- Home page

- Broker Recommendations

- How to withdraw money from Interactive Brokers?

How to withdraw money from Interactive Brokers?

目錄

What is withdrawing money from your Interactive Brokers account?

When you invest and make some money, the first question will be: how can I get this money back? Withdrawing money from your Interactive Brokers (IB) account refers to the process of transferring funds from your IB account to your personal bank account.

Then you can spend it happily! If you want to deposit funds into IB at a low cost, refer to another IB deposit tutorial.

Interactive Brokers do offer diverse withdrawal methods, depending on your location and the available options.

Later, we will give you a detailed step-by-step guide and tutorial for the top three most used IBRK account withdrawal methods: Bank wire/Transfer to Wise Balance/Connect Your Bank via ACH.

Notice:

Interactive Brokers offers one free withdrawal per month. Even if you make multiple withdrawal requests, the withdrawal fee is only $10 each time. (Excluding intermediary bank fees).

In other words, as long as you make no more than one withdrawal per month, the IB withdrawal fee will be 0$.

The speed of IB withdrawal is very fast, as long as you follow my instructions below. If you apply for IB withdrawal on working days, then you will receive the money within 12hrs.

Interactive Brokers can also set scheduled withdrawal times, which is very convenient for busy individuals.

Does Interactive Brokers have a minimum withdrawal limit?

Speaking of account withdrawal limits, Interactive Brokers has different limitations based on the authentication method used.

For example, if you use SMS authentication, you can withdraw up to USD 200,000 per day, while with IB Key authentication, you can withdraw up to USD 1,000,000 per day. These limits are generally sufficient for most users.

However, if you want to know more, you can visit their website for additional information.

What is the most low-cost Way to withdraw money from Interactive Brokers?

Interactive Brokers provides a flexible and low-cost way to withdraw your money from your IB account. When making an Interactive Brokers withdrawal, you can choose from various withdrawal methods. You can check their website for more information.

Now, I will explain the differences between the withdrawal methods.

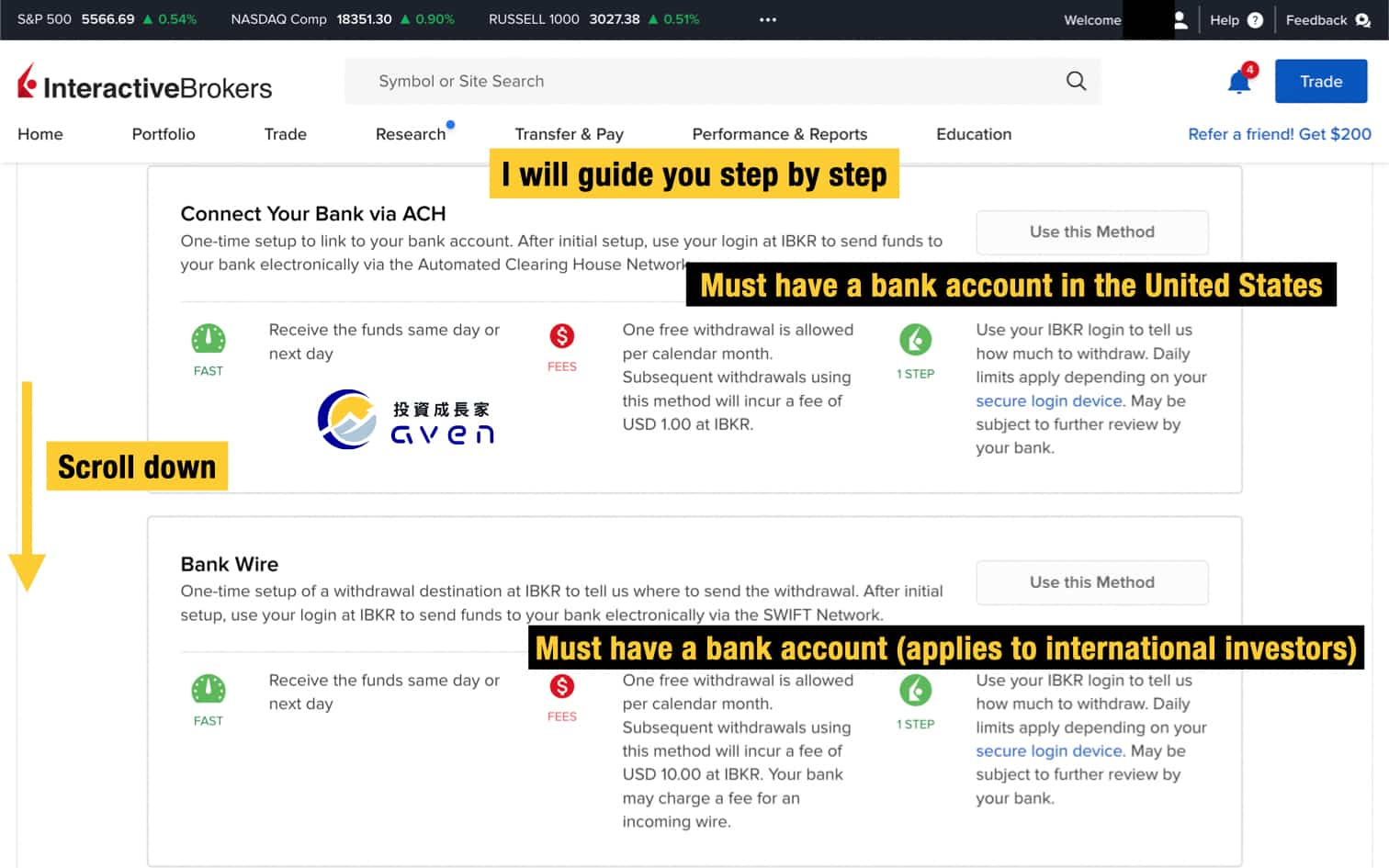

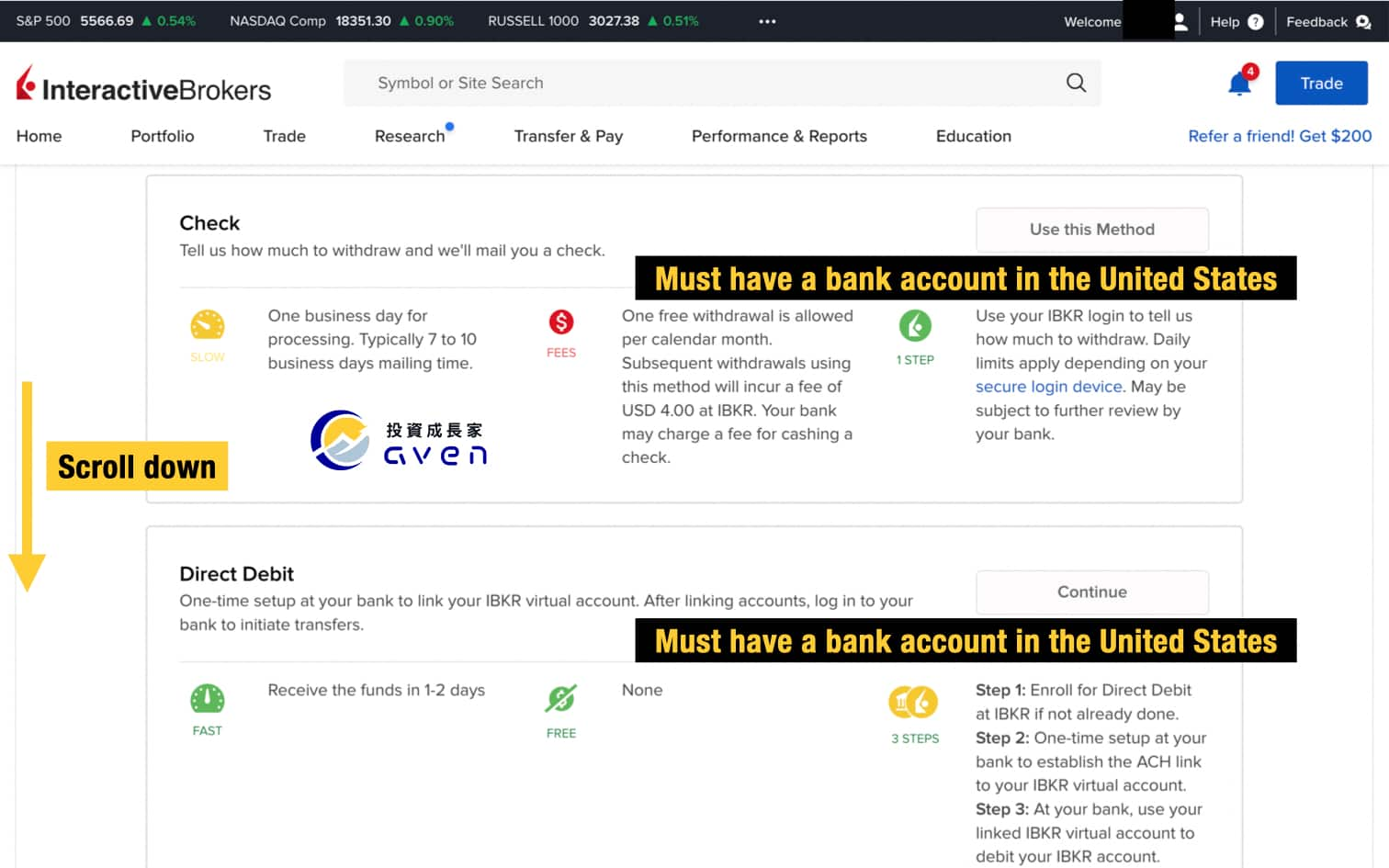

Withdrawal Methods Explained

1. Connect Your Bank via ACH or Direct Debit

- Requirement: Must have a United States bank account.

- Details: This method is suitable for users with U.S. bank accounts, offering a convenient way to transfer funds directly to your bank with no transaction fee.

2. Bank Wire

- Availability: Available to all investors worldwide.

- Details: This option allows for international transfers, making it accessible regardless of your location. Receive the funds the same day or the next day.

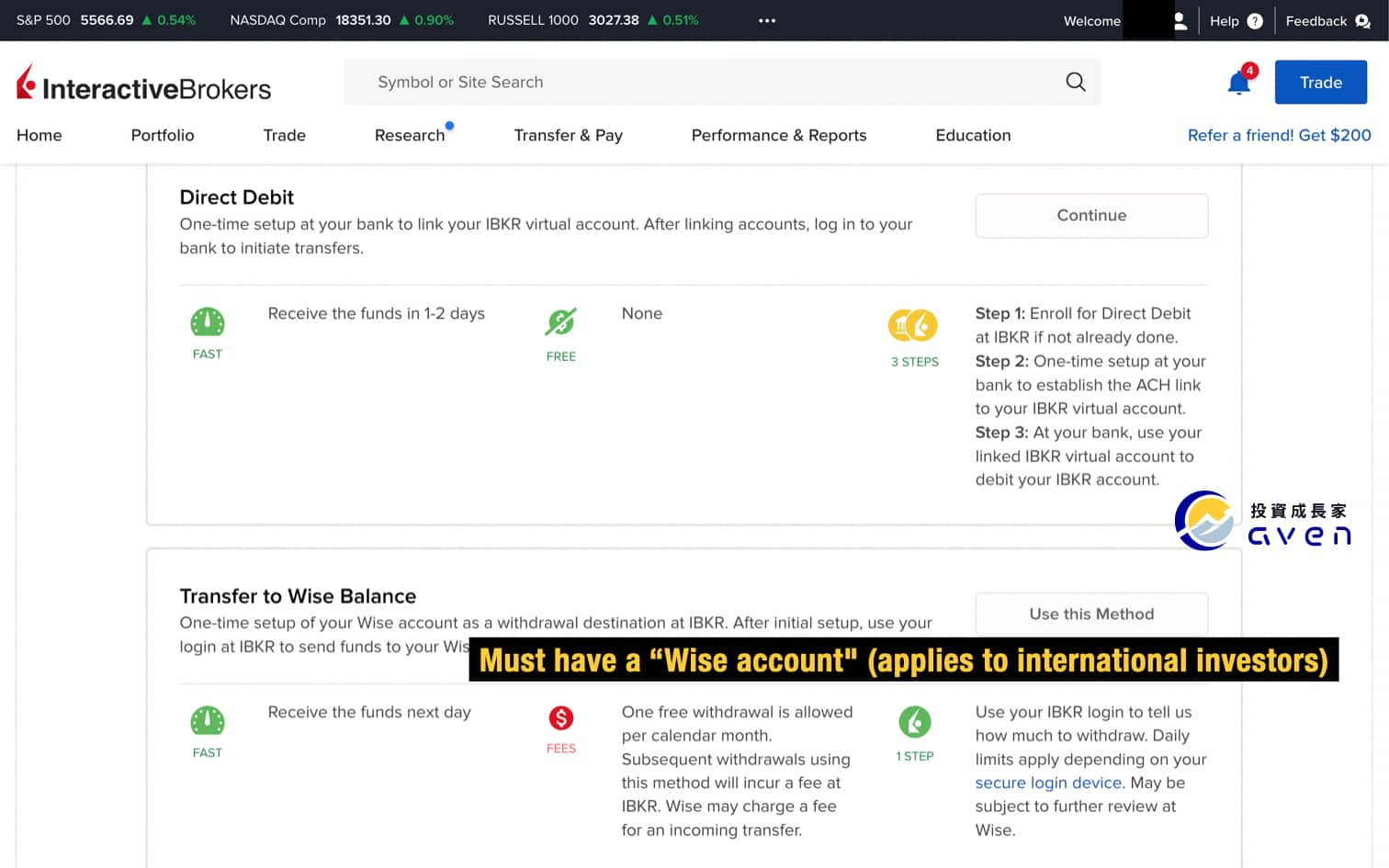

3. Transfer to Wise Balance

- Requirement: Requires a Wise account.

- Details: Ideal for international investors, this method enables transferring funds to your Wise account for further management.

4. Traditional Check

- Requirement: Can only be processed in USD and requires a U.S. address.

- Details: You can request your withdrawal amount from IB, and they will mail you a check. This is a more traditional method, suitable for those who prefer physical checks.

|

Withdrawal Methods |

Requirement |

|

Connect Your Bank via ACH Direct Debit |

Must have a United States band account. |

|

Bank Wire |

For internatioal investors |

|

Transfer to Wise Balance |

For international investors (who have Wire accounts) |

|

Traditional Check |

Must have a United States bank account. |

The most recommended funding methods are Bank wire, Transfer to Wise Balance and Connect Your Bank via ACH. We will give you a step-by-step guide and tutorial on these three funding methods.

|

Deposit Method |

Transaction Fee |

Processing Time |

Applied to |

|

Bank Wire |

Depends on the bank |

A few days |

International Investors |

|

Transfer to Wise Balance |

Depends on the Wise |

Immediately |

International Investors who have a Wise account |

|

Connect Your Bank via ACH |

$0 |

Immediately |

U.S. bank account holders |

Withdraw money from your Interactive Brokers with Bank Wire Method

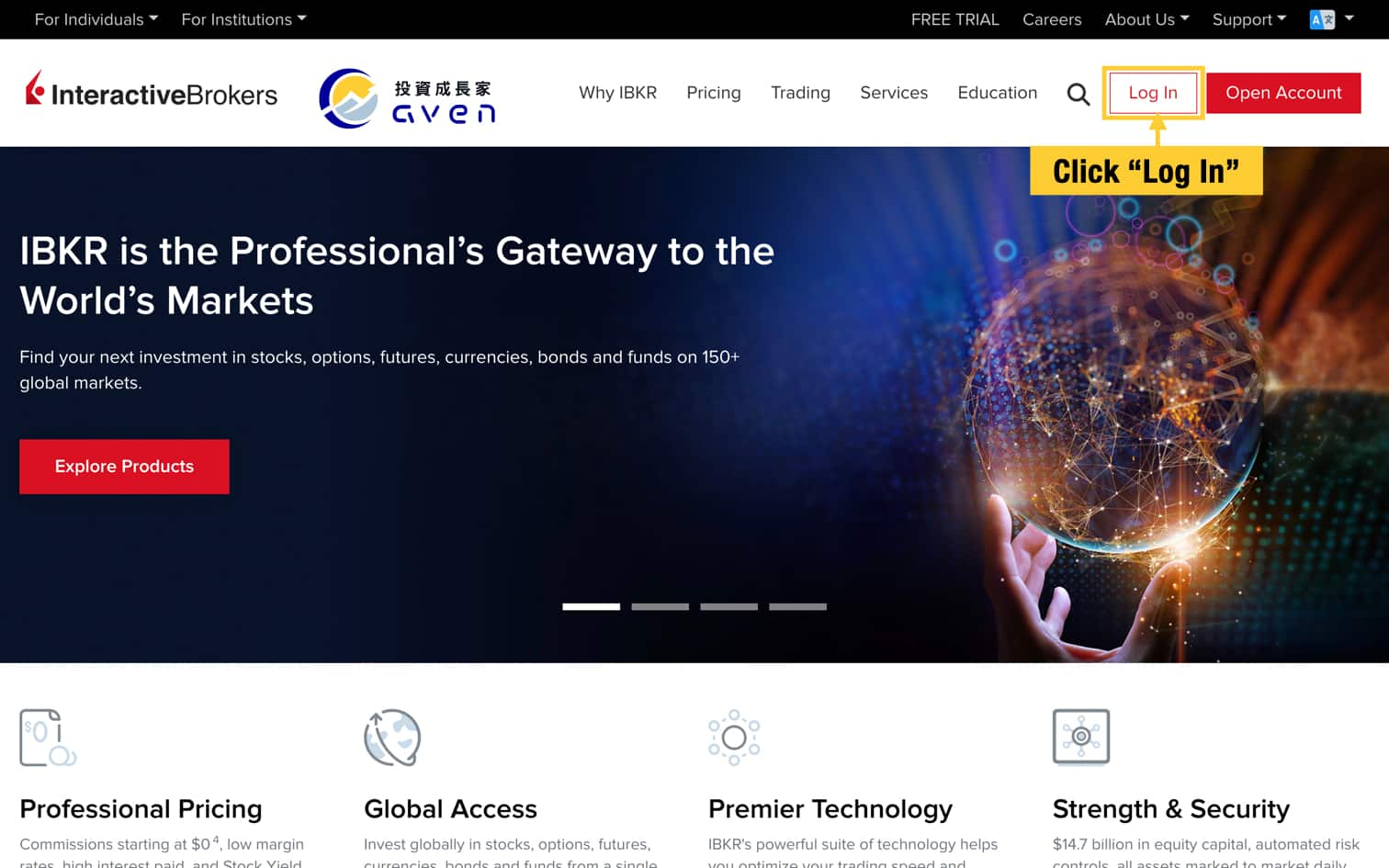

Step 1: Go to Interactive Brokers’ official website

Step 2: Log in to your account

Step 3: Choose your IBKR account withdrawal method

Step 4: Enter your Bank Wire withdrawal information

Step 5: Follow the Bank Wire Instructions to withdraw your money

Step 6: Check your Transaction Status & History

The most common method of depositing and withdrawing funds is to use Bank Wire. It is worth mentioning no matter which overseas brokerage it is, the logic of wire transfer is the same., so as long as you understand how to withdraw money at one brokerage, then wire transfer money from other brokerage firms can be solved easily.

This method can be applied by every overseas Interactive Brokers investor.

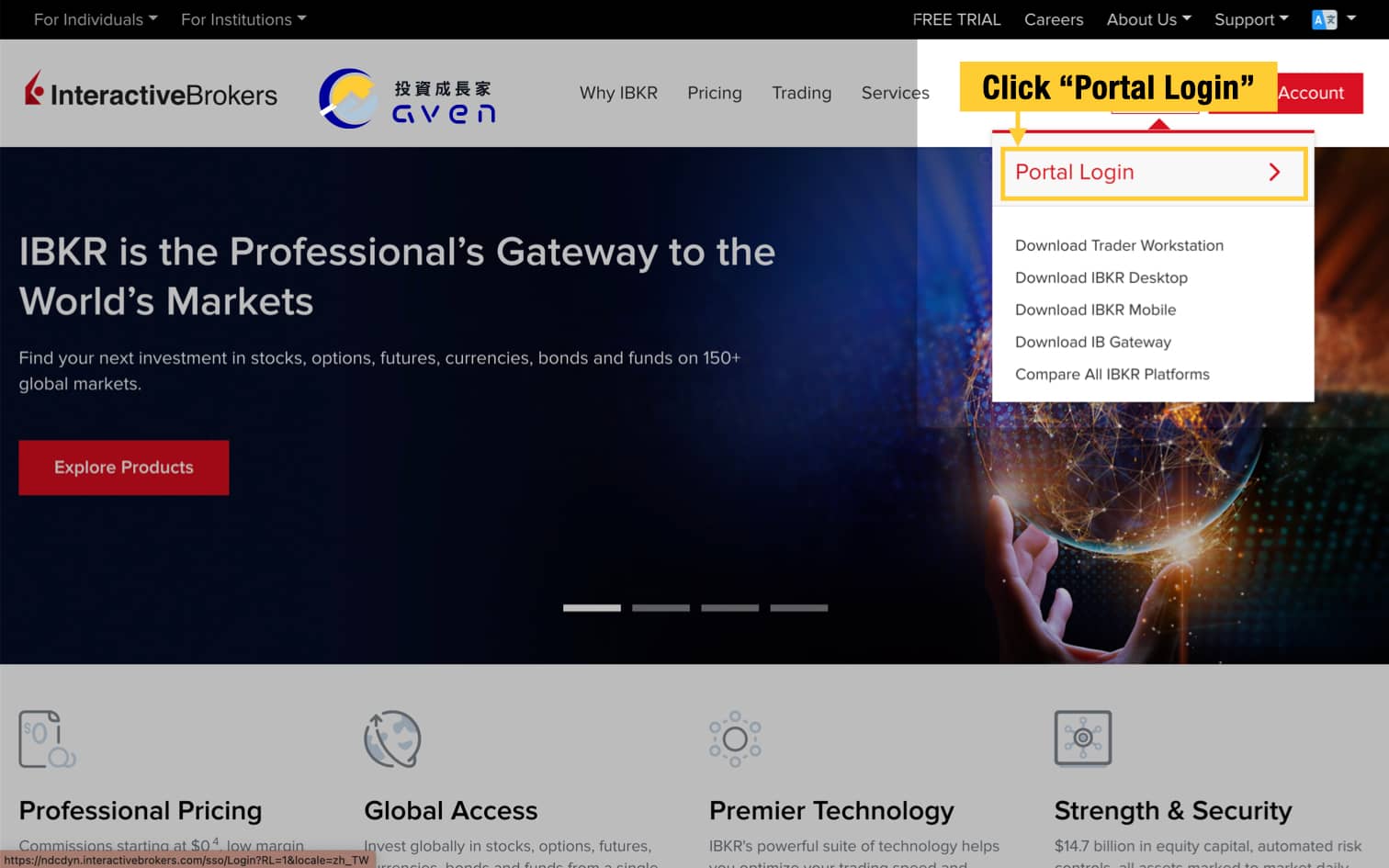

Step 1: Go to Interactive Brokers' official website

Click "Login"->Click "Portal Login:".

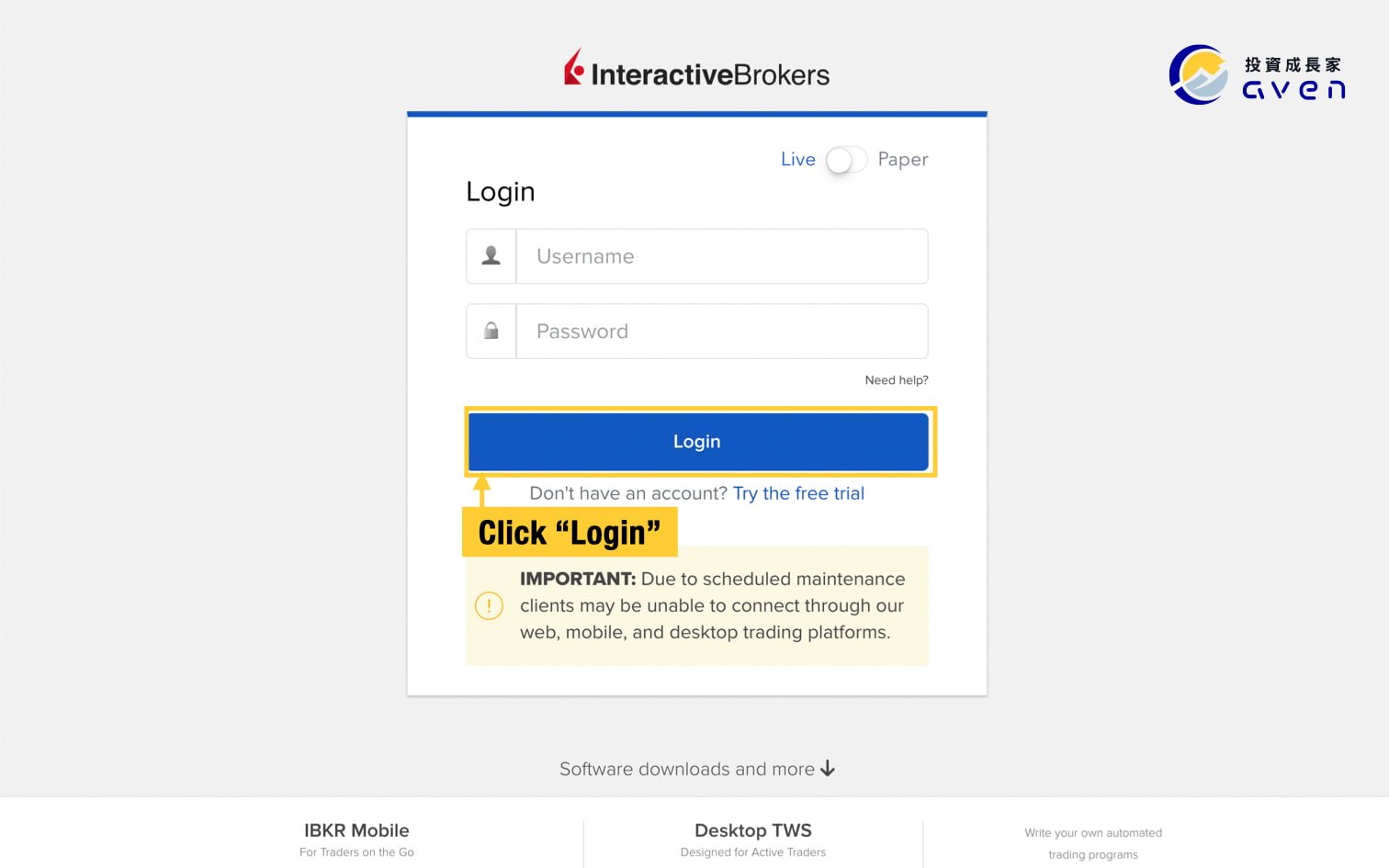

Step 2: Log in to your account

Enter your [Username] and [Password] here -> Click "Login".

When you log in, you'll need to verify through SMS or QR code scan. Just follow the instructions to complete it.

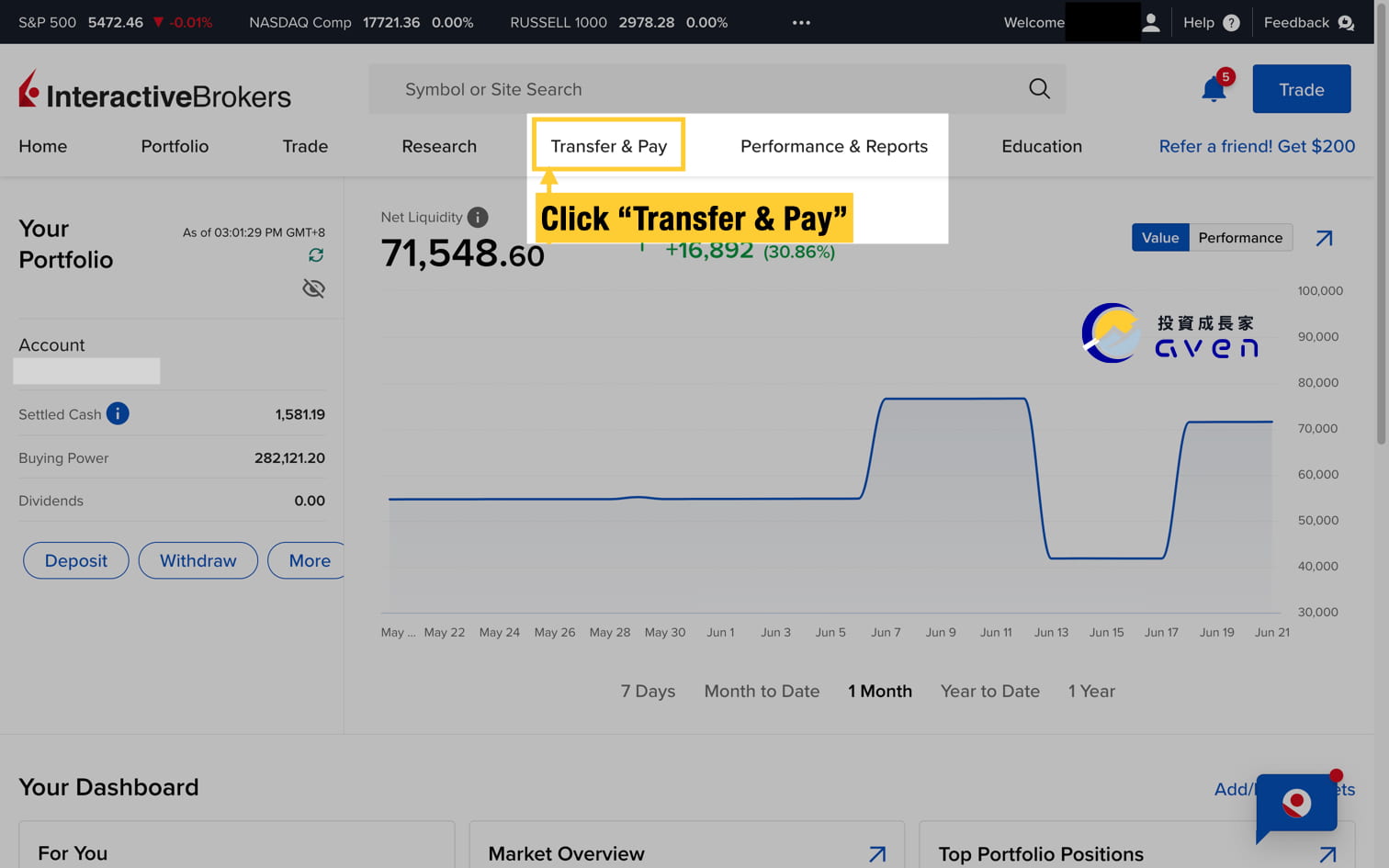

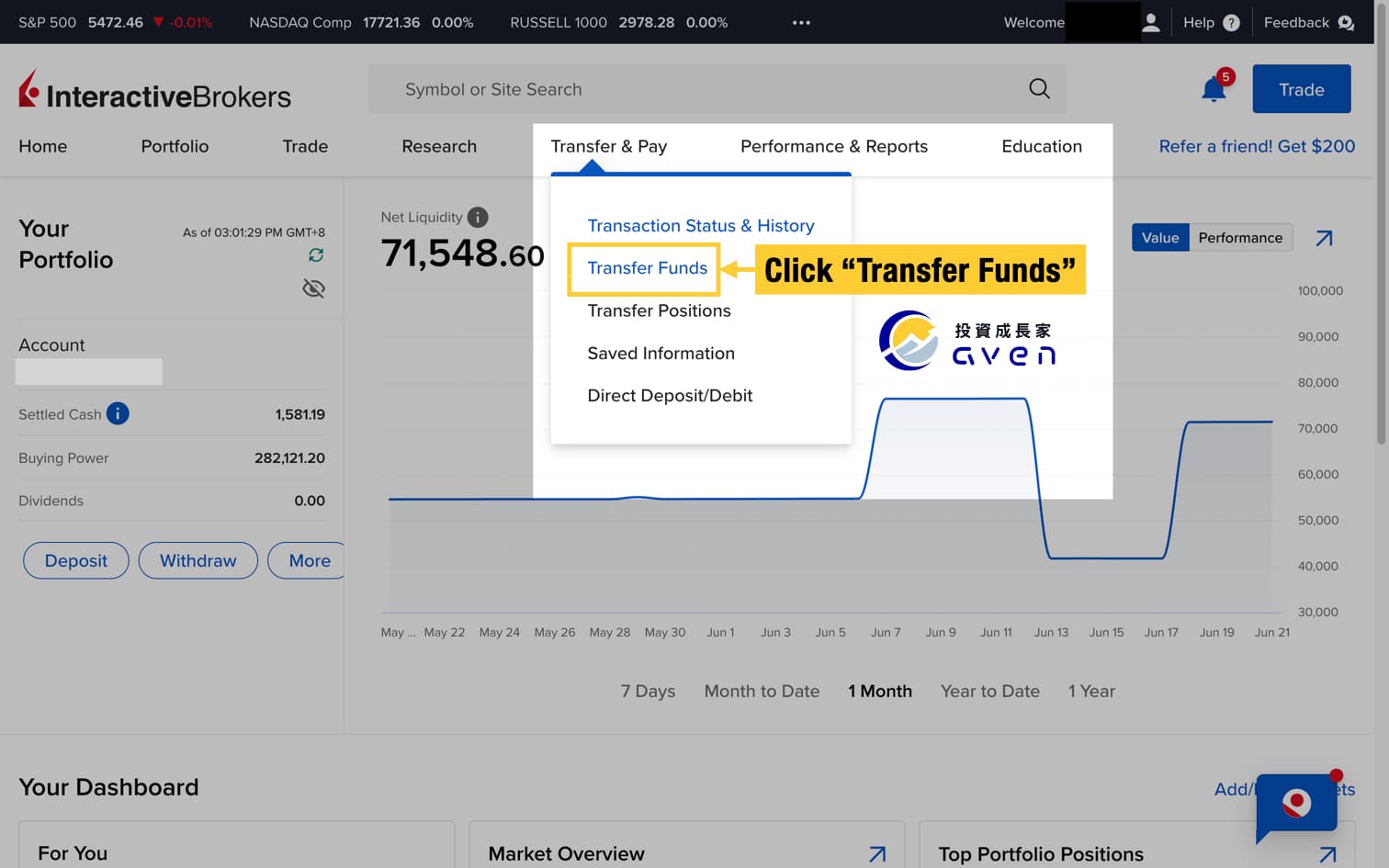

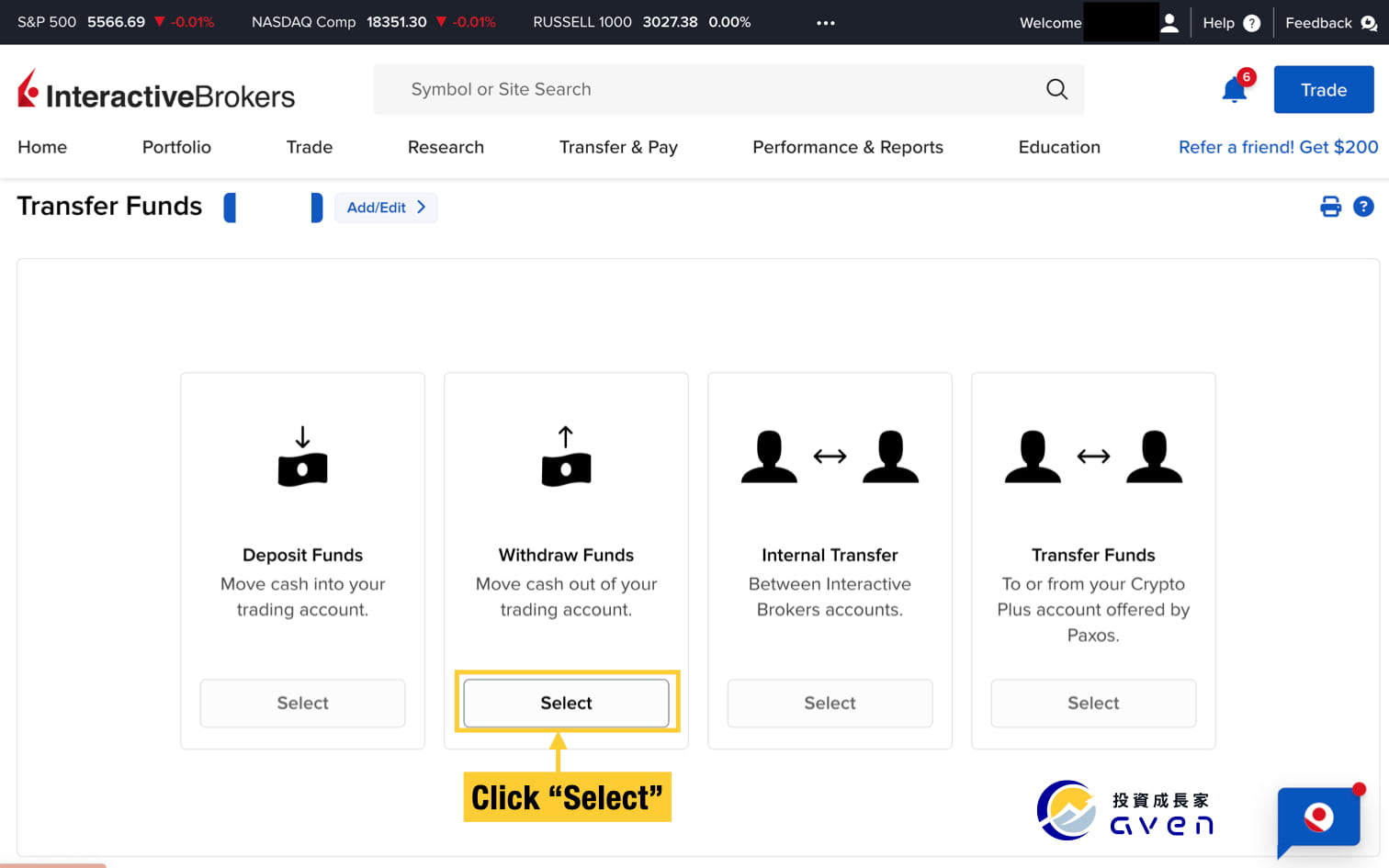

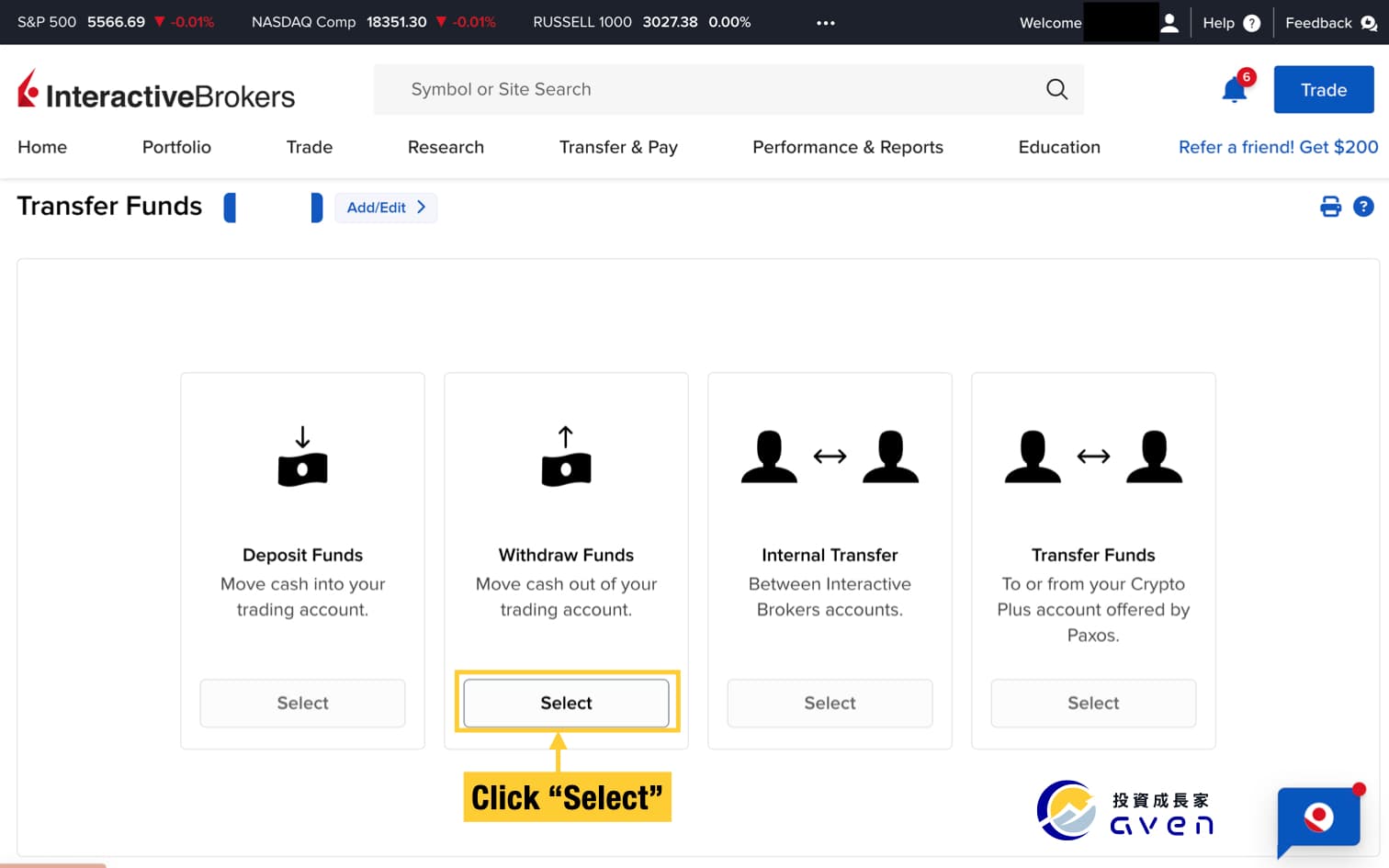

After you successfully log in, click “Transfer&Pay”-> “Transfer Funds”.

Choose "Withdraw Funds" and click "Select".

Step 3: Choose your IBKR account withdrawal method

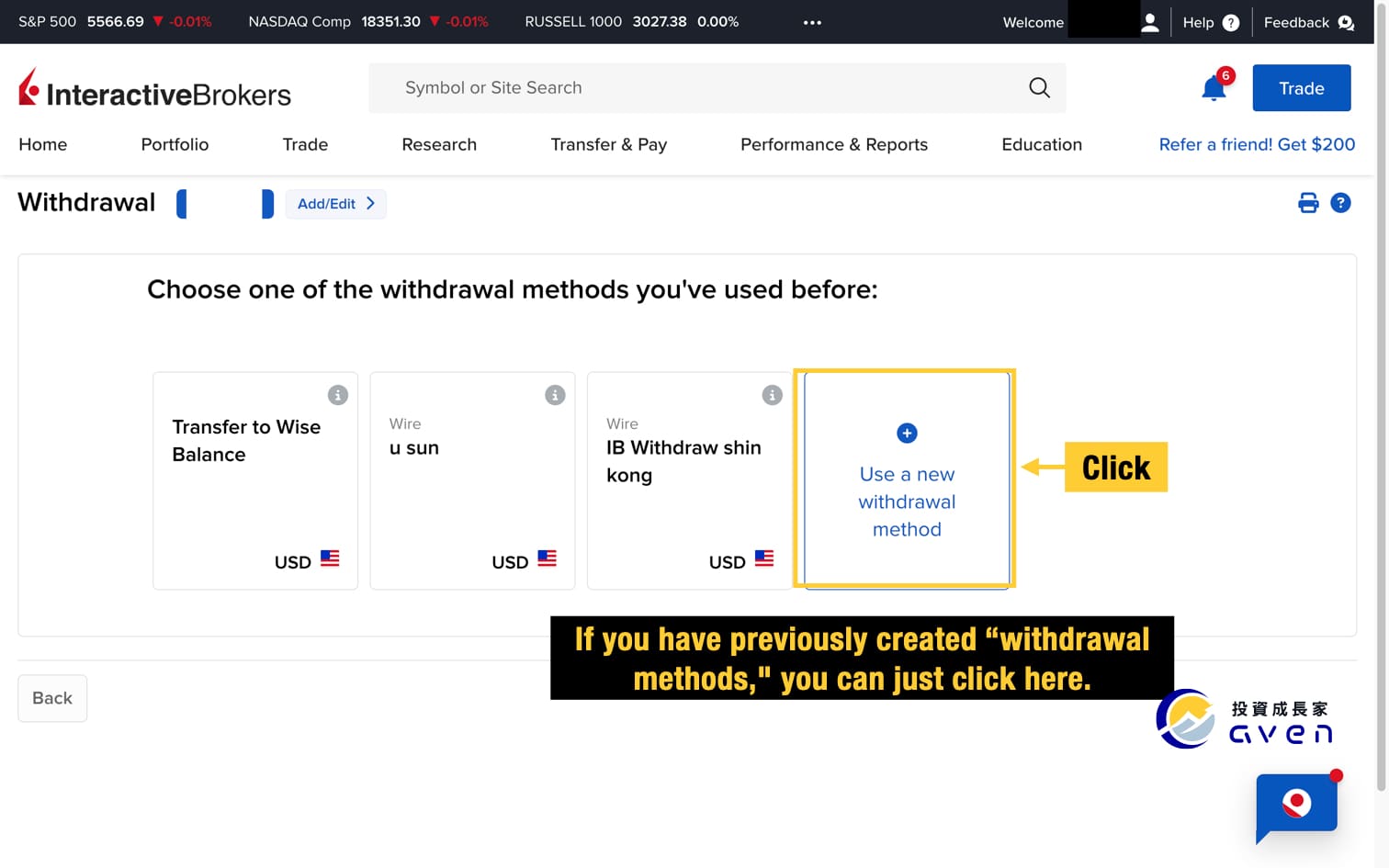

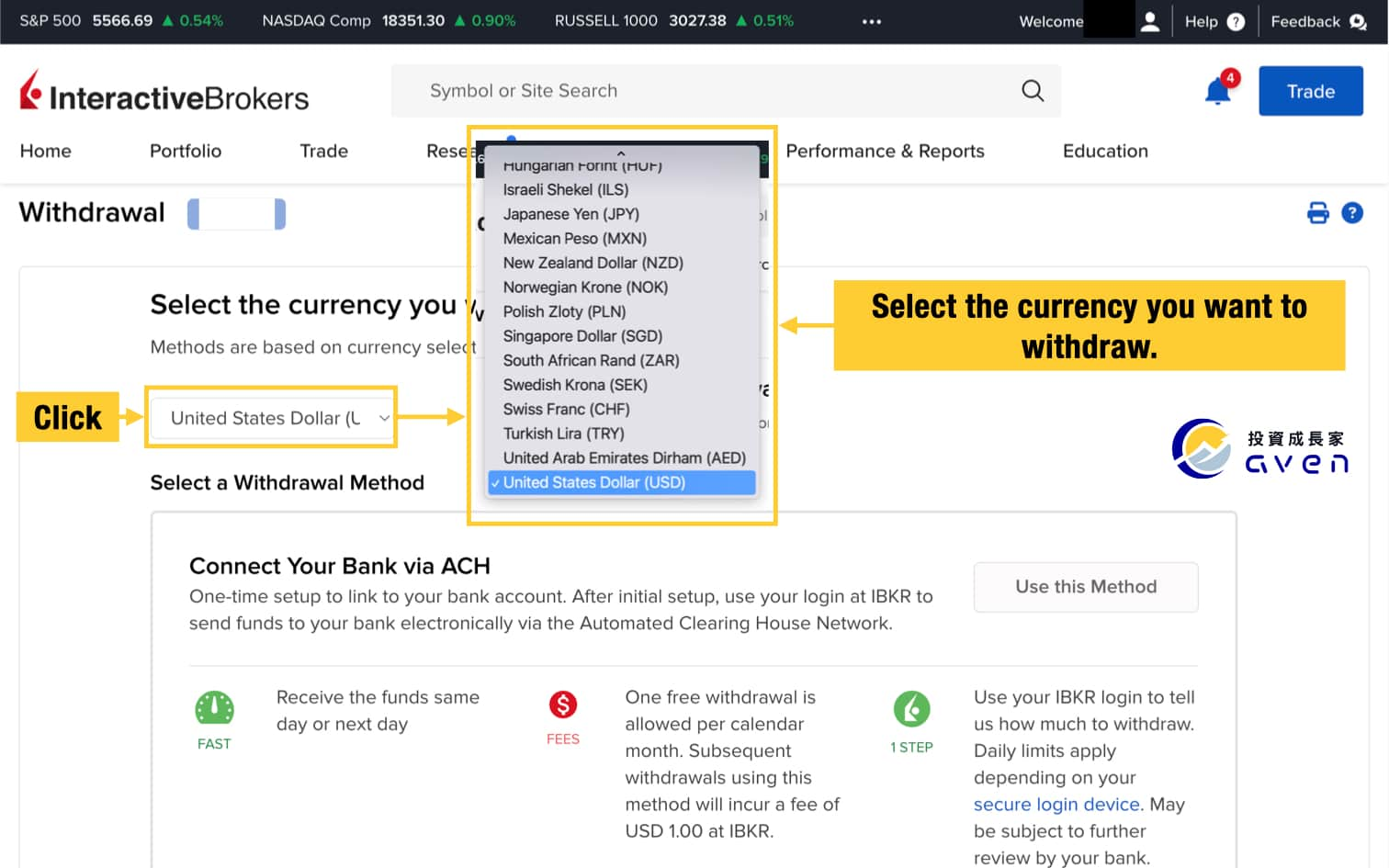

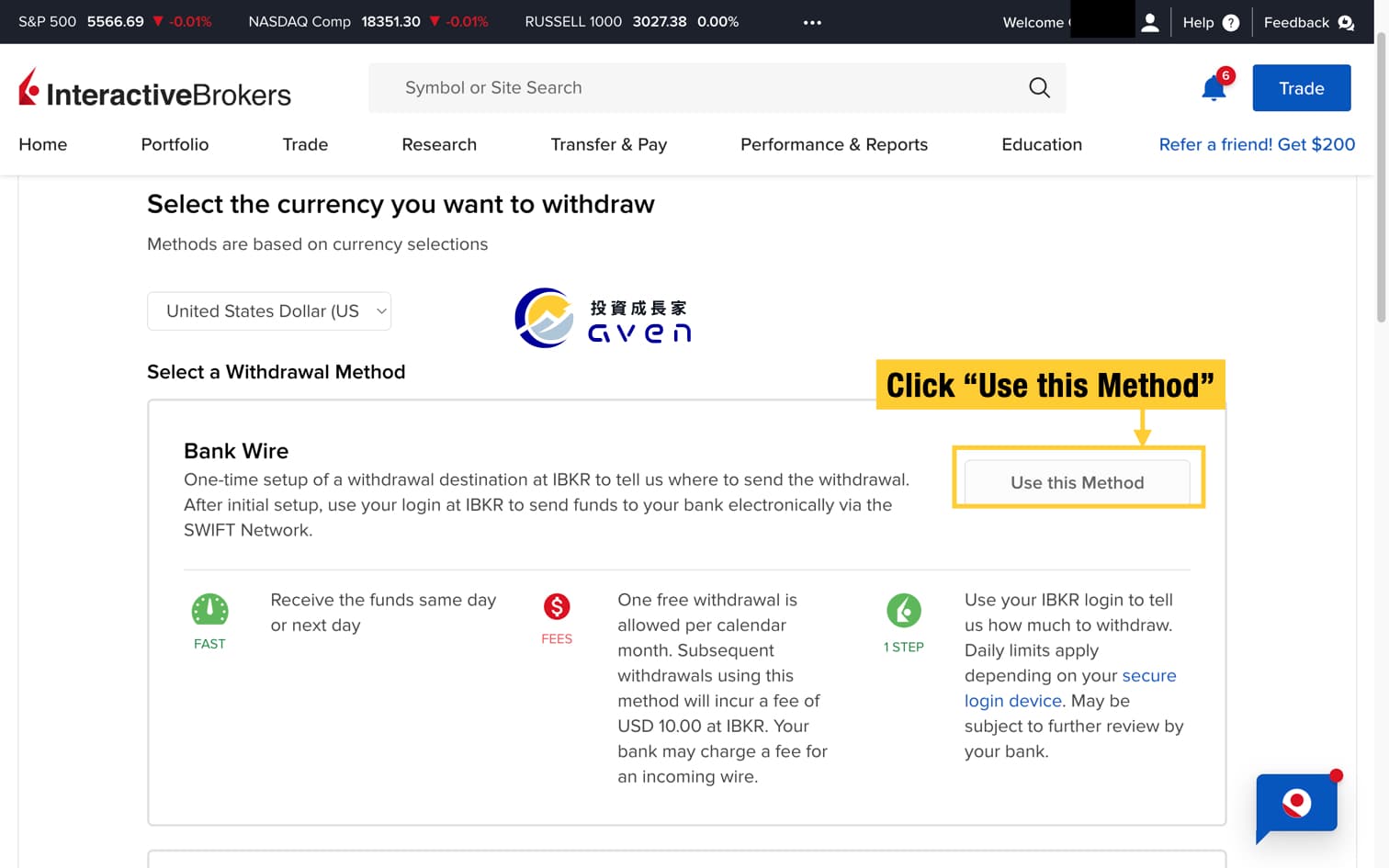

There will be diverse "withdrawal" methods on this page. At this step, we can choose "Bank Wire". After selecting your currency as USD, click "Get Instructions". (To use Bank Wire to withdraw money from your IB account, you must have a bank account.)

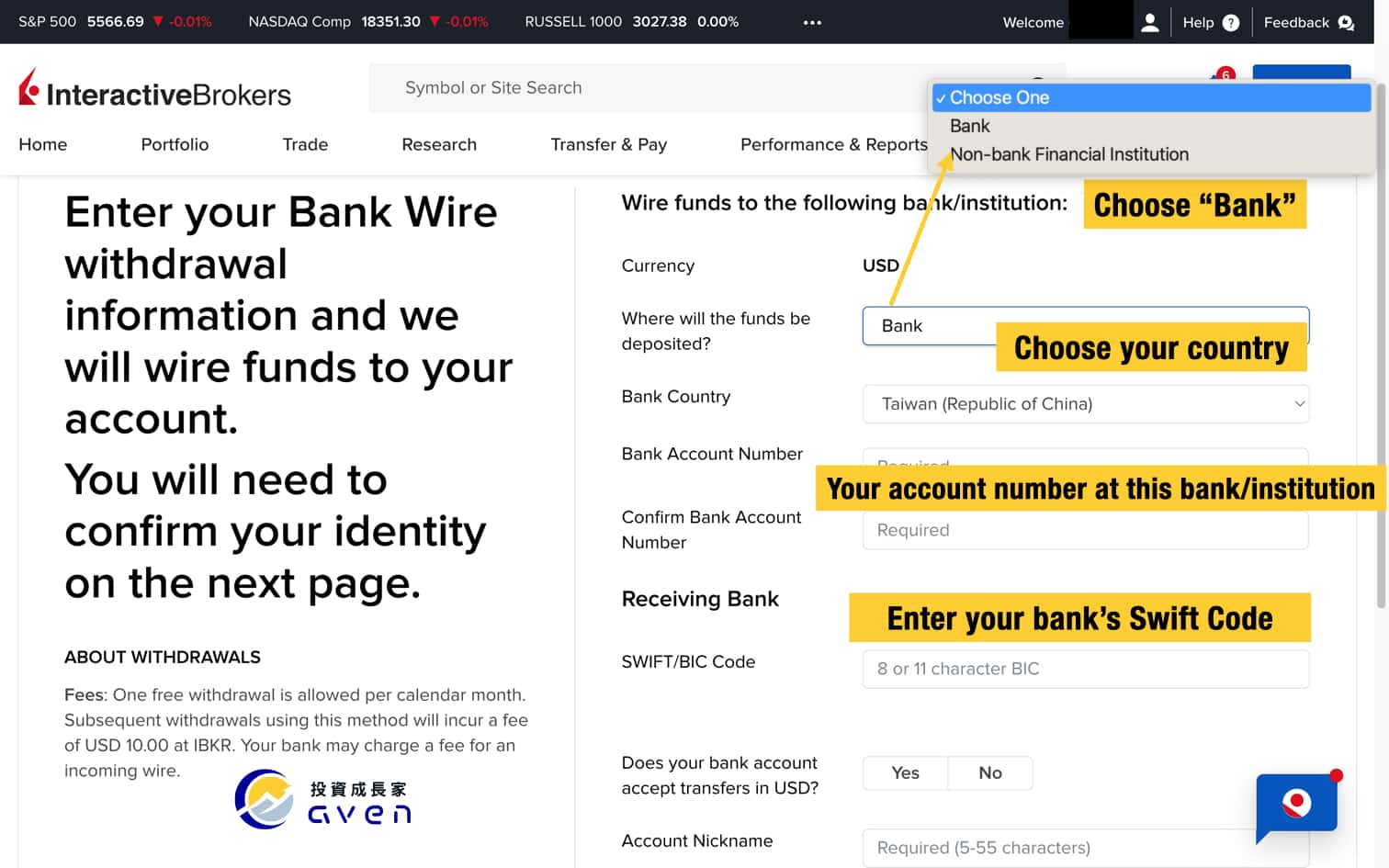

Step 4: Enter your Bank Wire withdrawal information

First, choose “bank” to receive your funds choose your country, and enter the information of your bank, including your account number and your Swift Code.

What is SWIFT Code?

SWIFT Code is a global network used to process remittances between countries. You can think of it as your bank's ID card.

In this way, as long as you correspond to the SWIFT Code when remitting money in the future, the bank can quickly know where the money is to be remitted. If you don’t know your bank’s SWIFT Code, you can find it by searching the XXX Bank SWIFT Code online.

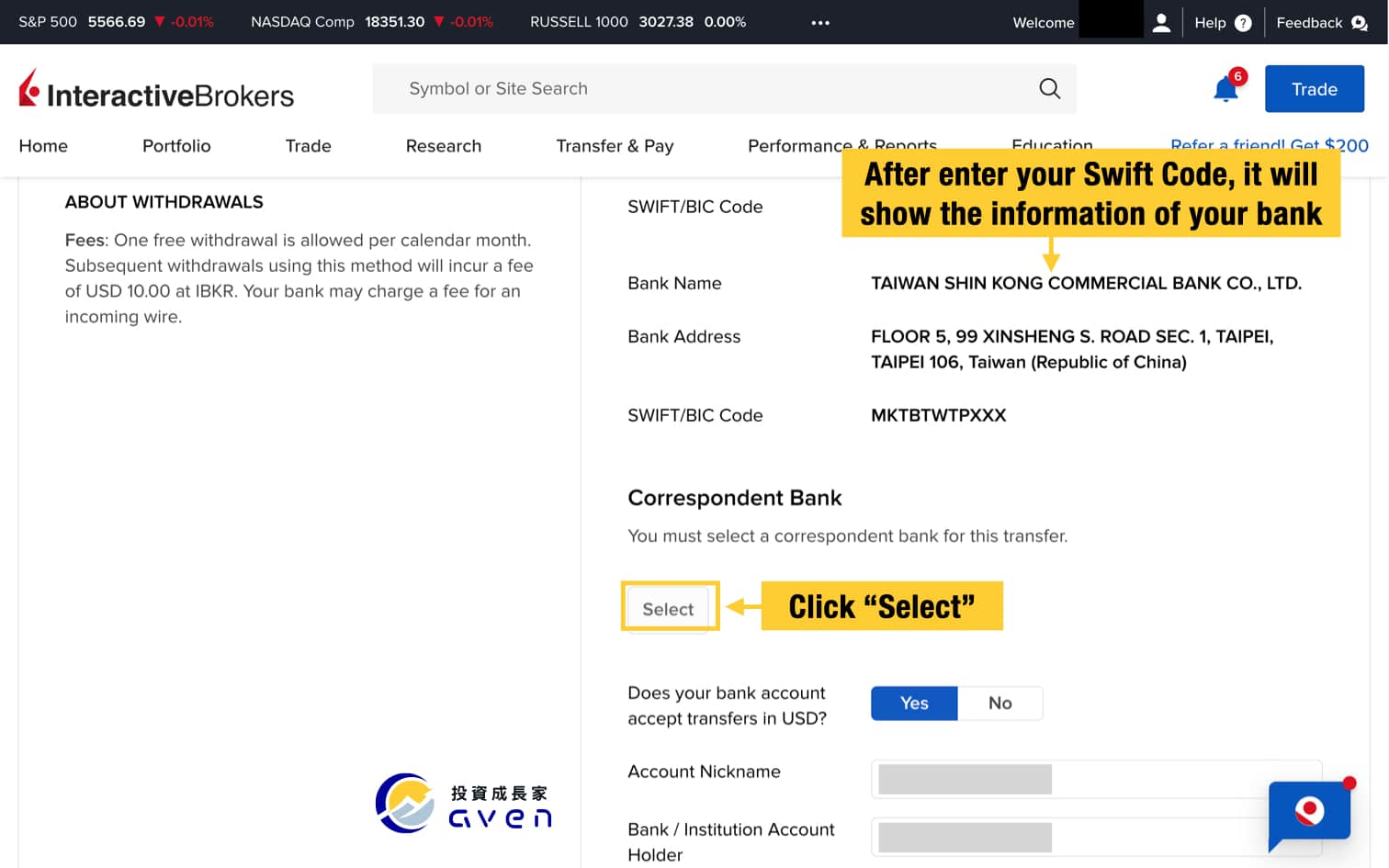

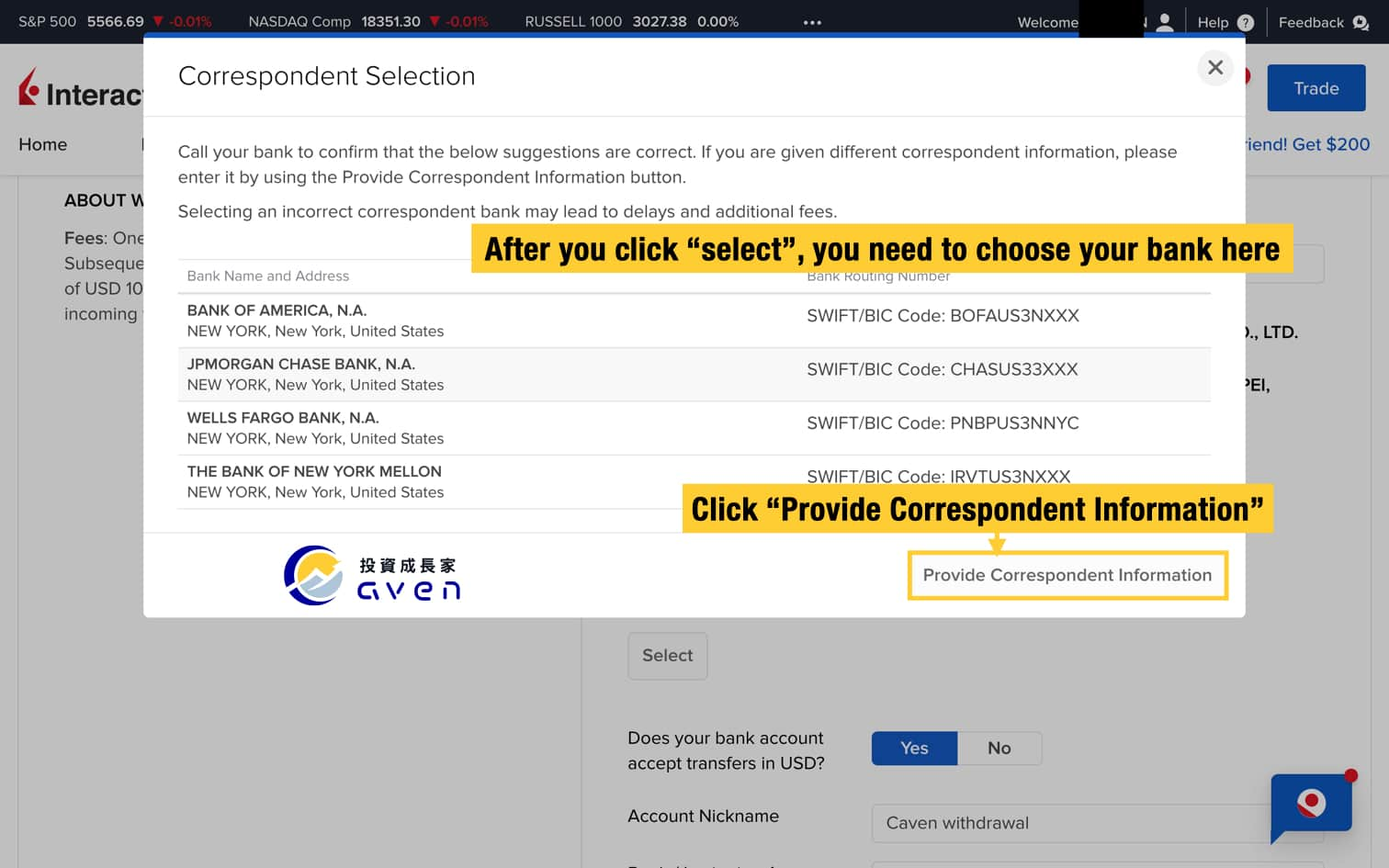

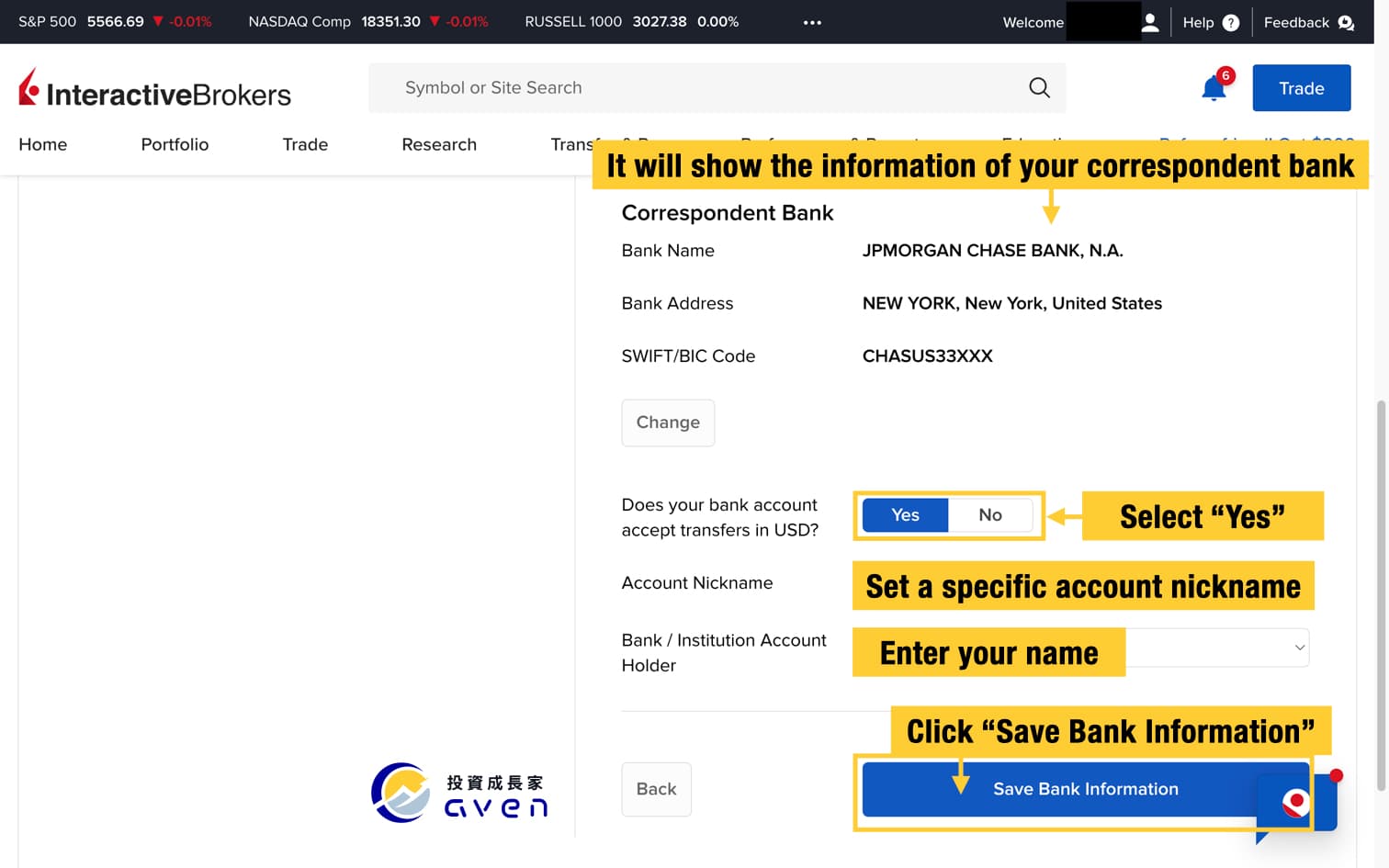

After we choose our bank, now we need to choose a correspondent bank, which is the IB's bank to transfer funds to your bank.

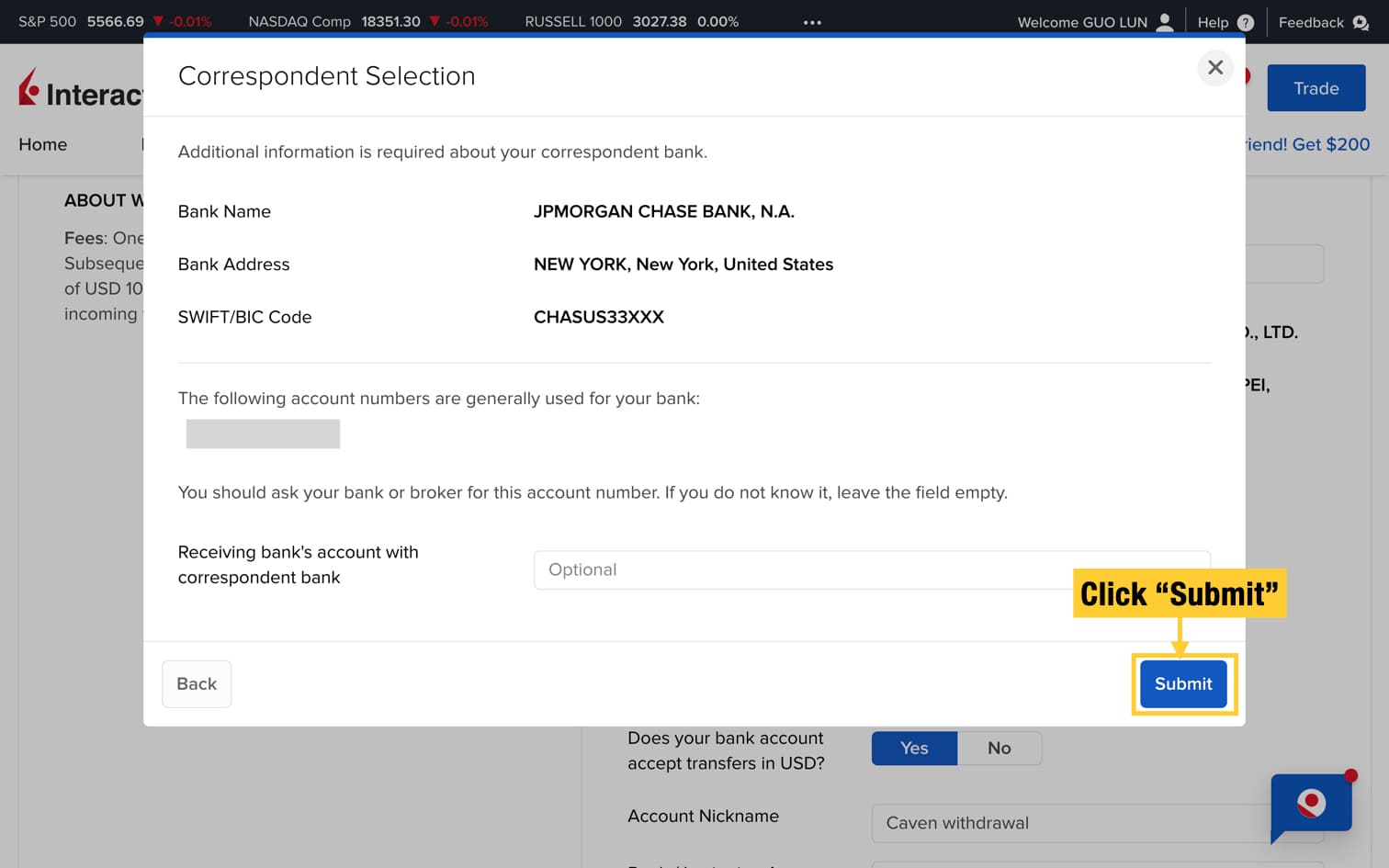

You need to ask your bank which bank of IB they can receive funds and choose one of them.

After choosing the correspondent bank, you can just enter the information of your account to receive funds from IB and save it.

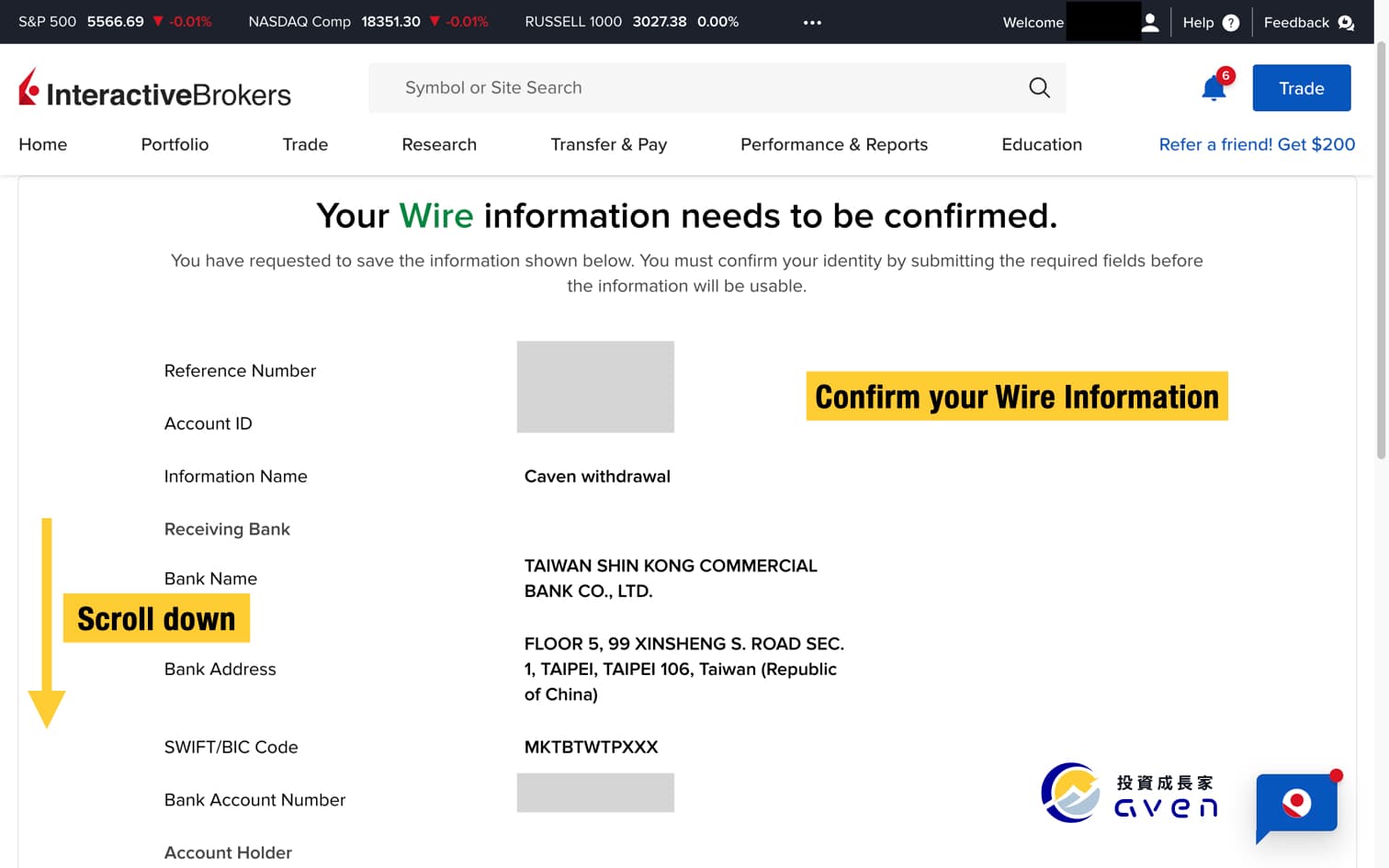

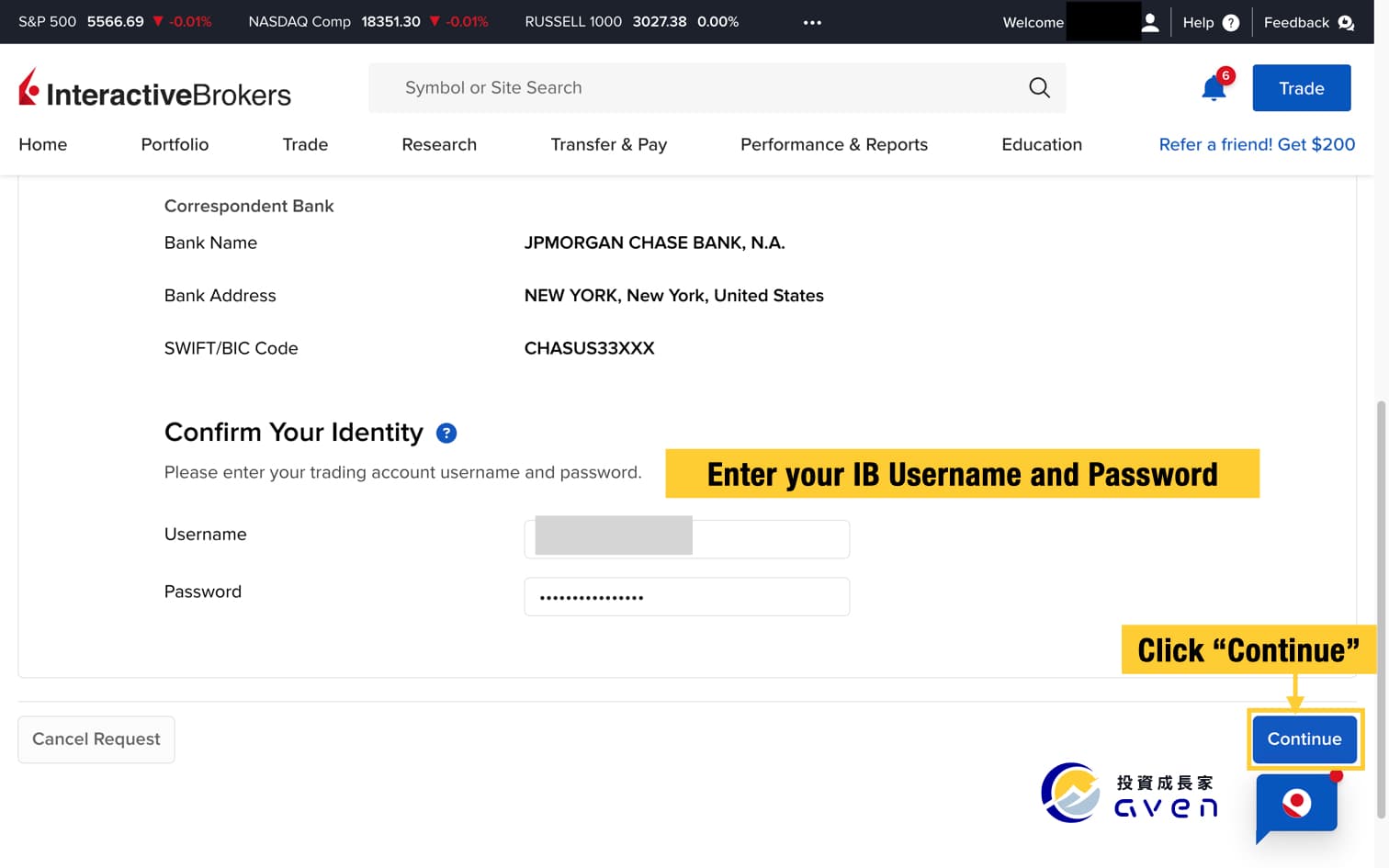

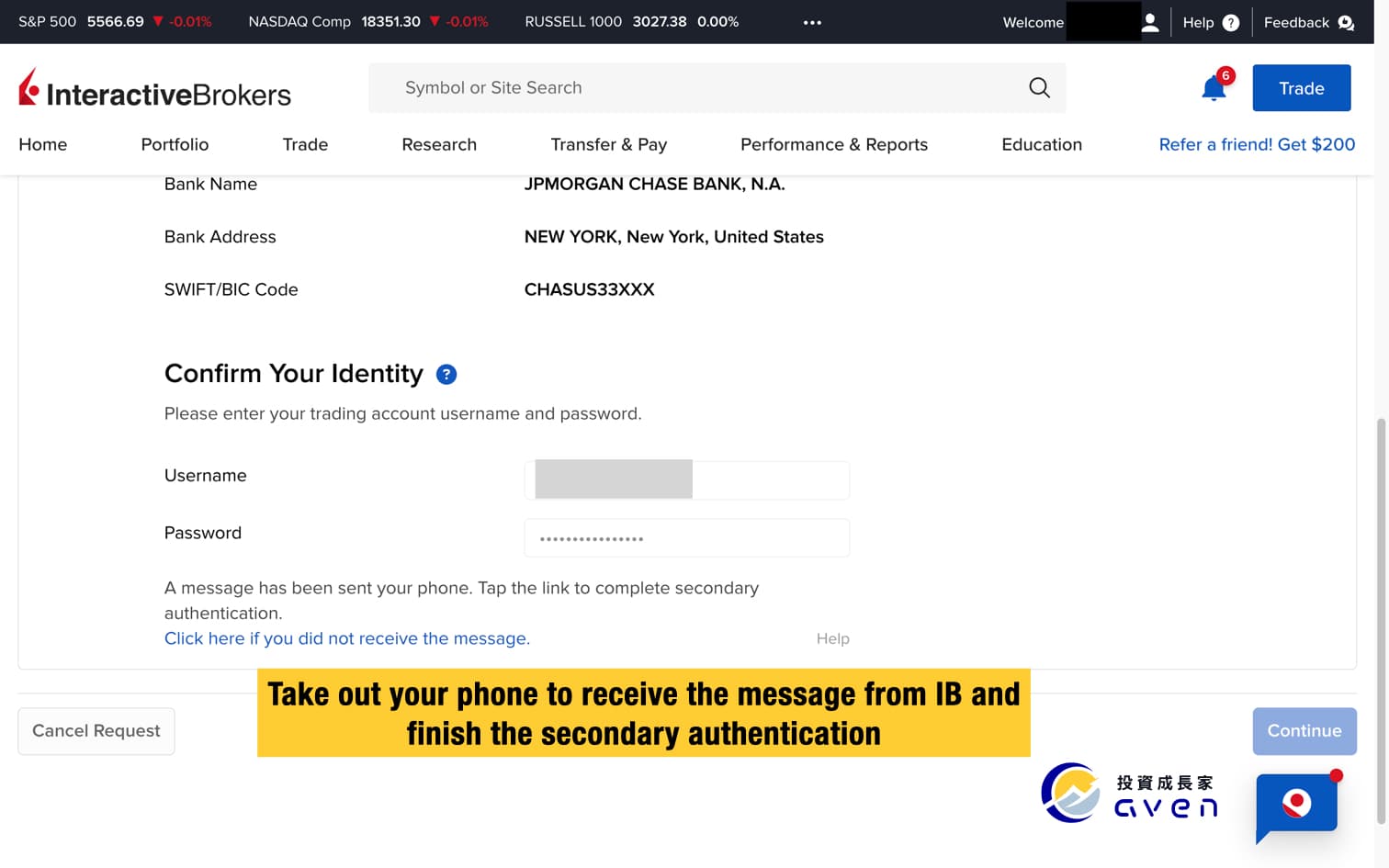

Next, the IB needs you to verify your identity by entering your username and password. Then, you can use your smartphone to complete your verification.

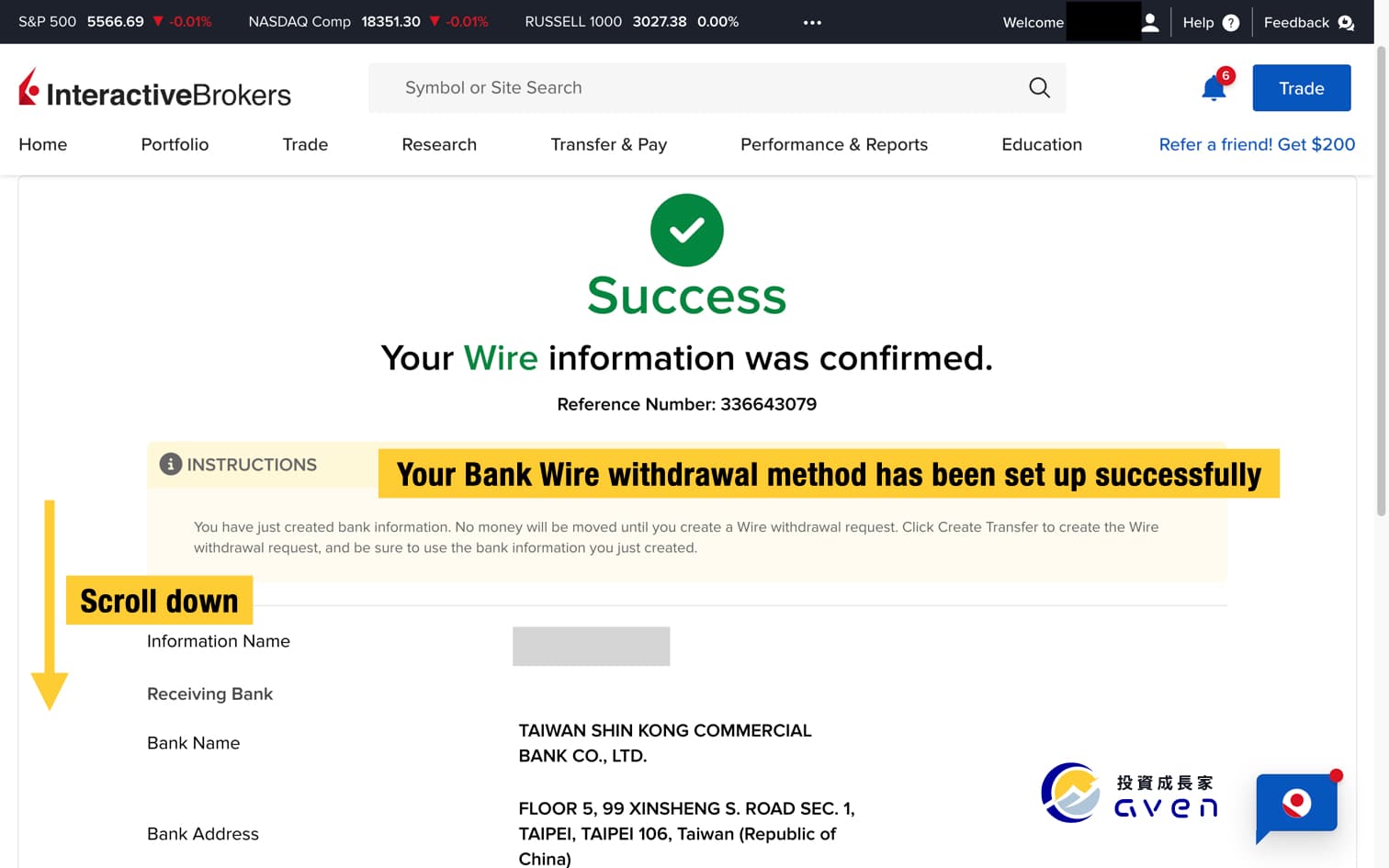

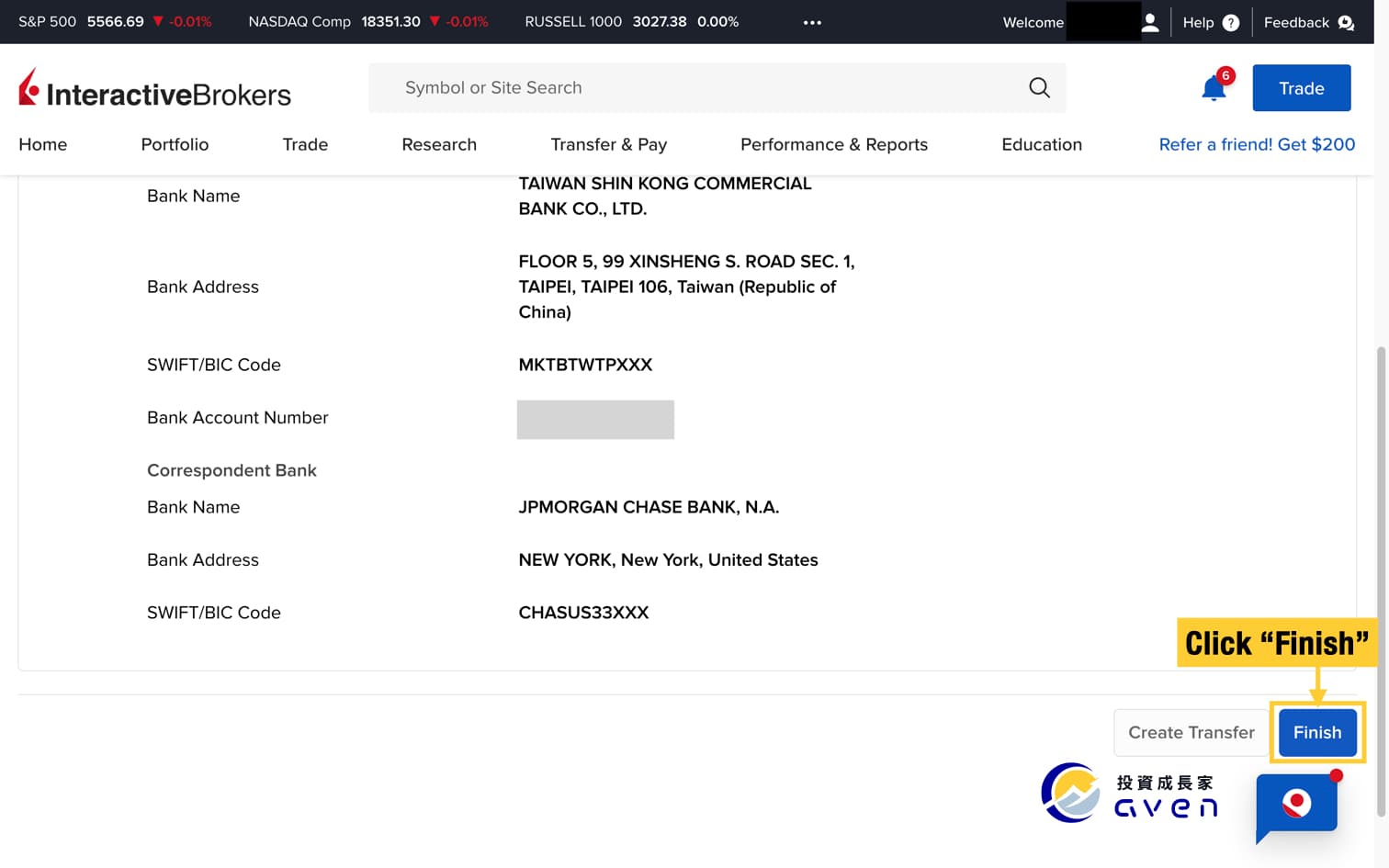

Once you see this message, it means your Wire information account has been connected successfully!

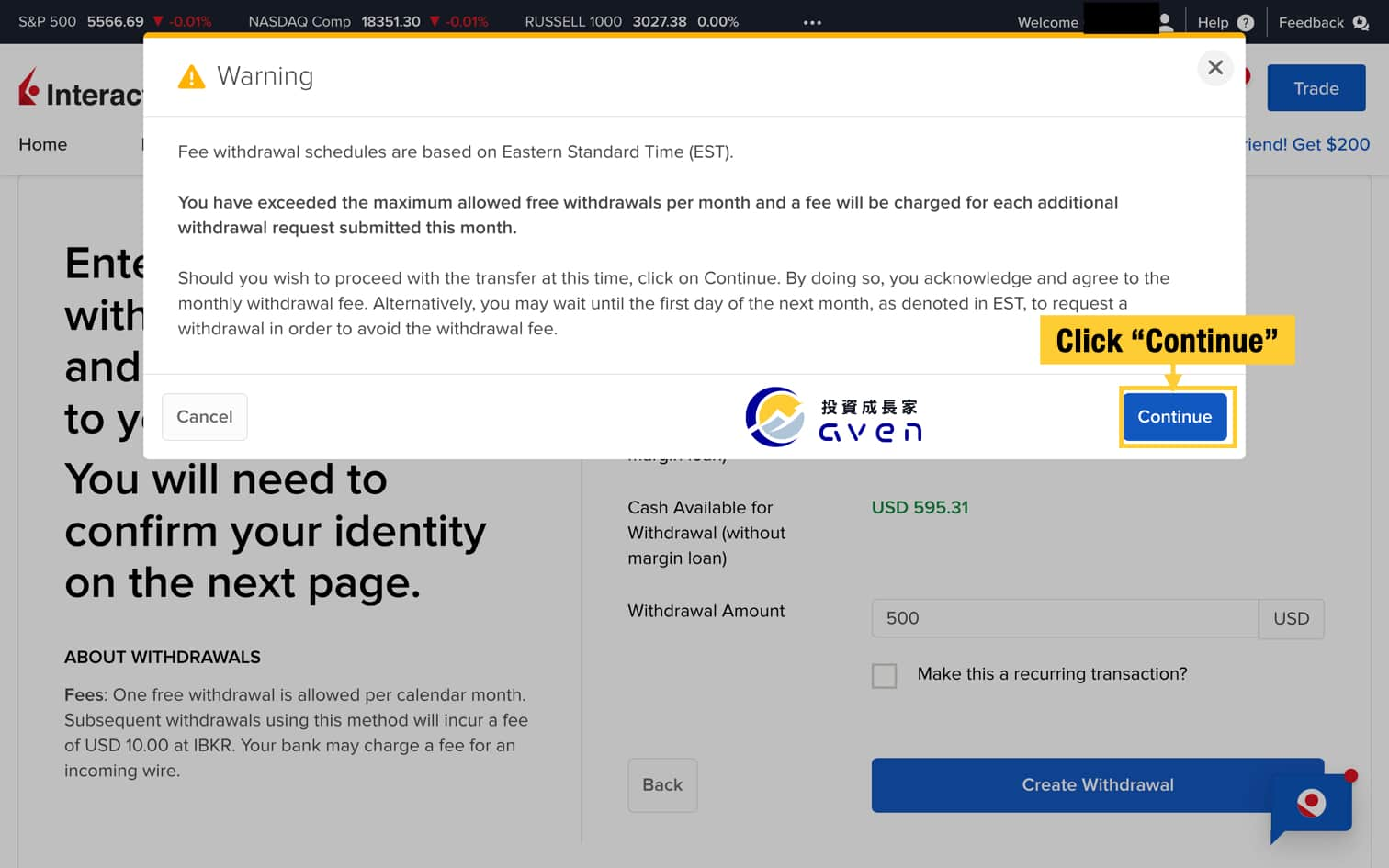

Step 5: Follow the Bank Wire Instructions to withdraw your money

After you click finish, you can go back to log in, and click "Transfer&Pay" -> "Transfer Funds" -> "Withdraw Funds". Here you can see you have created a new withdrawal method. Just choose it!

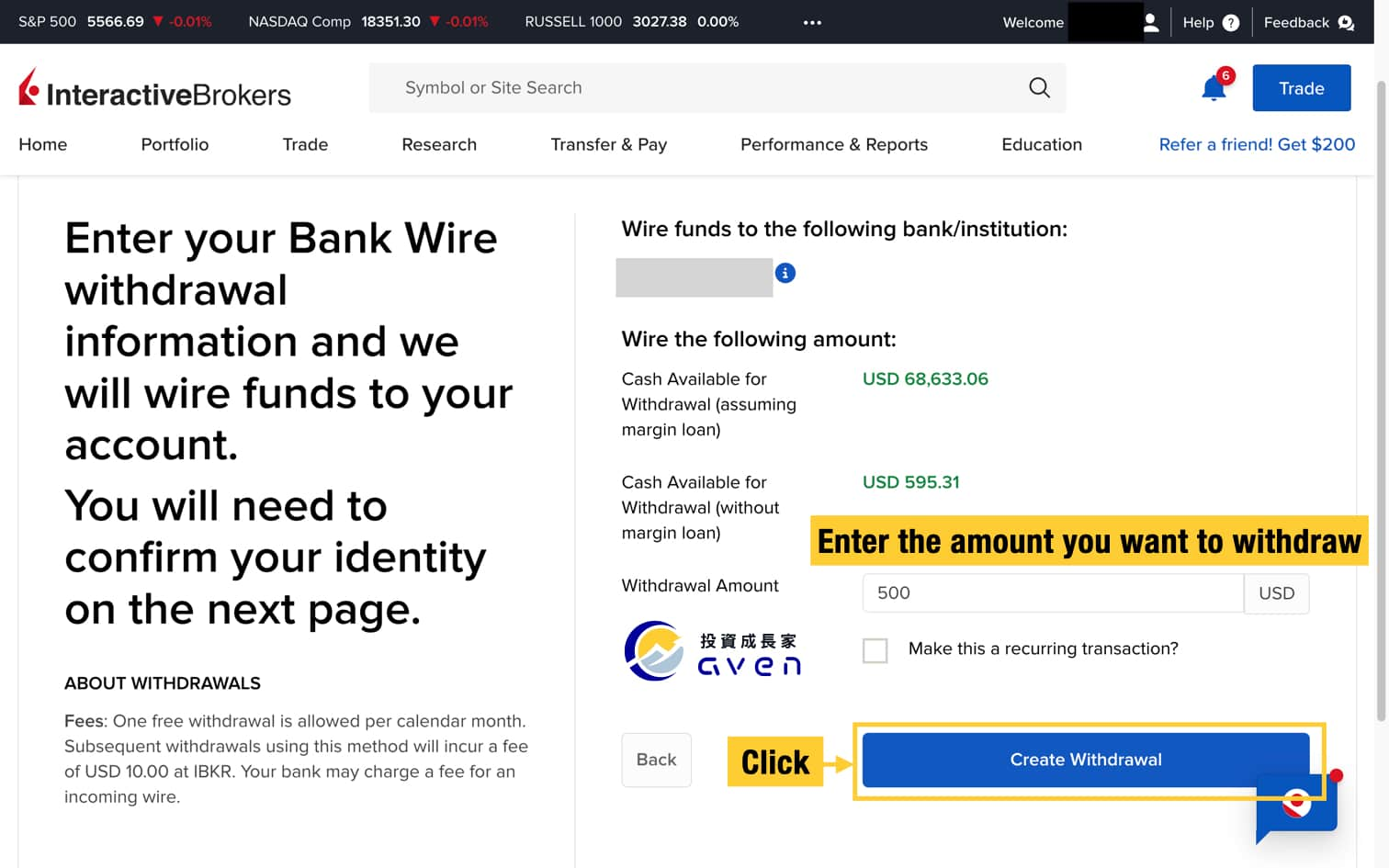

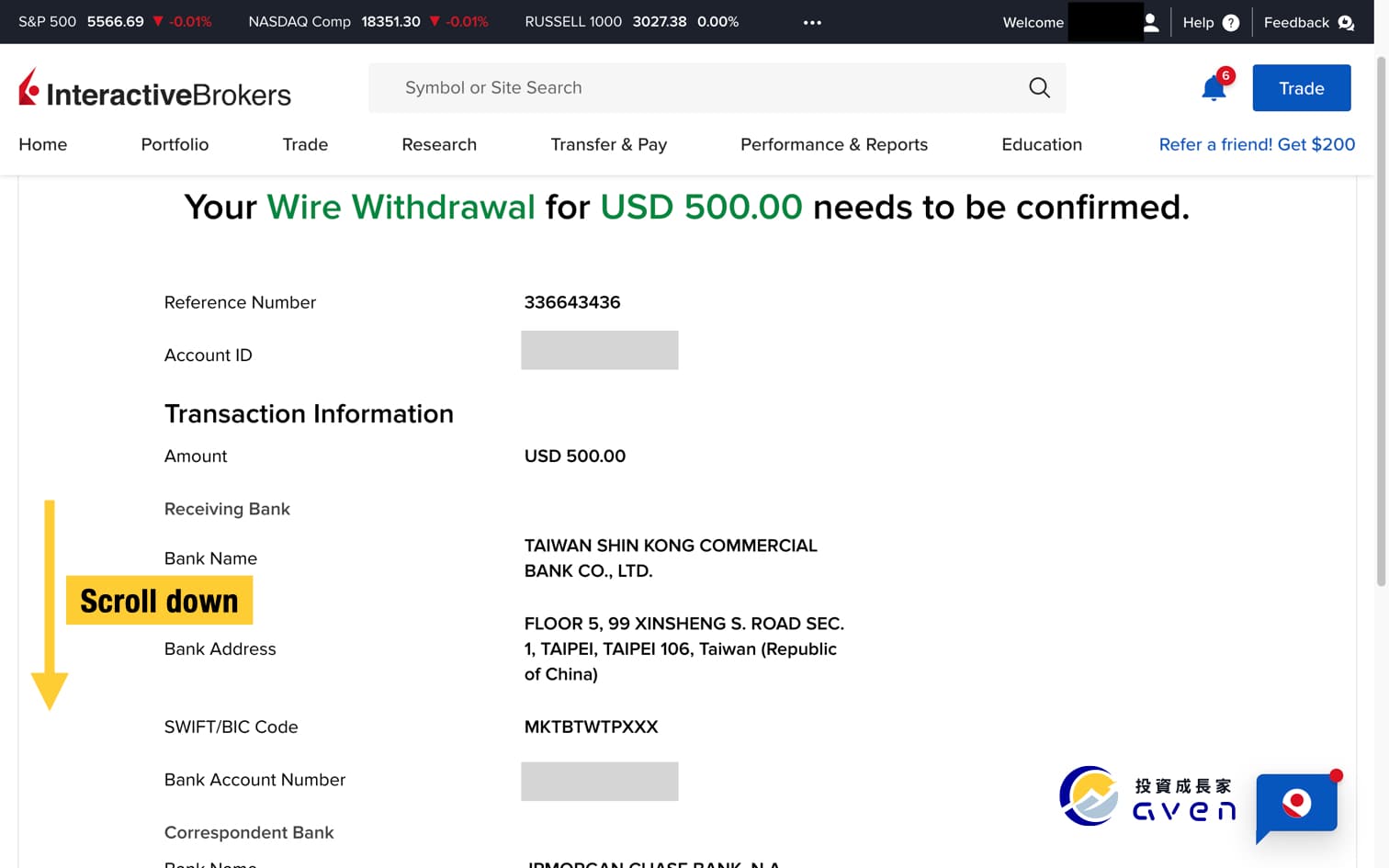

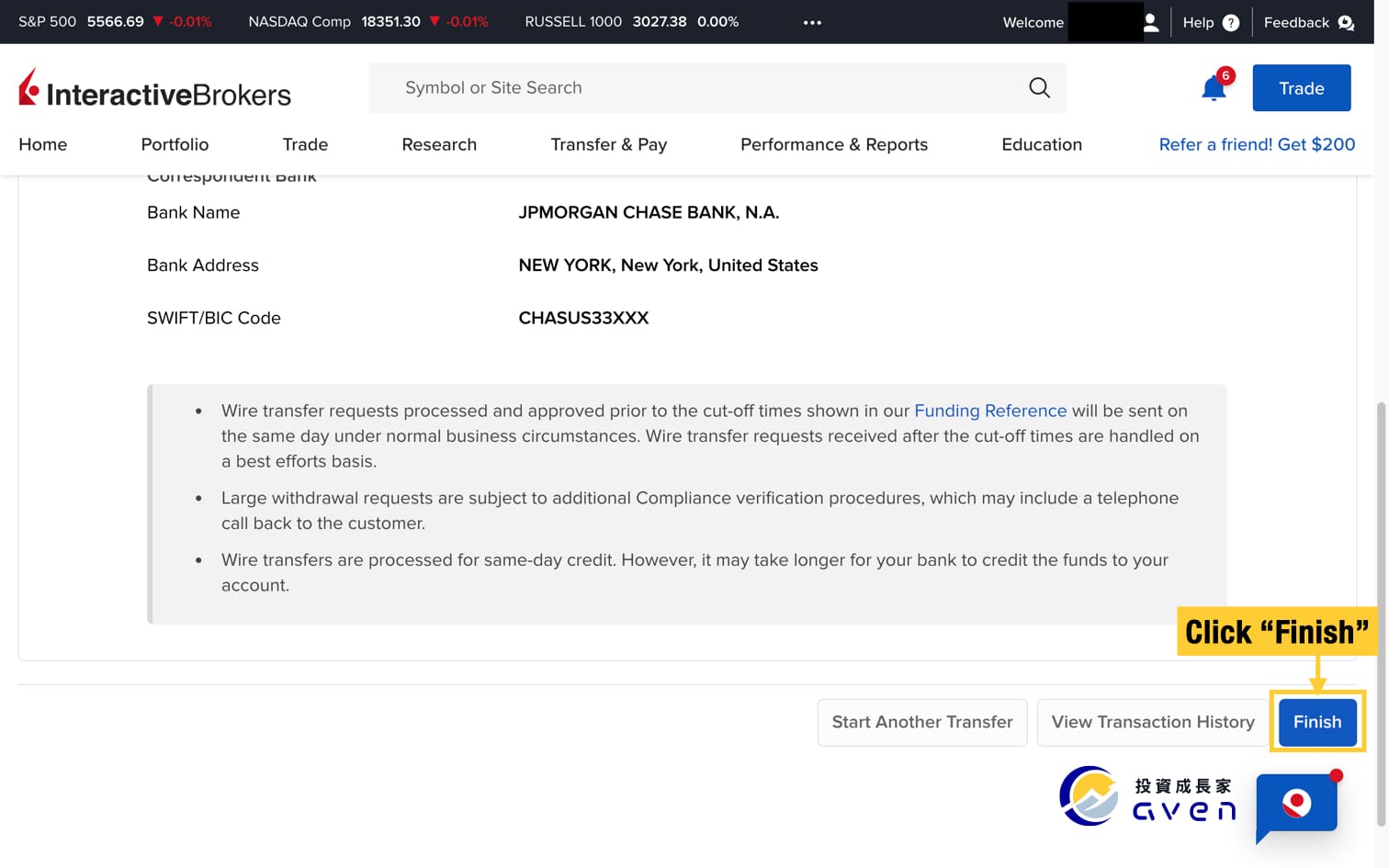

Now you can enter the amount you want to withdraw from your IB account and click "Create Withdrawal".Now you need to confirm your Wire Withdrawal information by keeping clicking "continue". This will complete the withdrawal.

Once you see this message, it means you have withdrawn your money to your bank account successfully!

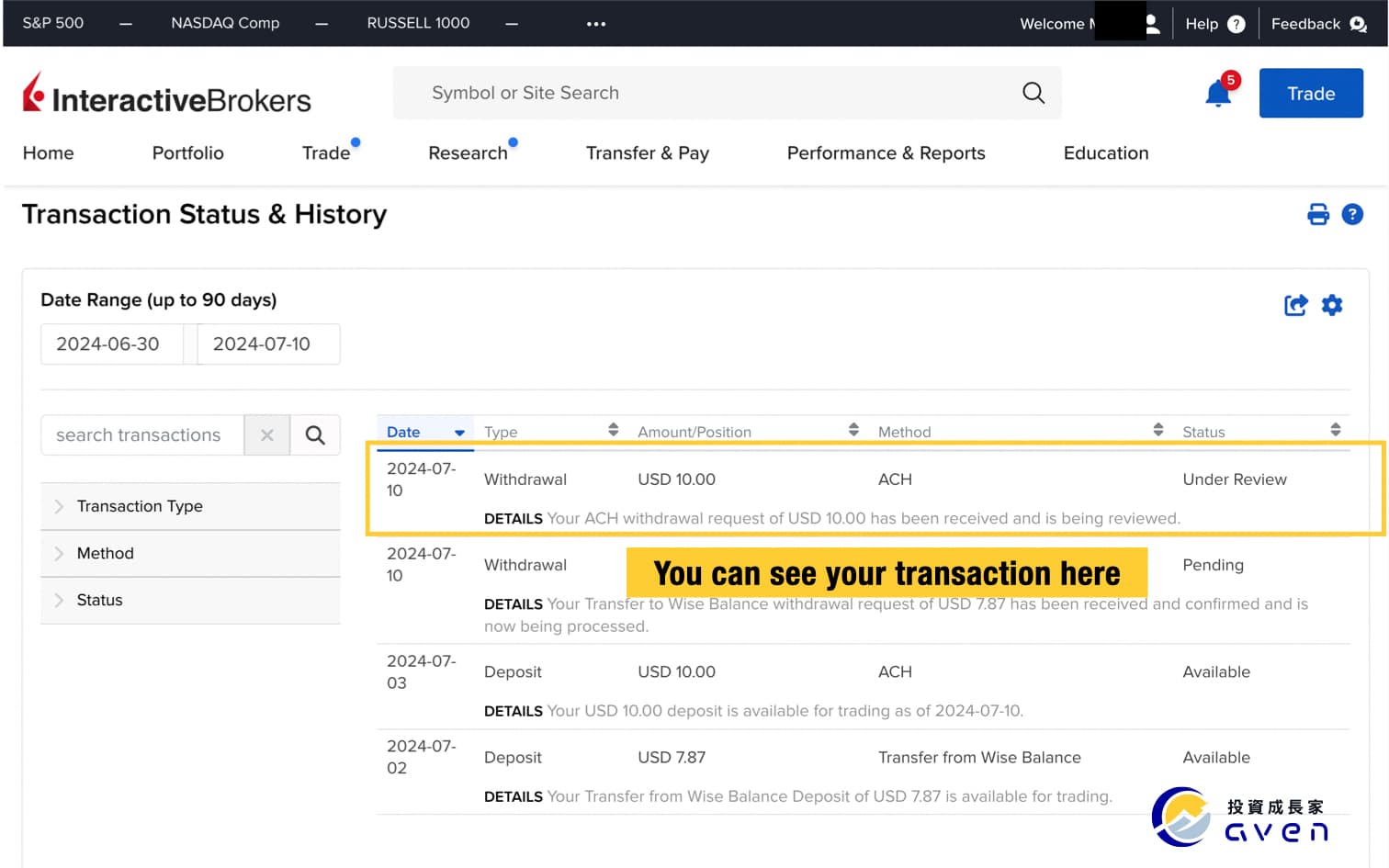

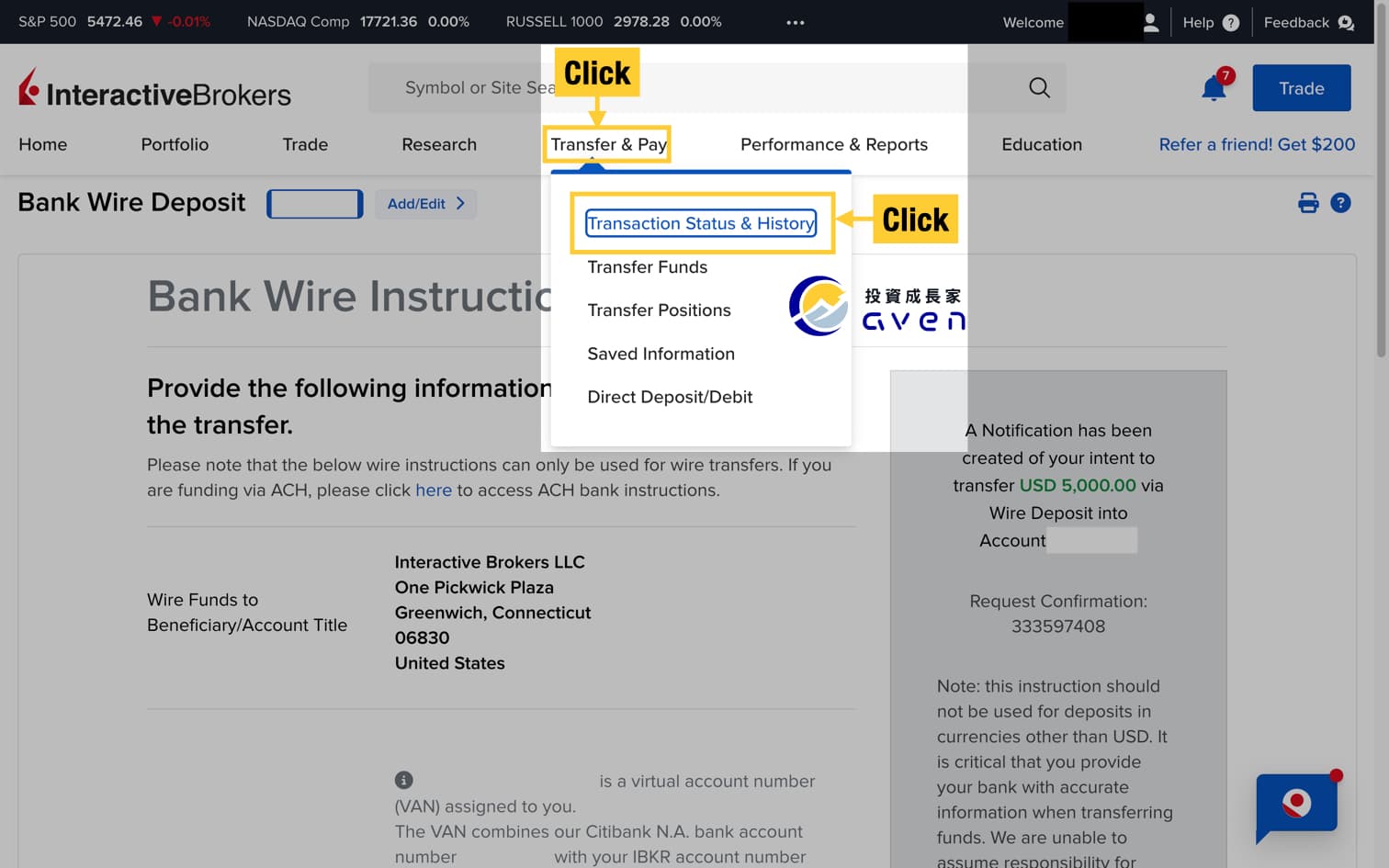

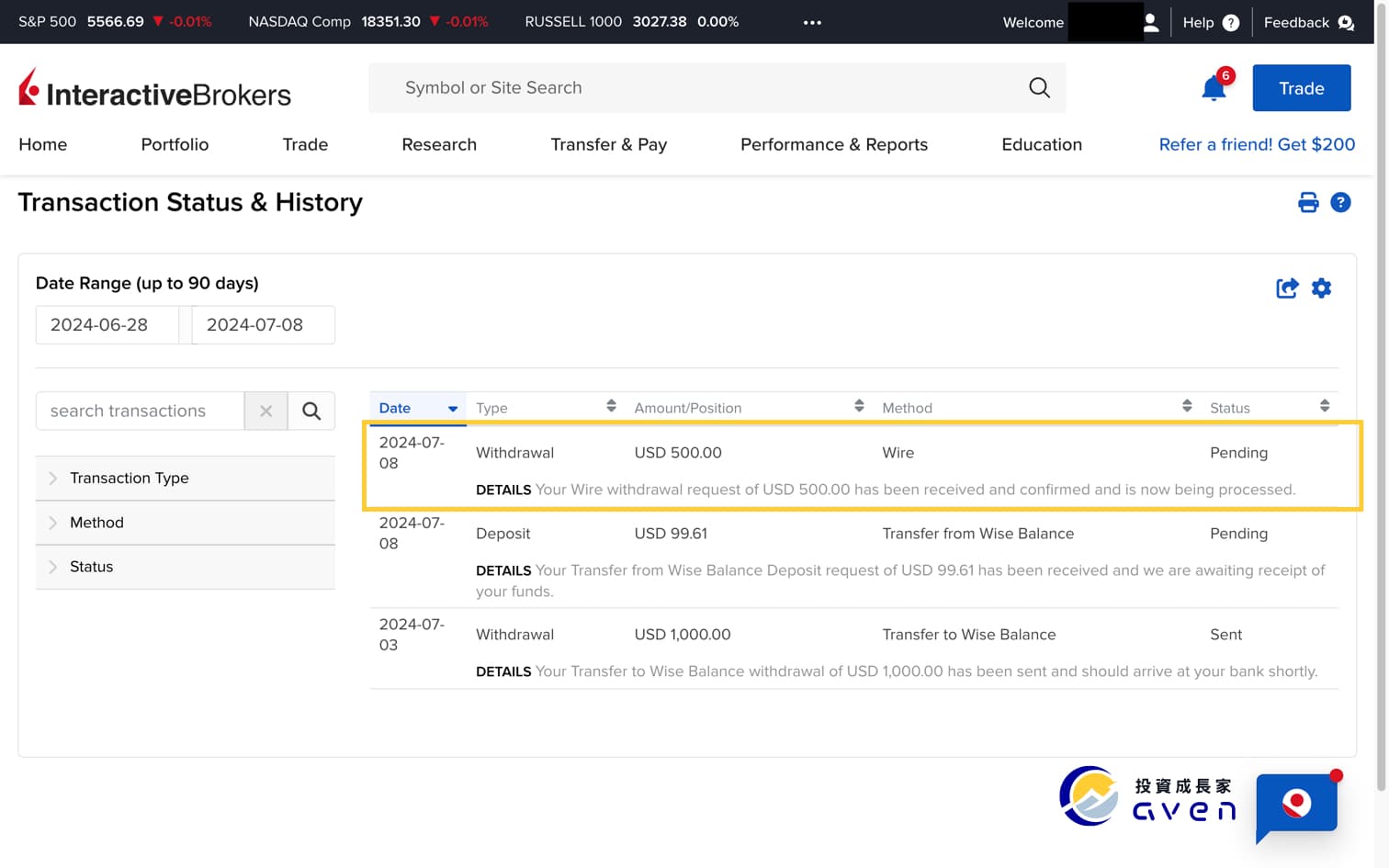

Step 6: Check your Transaction Status & History

After you withdraw your money from your IB account, you can click “Transfer & Pay”->” Transaction Status & History” to check your withdrawal.

Here you can see the past withdrawl notification you've just made.

Withdraw money from your Interactive Brokers with Transfer to Wise Balance Method

Step 1: Set up your wise account to receive your money

Step 2: Choose your IBKR account withdrawal method

Step 3: Link your IB account with your Wise account

Step 4: Withdraw your money from your IB account to your Wise account

Step 5: Check your Transaction Status & History

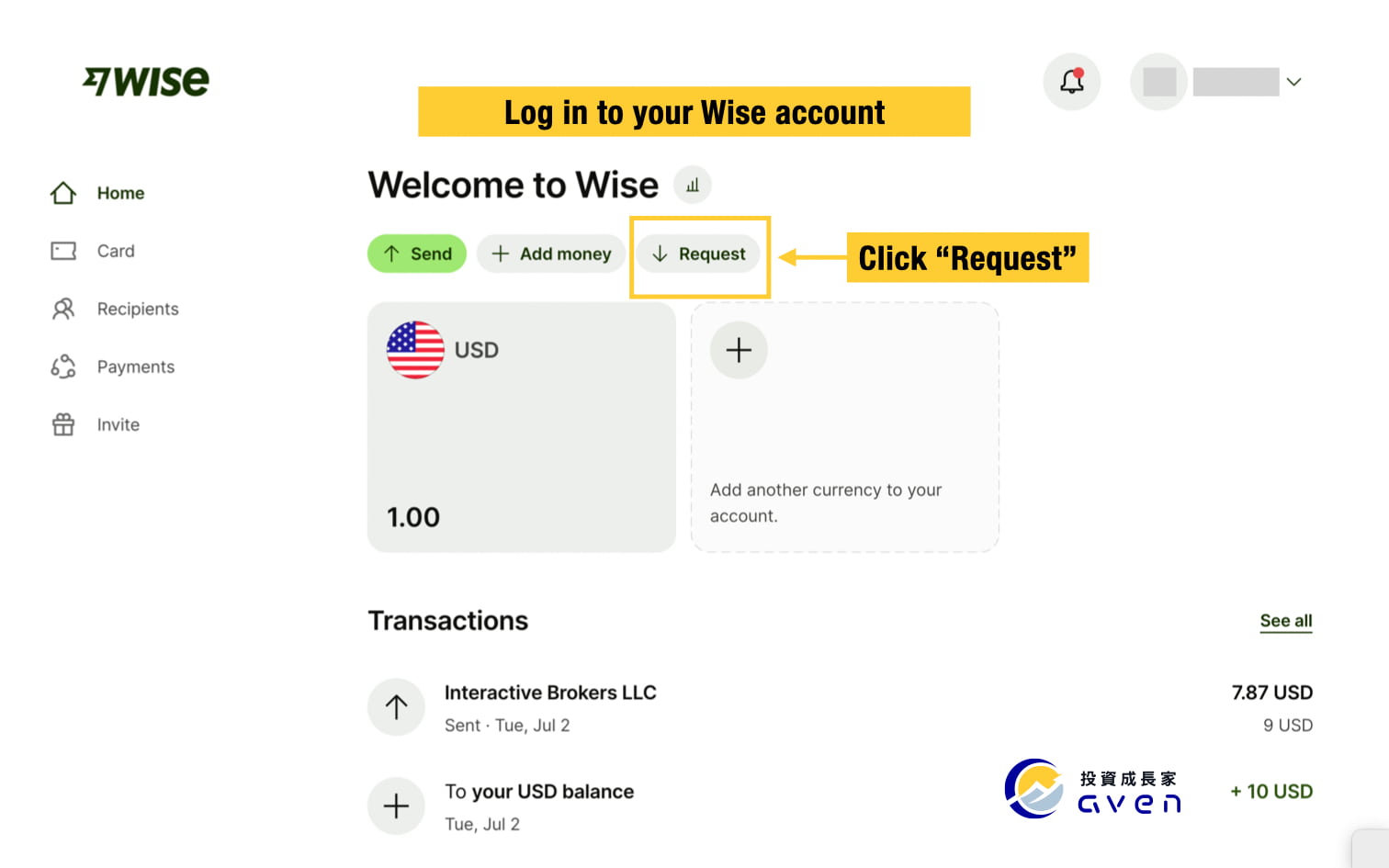

Step 1: Set up your wise account to receive your money

Log in to your wise account and click “Request”.

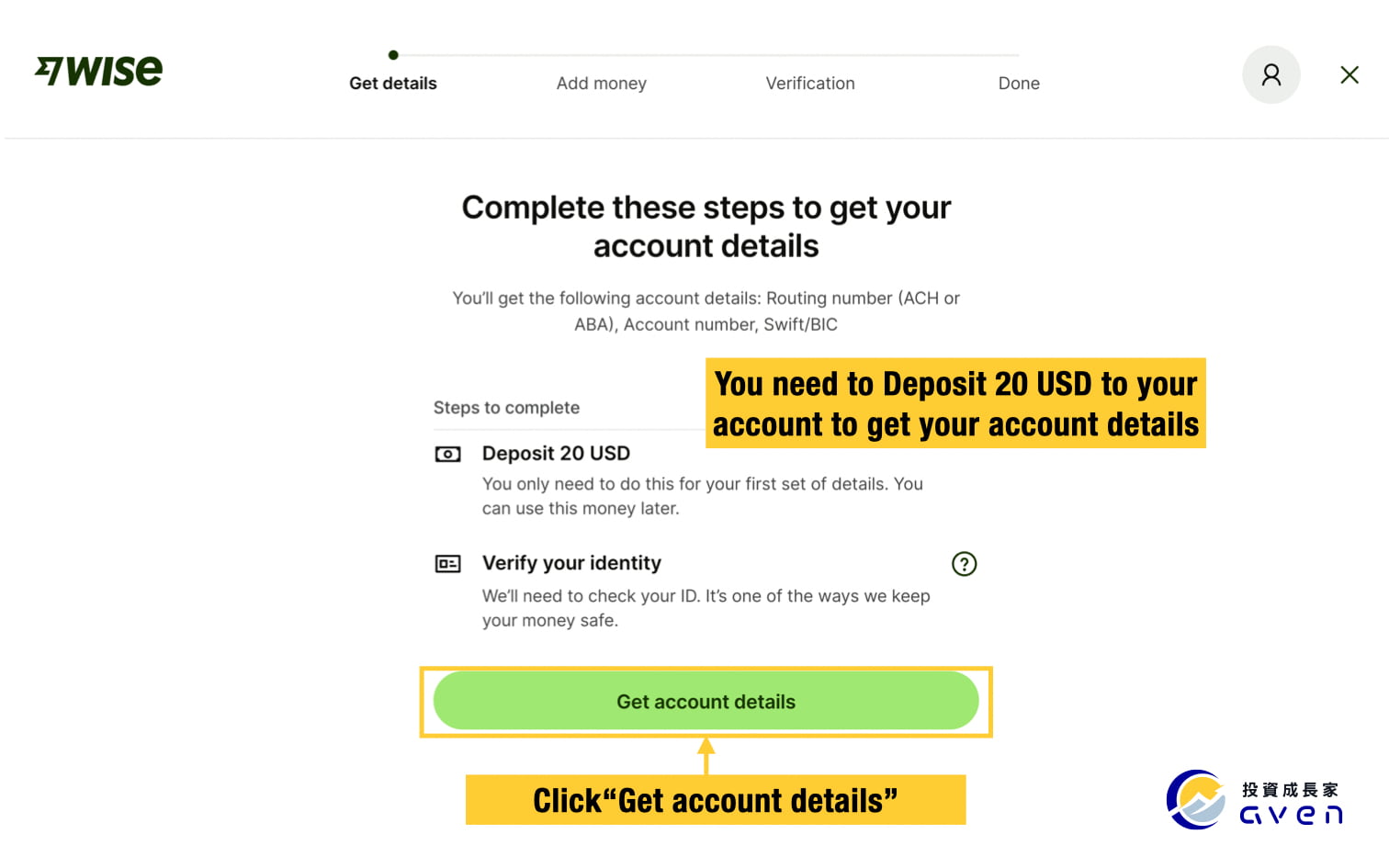

Here you can click "Get account details".

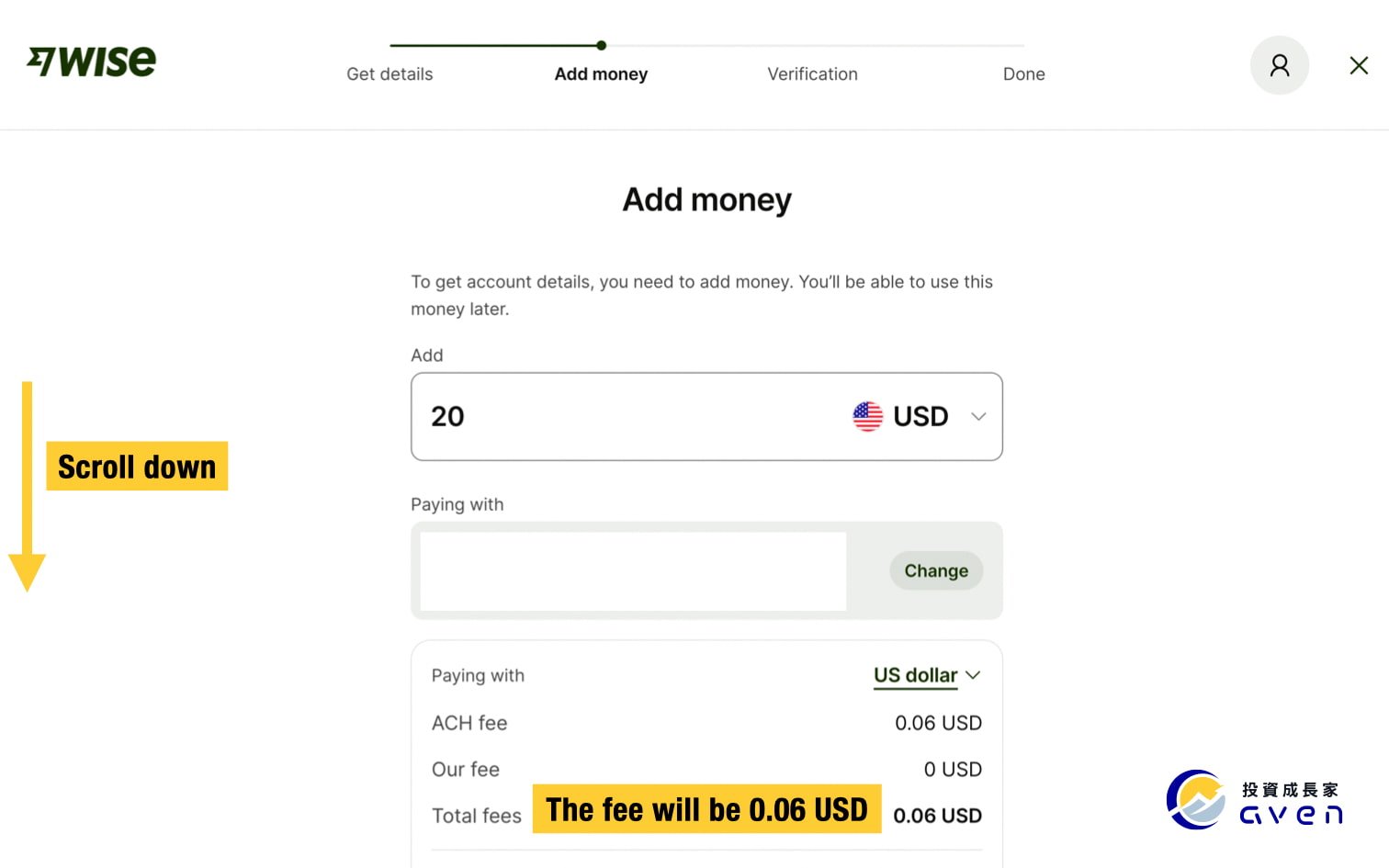

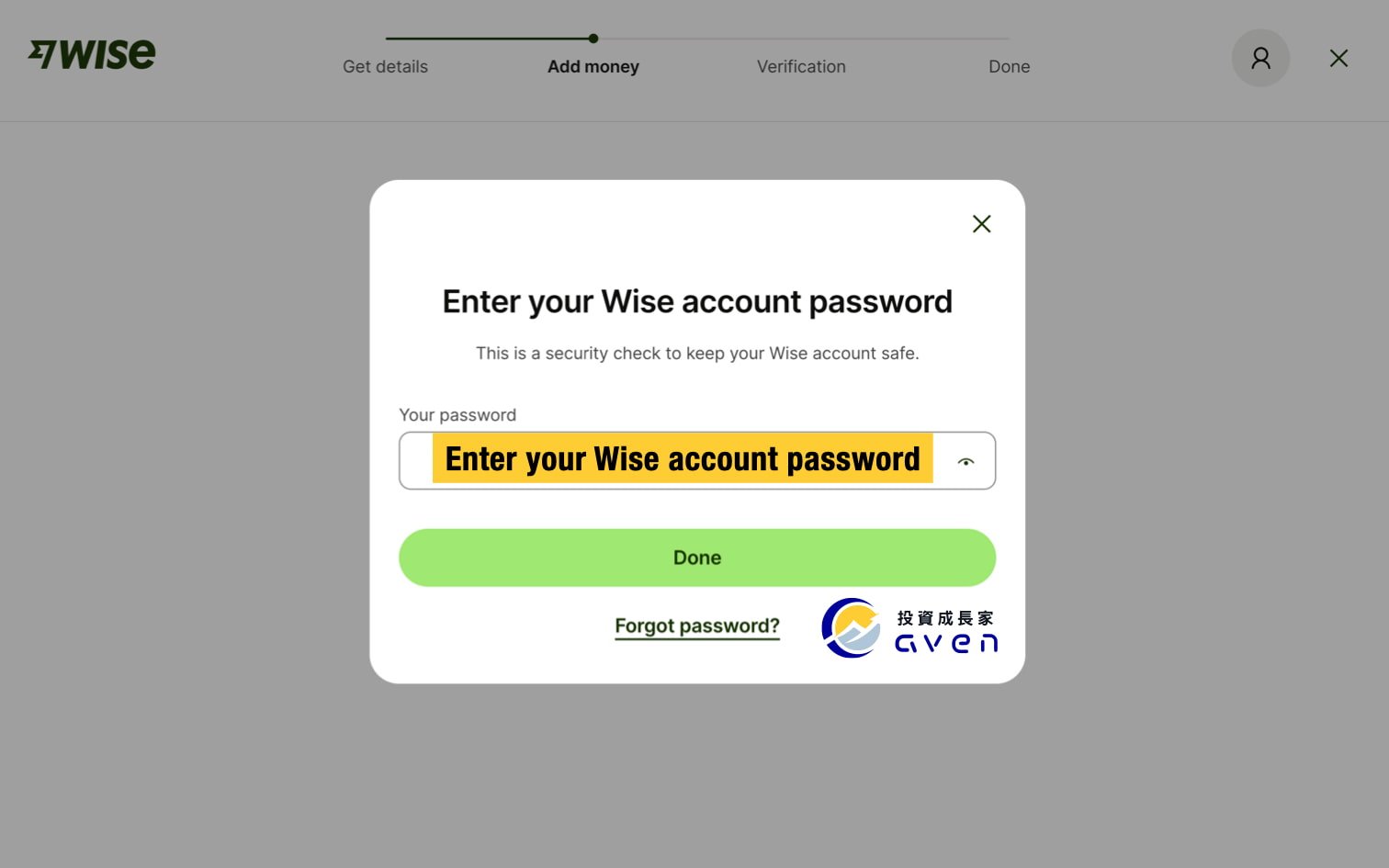

To set up your account, you need to deposit 20 USD to your Wise, the ACH fee will be 0.06 USD.Enter your Wise to finish the transaction.

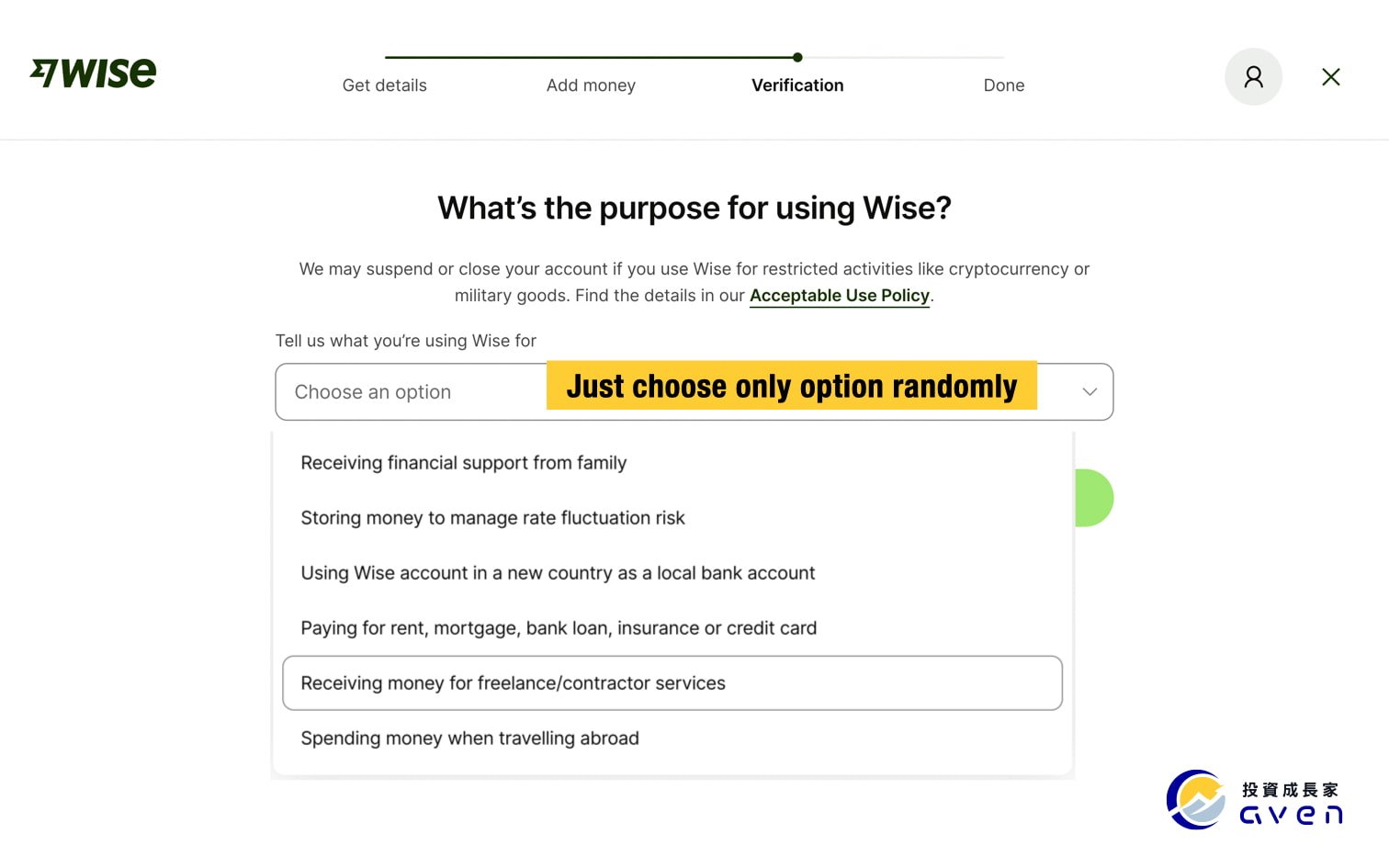

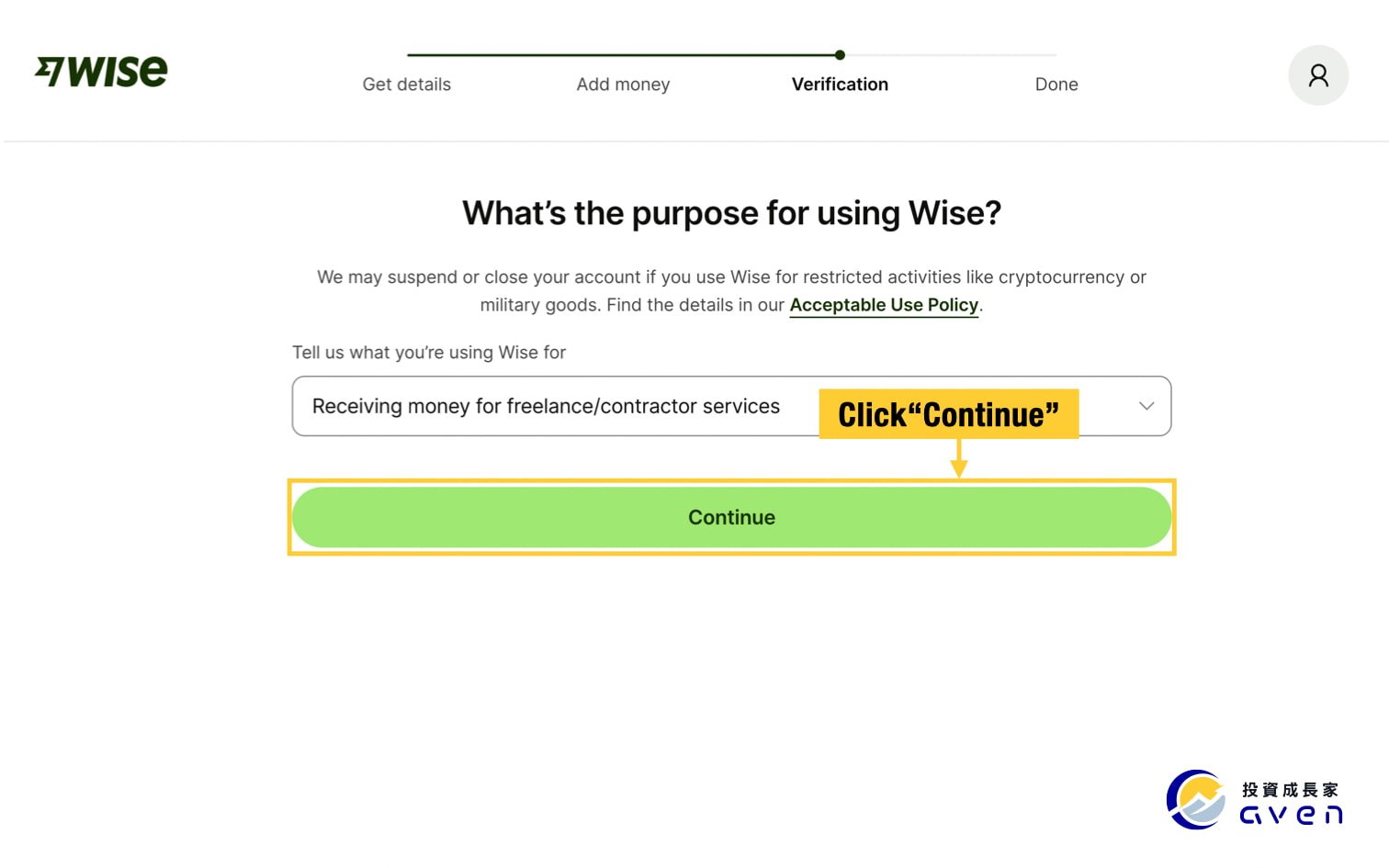

Choose your purpose for using Wise.

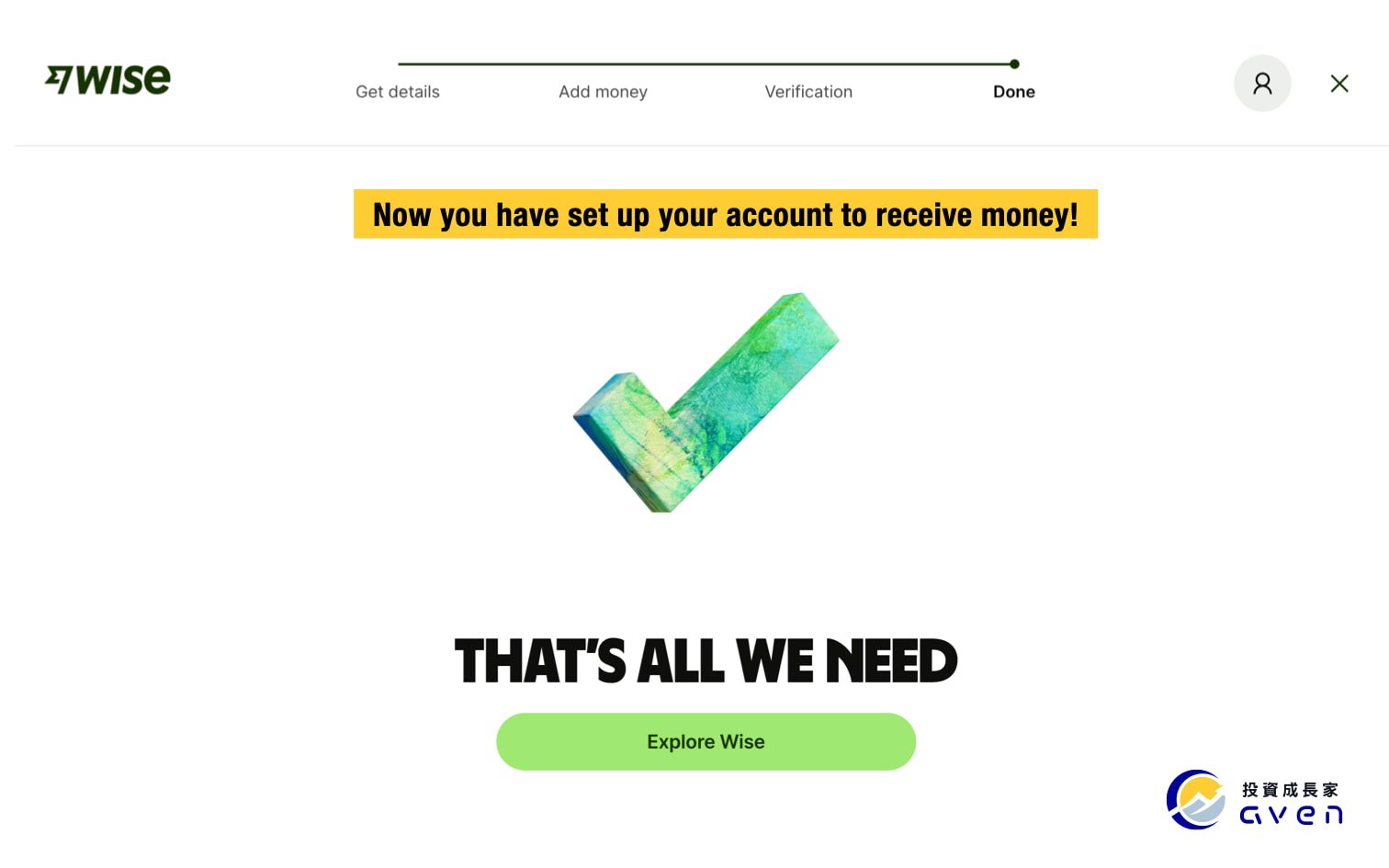

Now you are all set. You can close this website and return to IB website.

Step 2: Choose your IBKR account withdrawal method

Log in to your IBKR account, click "Transfer & Pay" and choose "Transfer Funds" -> "Withdraw Funds".

At the step of selecting your IBKR account withdrawal method, chooes "Transfer to Wise Balance" and click "Use this Method".

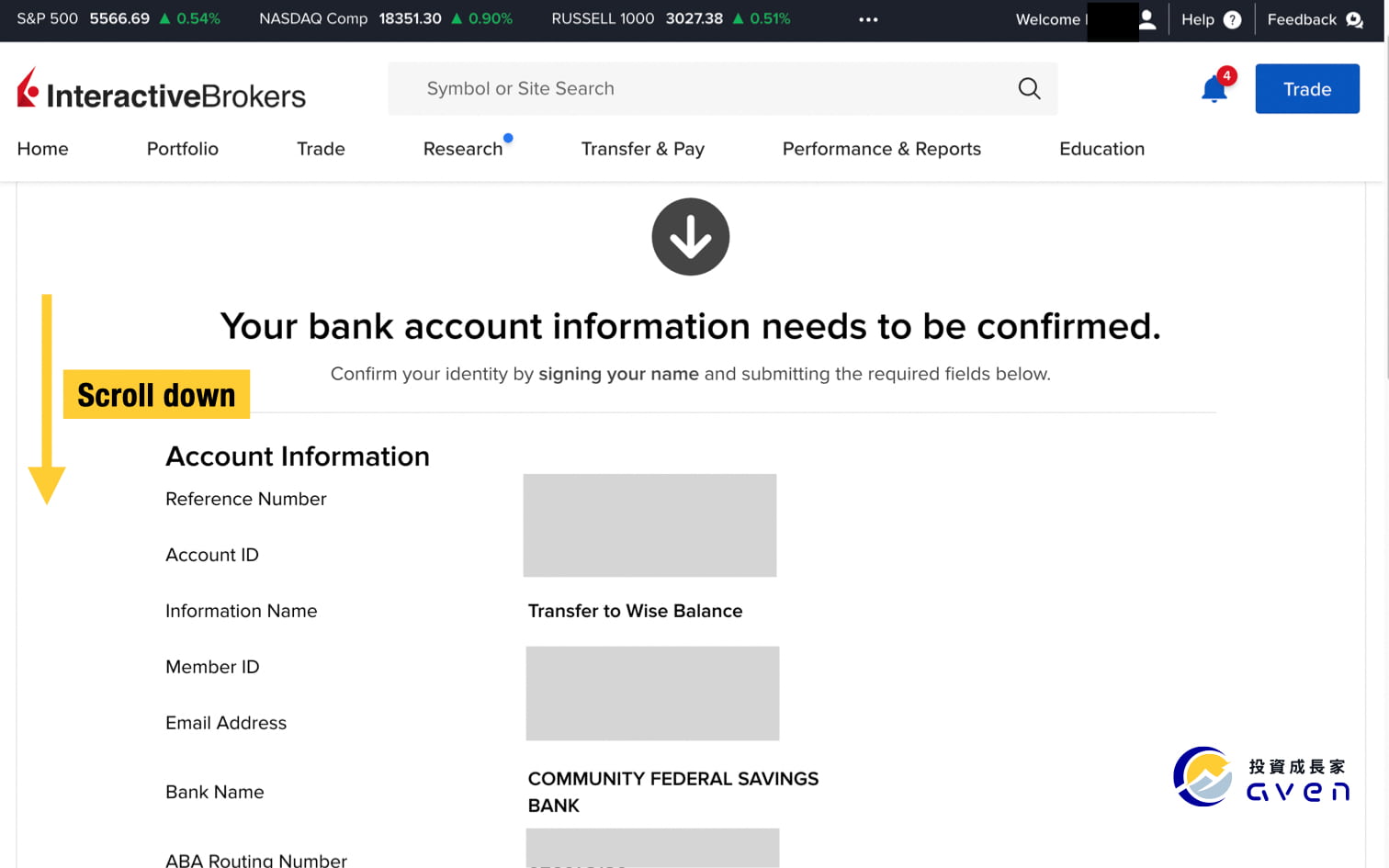

Step 3: Link your IB account with your Wise account

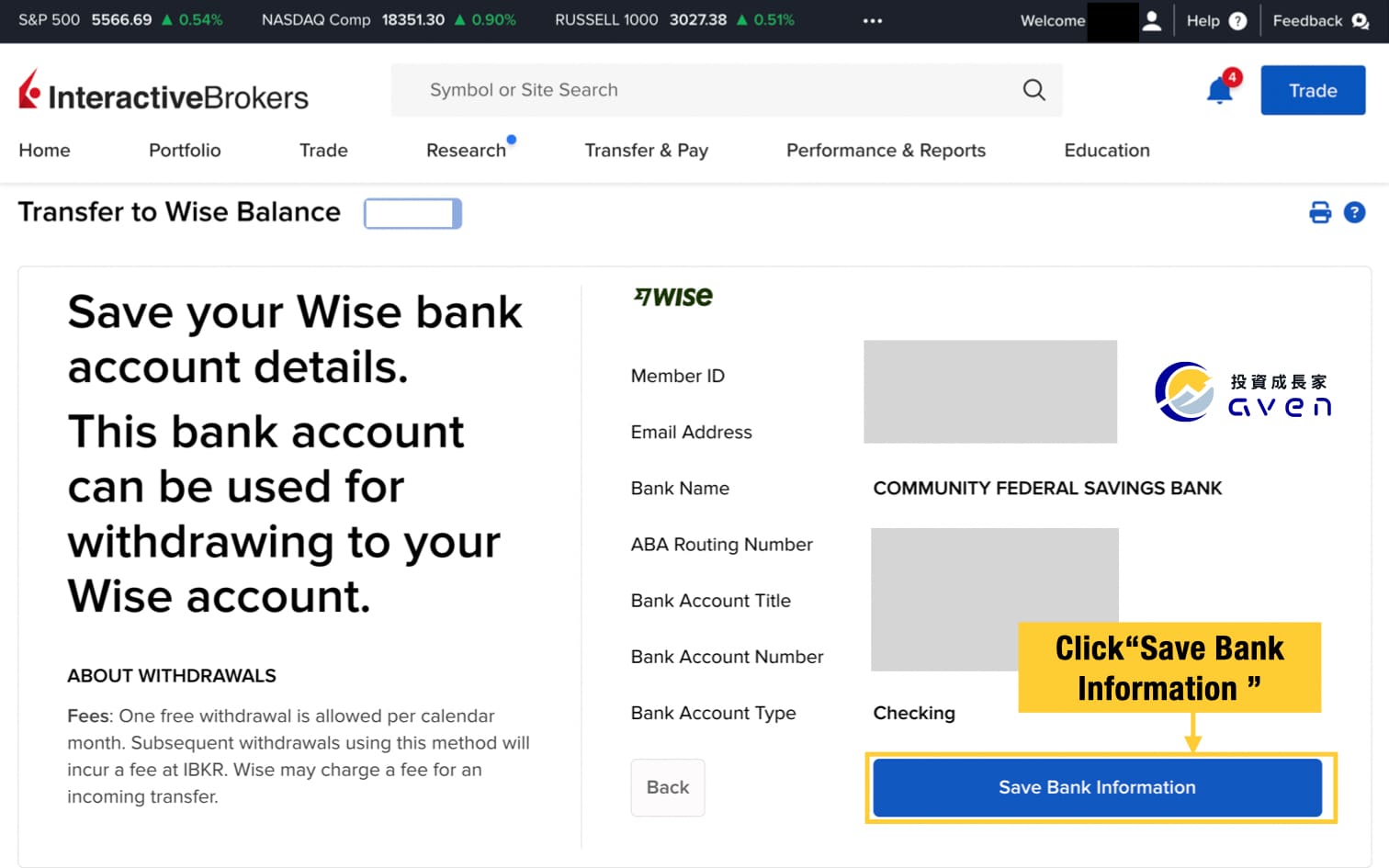

If you have set up your Wise account to receive money, you will see this page. Just click “Save Bank Information ”

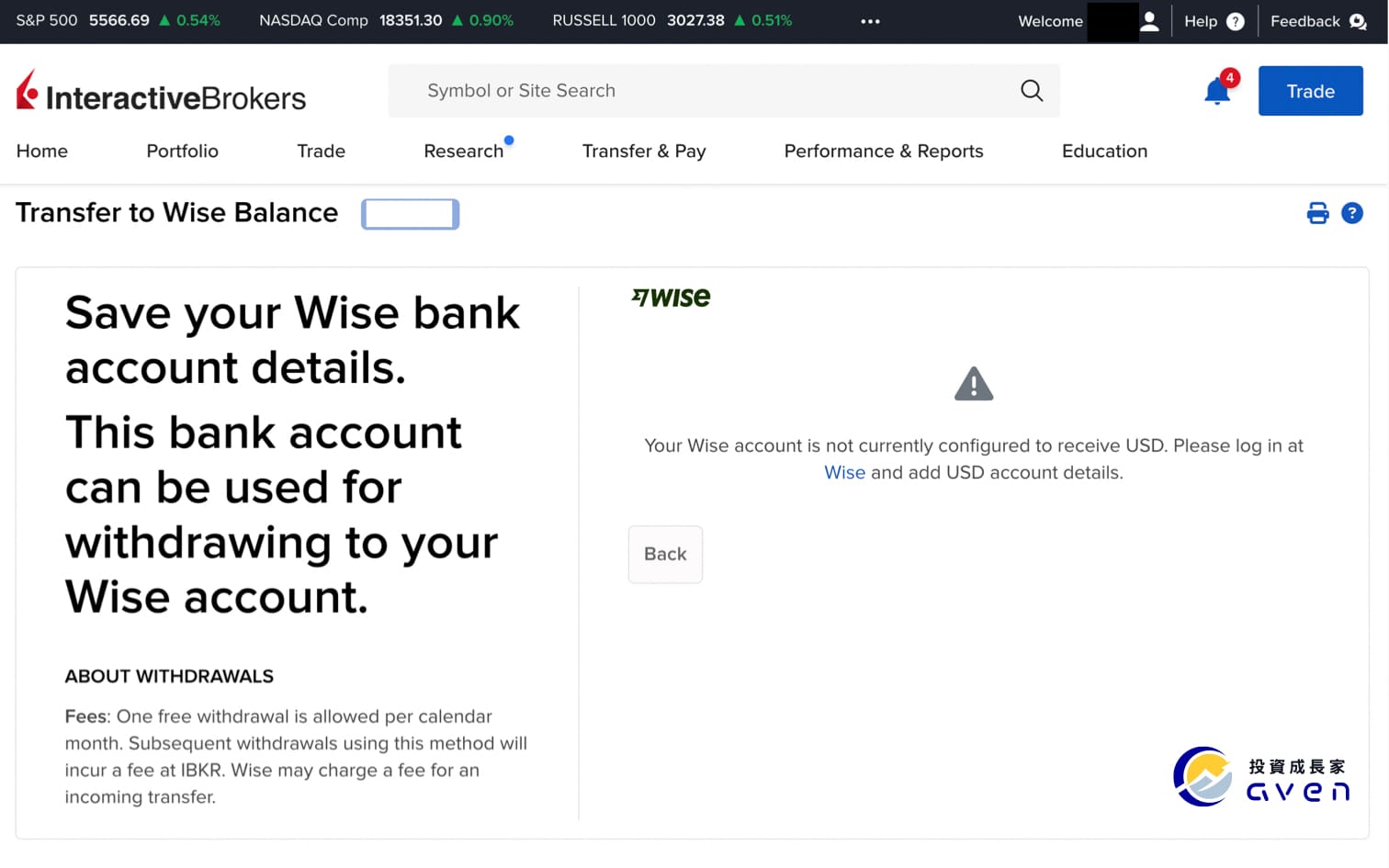

If you haven't set it up, you will see this page. In this case, you can follow step 1 to finish your set-up.

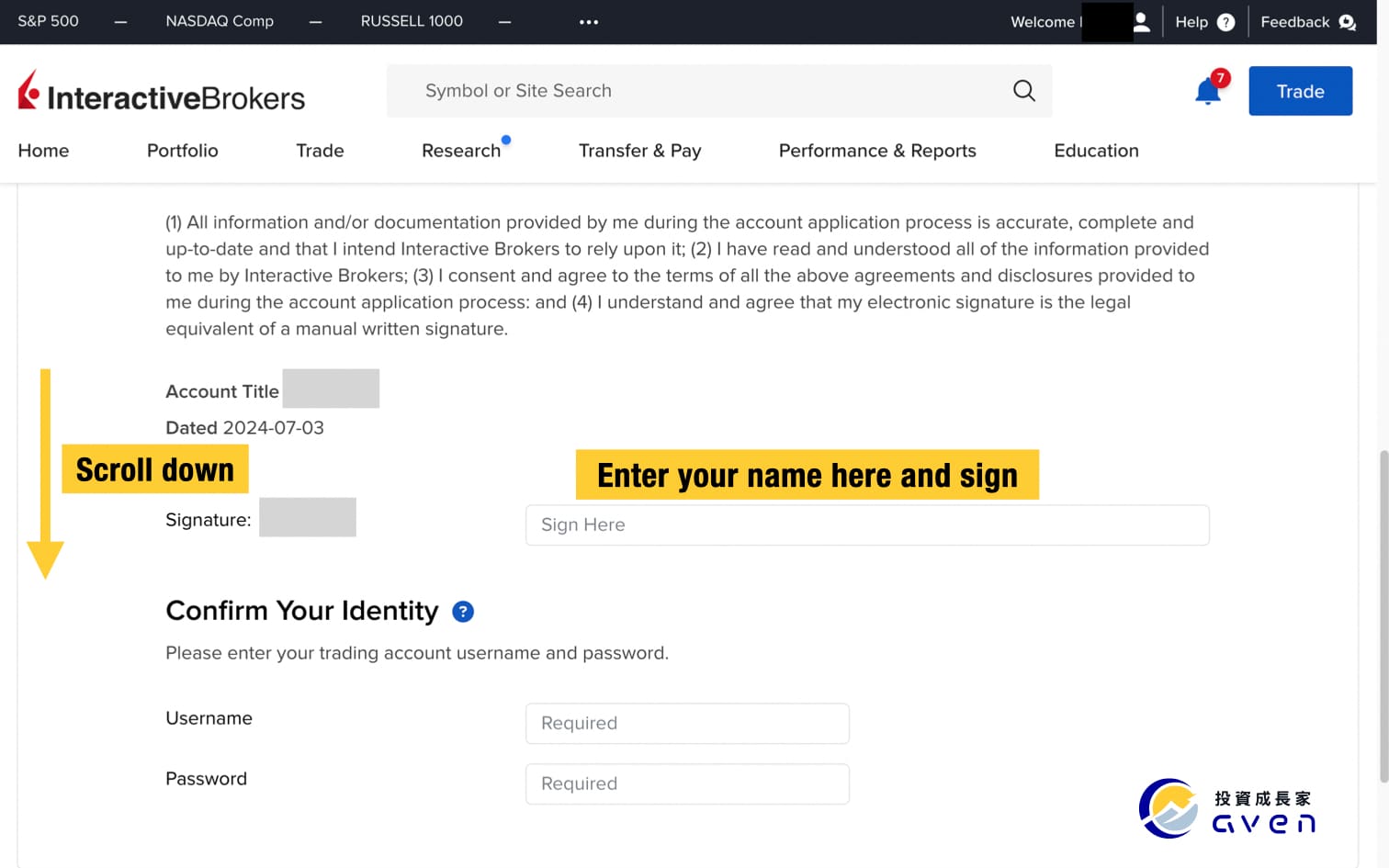

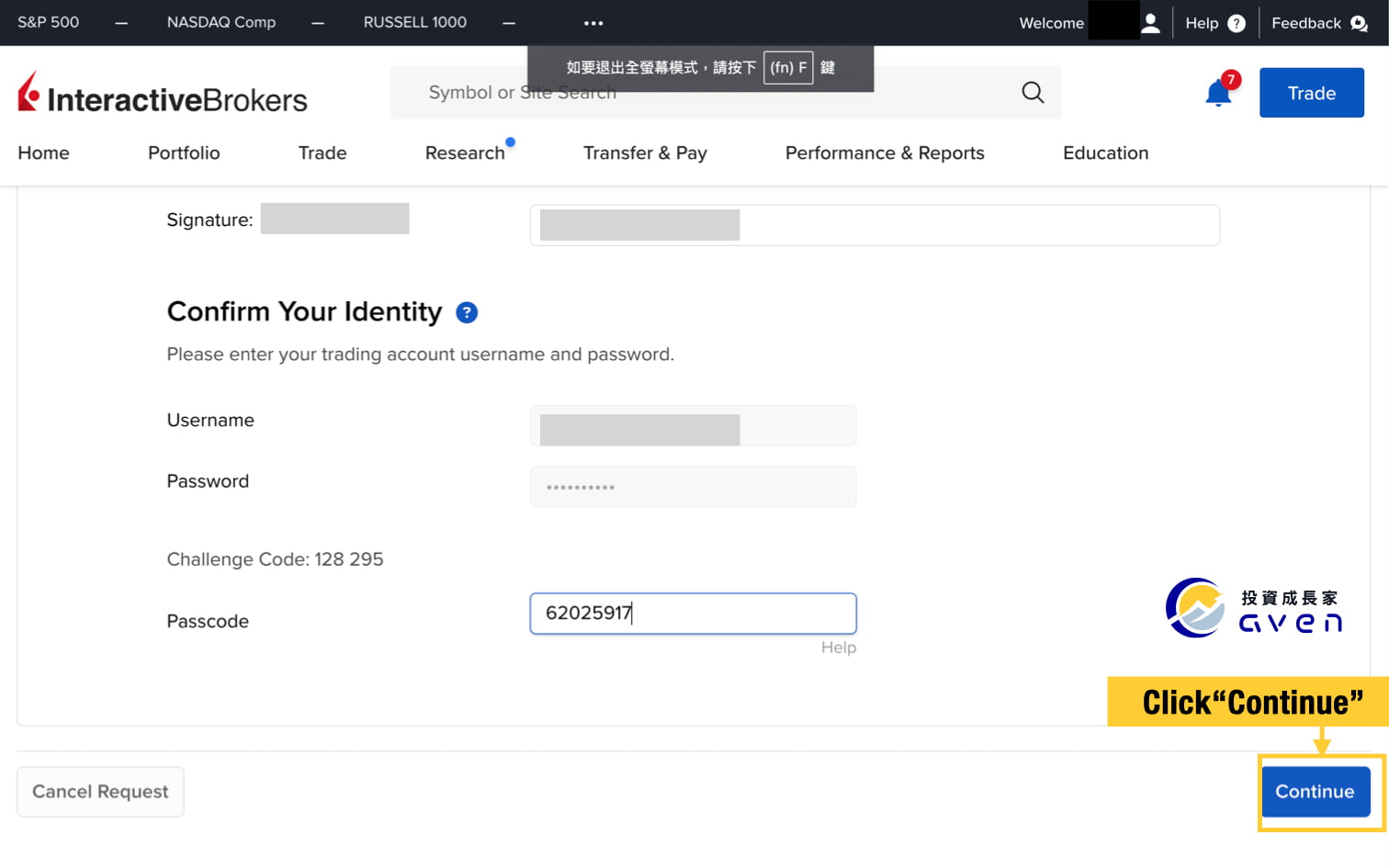

After you click "Save Bank Information," you will need to confirm your bank account information and finish the verification. You will need your smartphone at this step.

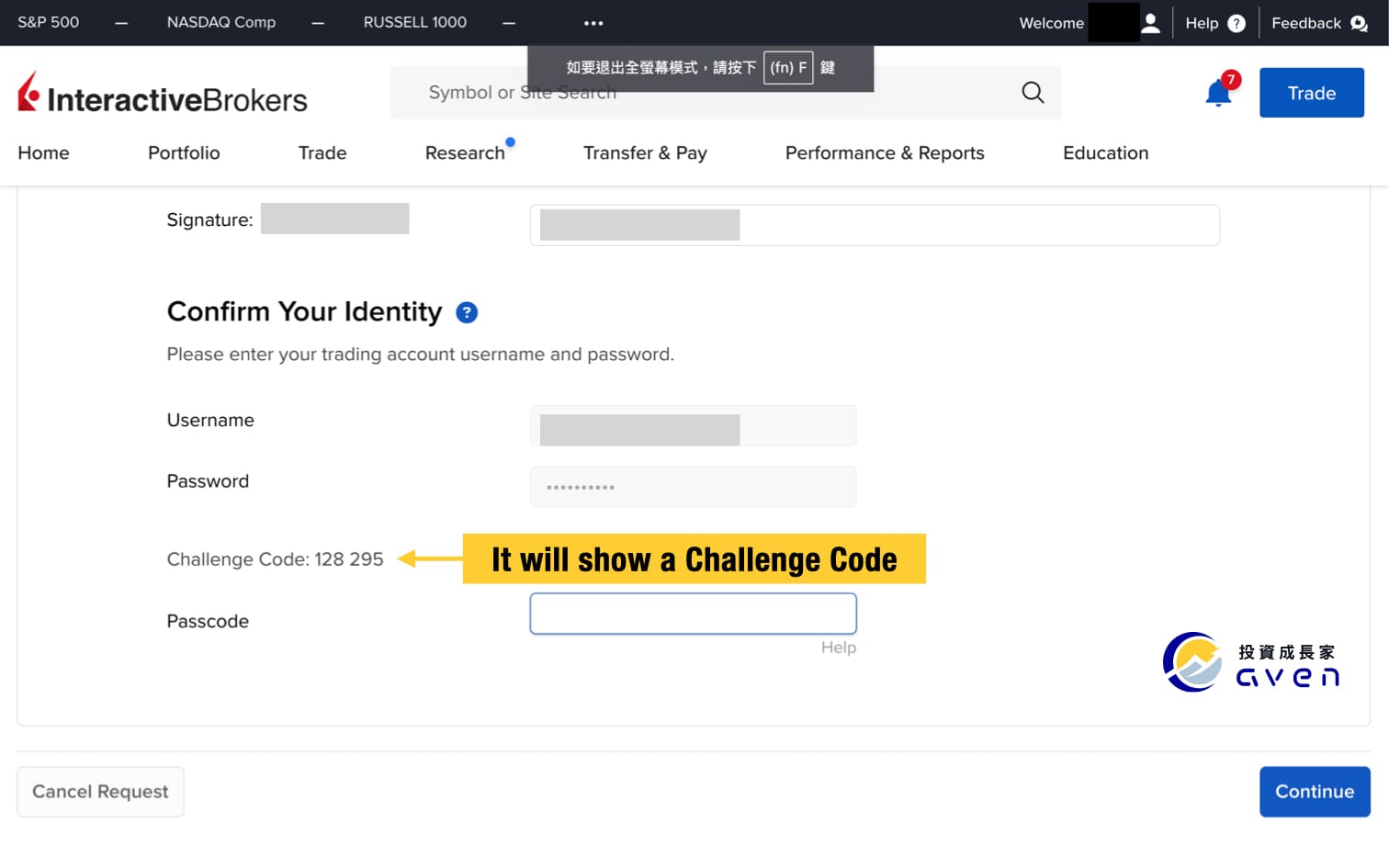

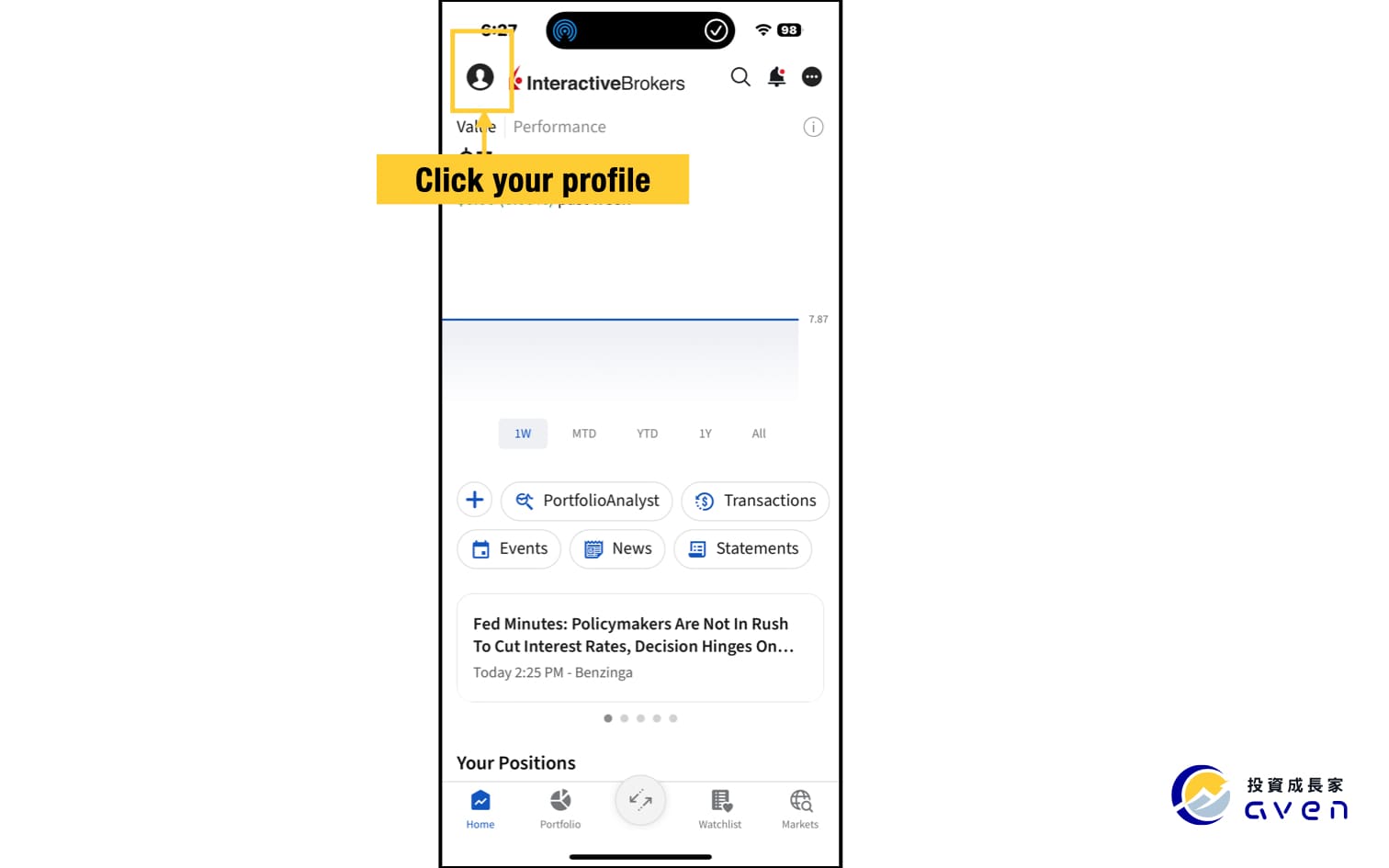

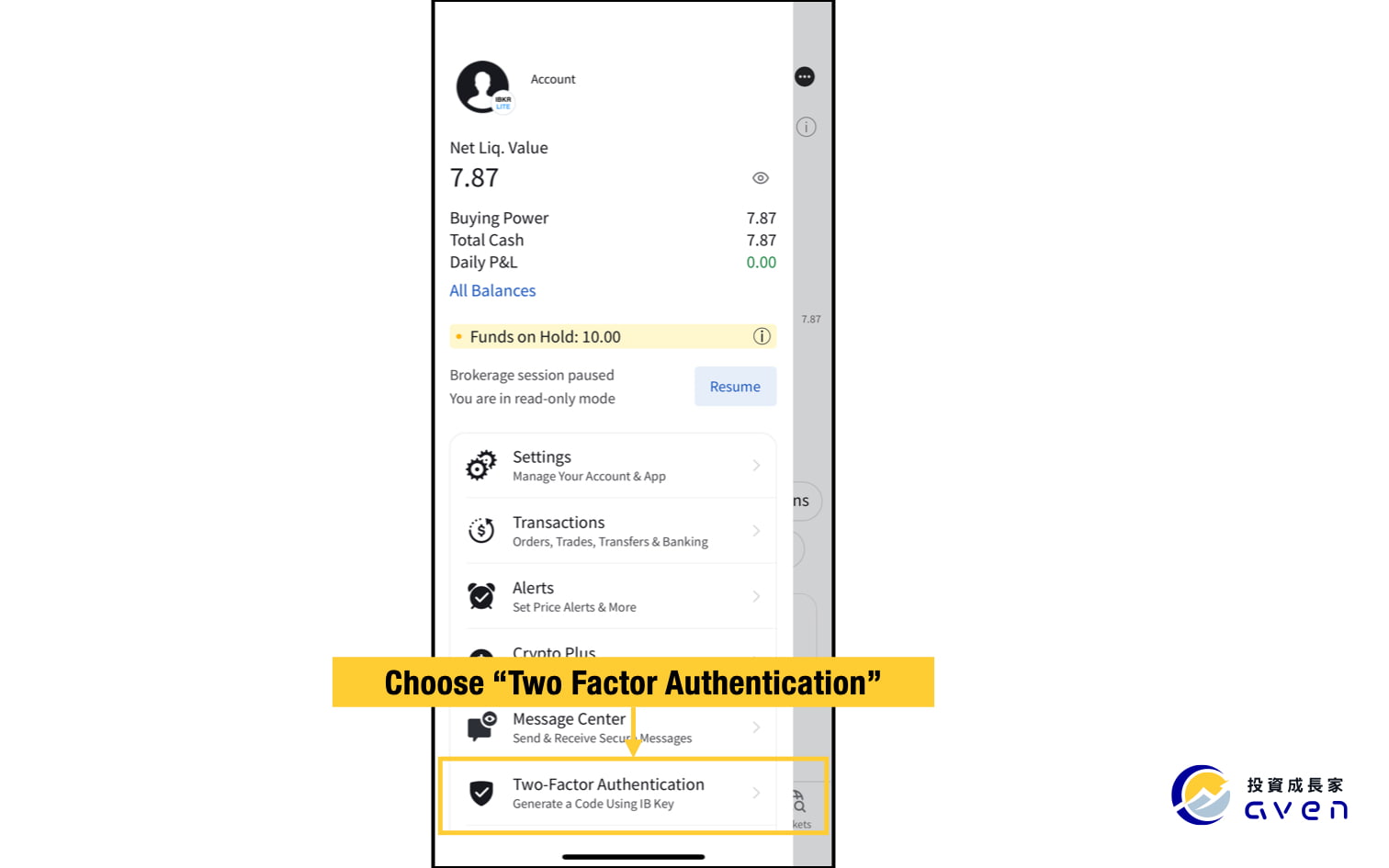

After you enter your IB Username and Password, it will show a Challenge Code. Now take out your smartphone, open your IB app, and click on your profile image.

Choose "Two Factor Authentication".

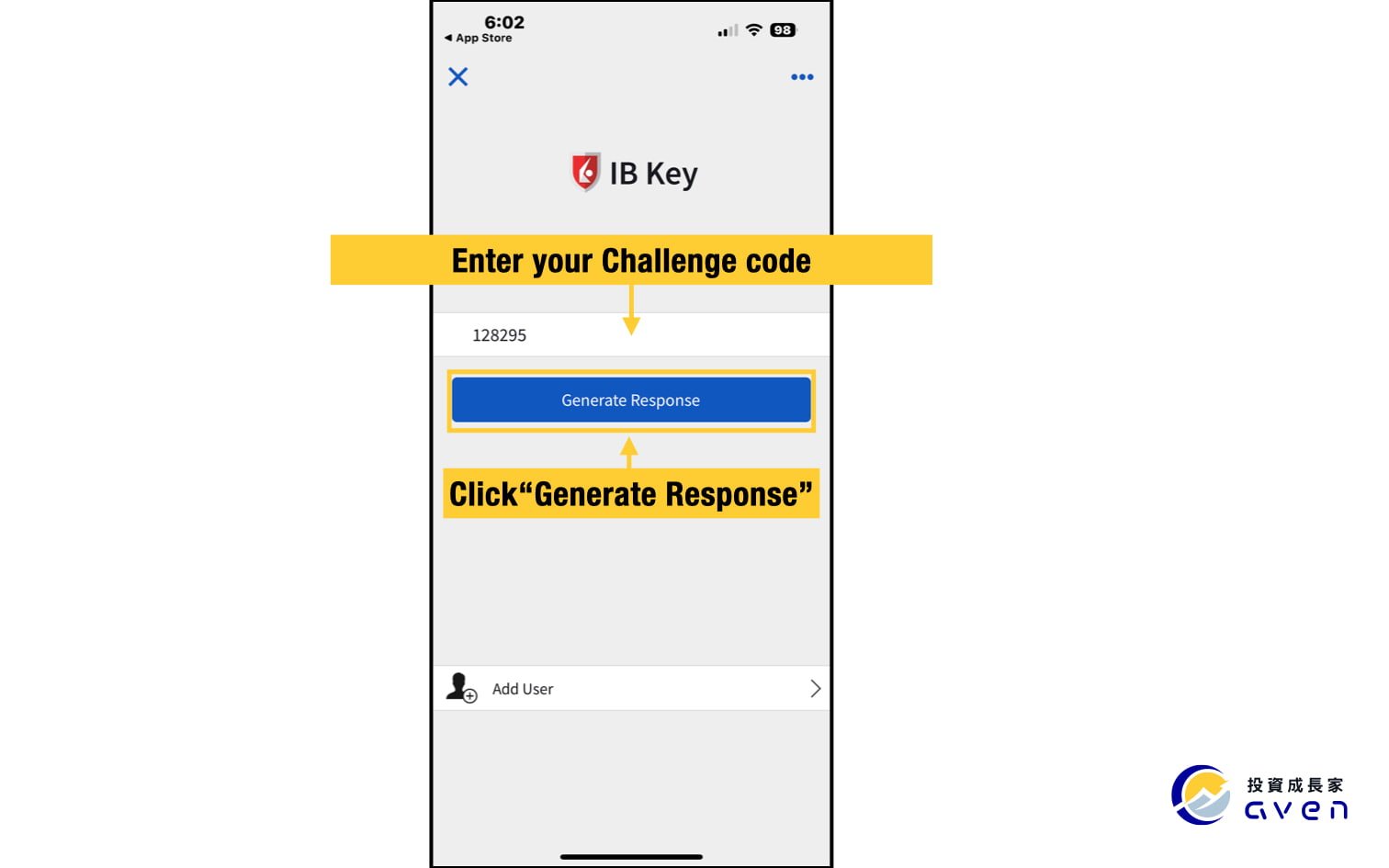

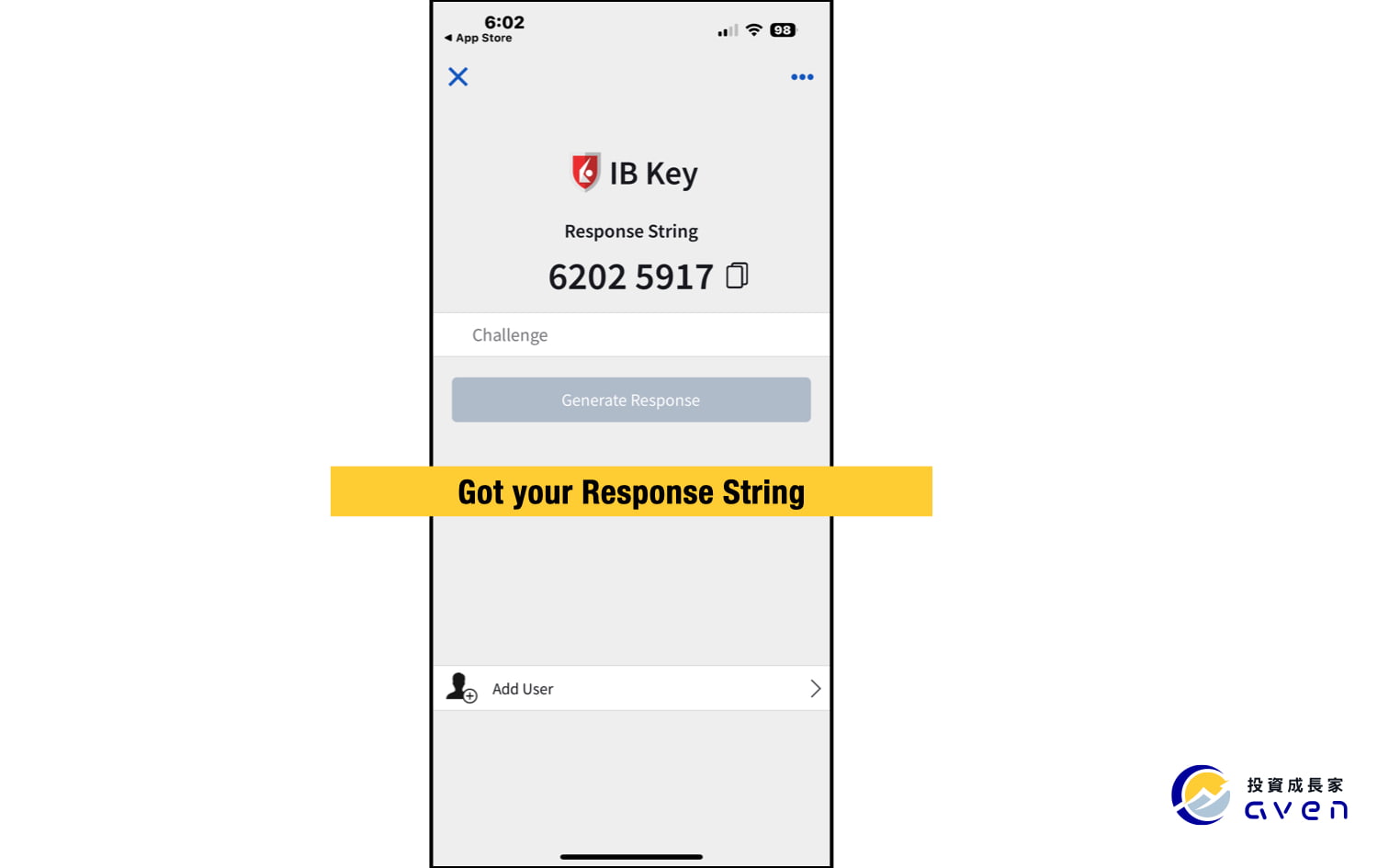

Enter your Challenge Code and get your Responses String code.

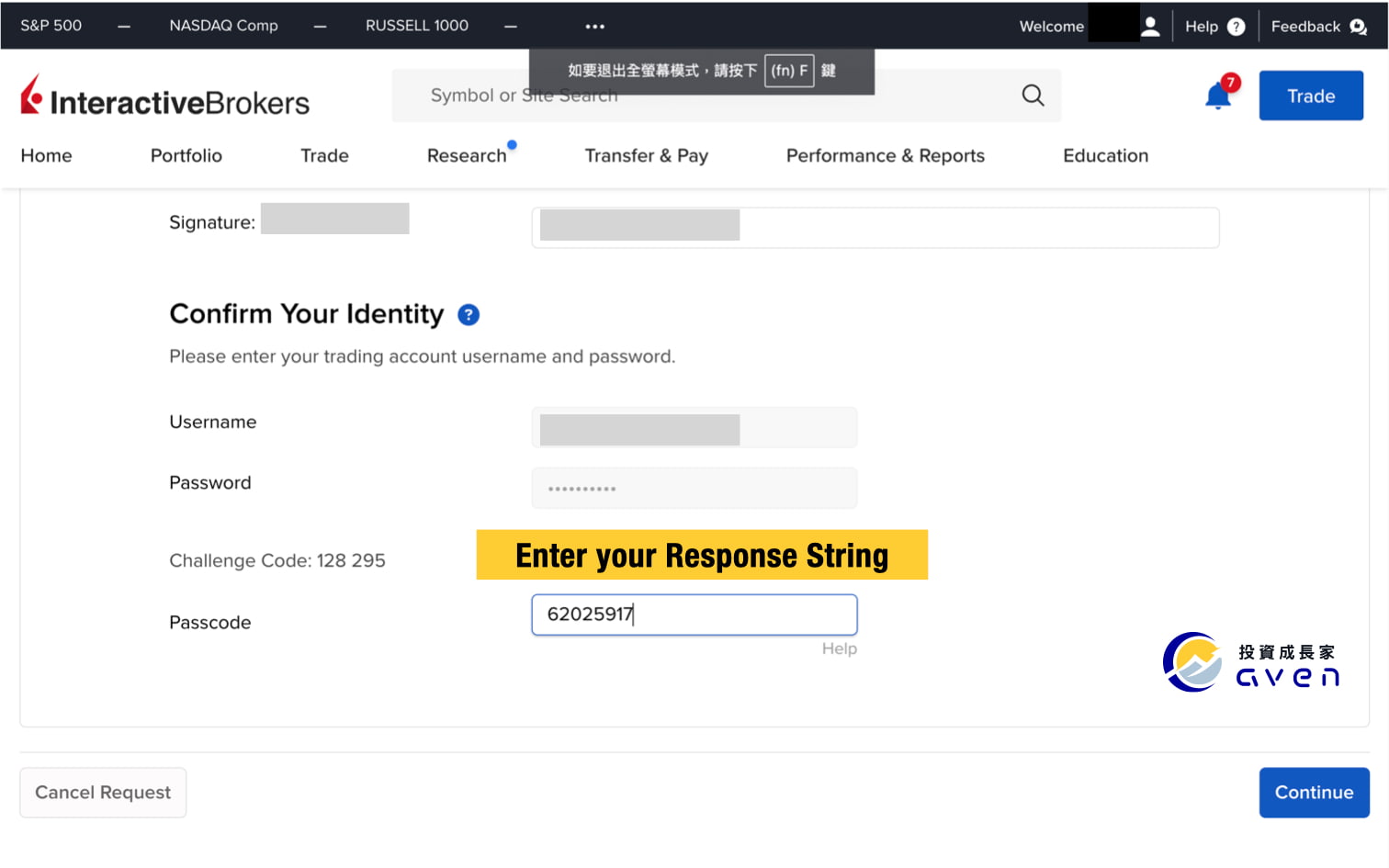

Go back to your website and enter your Response String code.

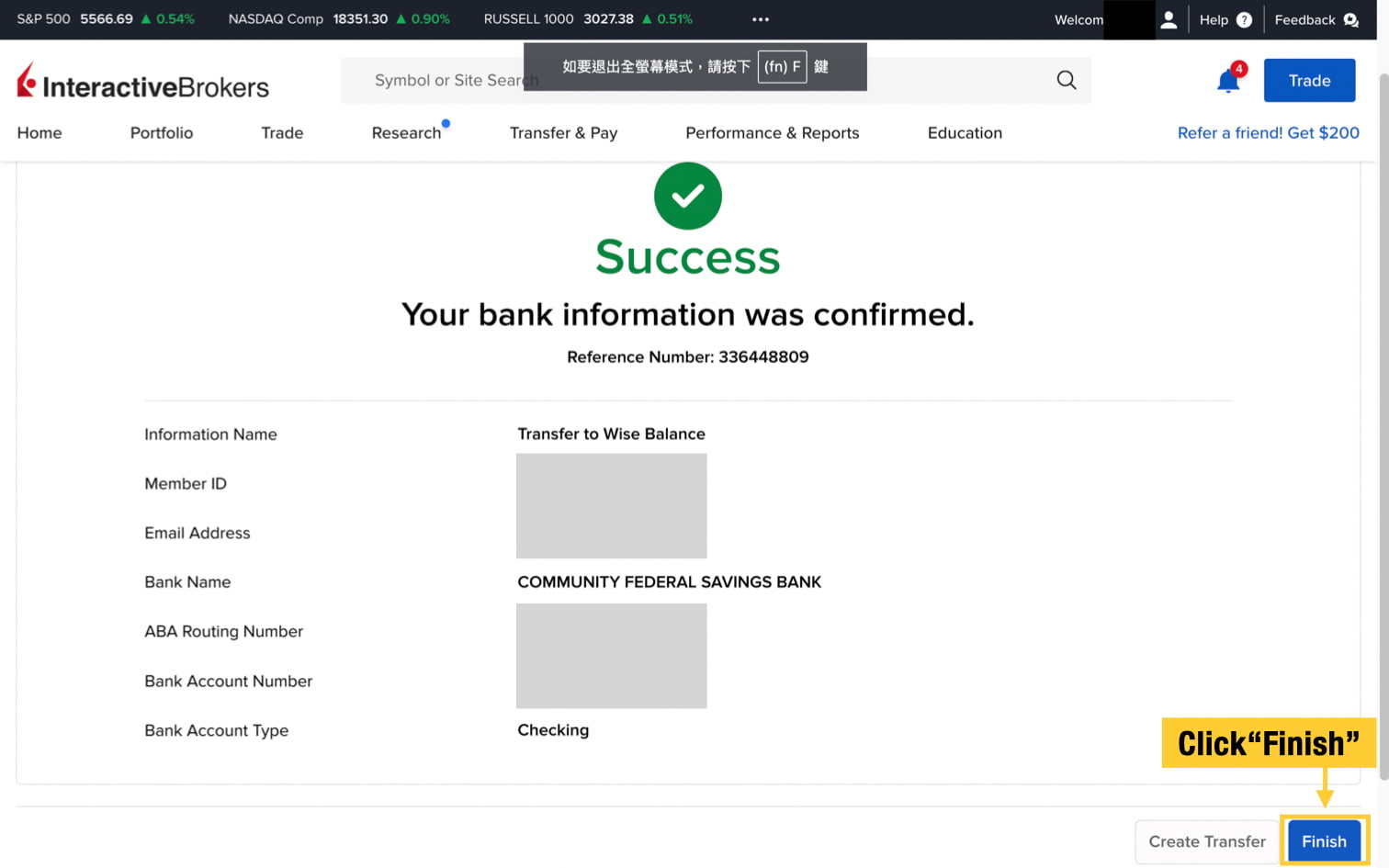

Now your Wise account has been successfully linked to your IB account to receive money!

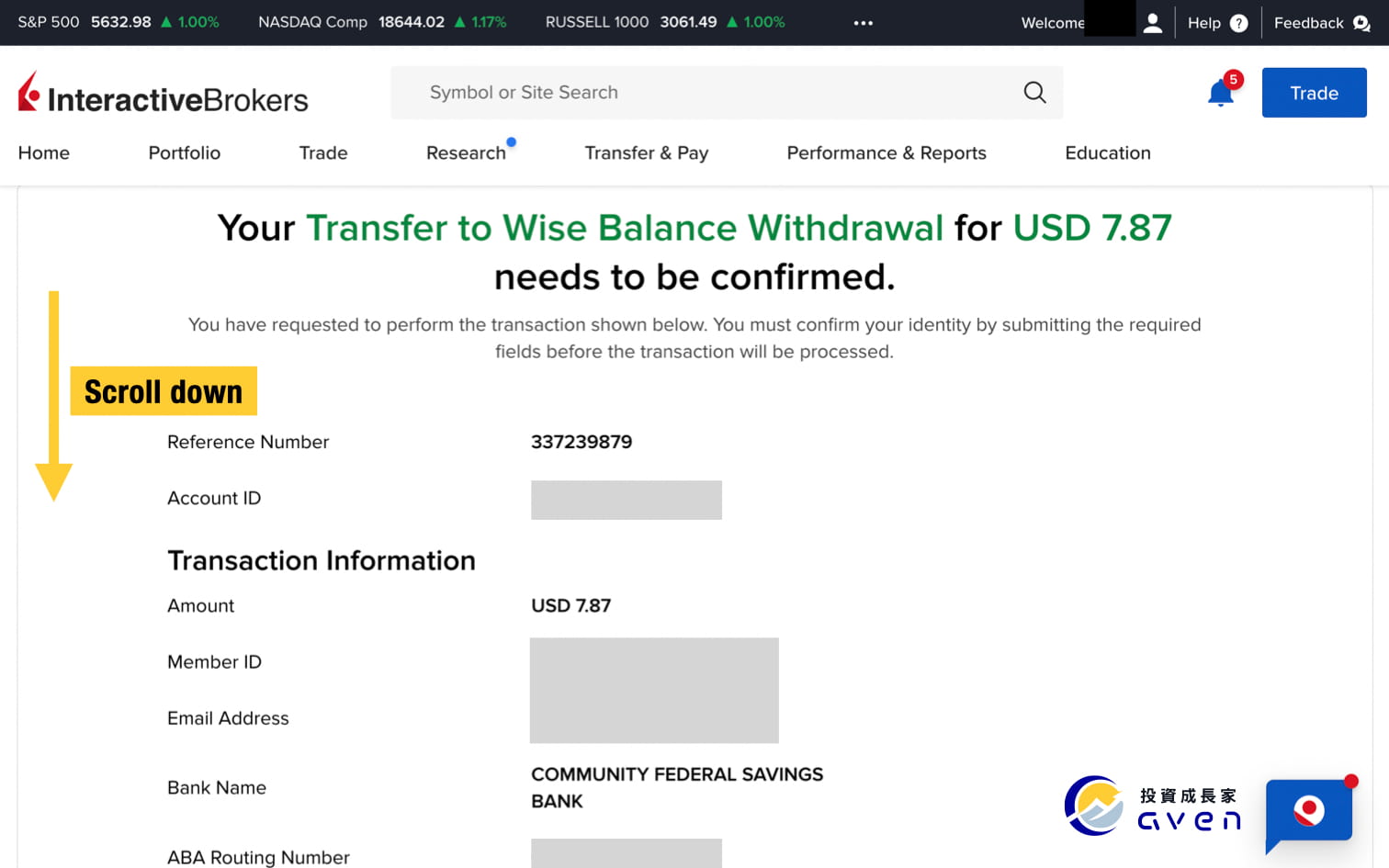

Step 4: Withdraw your money from your IB account to your Wise account

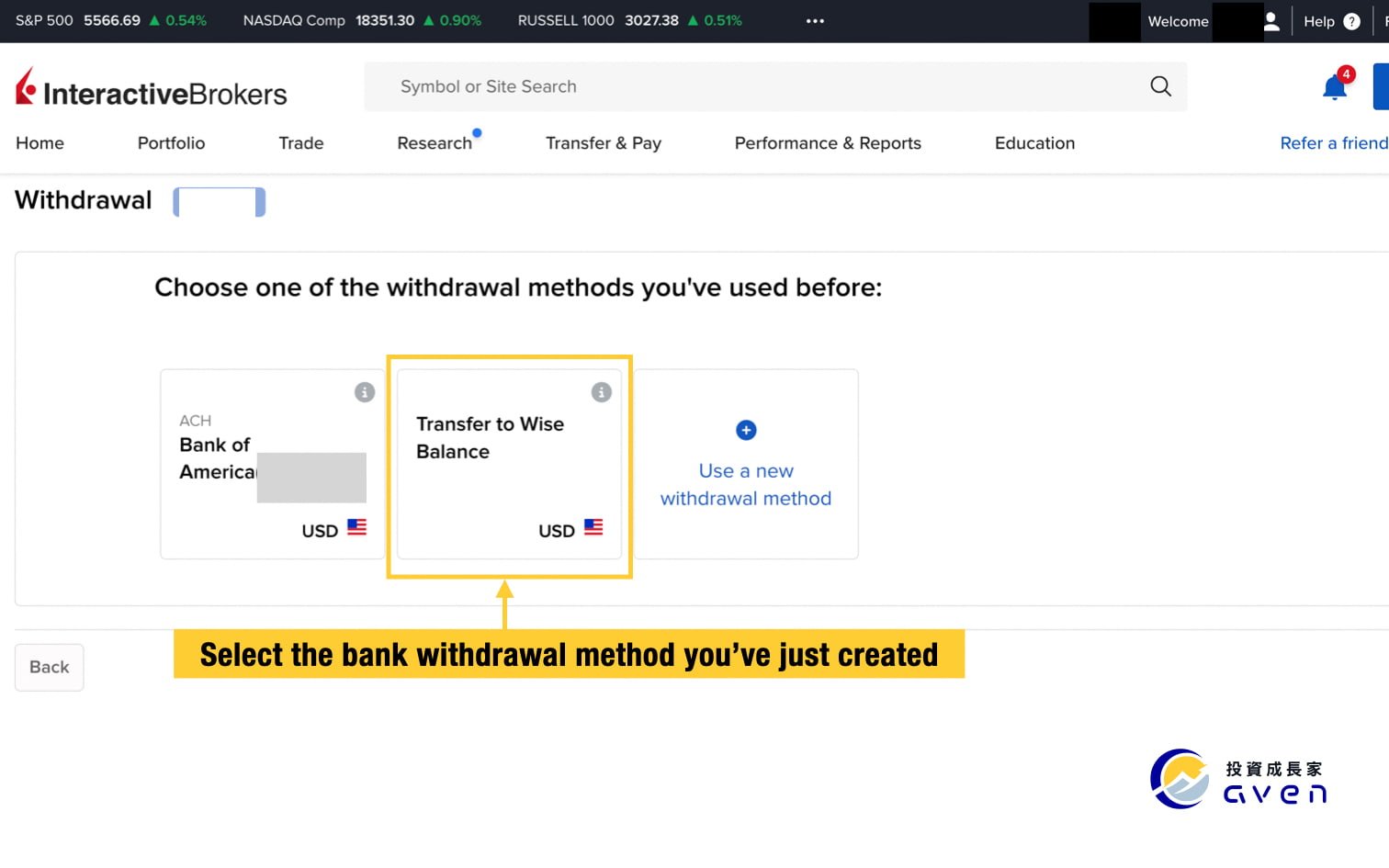

Now we can withdraw your money from your IB account and transfer it to your Wise balance. Log in to your IB account, click Transfer & Pay and choose "Transfer Funds" -> "Withdraw Funds".

If you've successfully linked your Wise account, you will see it in your withdrawal method. Now you can select it.

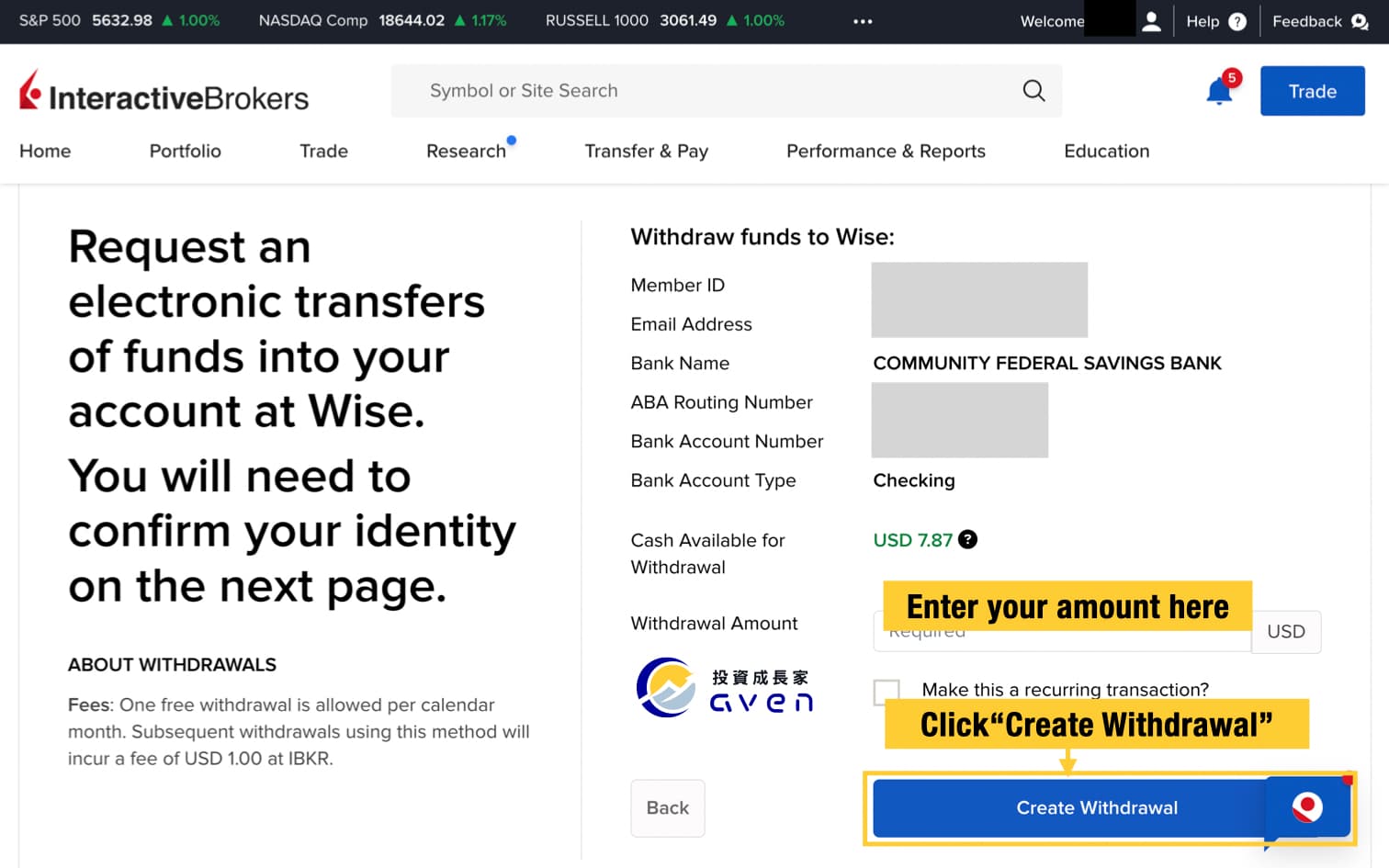

Just enter your withdrawal amount.

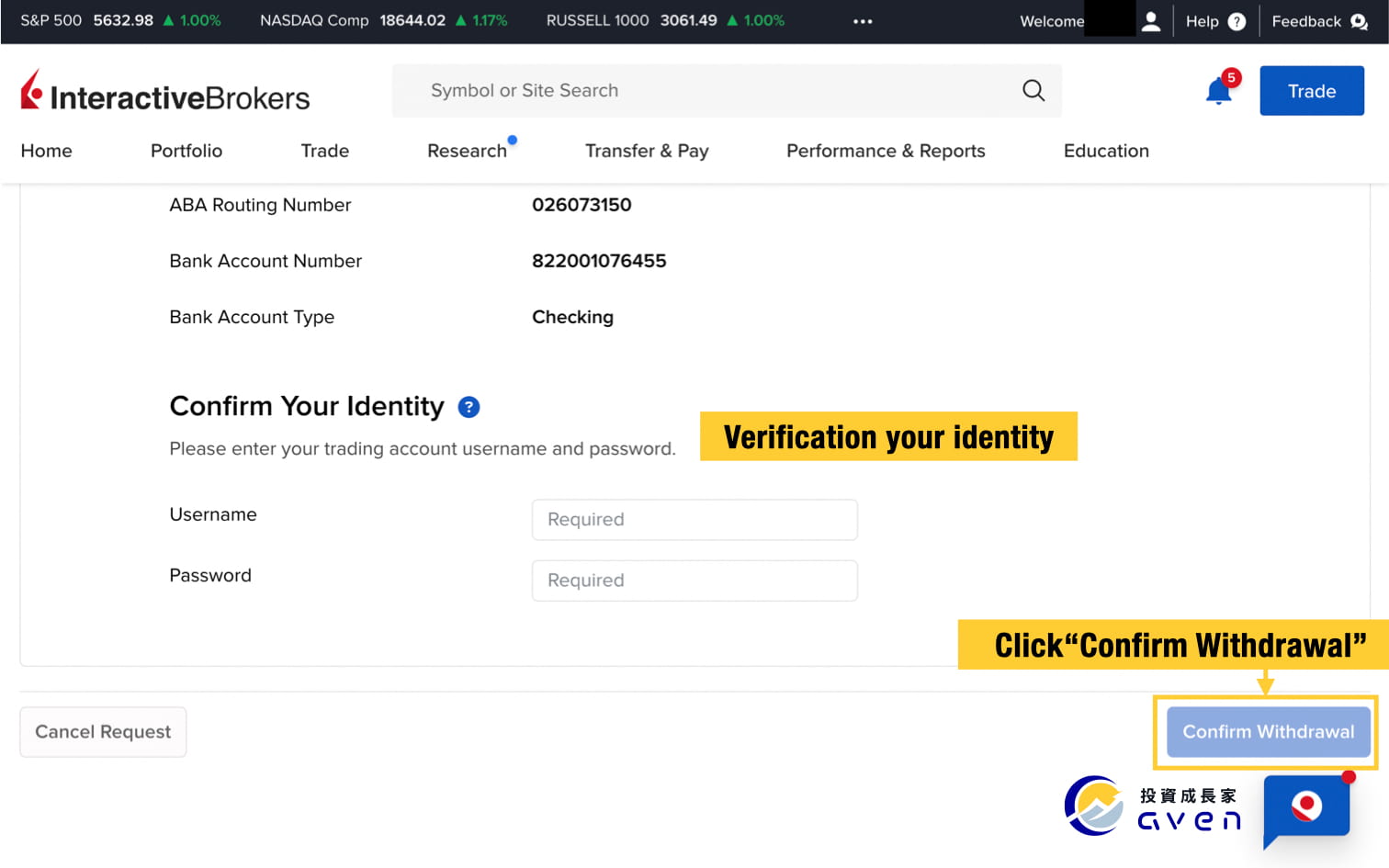

Then you need to confirm your information and verify your identity to withdraw money to your Wise account.

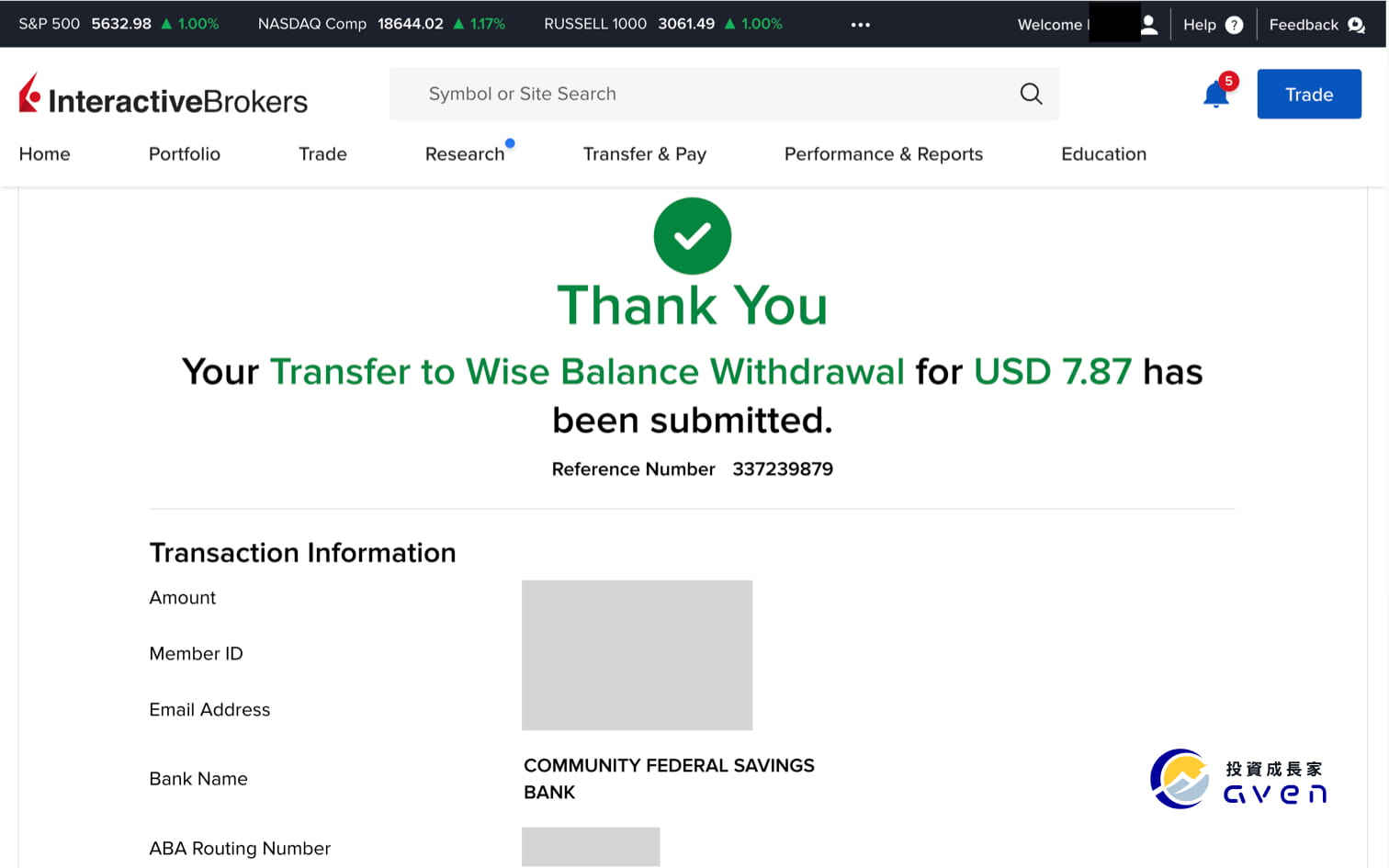

After you see this message, it means you have successfully withdrawn your money from your IB account to your Wise account.

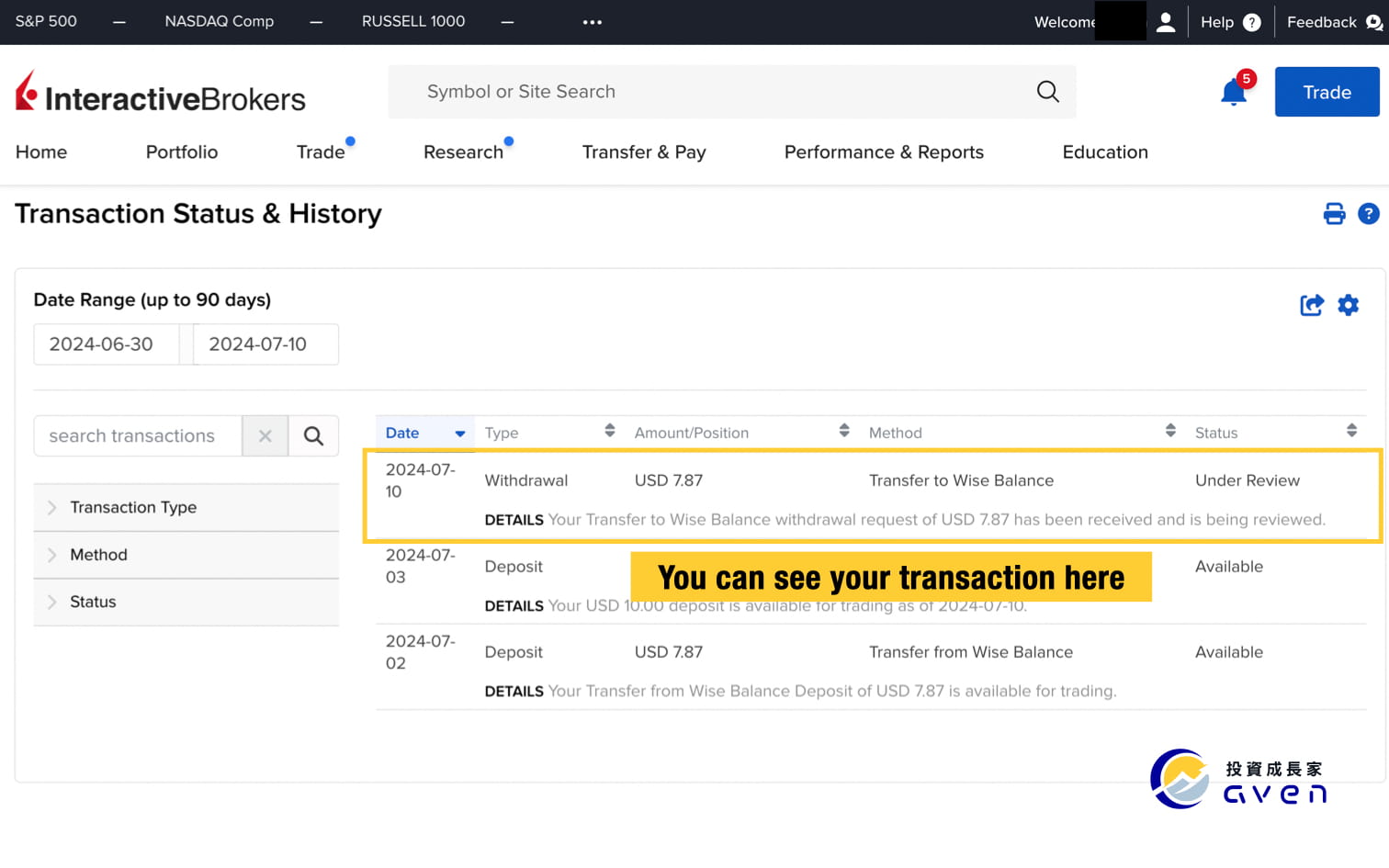

Step 5: Check your Transaction Status & History

After you deposit your IB account, you can click “Transfer & Pay”->” Transaction Status & History” to check your deposit.

Withdraw money from your interactive Brokers with Connect Your Bank via ACH Method (Apply to only U.S bank account owners)

Step 1: Withdraw your money from your IB account to your US bank account

Step 2: Check your Transaction Status & History

Step 1: Withdraw your money from your IB account to your US bank account

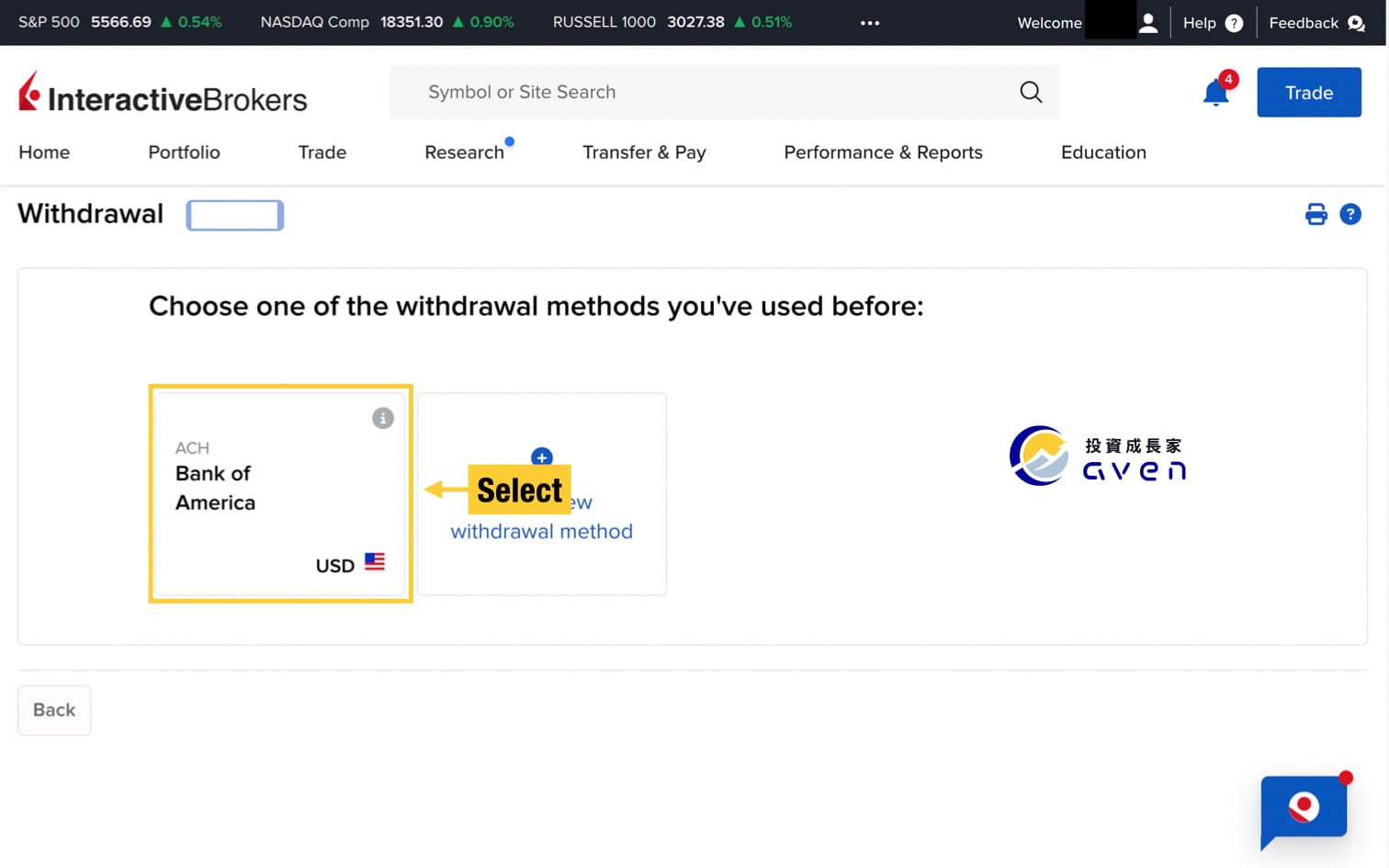

If you have linked your Bank to your IB account, your ACH method will show up automatically in your withdrawal method. You can log into your IB account and click "Transfer & Pay" -> "Withdrawal Funds" and select it.

(If you haven't linked your bank account yet, you can refer to the "IBKR Deposit Guide" article for instructions on how to do so.)

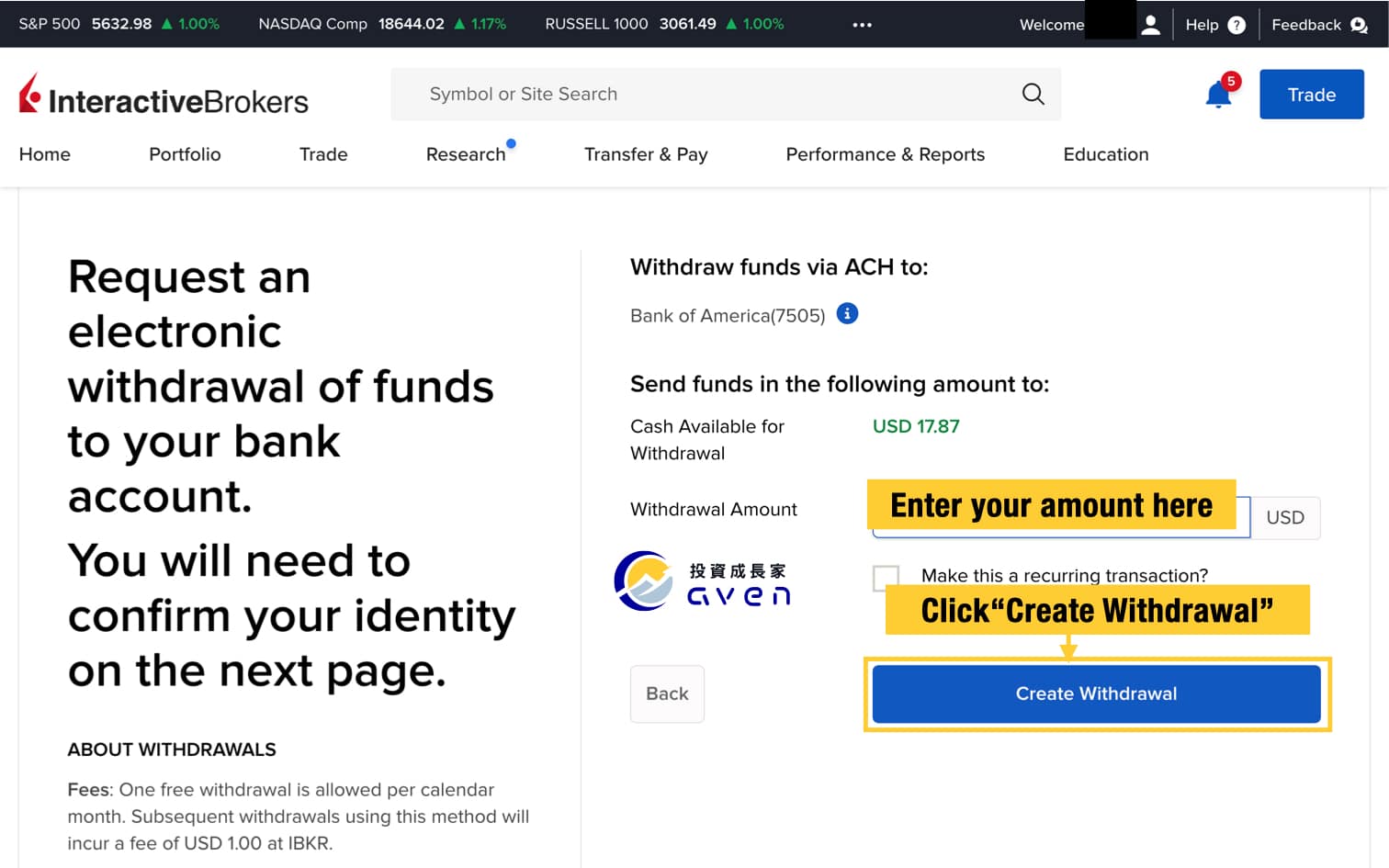

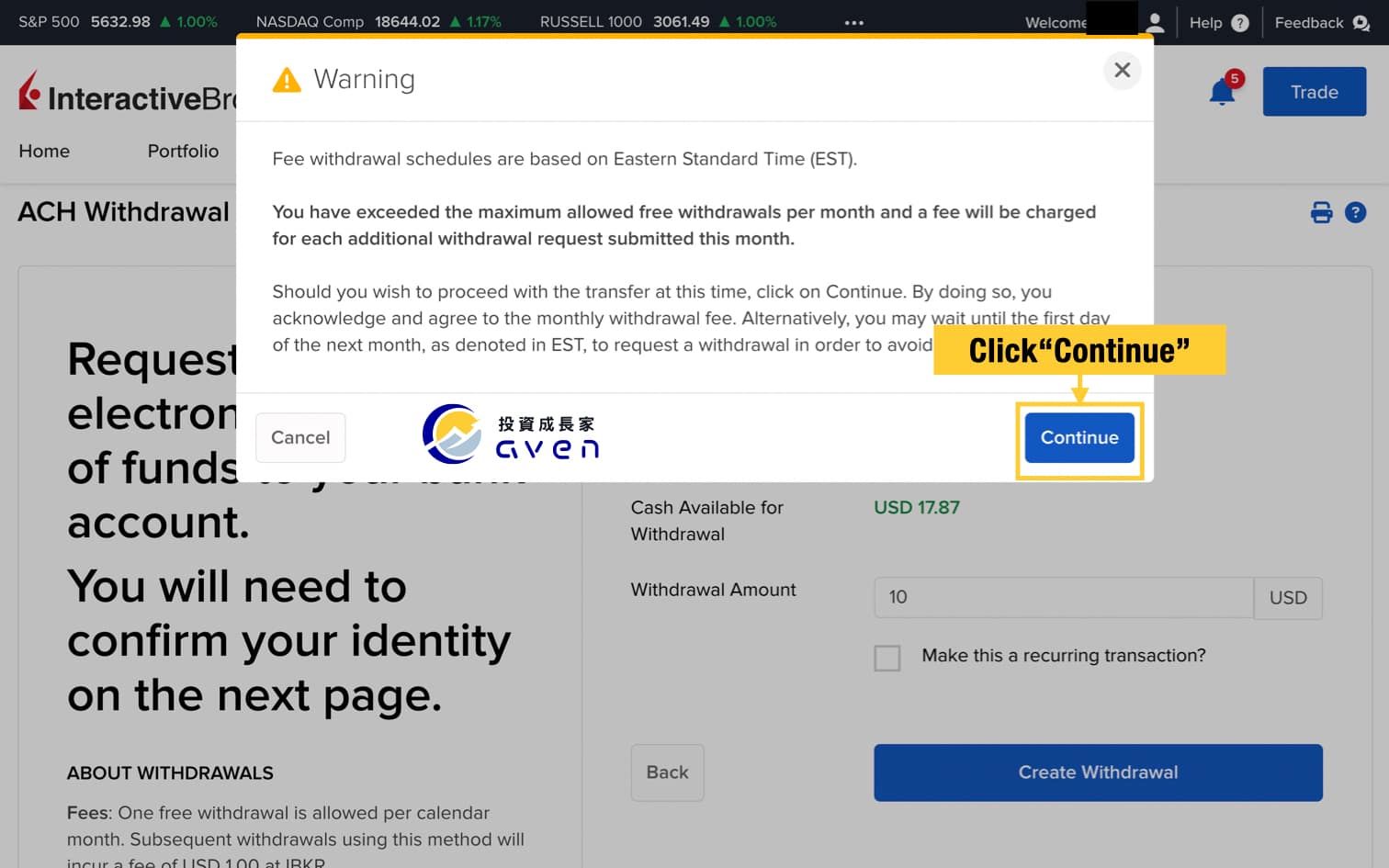

Enter your withdrawal amount and click "Create Withdrawal".

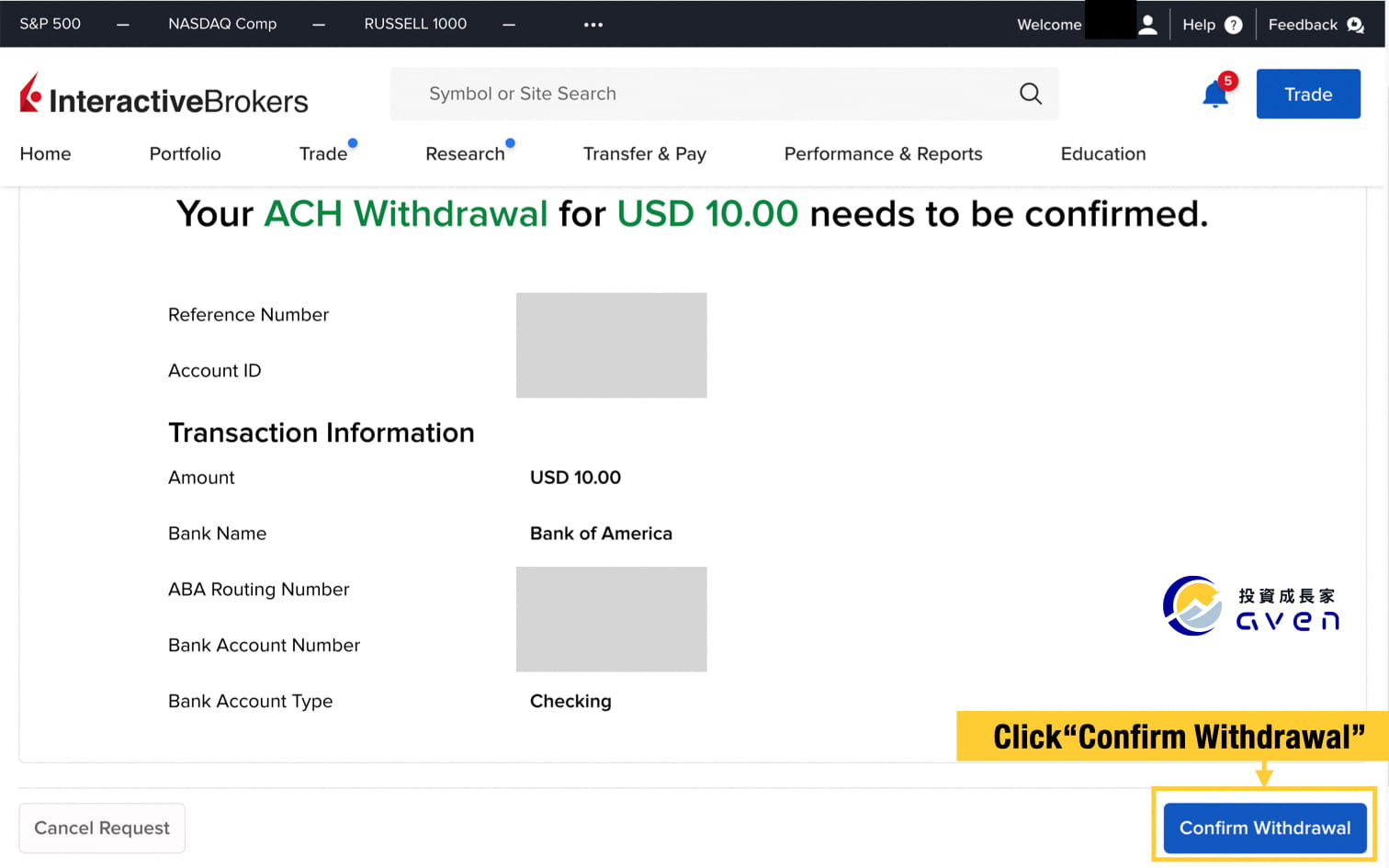

Then you need to confirm your withdrawal information.

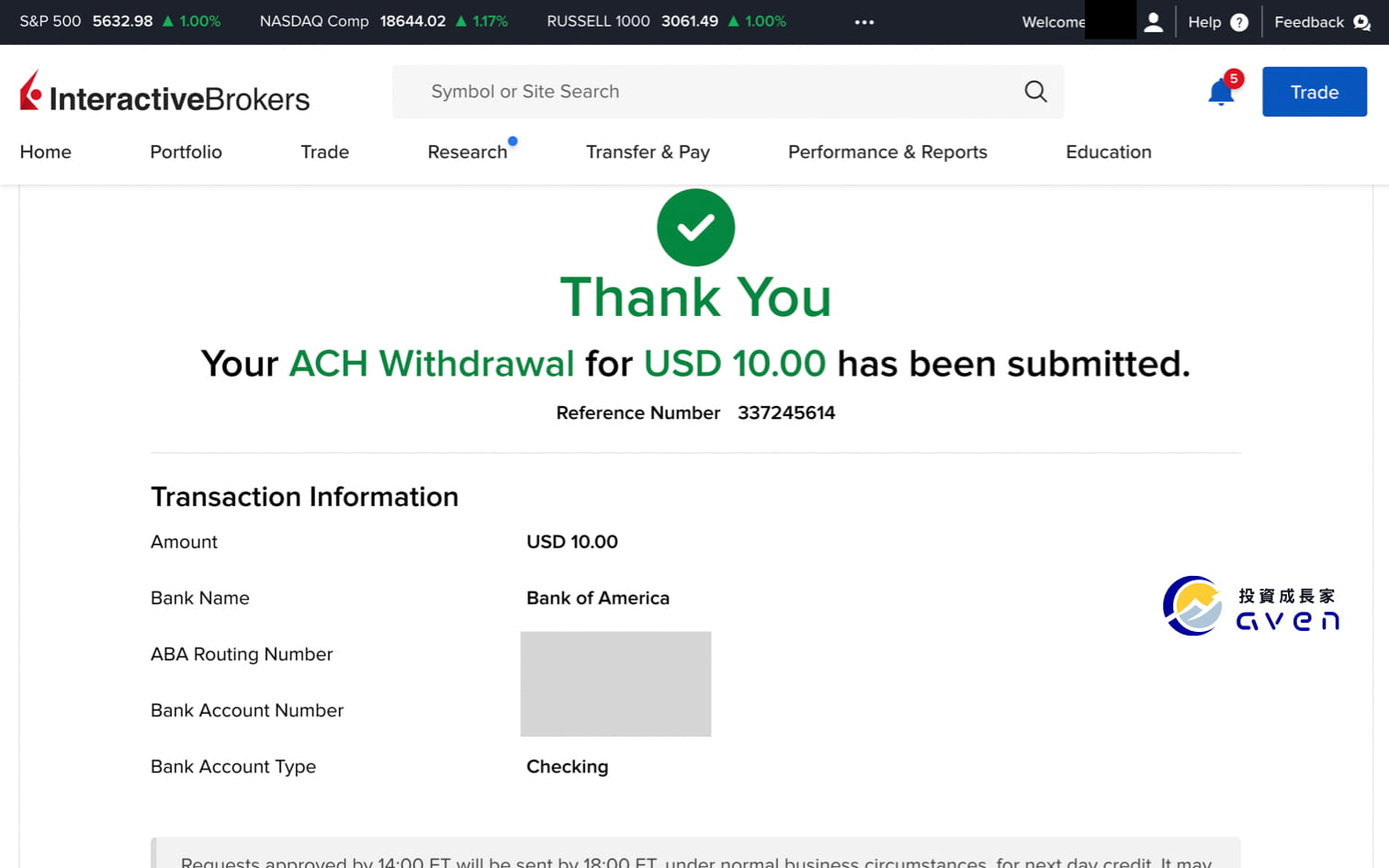

After you see this message, it means you have successfully withdrawn your money from your IB account to your U.S. bank account.

Step 2: Check your Transaction Status & History

After you deposit your IB account, you can click “Transfer & Pay”->” Transaction Status & History” to check your deposit.