- Home page

- Introduction to US Stocks

- Seeking Alpha Review, Pricing and Features 2024

Seeking Alpha Review, Pricing and Features 2024

Are you ready to become a professional U.S. stock investor? A powerful tool can make all the difference. (It enables investors to analyze financial reports, market trends, and policy news much more effectively.)

In recent years, Seeking Alpha has become one of the most influential investment communities and research platforms globally, known for its in-depth market analysis, professional investor community, and advanced trend prediction features. It has attracted U.S. stock investors from all over the world.

In this article, Caven will introduce some of the outstanding features of this platform that I find incredibly useful. When used wisely, it can significantly enhance your efficiency in investing in U.S. stocks.

目錄

What is Seeking Alpha?

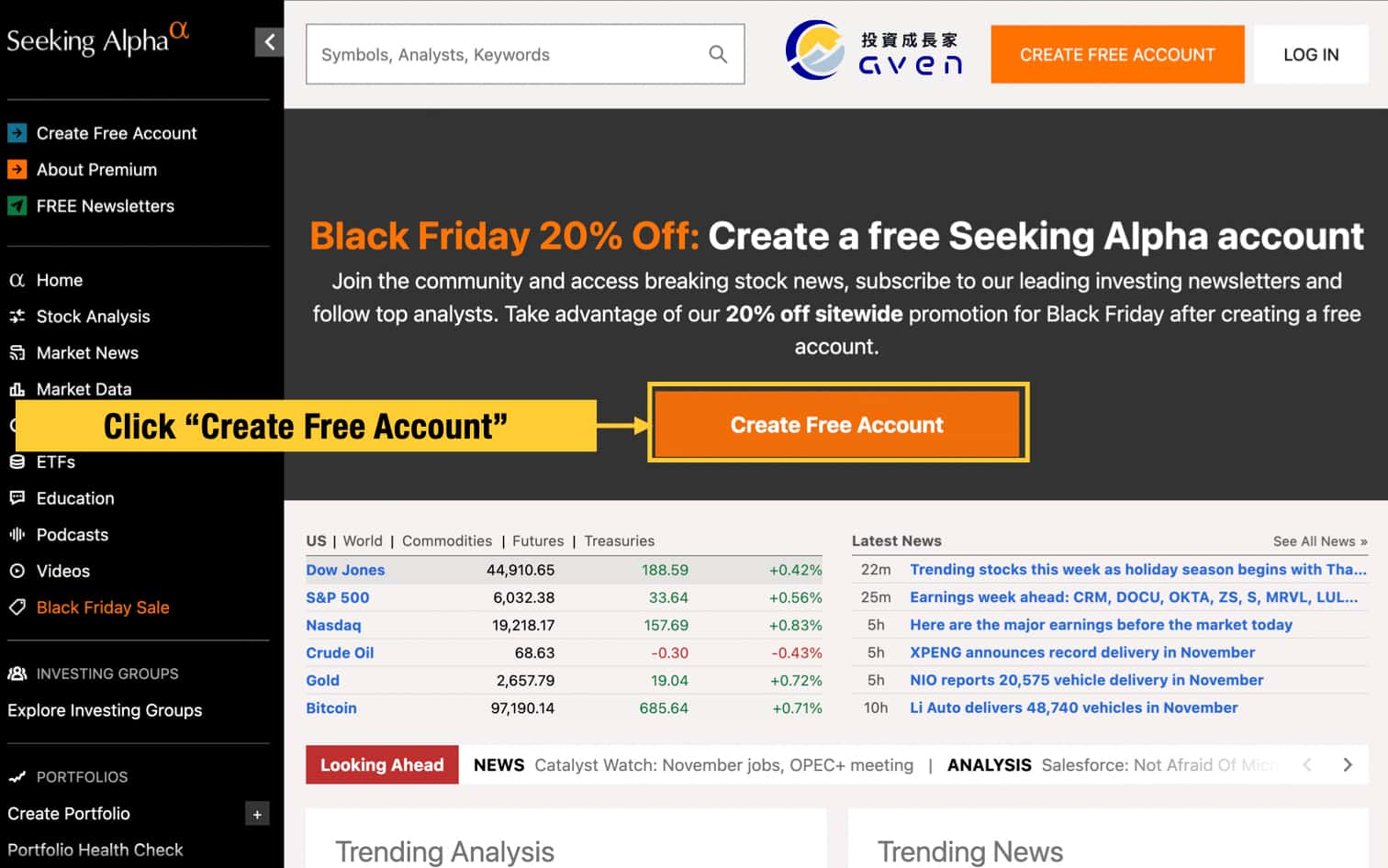

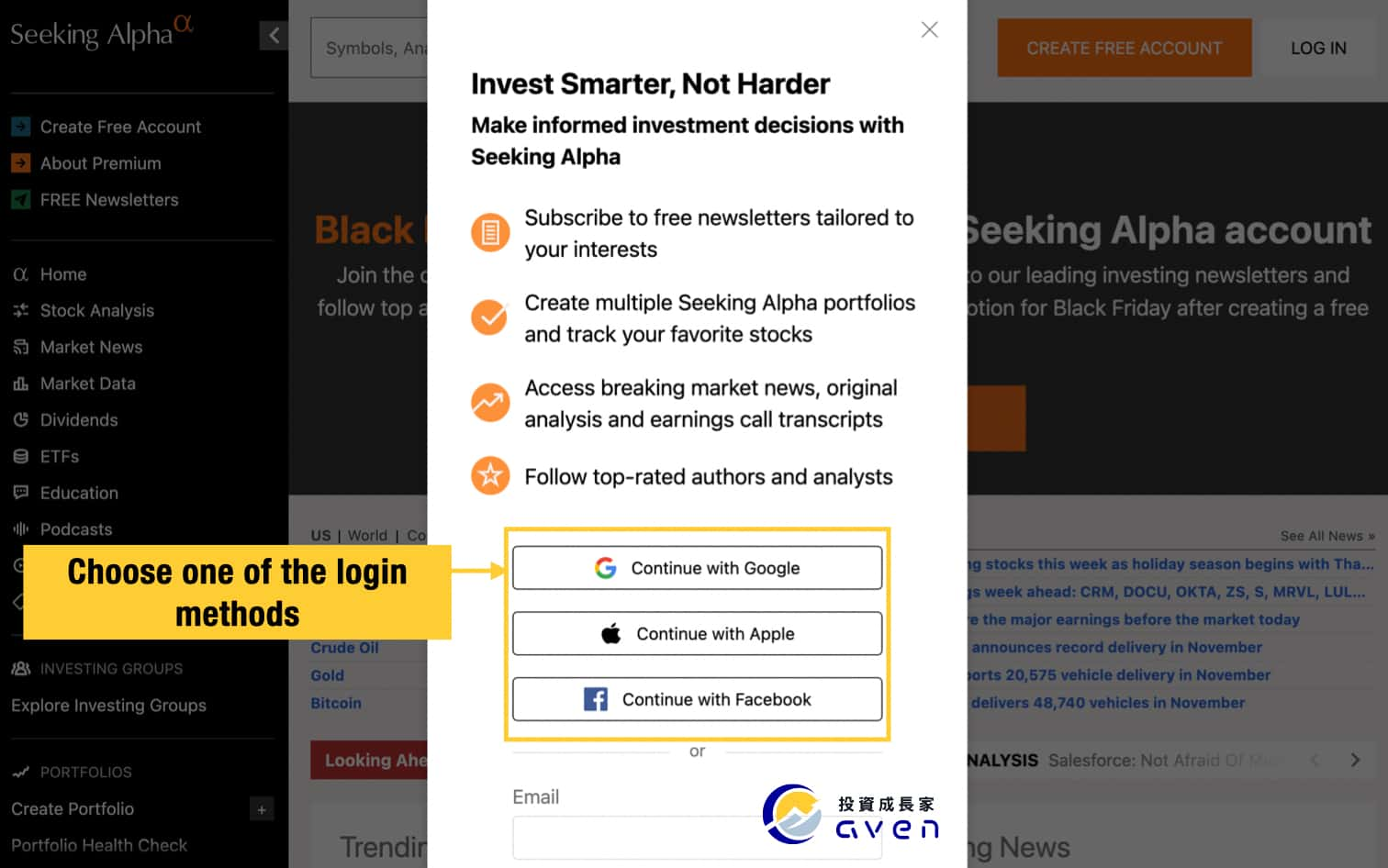

Founded in New York in 2004, Seeking Alpha is a comprehensive stock and ETF analysis and rating website. The website's core is to provide complete financial product trends, market-related news, stock ratings, etc., so that investors can review their investment portfolios comprehensively.

The most special thing about Seeking Alpha is that they have a professional investment community forum. Analysts who meet the regulatory standards can publish their investment strategies on it, and followers can subscribe freely.

On the one hand, they can obtain the best strategies of professional investors, and on the other hand, they can also encourage more professional investors to join through this additional income.

Seeking Alpha Features

Seeking Alpha currently offers three subscription tiers: Basic, Premium, and Pro. Personally, I use the Premium plan! However, that doesn't mean you need to go for the Premium tier as well. Many of its free features are also highly useful. But if, like me, you’re eager to dive deep into stock research, upgrading to Premium might be worth considering.

Next, I'll share the Seeking Alpha features—both free and paid—that my U.S. stock investment team and I find incredibly helpful.

But what are the differences between these functions? Caven tried out the Basic and the Premium respectively, and briefly showed you these features and taught you how to use them.

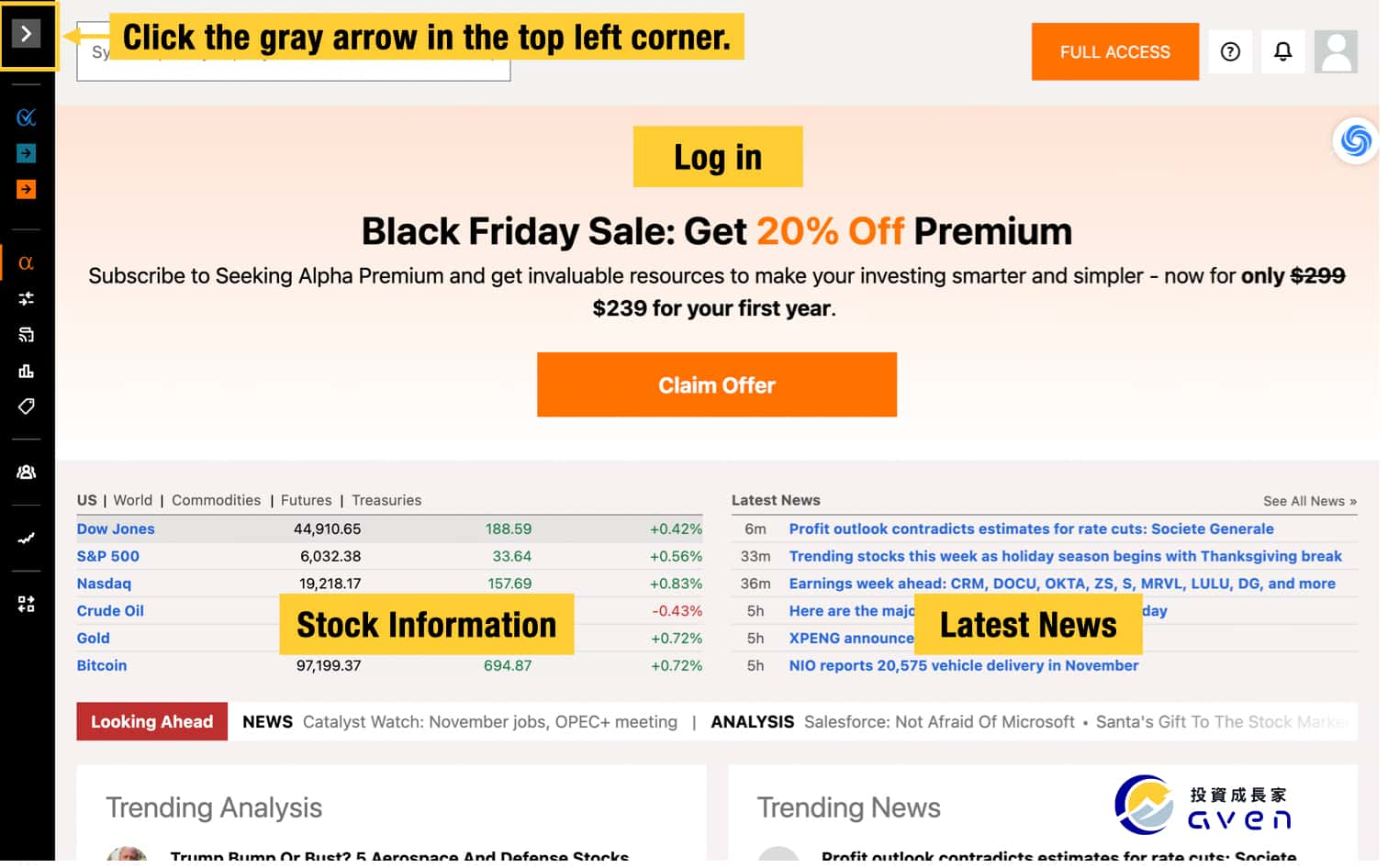

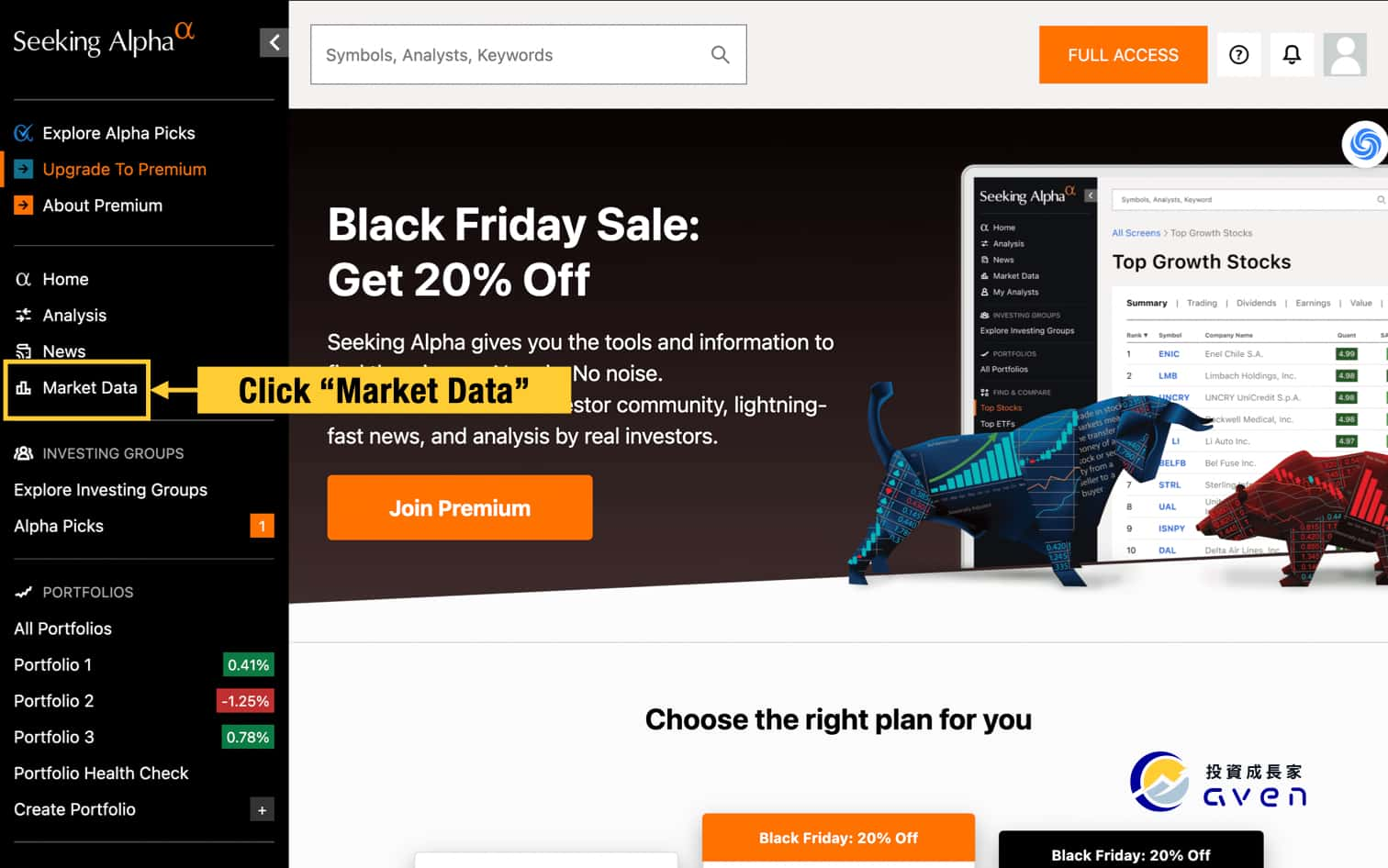

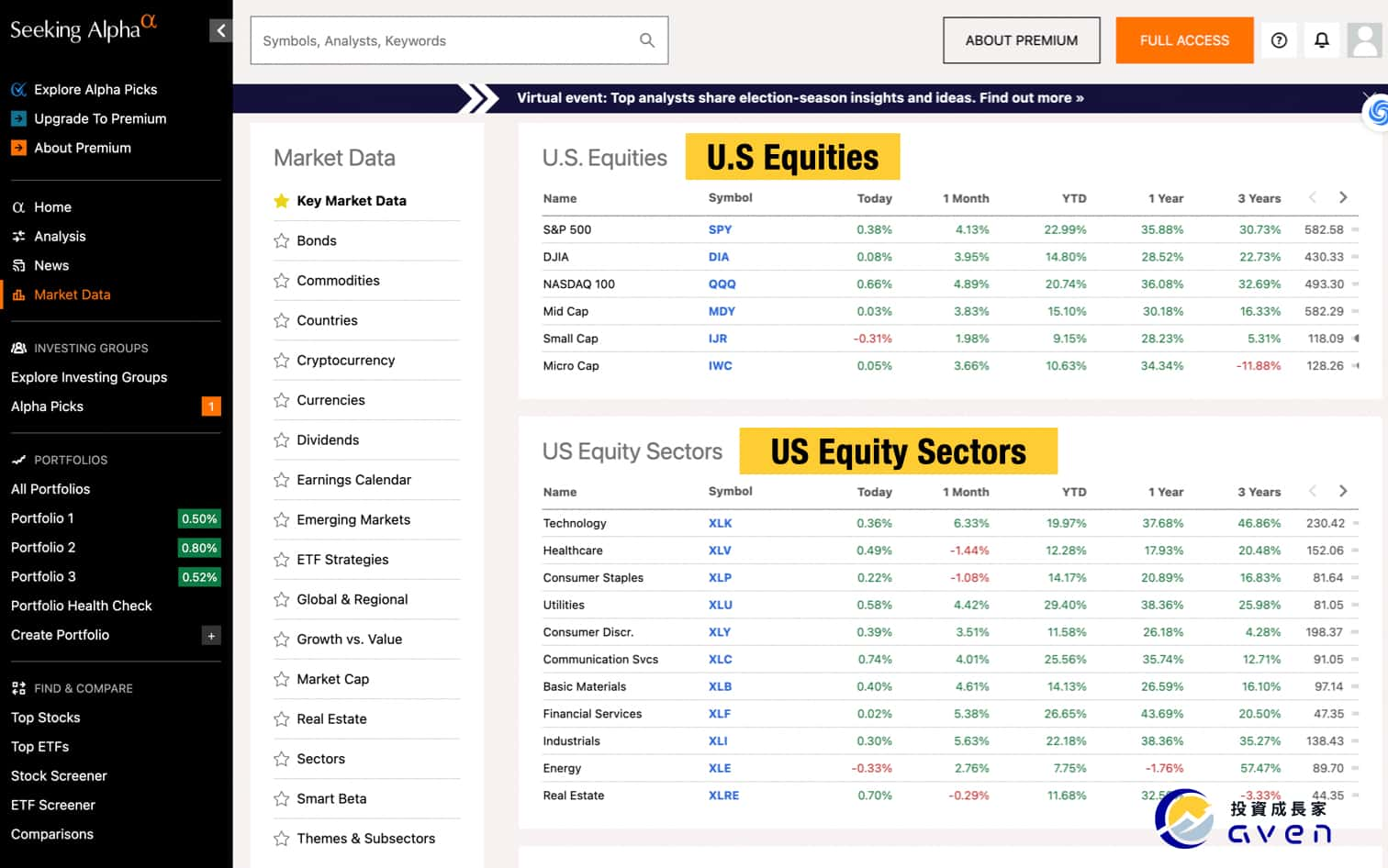

Real-time Market Data - Basic

Seeking Alpha provides comprehensive real-time quotes and growth trend data for U.S. stocks.

In addition to U.S. equities, it also offers insights into global stocks, cryptocurrencies, bonds, ETFs, and more. With its extensive coverage of financial products, Seeking Alpha allows us to track trends across multiple industries, helping investors identify opportunities in various sectors.

What impressed me the most was the sequence of market rallies from late September to October this year: first Chinese stocks soared, followed by Bitcoin, and then U.S. stocks. Every time there was a surge, my team could find corresponding analysis articles on Seeking Alpha!

These articles allowed us to calmly understand the reasons behind the trends rather than blindly following the crowd. (For example, the major crash in October following the sharp rise in Chinese stocks was a stark warning!)

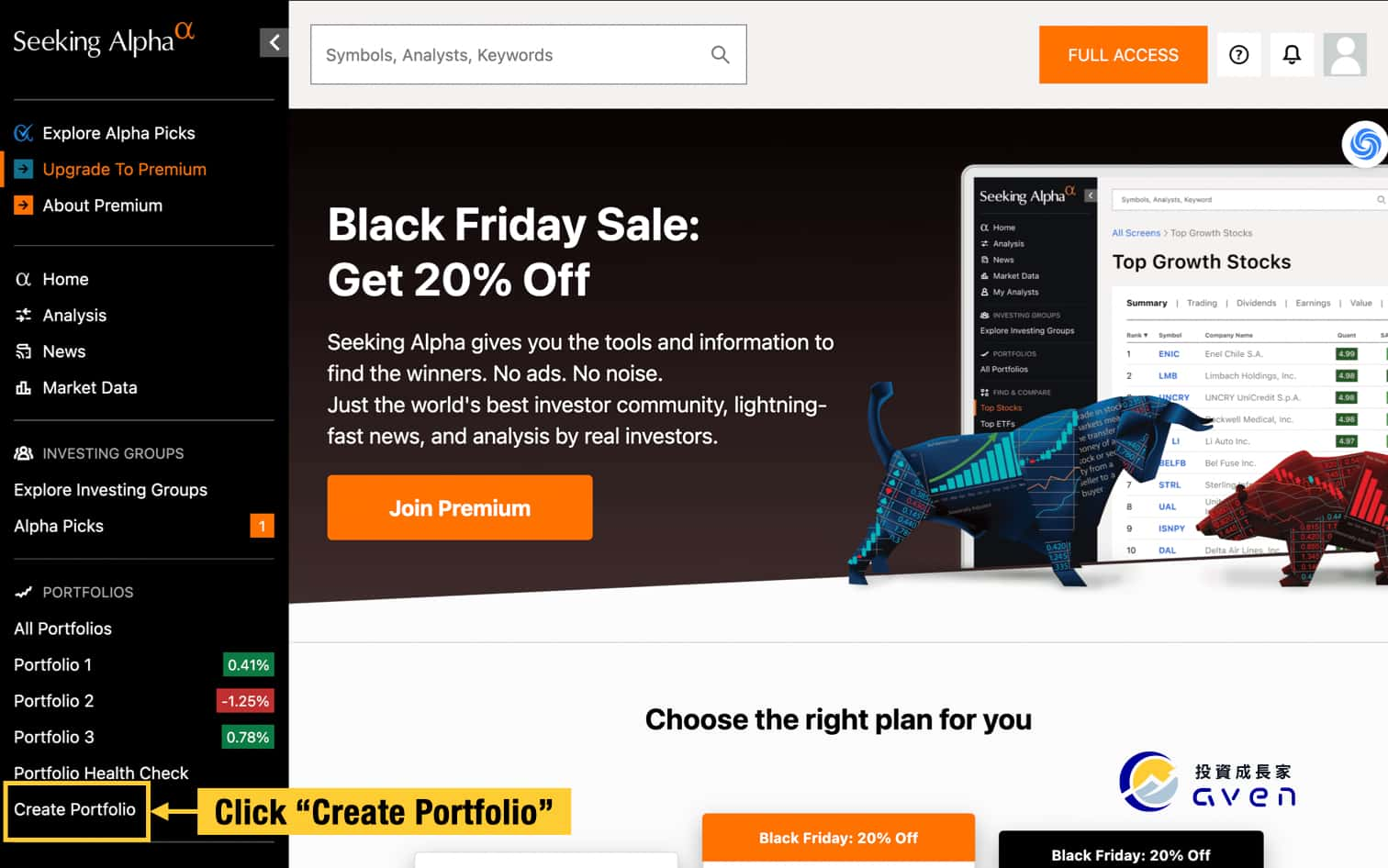

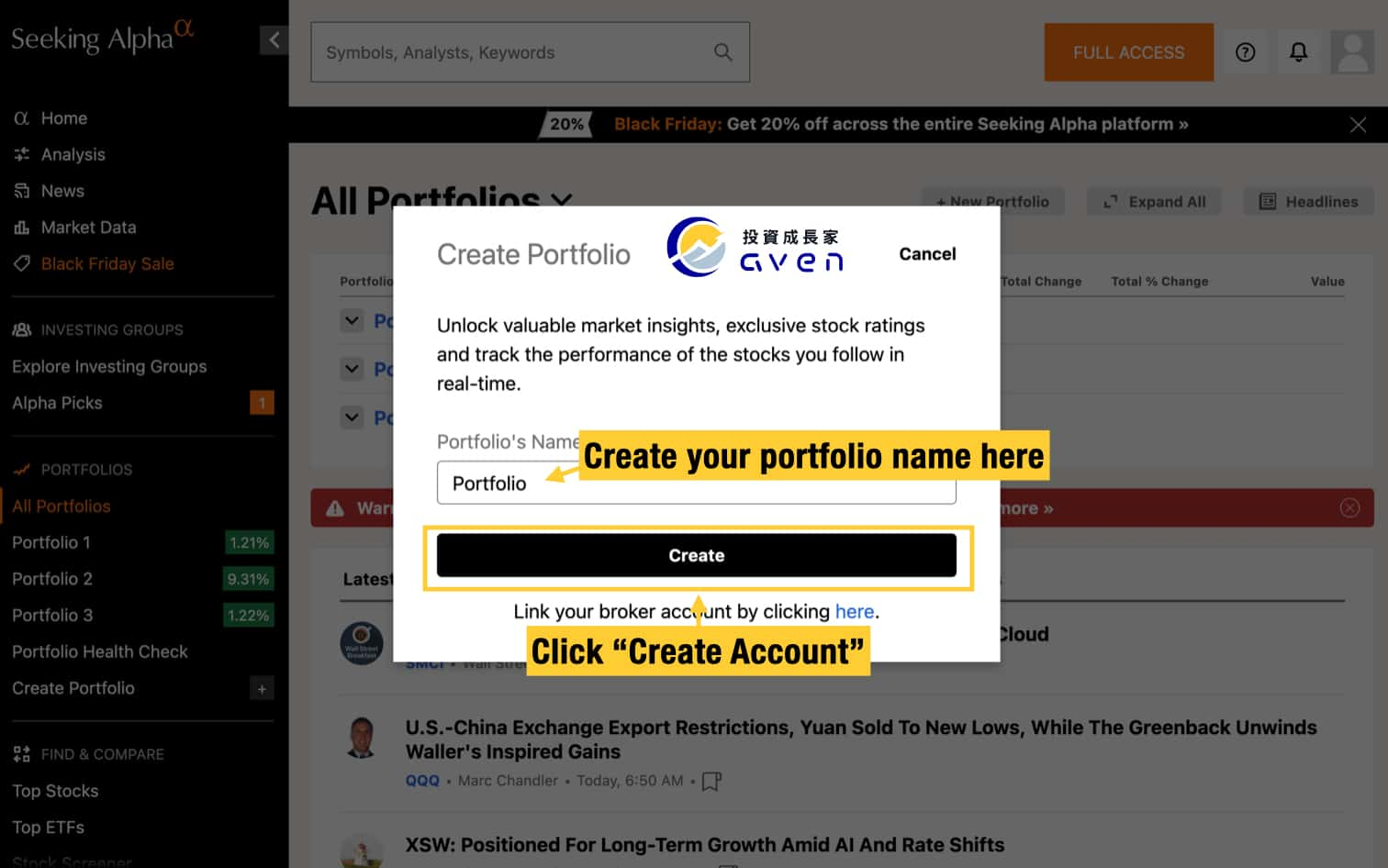

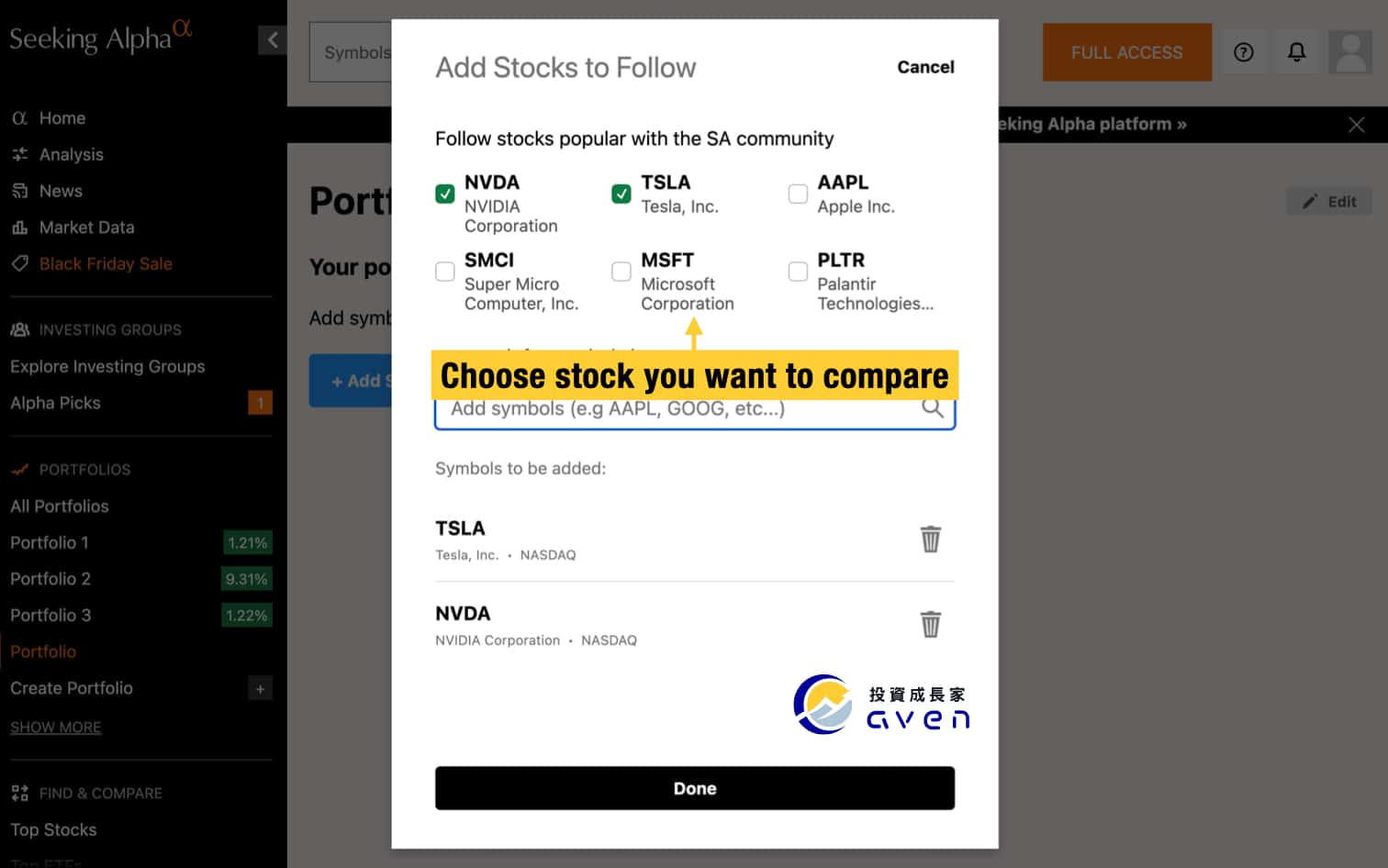

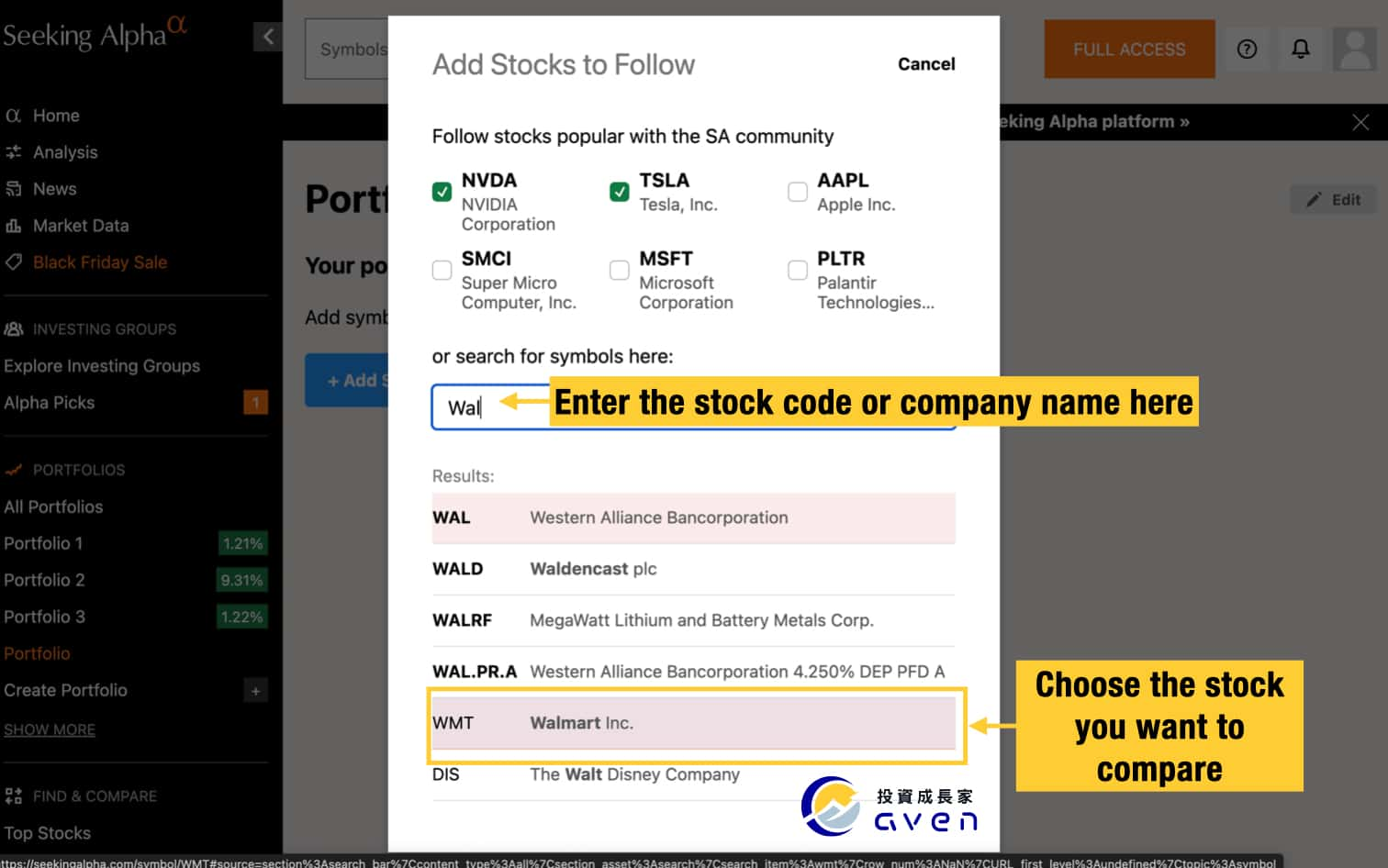

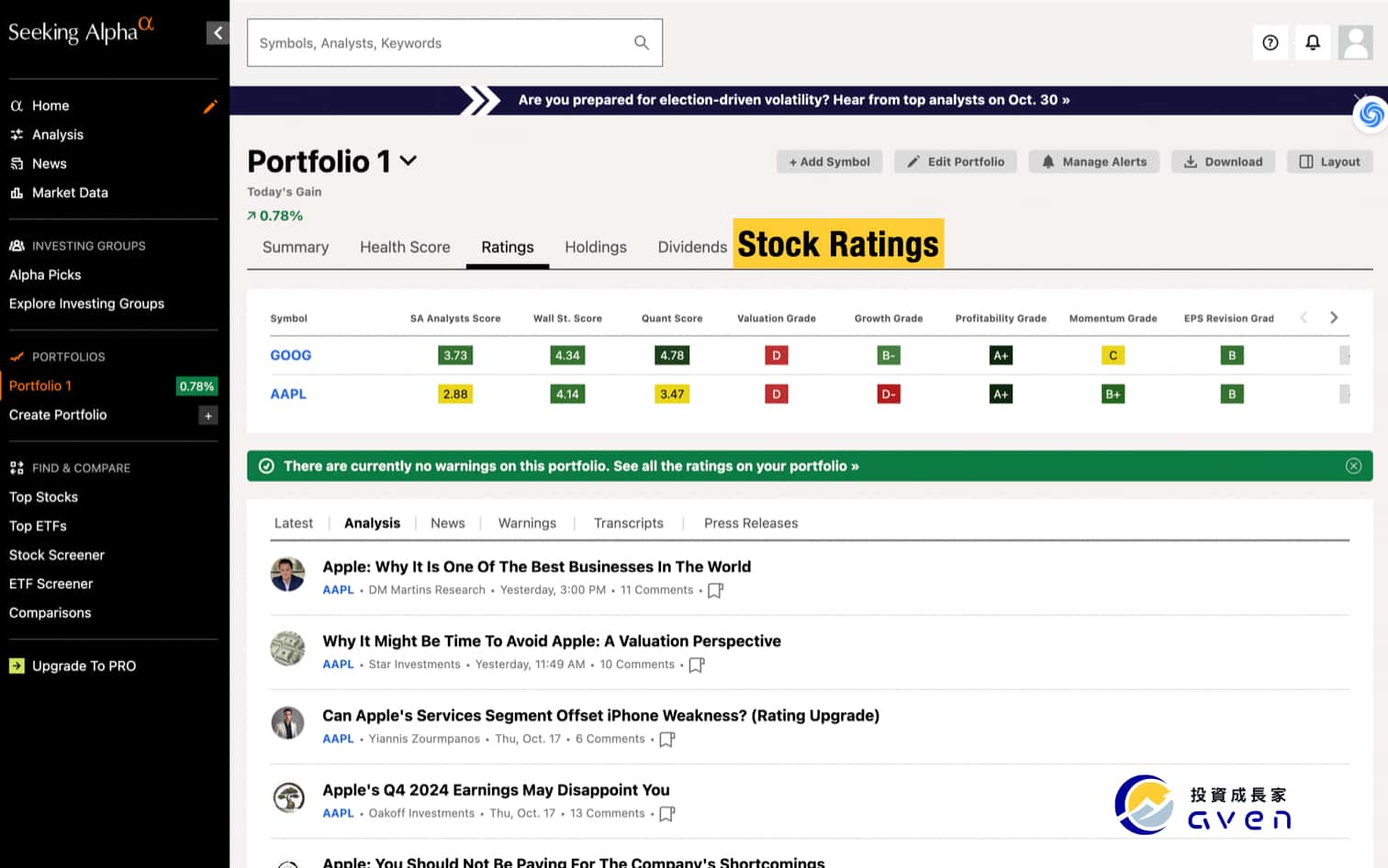

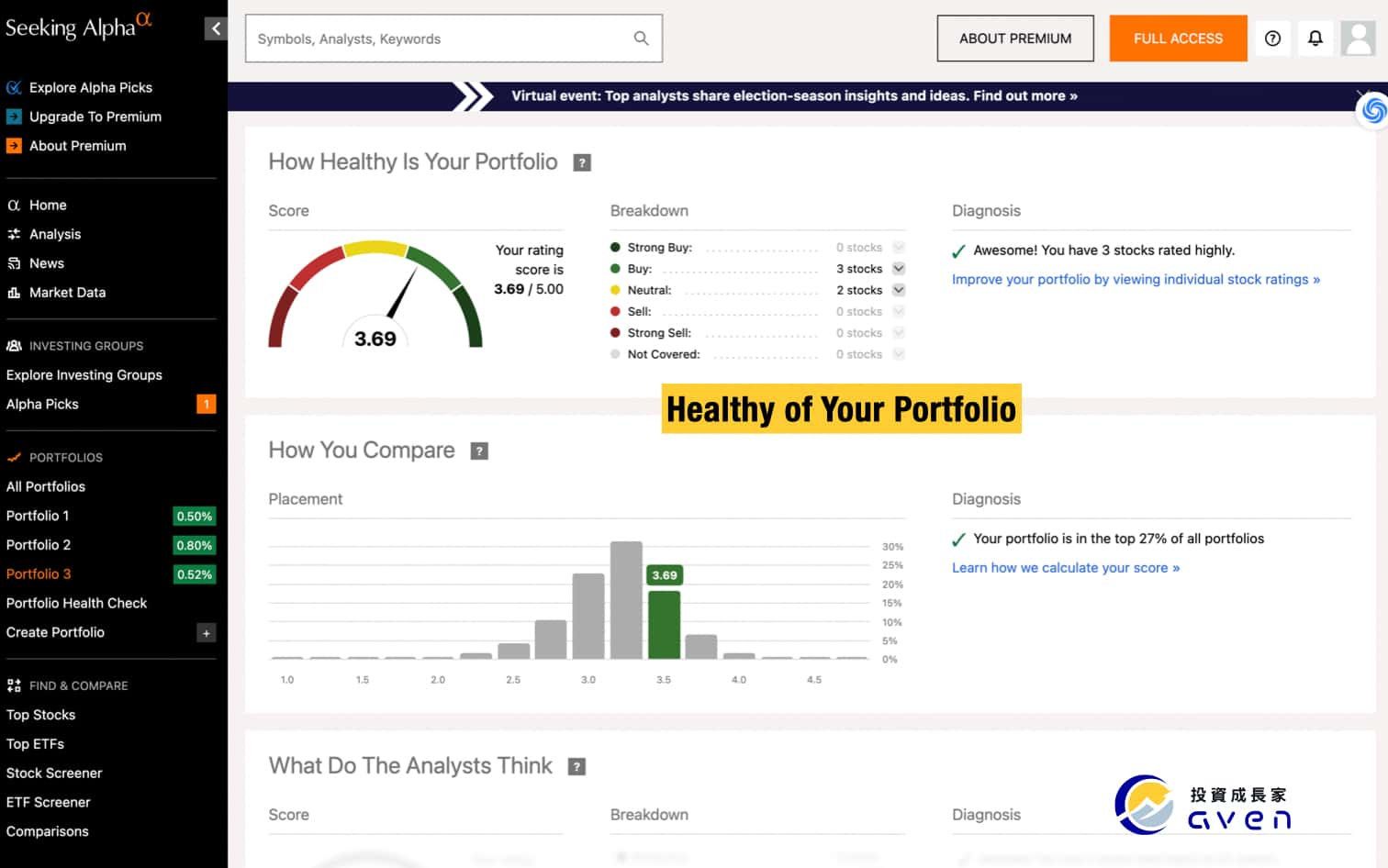

Create Portfolio, Portfolio Health Check- Basic/Premium

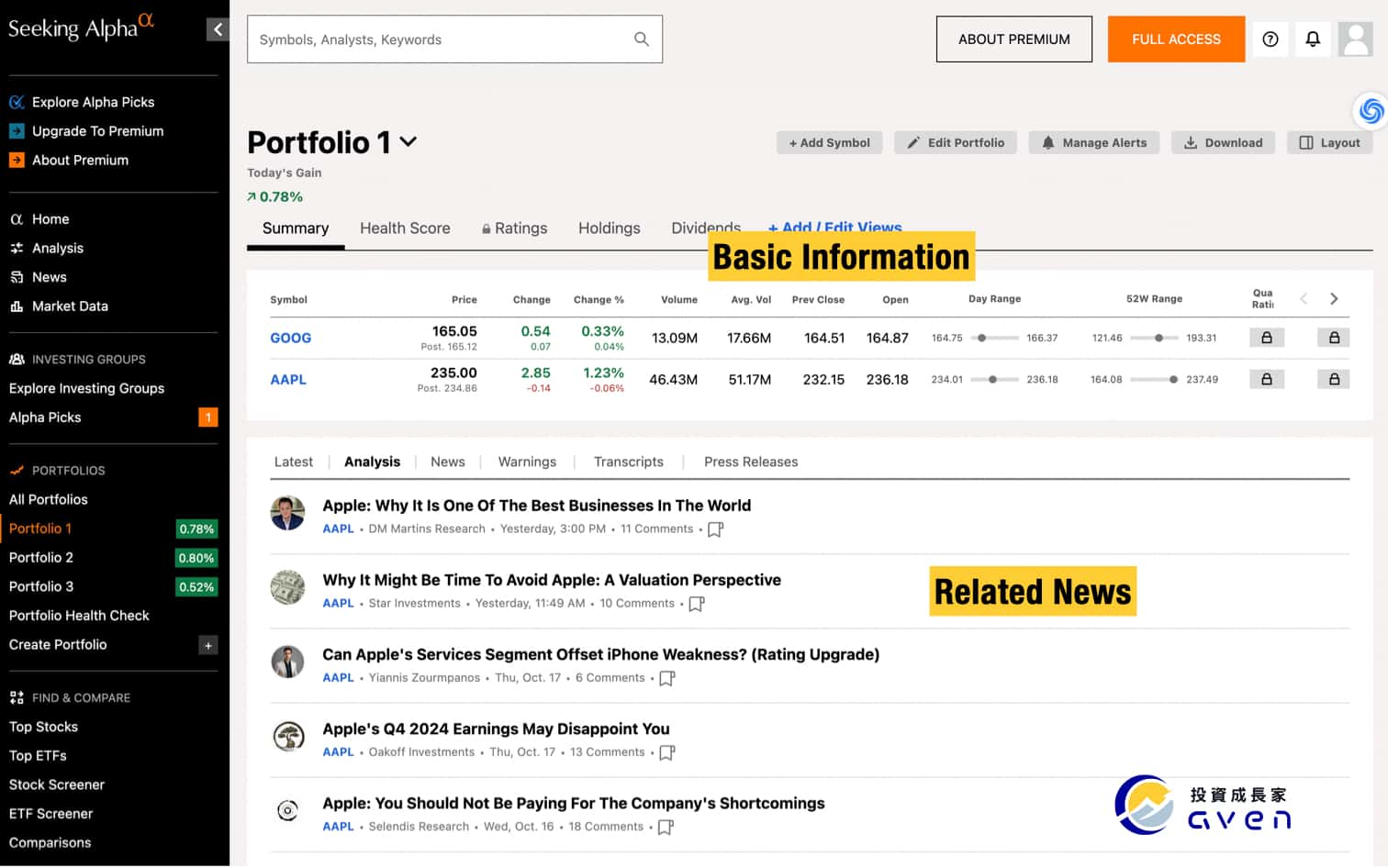

Seeking Alpha allows us to connect our U.S. brokerage accounts, import our existing investment portfolios, and perform profitability assessments and portfolio health checks. We can also create custom portfolios to compare with our current investments.

Once a portfolio is added, we can not only track stock price changes but also access related news and analyses for our holdings. This helps us better understand future trends for the stocks we own. It's an incredibly practical feature, making it convenient for us to review our asset status anytime.

In Premium, you can also see the stock ratings.

In addition, you can also do a portfolio health check, which will help you review your current holdings. If you need more detailed analysis reports, you can also obtain them by subscribing to the Premium.

In addition to ratings, premium version also includes recent price analysis, dividend information, and more.

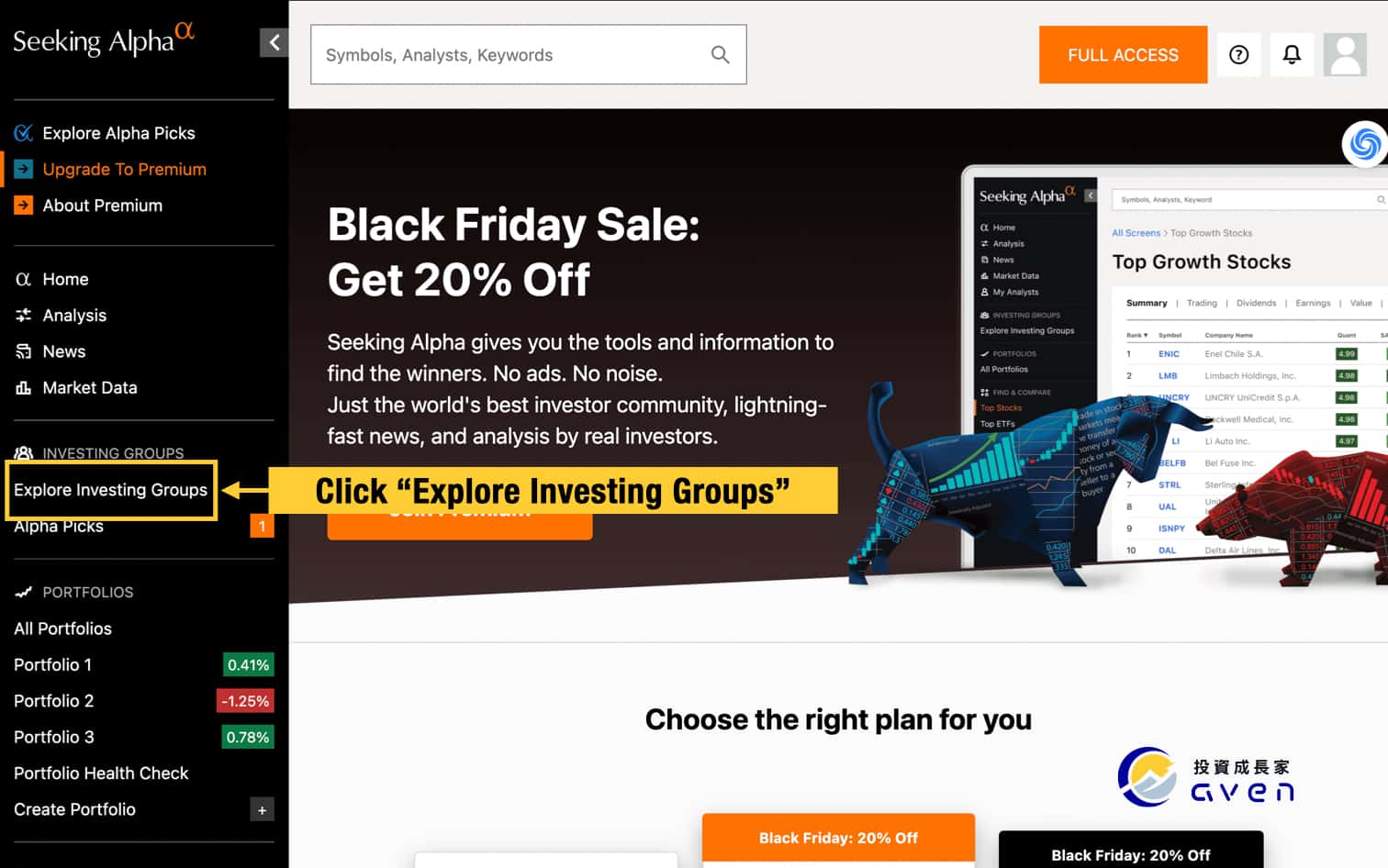

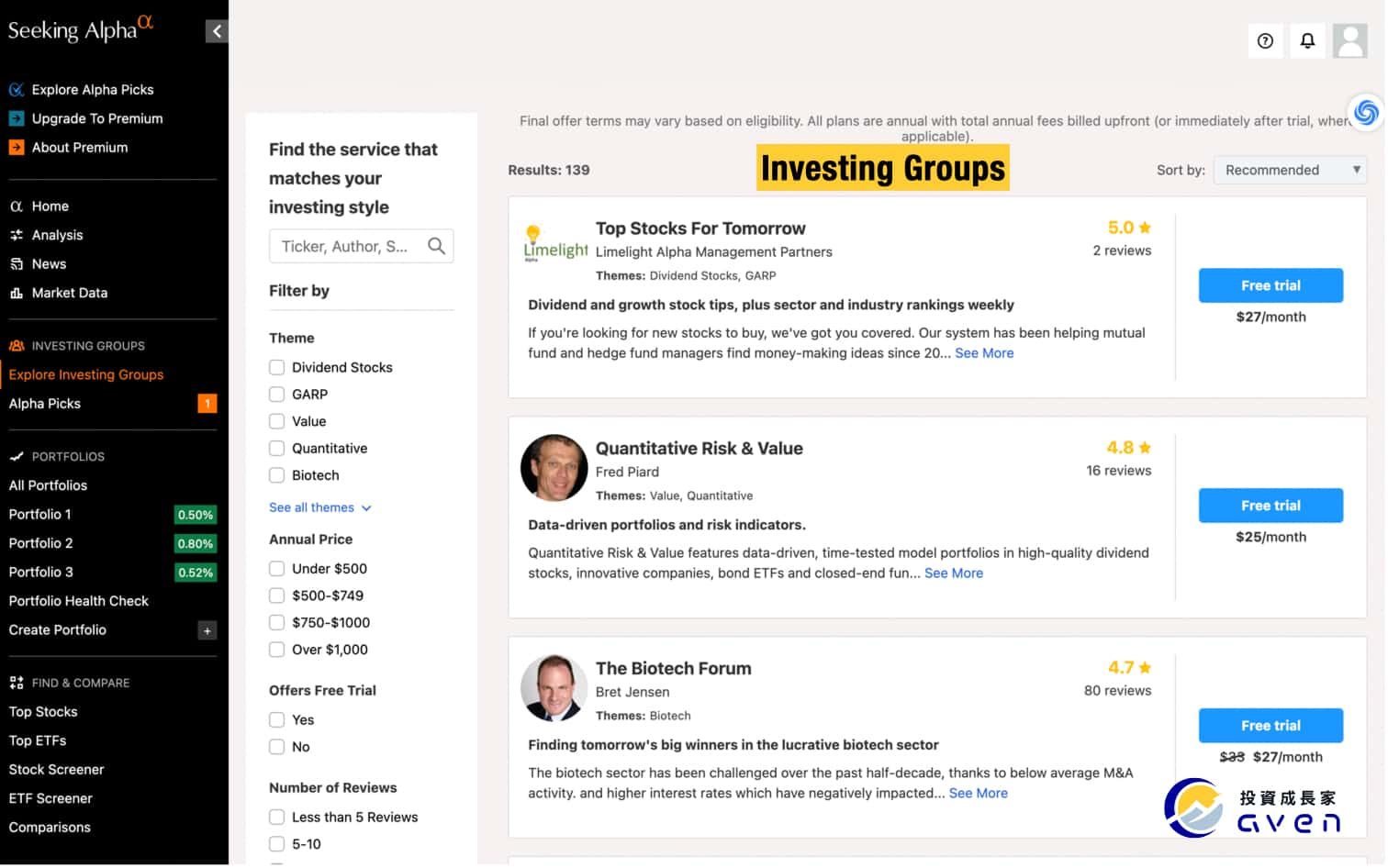

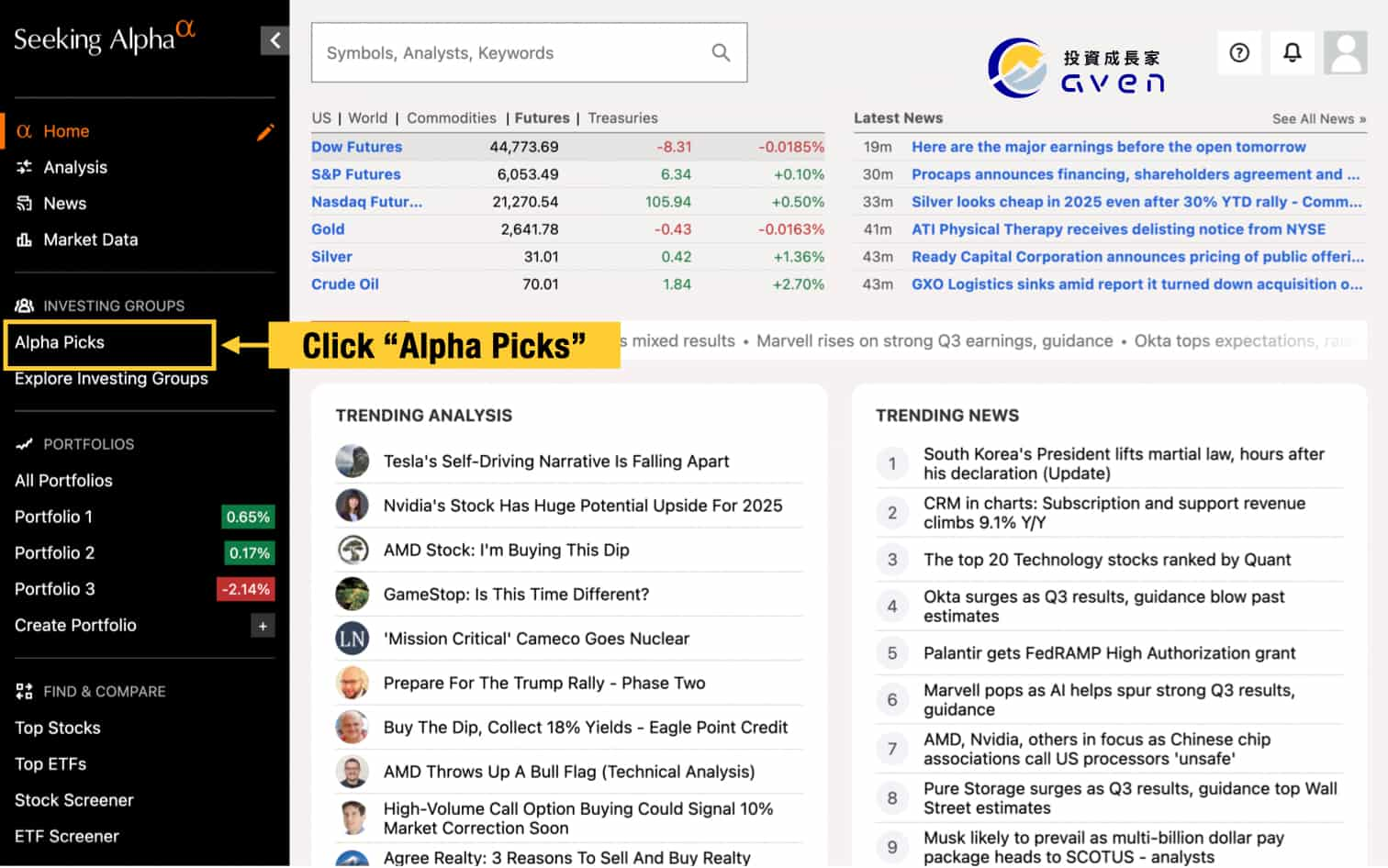

Investing Groups - Basic/Premium

This is the biggest feature of Seeking Alpha: whether using the free or Premium version, users can access this function.

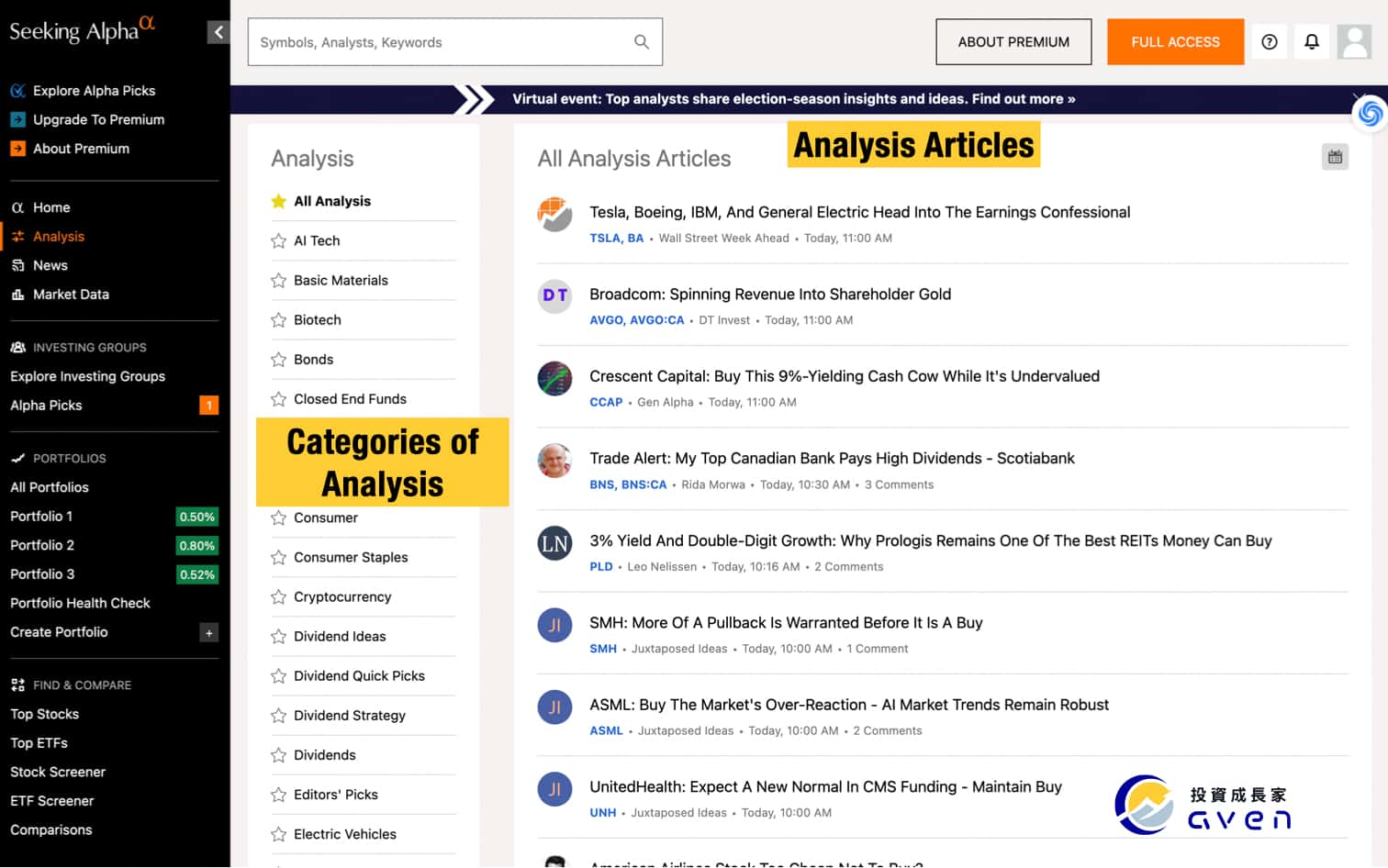

The investor forum hosts stock analysts from around the world, including Wall Street analysts and independent analysts. Users can subscribe to the analysts they prefer based on their needs and receive the investment articles they write. The subscription fee is approximately $30 per month on average.

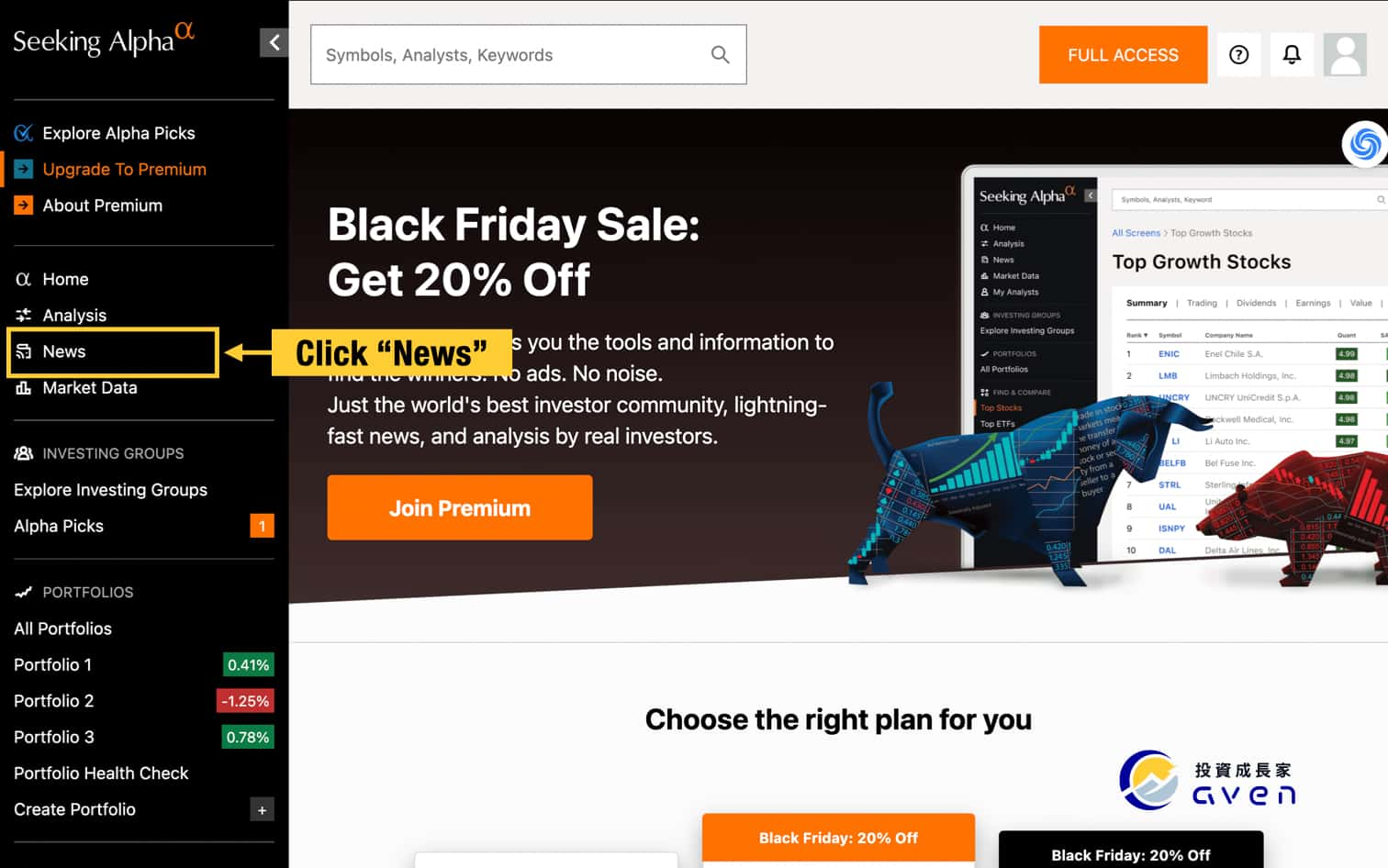

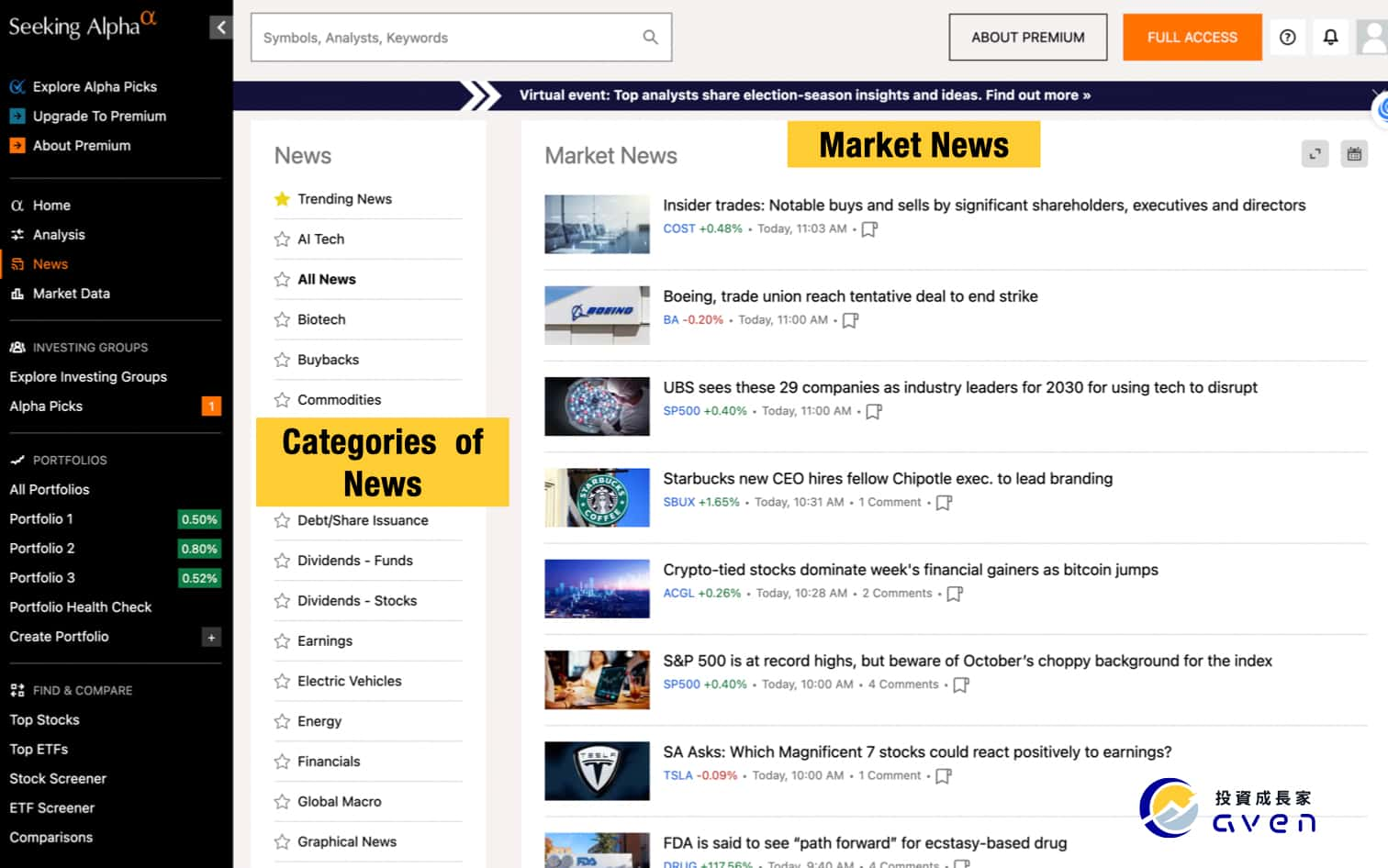

In addition to the groups, users can also read news reports curated by Seeking Alpha, as well as in-depth analyses of individual stocks, ETFs, and overall market trends. These articles cover a wide range of topics, from quarterly earnings reports to long-term investment strategies, helping investors research their holdings more thoroughly.

Furthermore, in the news and analysis sections, each article will list the related stocks at the bottom, allowing you to quickly match the analysis to the specific stocks.

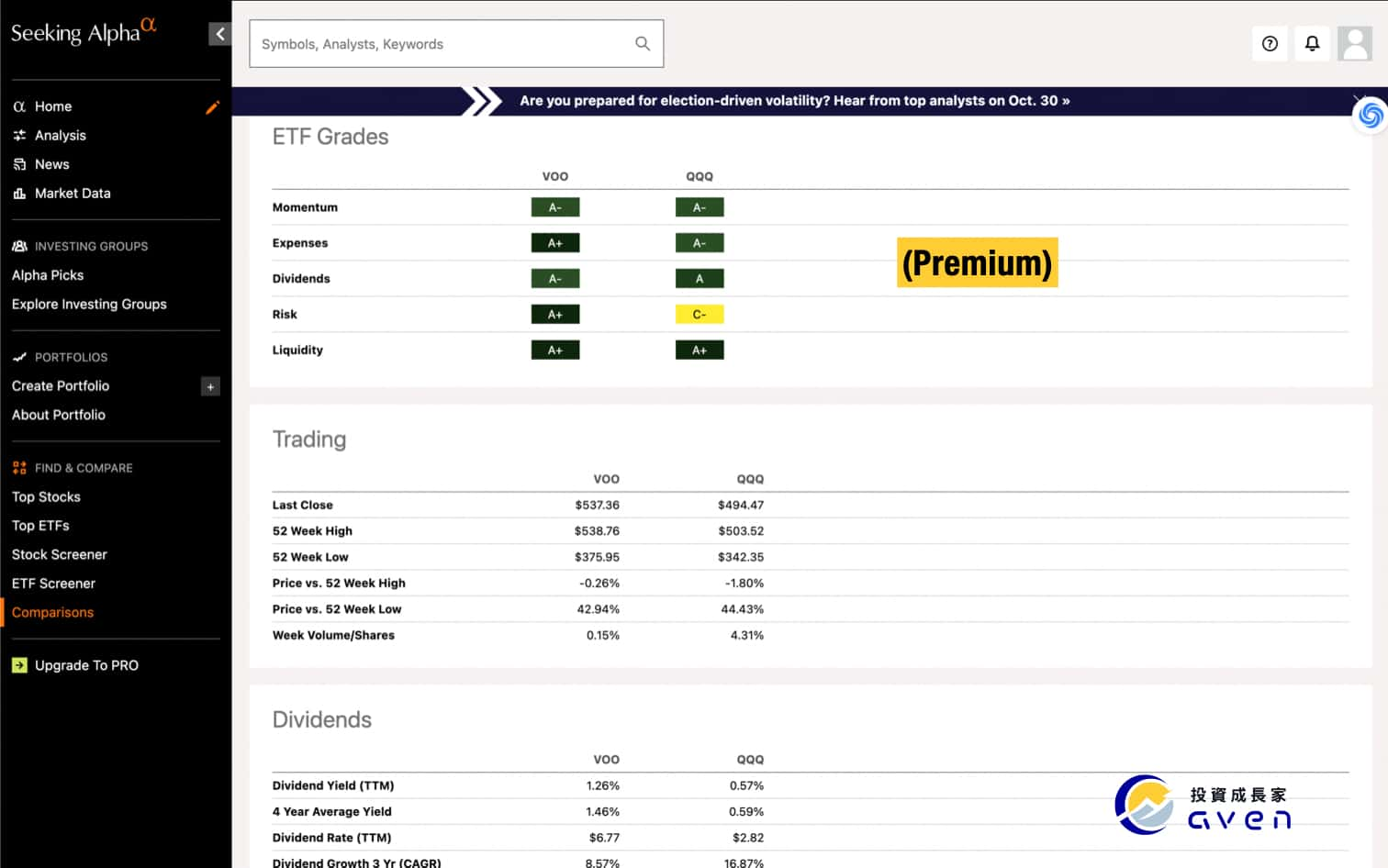

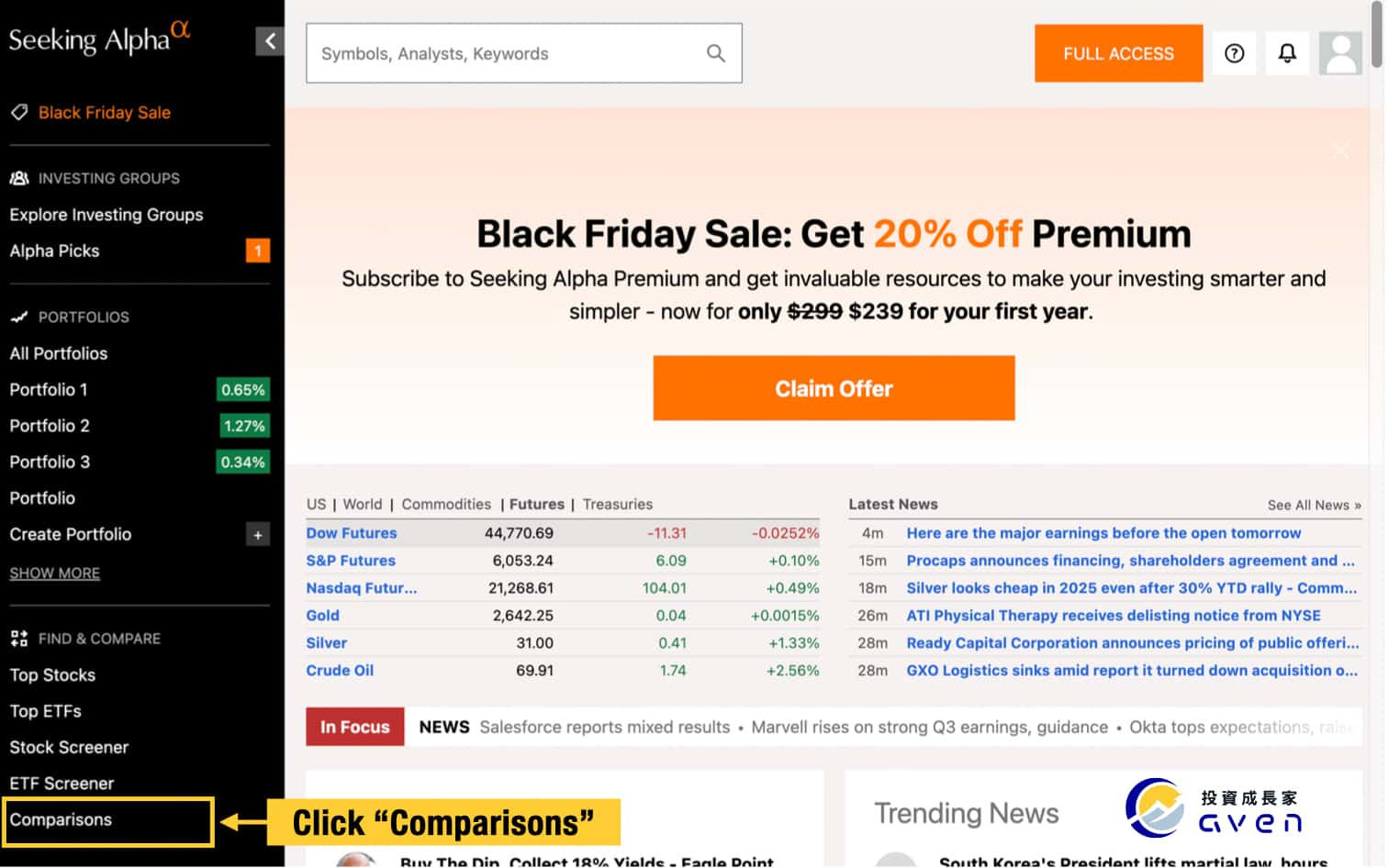

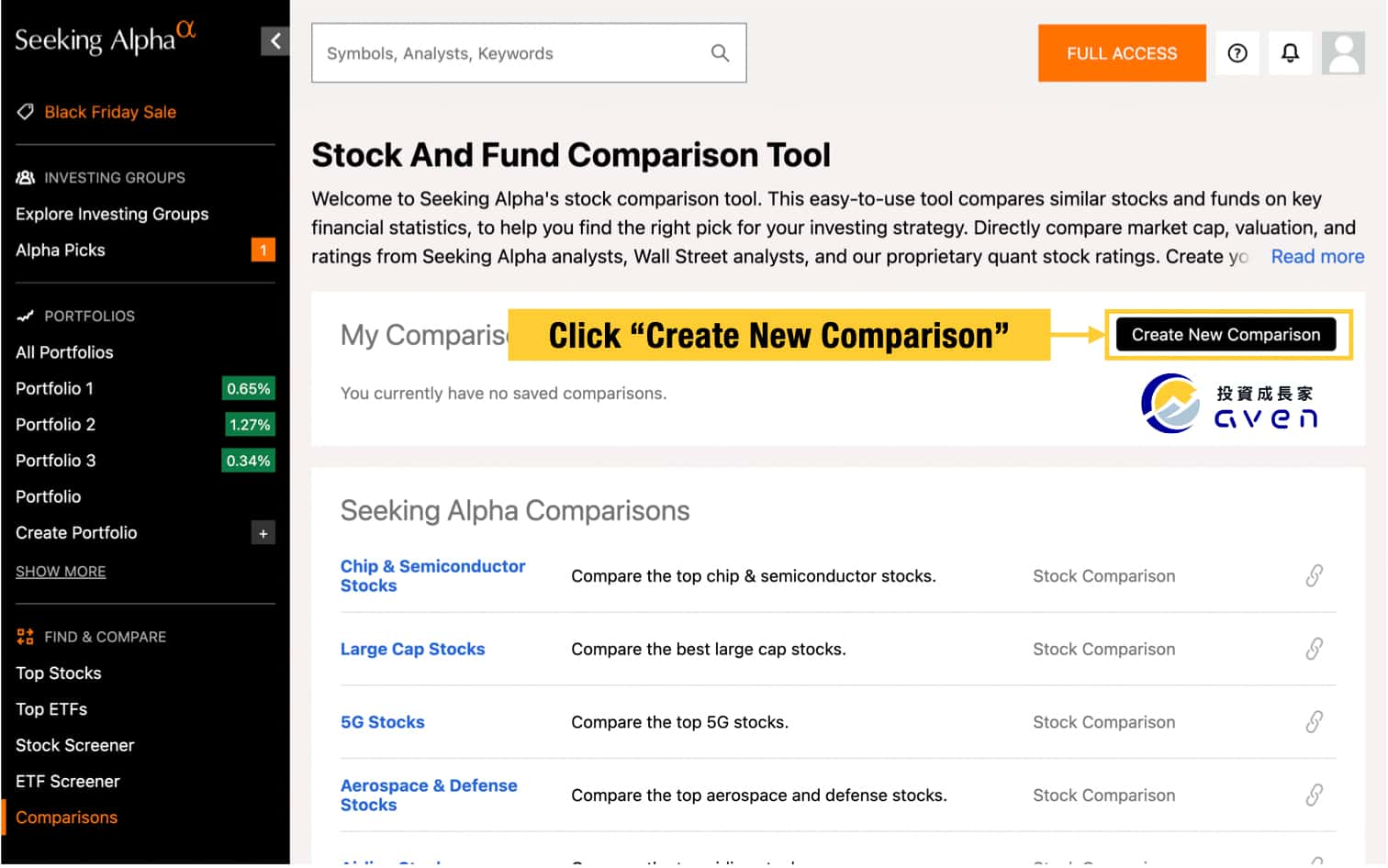

Comparison Tool-Basic, Premium

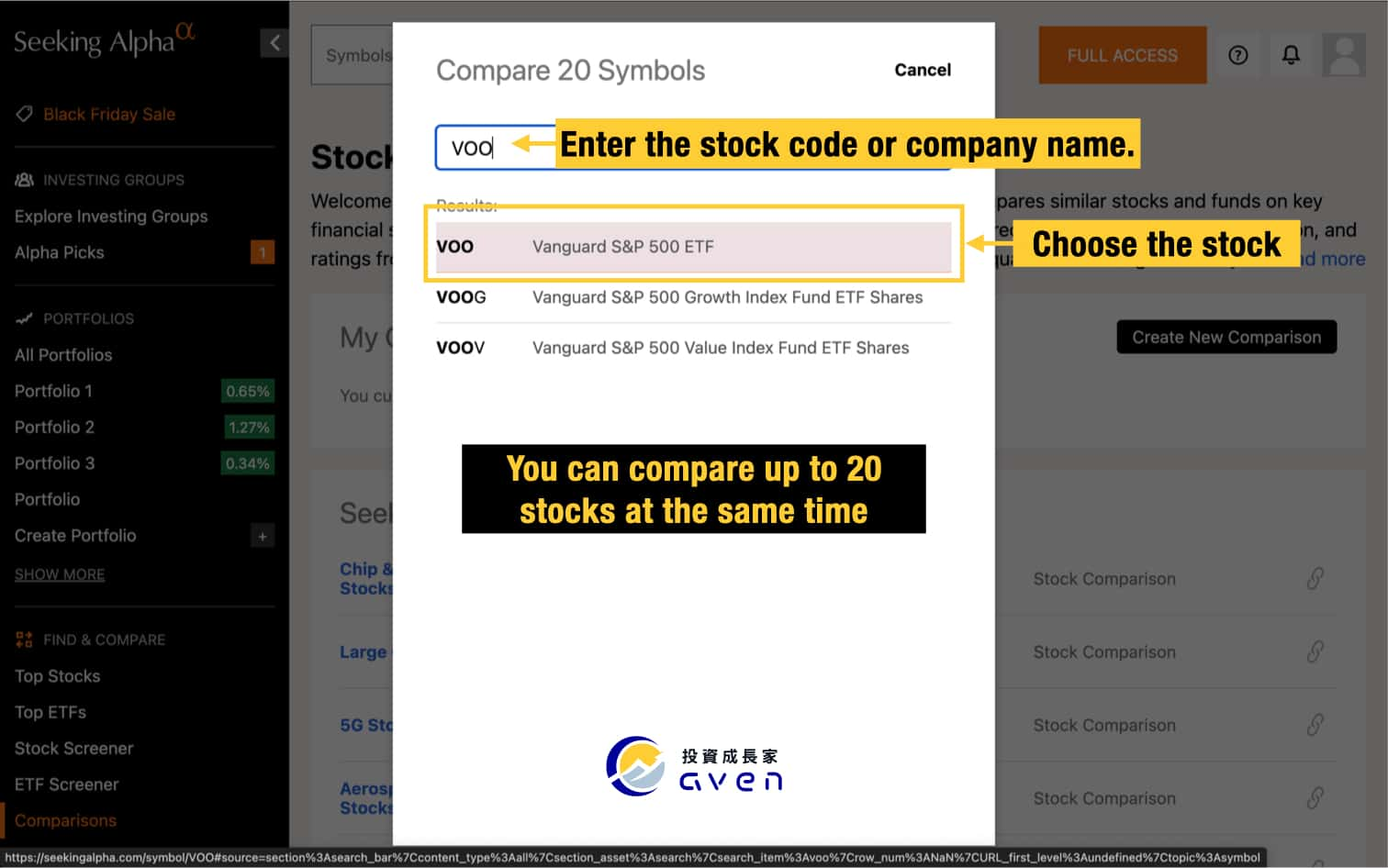

Caven highly recommended this feature. If you don't know which stock or ETF is better to invest in, you can use comparison to help you evaluate.

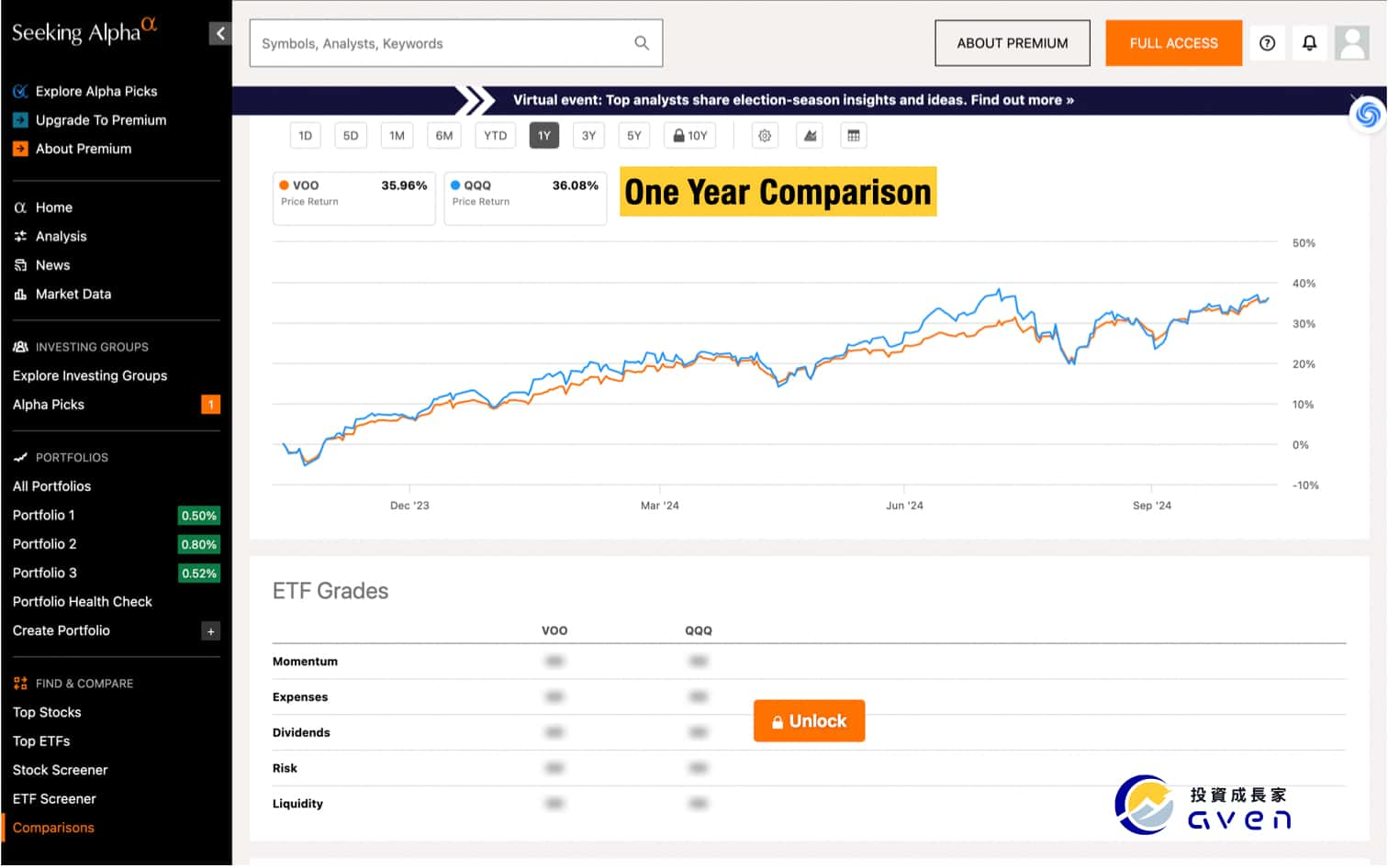

For example, here I use the comparison to compare VOO and QQQ and found that their growth trends over the past year are similar.

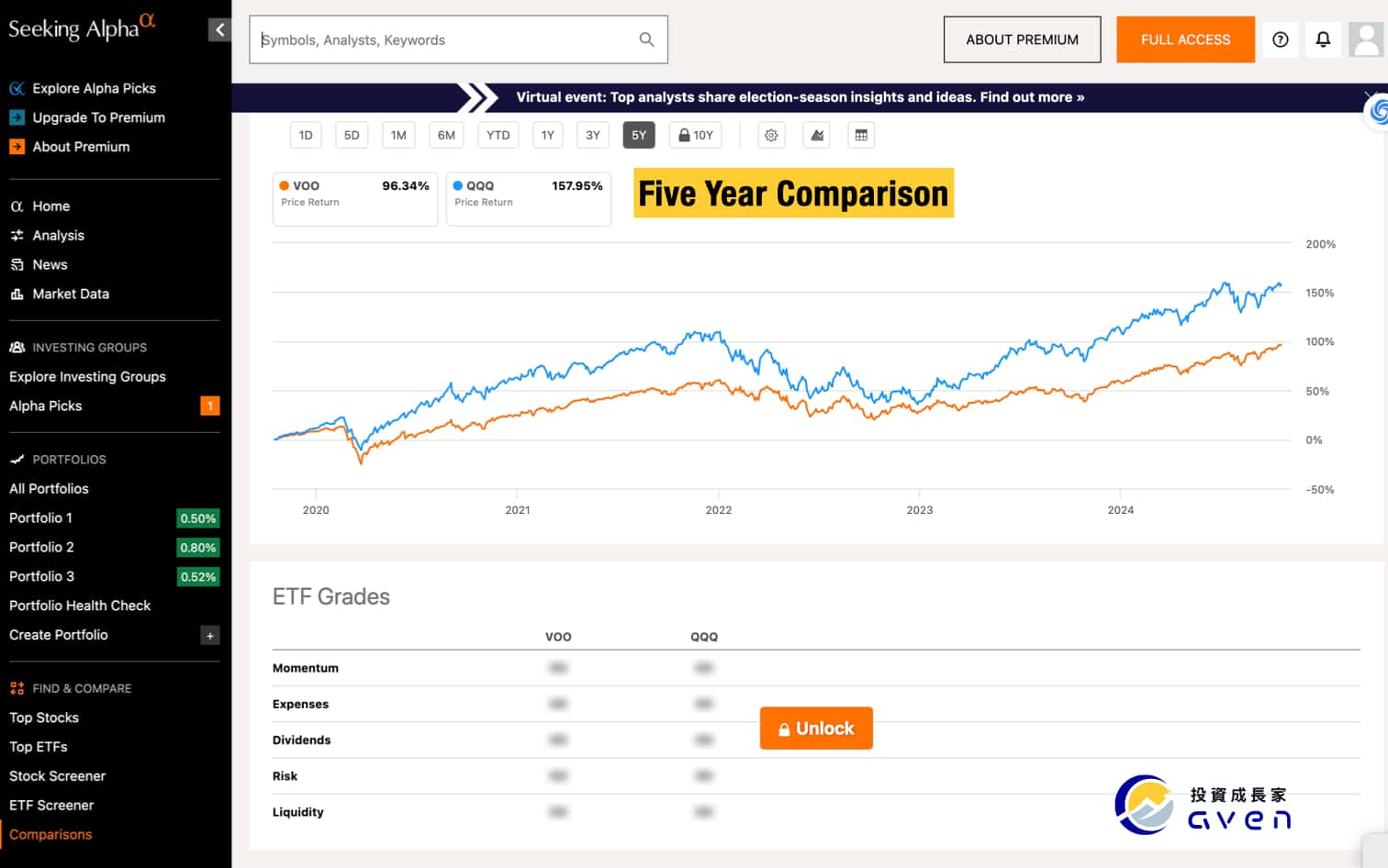

The period can be extended to 5 years, and the growth gap between the two ETFs cam be seen. It can be seen that the growth rate of QQQ is relatively high in the long term.

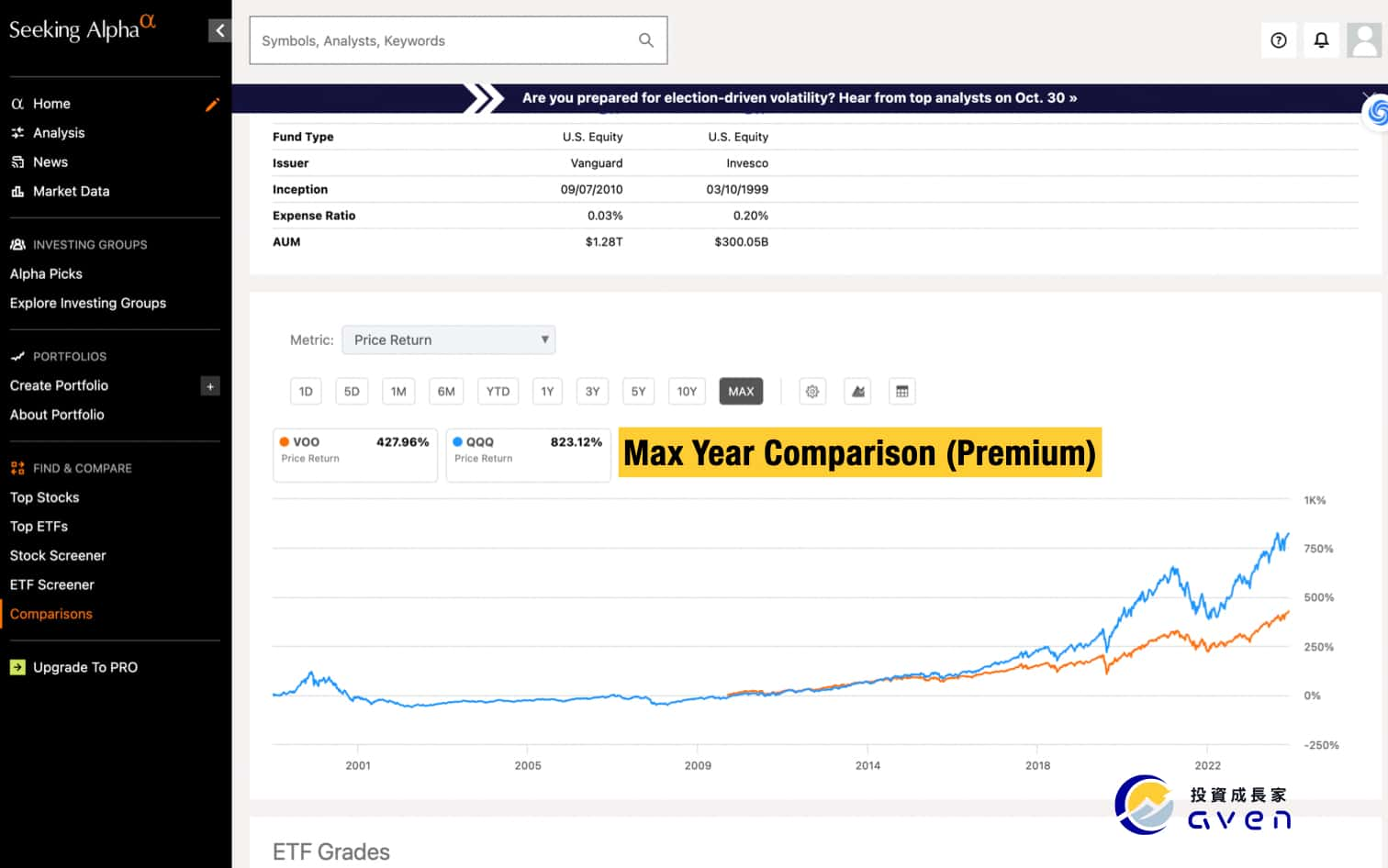

In Premium, you can extend the timeline and compare the performance of the two ETFs since their establishment. In addition, there are also very detailed stock ratings, risk assessments and other information for reference.

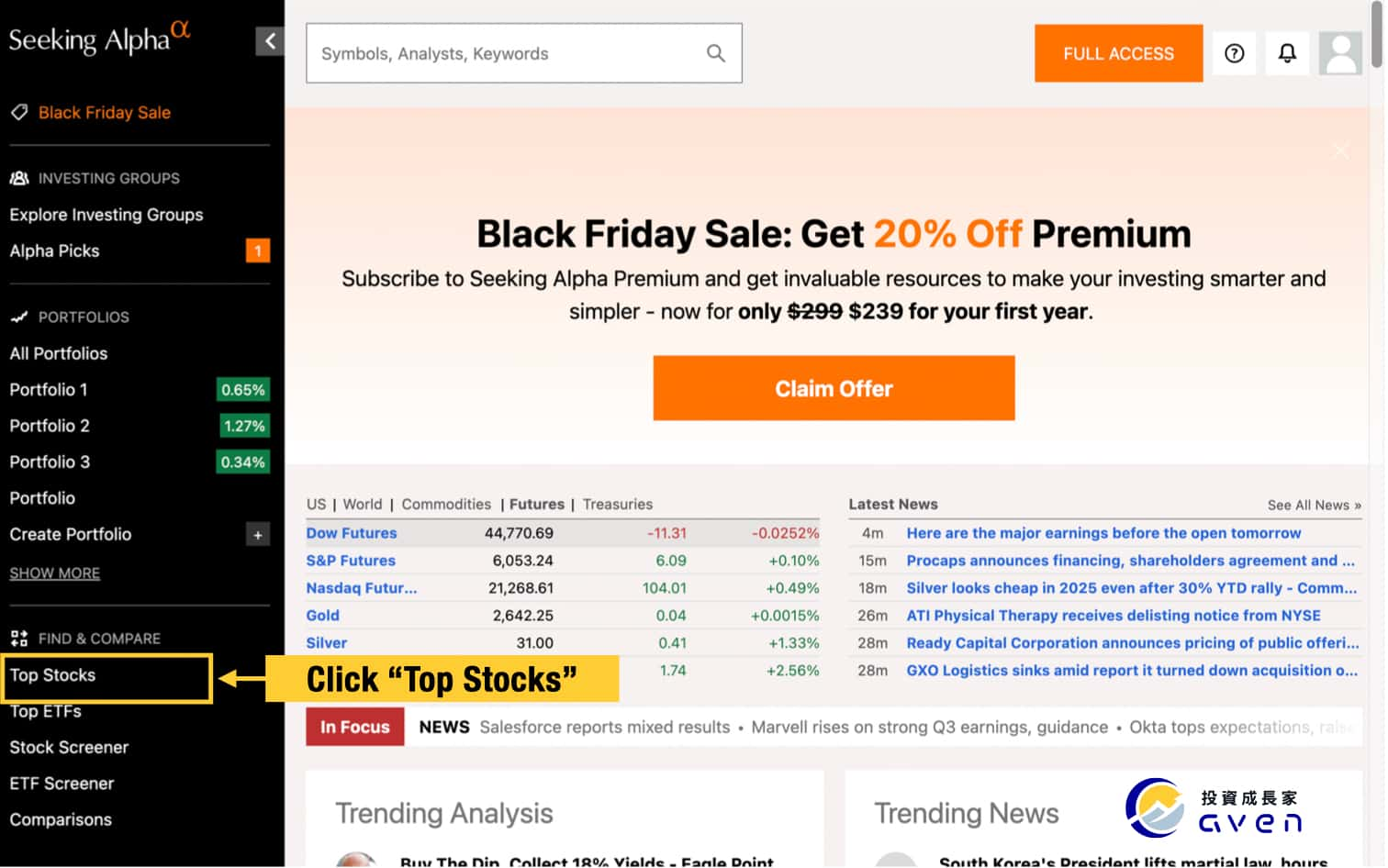

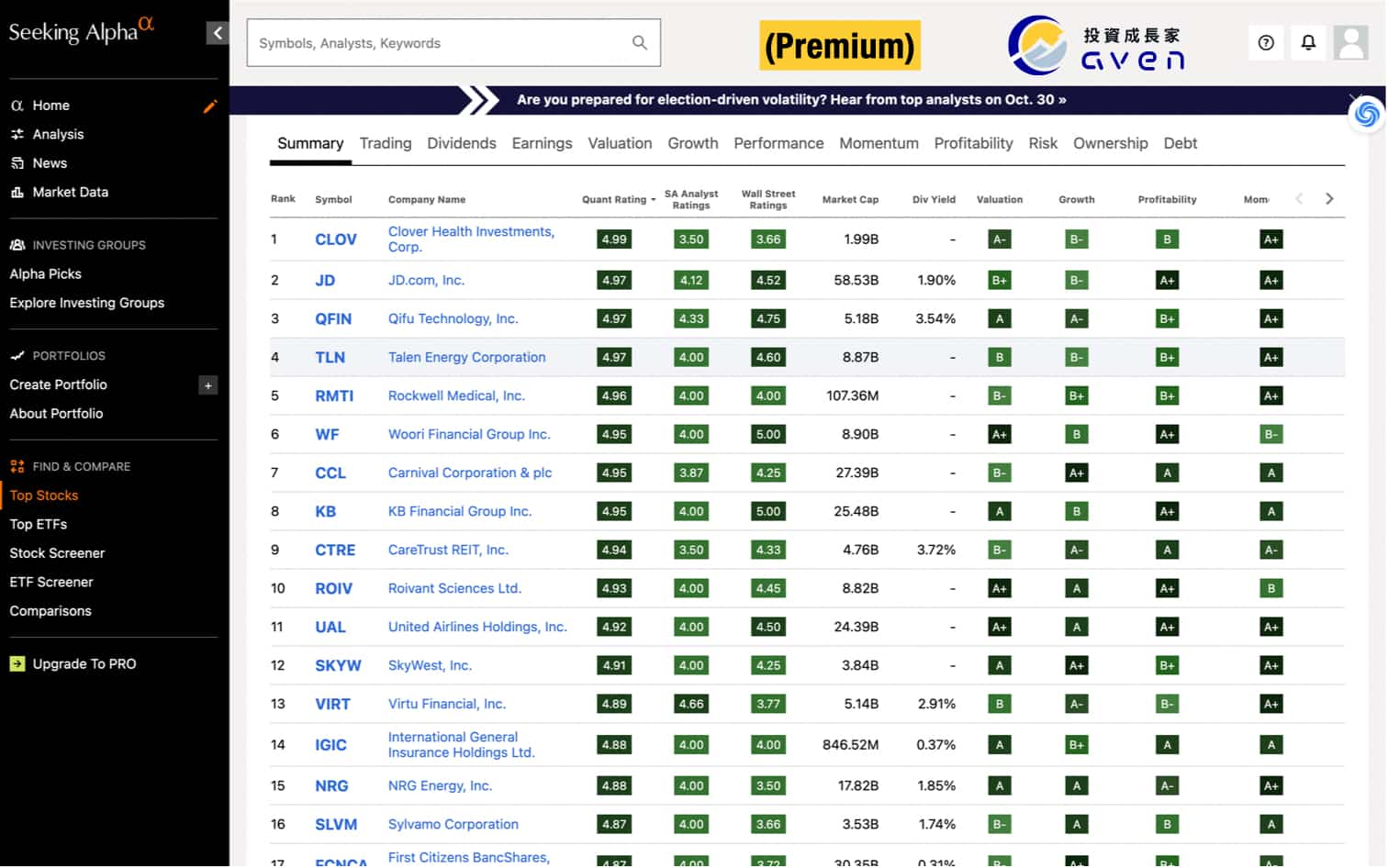

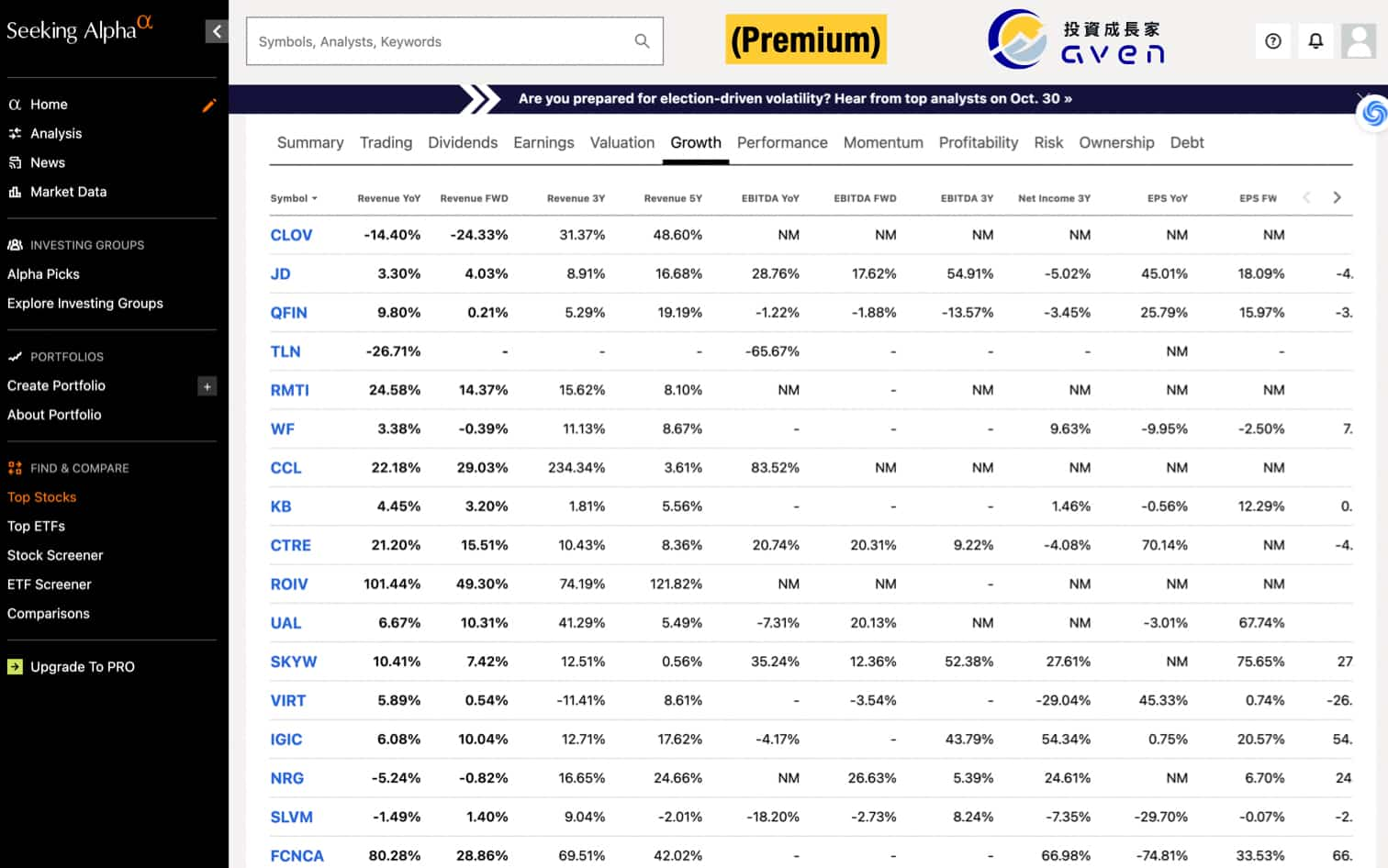

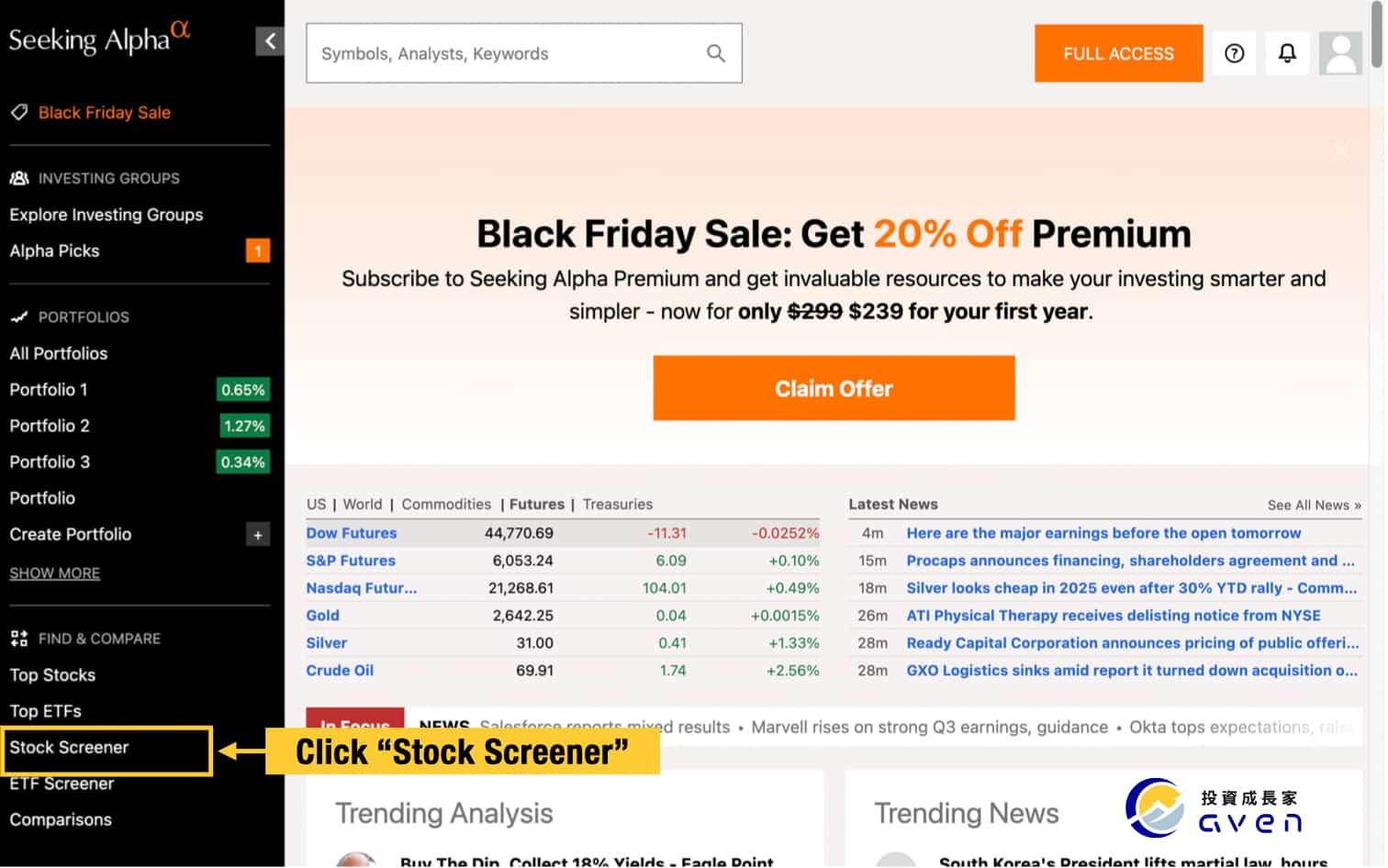

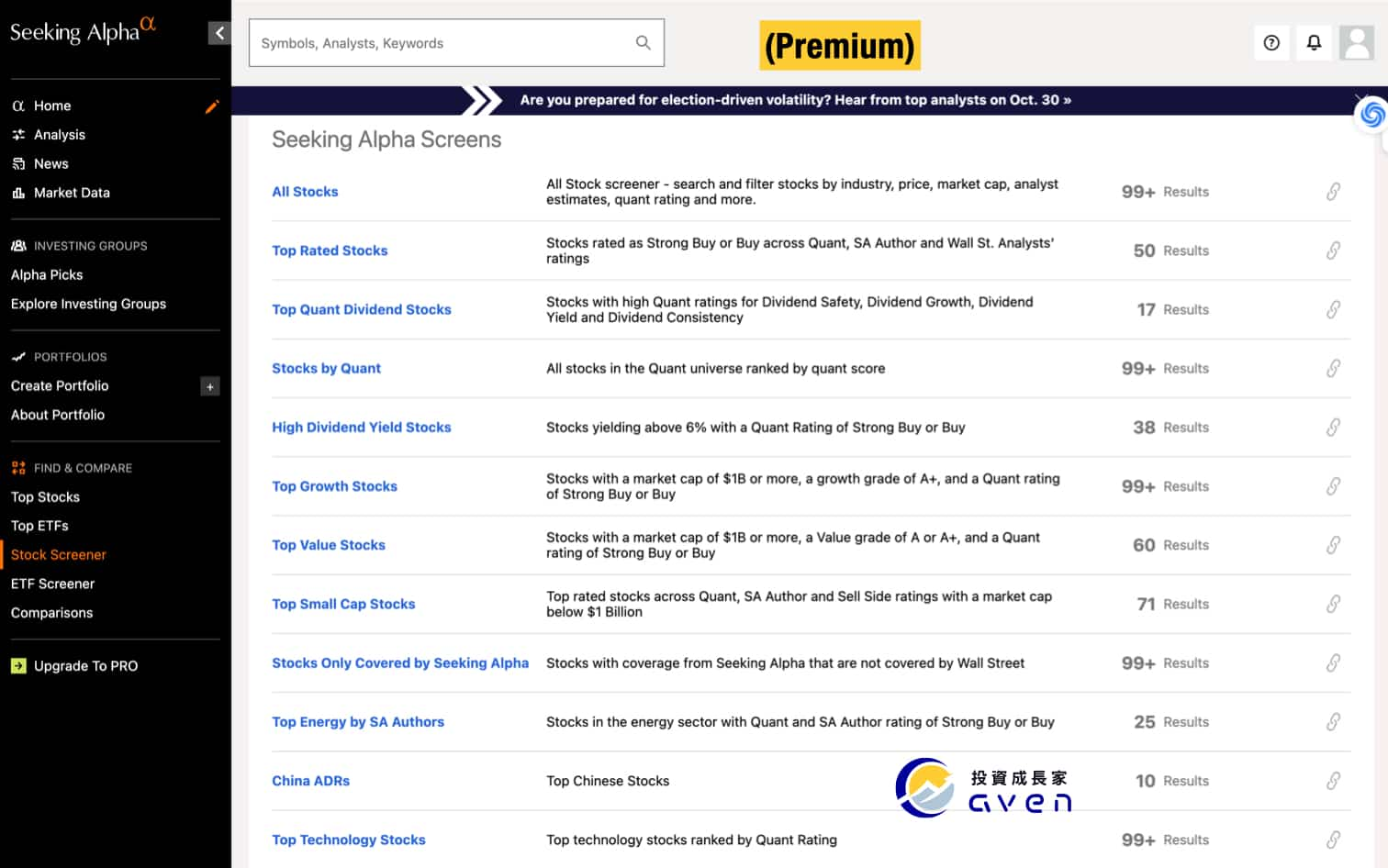

Stock and ETF Ranking (Premium only)

In the Premium version, you can clearly see stock ratings, including growth potential, profitability, and more, which can help you make investment decisions. This is what we often refer to as "quantitative analysis" and "quantitative ratings."

Seeking Alpha conducts big data research to assess whether a stock has long-term growth potential. They use quantitative algorithms to identify U.S. stocks that perform strongly in terms of value, growth, profitability, and price, and then assign ratings to these stocks.

In addition, you can also view the dividends, growth, earnings, trading volume and other information of each stock, which is very complete. You can also build your investment portfolio to observe the stocks you want to buy.

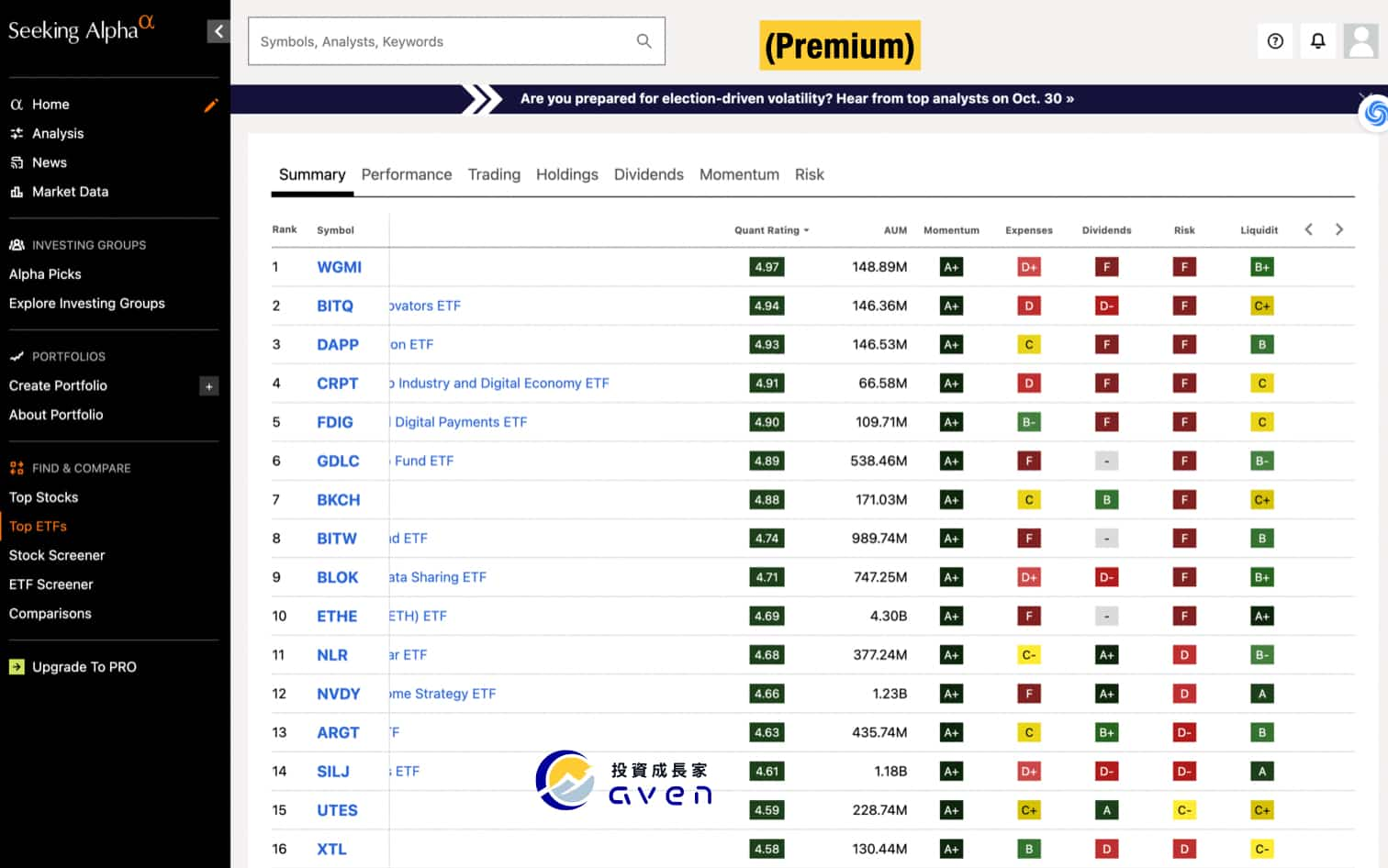

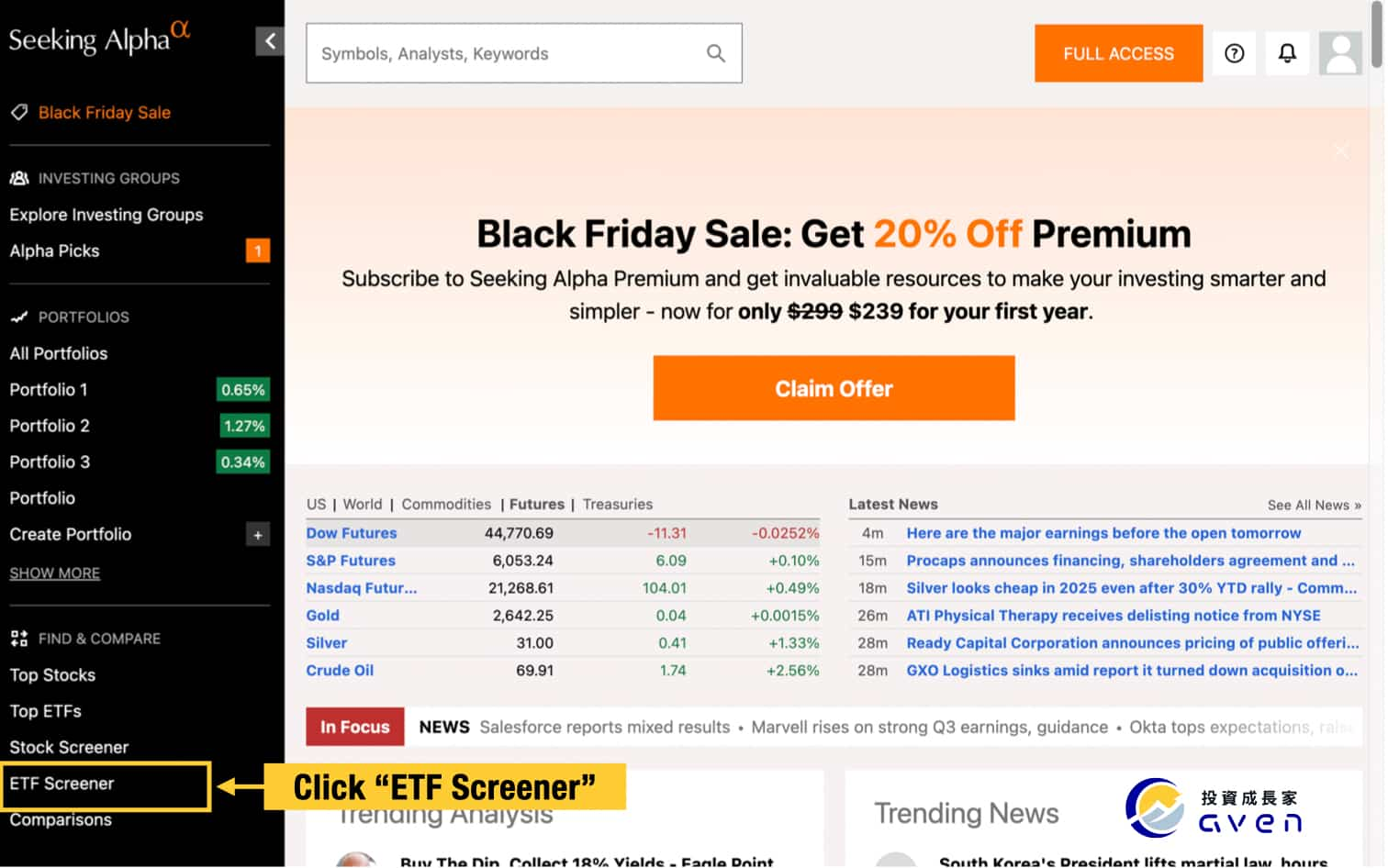

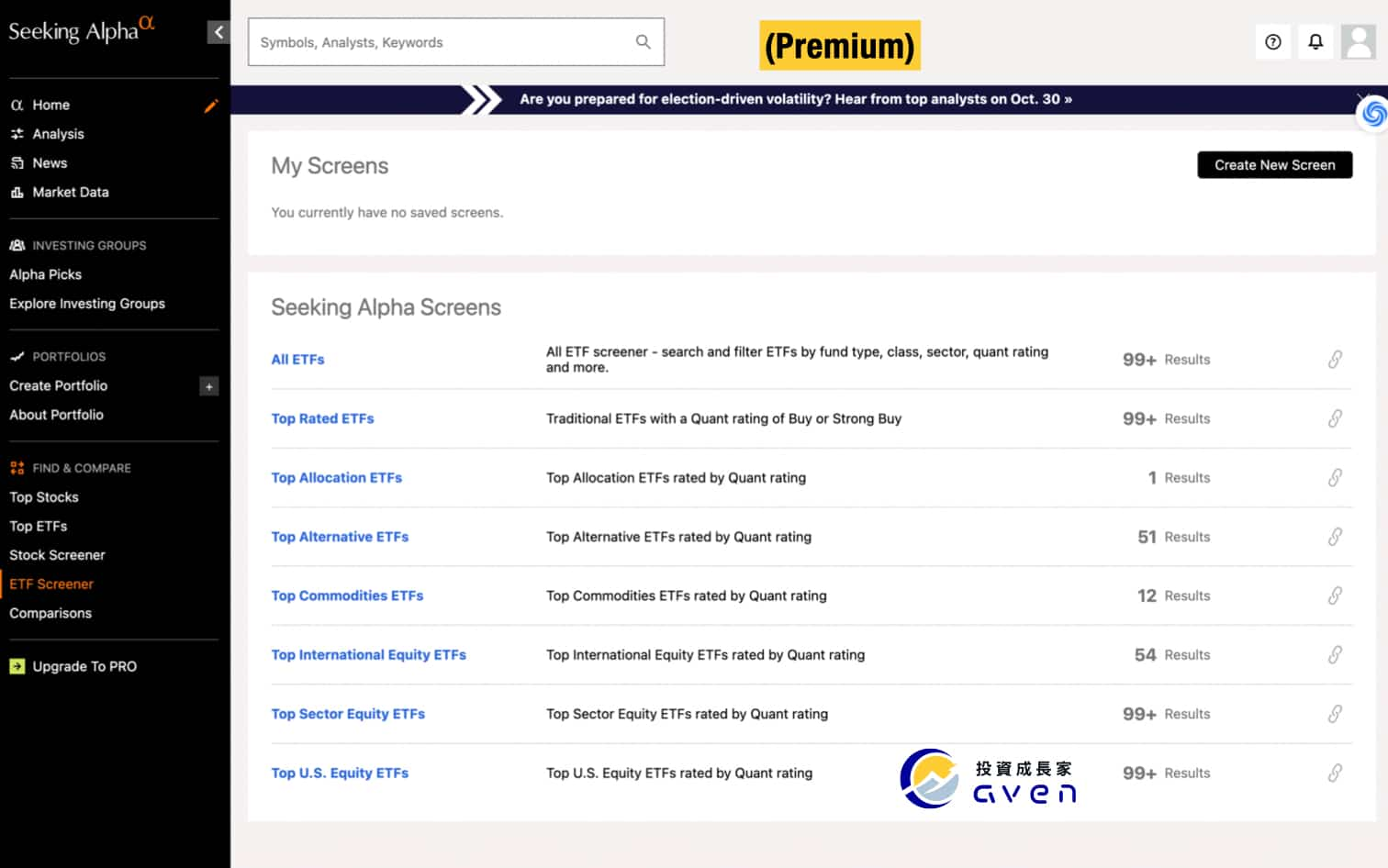

The ETF section also has various ratings.

In addition, you can also find stocks with different needs from Seeking Alpha, such as stocks pursuing high growth, stocks pursuing dividends, stocks with the highest ratings, etc.

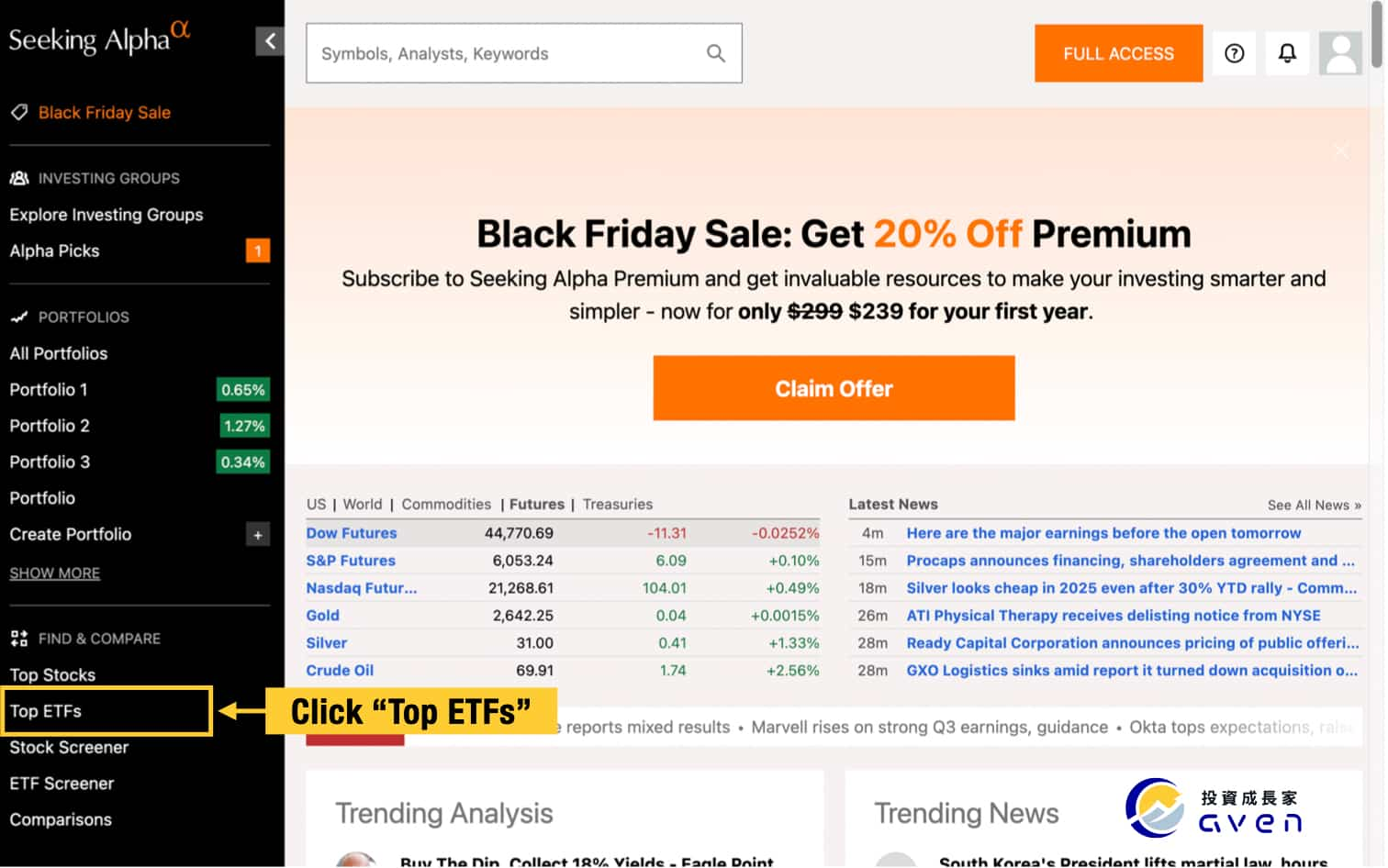

ETFs are also divided into different recommended combinations such as top-rated ETFs, top allocation ETFs, top international equity ETFs, US equity ETFs, etc. It can serve as a reference for building your own investment portfolio based on your needs.

Generally speaking, Caven feels that Premium is much more comprehensive than Basic. On average, it costs less than US$25 per month, which is about NT$800, which is not too expensive.

If anyone is interested, you are also welcome to use Caven's referral link to get a $30 discount, reducing the yearly price from $299 to $269 plus 7 day free trial! (It will costs US$22 per months, which is about NT$544)

Or you can also use the Bundle Discount Link(Premium + Alpha Picks): Reduced from $798 per year to $639 per year (a $159 savings)!"

Alpha Picks Reviews 2024

Seeking Alpha has also launched the Alpha Picks with an annual fee of $499 per year ($449 for subscribing through Caven's link).

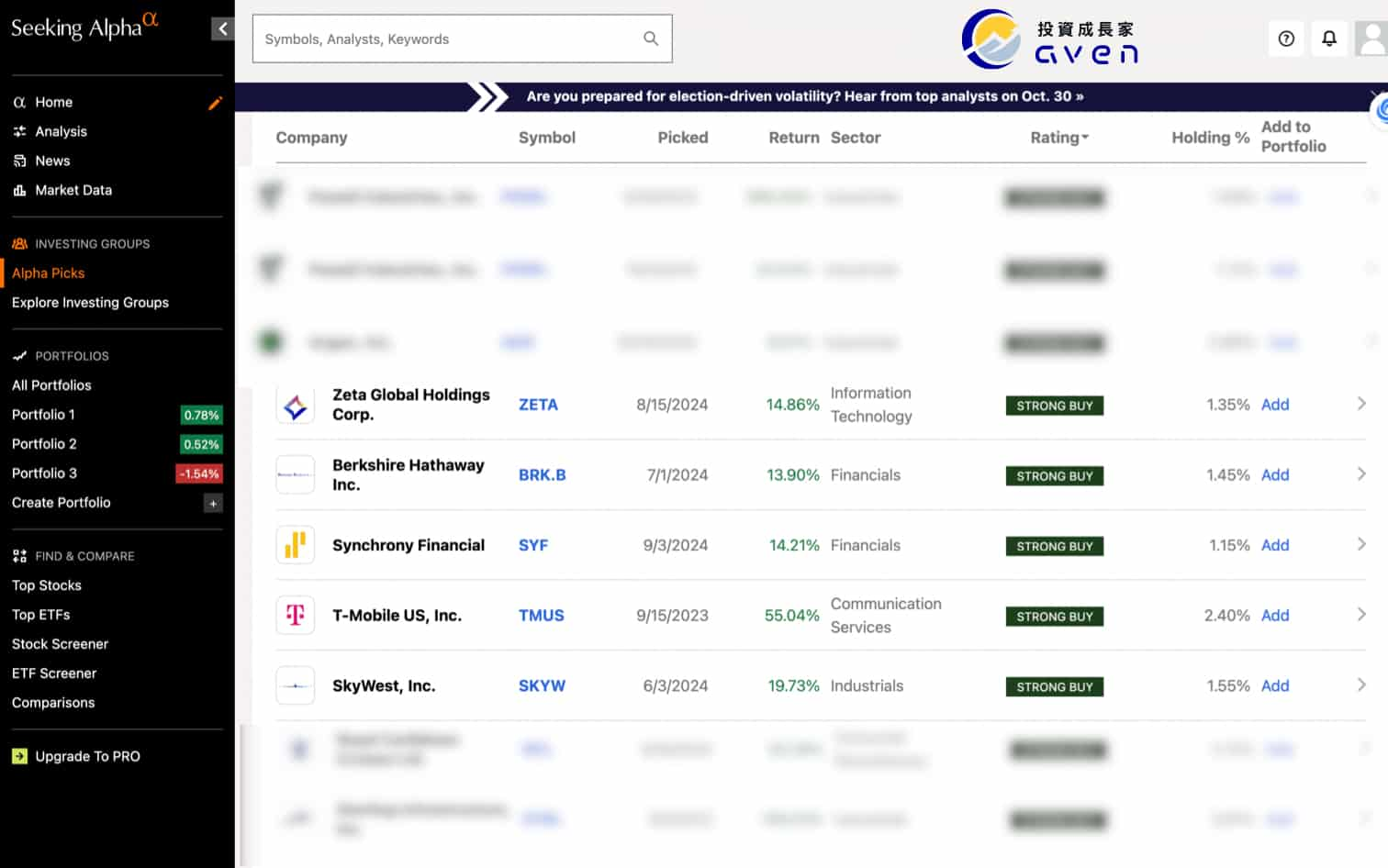

This is an investment tool that can actively select stocks based on Seeking Alpha's quantitative trading strategy. After subscription, you can see the Strong Buy stocks by Seeking Alpha as your investment reference. You can just click Add Portfolio to add these stocks to your portfolio.

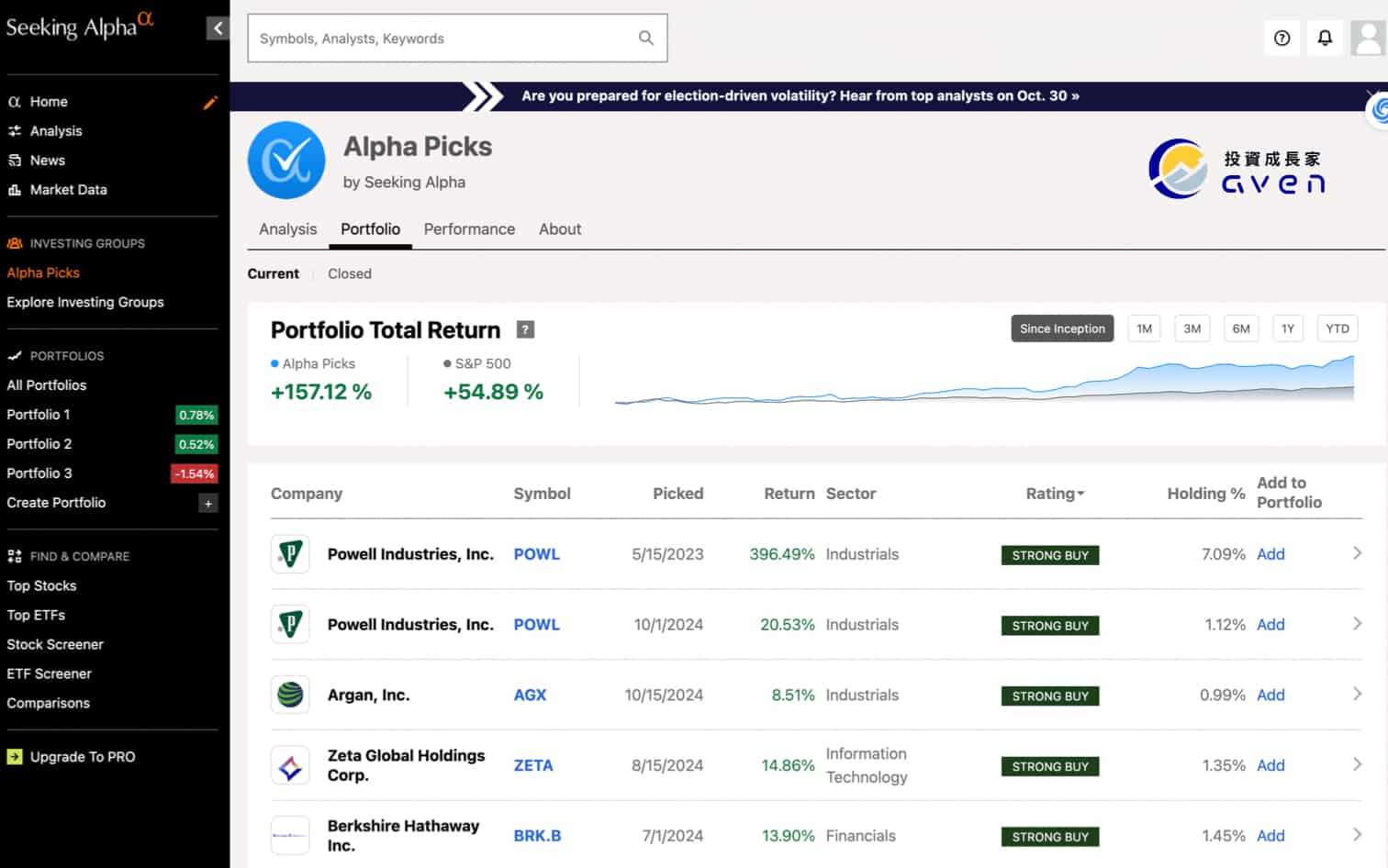

It can be seen that the total return of Alpha Picks is greater than that of the S&P500.

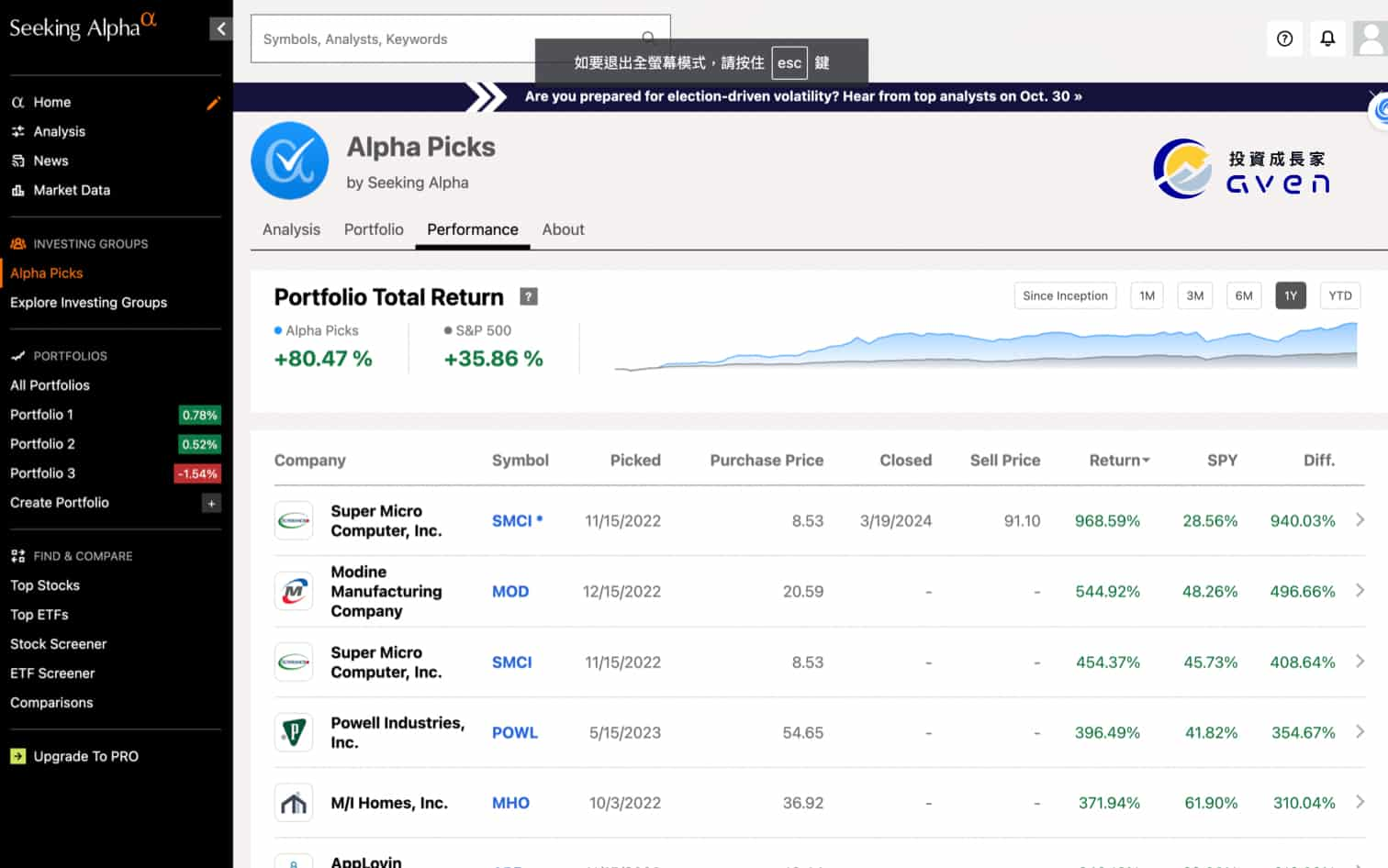

If you compare the annual returns, Alpha Picks has twice the return of the S&P500, which is quite impressive.

In addition, after subscribing, you can also enjoy various analysis from Alpha Pick. For example, a Weekly Market Recap can help investors understand the investment market better weekly.

Additionally, Alpha selects 2 recommended stocks each month and sends out related newsletters weekly. Occasionally, there are also online investment seminars available to help you gain more investment insights.

Seeking Alpha’s Subscription Plan

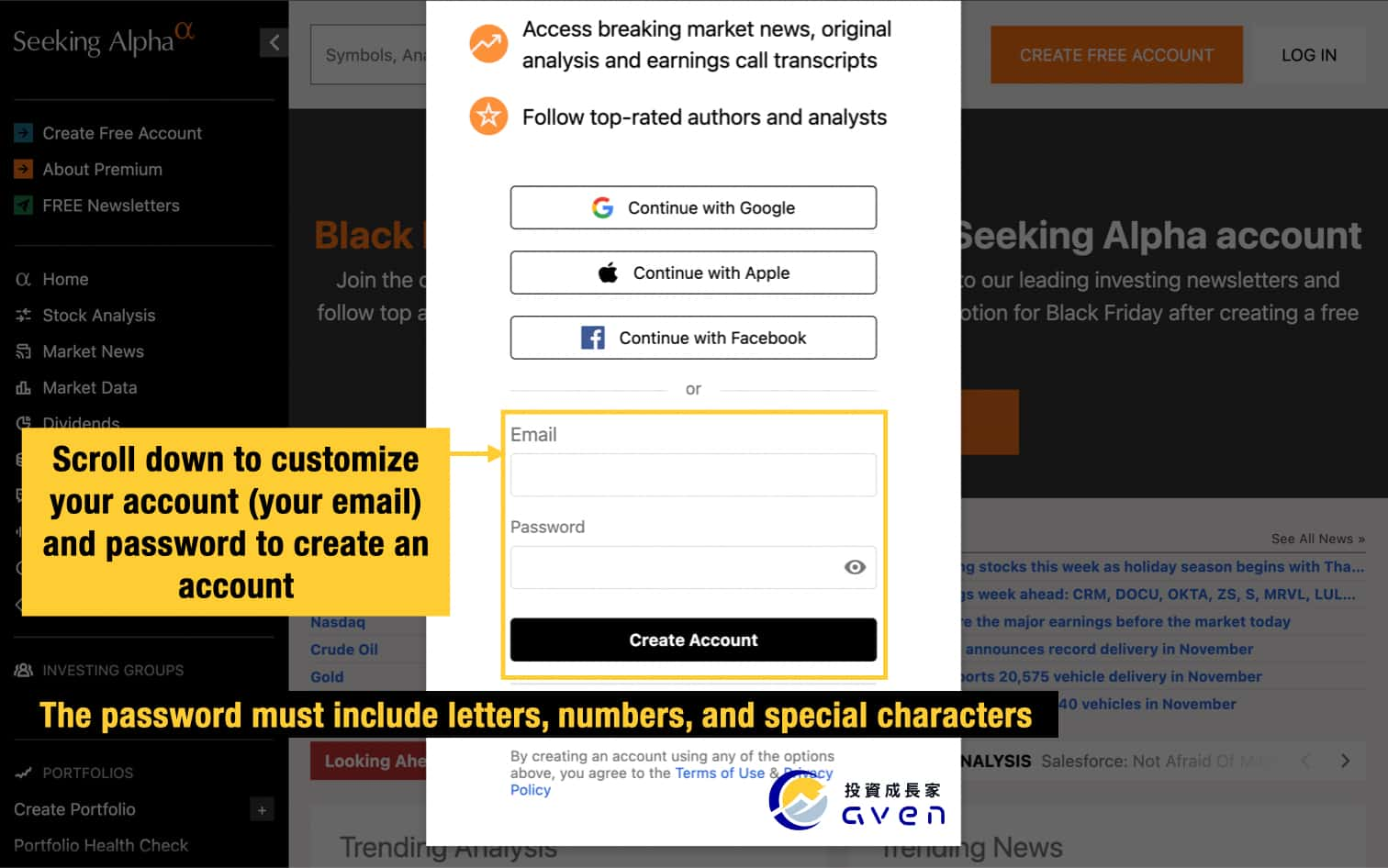

Seeking Alpha is currently divided into three levels, Basic, Premium and Pro.

The Pro version is more suitable for professional investors or companies, and the price is US$2,400 per year. As ordinary investors, we only need to use the Premium at most. Below, Caven will briefly compare the features of the basic version and the Premium:

Comparison between Seeking Alpha Basic and Premium

| Type | Basic | Premium |

| Cost | Free | 7 day free trial and $209 per year (If you use Caven's referral link) |

| Analysis | ⭕(Only read one articles a day) | ⭕(Full access) |

| News | ⭕ | ⭕ |

| Real-time Market Data (US stocks, bonds, etc.) |

⭕(Some data blocked) | ⭕(Full access) |

| Create your portfolio | ⭕ | ⭕ |

| Top Stocks | ❌ | ⭕ |

| Top ETFs | ❌ | ⭕ |

| Stock Screener | ❌ | ⭕ |

| ETF Screener | ❌ | ⭕ |

| Comparison | ⭕ | ⭕ |

If anyone is interested, you are also welcome get the special price from Caven's referral links listed below:

- Premium Discount Link: Reduced from $299 per year to $269 per year (a $30 savings) plus 7 day free trial!

- Alpha Picks Discount Link: Reduced from $499 per year to $449 per year (a $50 savings)!

- Bundle Discount Link(Premium + Alpha Picks): Reduced from $798 per year to $639 per year (a $159 savings)!"

If anyone is interested, you are also welcome get the special price from Caven's referral links listed below:

- Alpha Picks Discount Link: Reduced from $499 per year to $449 per year (a $50 savings)!

- Bundle Discount Link(Premium + Alpha Picks): Reduced from $798 per year to $639 per year (a $159 savings)!"

The U.S. stock market is the largest in the world, but there are too many good companies in it that we don't know about. Seeking Alpha uses a very simple interface and comprehensive website to allow us to have a clear understanding of stocks in the United States and even the world. Rating, and can accurately compare the return on investment.

If you are interested in U.S. stock investment, you can try the Basic to observe these investment targets as well as news, analysis and market data. If you are interested in building an investment portfolio more actively, it is also recommended to subscribe to Premium and Alpha Pick, which can help you gain a deeper understanding of the entire world market.