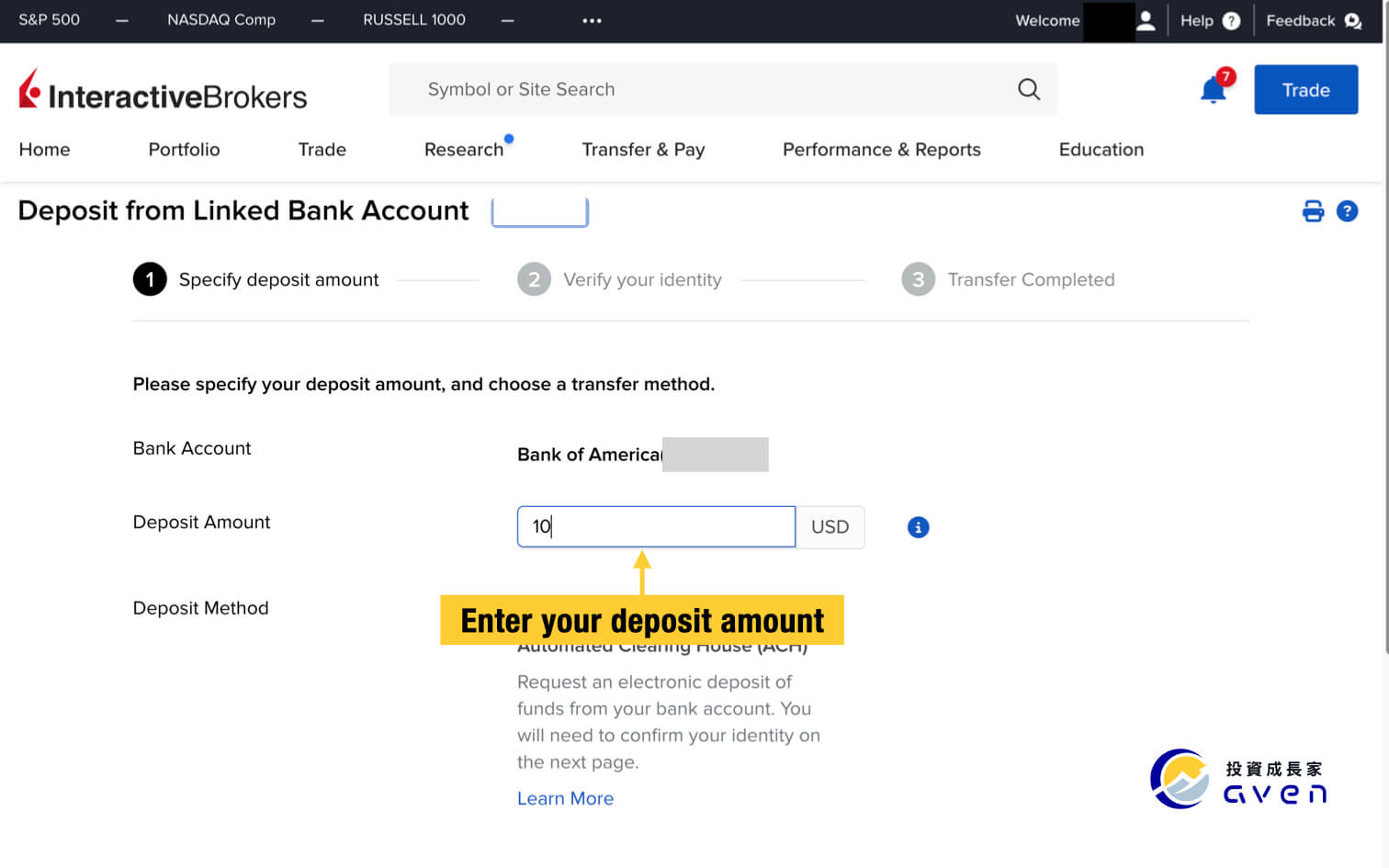

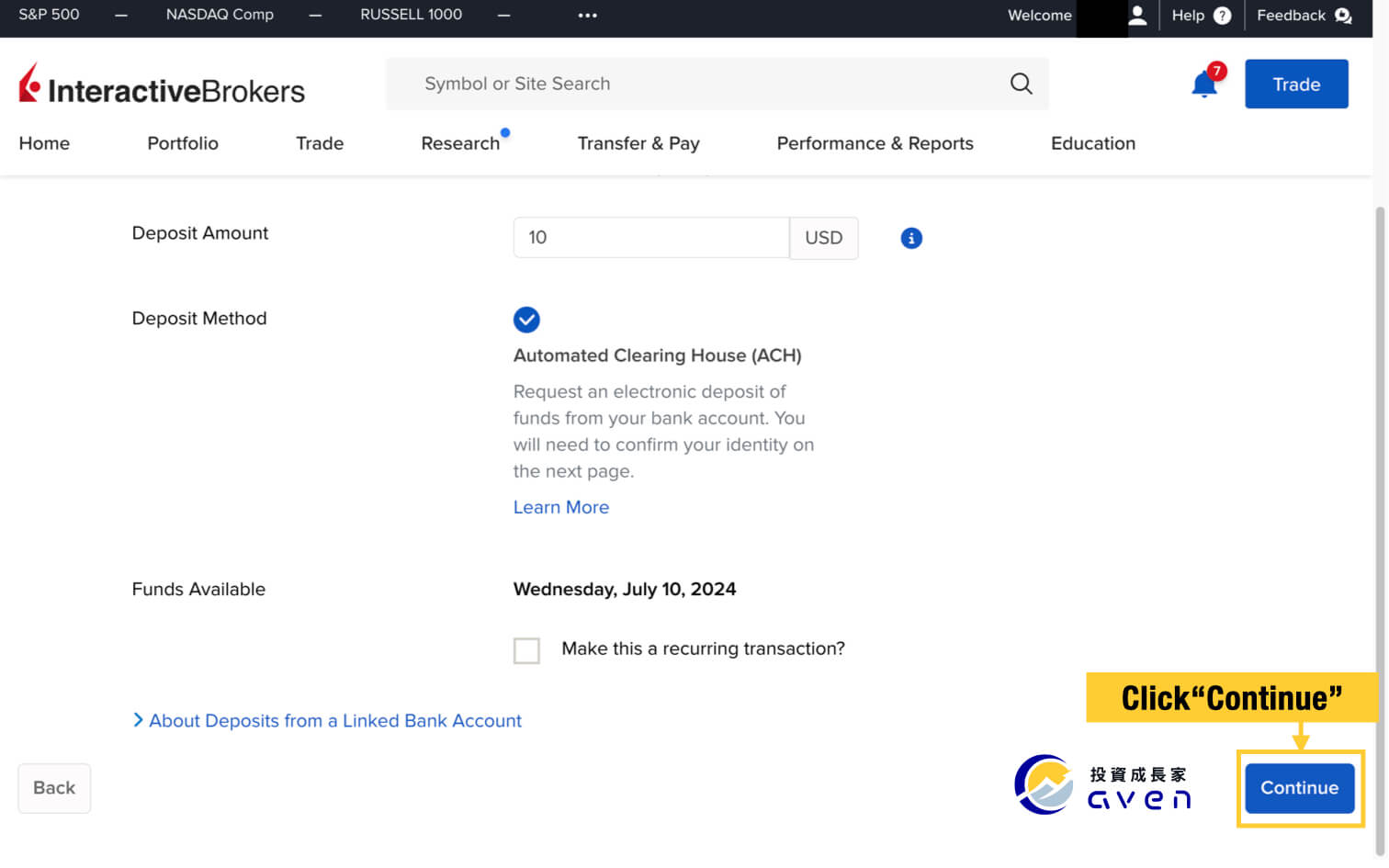

Enter your deposit amount and click "Continue".

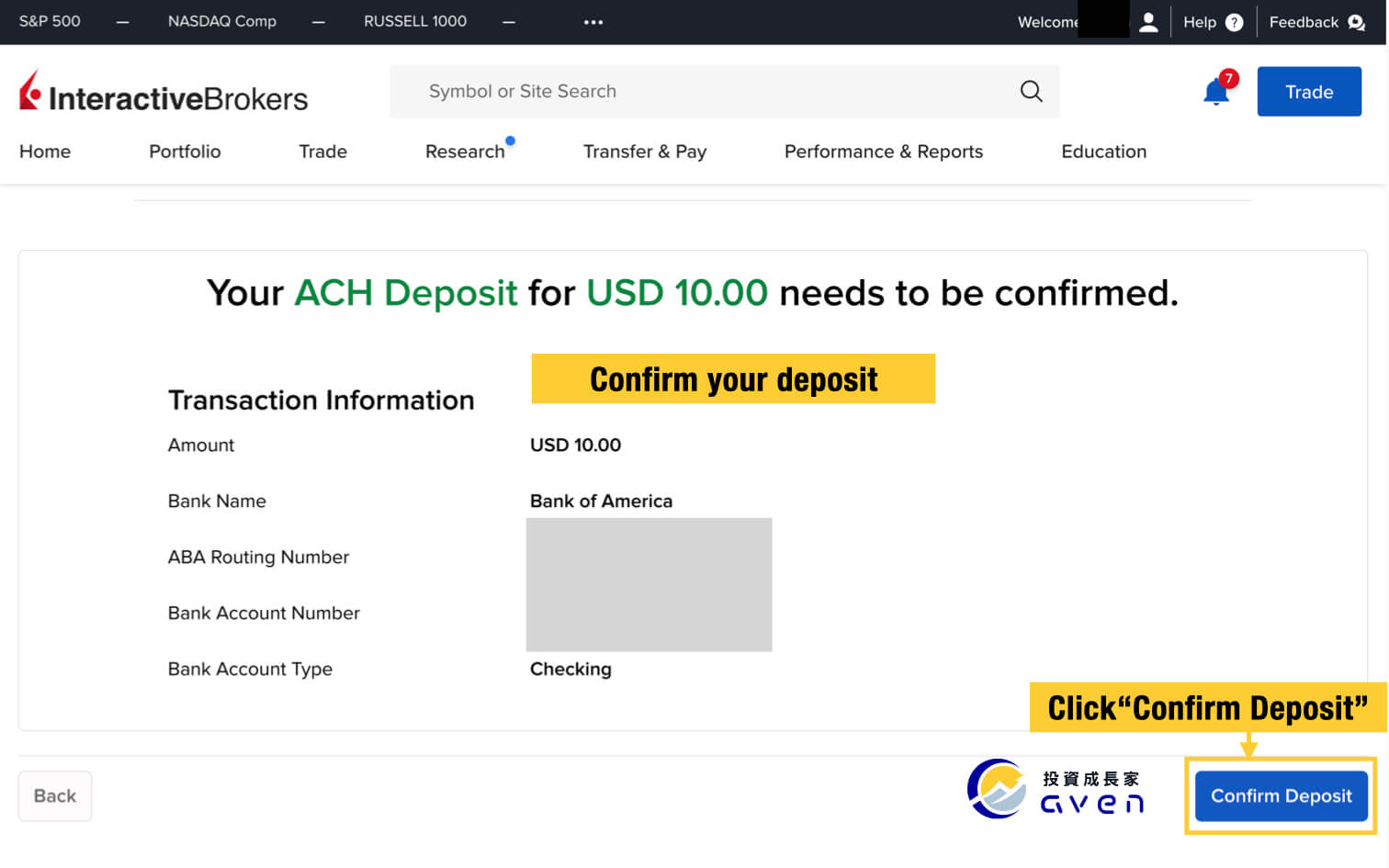

Confirm your deposit and click the button.

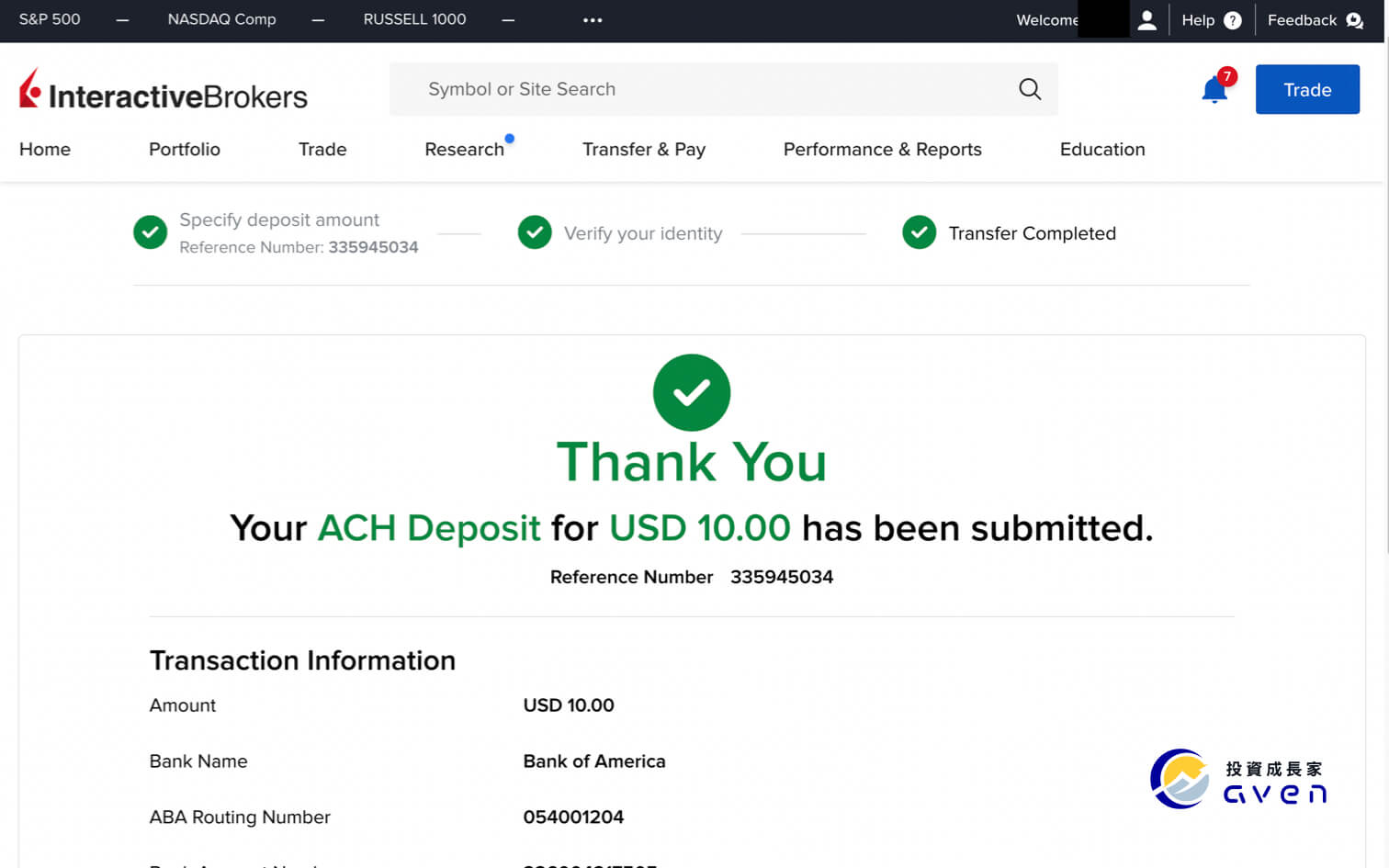

After you see this message, it means you have successfully funded your IB account through your US bank account. Without any transaction fee.

Step 4: Check your Transaction Status & History

After you deposit your IB account, you can click "Transfer & Pay" -> "Transaction Status & History" to check your deposit.

.jpeg)